Shattering the silence: the untold influence of high emitters

|

Written By: David Crawford |

David Crawford of Nordea Asset Management UK discusses ways in which asset managers can deliver net zero portfolios, and explains how investment in environmental laggards can bring real value

The sense of urgency surrounding climate change is growing more pronounced, underscoring the critical nature of the situation. Human-generated emissions are wreaking havoc on our planet, pushing us deeper into an irreversible climate crisis.

Compelling evidence reveals that our planet is experiencing a steady rise in temperatures, with global average temperatures now 1.2℃ higher than during the pre-industrial era. While 1.2℃ might sound insignificant, the reality is that we are already witnessing the adverse impacts of incremental warming, including erratic weather patterns such as severe storms, rising sea levels, loss of polar ice and ocean acidification.

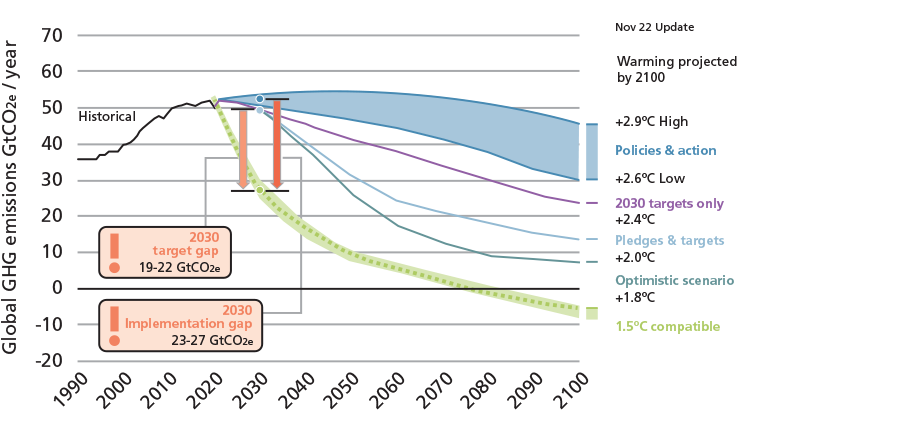

If current worldwide policies remain unchanged, global temperatures are projected to increase by as much as 2.7℃ by 2100, posing the risk of rendering parts of our planet uninhabitable (Figure 1).

Figure 1: 2100 Warning Projection | Emissions and expected warming based on pledges and current policies

Source: Climate Action Tracker, November 2022

To curtail this escalating global warming, a substantial reduction in greenhouse gas emissions, particularly CO2, is both necessary and imperative. This is where initiatives like Net Zero or the 2021 Glasgow Climate Pact come into play.

The primary objective of the COP27, held in November 2022 in Sharm El Sheikh, was to ensure that countries and businesses uphold their commitments. However, it fell short of meeting the expectations of many.

In 2022, governments and supranational bodies faced a challenging juggling act, attempting to manage the immediate economic fallout of wars, ongoing disruptions in supply chains, and labour shortages while the climate crisis continued to escalate. Nevertheless, this serves as a stark reminder that in 2021, numerous asset managers and investors made new commitments to achieve net zero emissions as a crucial step toward urgently decarbonising the planet.

Most asset managers focus on reducing emissions within their portfolios, since financed emissions typically constitute the bulk of their carbon footprint. However, given the persisting severity of the climate crisis, the GFANZ (Glasgow Financial Alliance for Net Zero), including the Net Zero Asset Managers Alliance and other net zero groups, has now prioritised tangible emissions reductions in the real world.

The truth is that merely shifting portfolios to lower-emitting assets may not accomplish the real-world decarbonisation that is urgently needed.

Asset managers can deliver net zero portfolios in two different ways: building portfolios that are already low-emitting, or building portfolios that are net zero-aligned, meaning they are on the trajectory to reach net zero by a certain date.

- Low emission portfolios can be achieved only by excluding higher emitting companies. While this sends a powerful message to these high emitters, there are always other investors who, for the right expected return, will continue to finance them. At best, the investor will have a clean portfolio in a dirty planet, and at worst, they will have a portfolio free from the highest-emitting sectors but full of companies that fail to deliver credible decarbonisation.

- Net zero-aligned portfolios invest in companies that have credible decarbonisation plans. This is a strong way to direct funds towards companies that are working to bring about real world change. The investor sees portfolio emissions fall to achieve their net zero goals while companies effect real world change.

These approaches, however, leave unanswered the key question: what happens to the companies that are lagging behind in their carbon emissions? They are excluded from any net-zero-targeting portfolio, and yet these are the companies that most of all need to change. Can we really just ignore them?

Time to get your hands dirty

The reality is that many of these companies will still be around in the low-carbon economy of the future, and some may even play a crucial role in achieving important sustainability goals. Excluding them from portfolios may look good on paper, but will have a limited impact in the real world.

In fact, by definition, heavy emitters account for a considerable part of global pollution.

According to a report by Rhodium Group published in December 2022, in 2020 industry remained the largest emitting sector, generating 31% of global emissions (Figure 2). Emissions from the electric power sector contributed 28% of global emissions, the vast majority of which came from coal combustion. Combined emissions from land use, agriculture and waste made up 18%, followed by transportation at 16% and buildings at 7% of the global total.

Figure 2: Global emissions by sector | (Percentage share of 2020 net GHG emissions)

Source: Rhodium Group

This means that a significant part of the current reduction in carbon emissions comes from certain sectors, rendering them relevant and even critical to enabling the transition.

If we look for example at the carbon-intensive steel industry, it is viewed negatively on ESG criteria – which means stocks in this space are unlikely to feature in many sustainability-focused investment strategies.

Despite its emissions-intensive profile, the steel industry is a key structural enabler in the energy transition. For example, an offshore wind farm or photovoltaic plant can be multiple times more steel-intensive than a conventional coal or gas plant. This basically translates to the fact that a material as ubiquitous as steel cannot be ignored in the global decarbonisation drive. Decarbonising the steel-making process should be taken very seriously in the context of a global net zero ambition.

An extensive unexplored land of potential

High emitters possess a dual value proposition for a portfolio. Not only can they have a significant impact on the global emissions reductions, but they also hold the potential for generating alpha which makes them quite attractive.

Why is that?

Well, first of all, if we look at the valuations, market mispricing often affects companies that lag in tackling climate change or more in general companies that are not perceived as “green darlings” in ESG terms. This results in meaningful valuation discounts.

In addition, according to the MSCI World Index, the average cost of capital of the highest-ESG-scored quintile was 6.16%, while the lowest-ESG-scored quintile’s was 6.55%.¹ The findings come as no surprise, since lower ESG scores often interrelate with higher systematic risks. In the same line of reasoning, companies with improved ESG ratings saw reduced costs of capital, as MSCI Research confirmed. By allocating capital to, and being an ESG activist shareholder in, companies with the potential to enhance their environmental performance and mitigate perceived risks, investors can capture financial rewards from those which are successfully moving up the ESG ladder.

In other words, this is really an extensive unexplored land of potential that includes a wide range of sectors, from the energy-related industry to the utilities space.

Engagement: more ambitious actions for more impactful results

Decarbonisation requires both collaboration and action. Therefore, rather than avoiding the high emitting sectors, it is important to engage with these forgotten companies and heavy emitters that can play a crucial role in achieving the transition to a more sustainable world. By allocating capital and experience in those companies, together we can achieve returns while curbing real world emissions.

Engagement means having a constructive and active dialogue with the companies. Such dialogues enable us to understand how a company is thinking about and addressing ESG risks or opportunities that are relevant for its business as well as to support those businesses in fulfilling their financial and environmental potential.

The first key element is to determine the feasibility of engagement with a specific company on a specific targeted topic. Questions that could arise include how cooperative the management team is, whether they can incorporate the relevant ESG objectives in the business model, and their willingness to execute.

As soon as feasibility is established, key performance indicators (KPIs) can follow suit. Depending on how far each company has progressed in its decarbonisation journey, a roadmap with different short- to long-term targets can be drawn to help them achieve their goals. In the entire process, transparency is key. Companies which duly align their reporting with a high-quality and rigorous framework such as the Task Force on Climate-Related Financial Disclosures (TCFD) make it smoother for investors to assess their performance in comparison to peers.

Once engagement efforts begin, an effective monitoring process is to be implemented to keep track of each company’s progress. For companies that have come a long way in executing on their climate strategy, engagement efforts can occur at quarterly intervals. For those that are still at the beginning of their journey, it may be beneficial to leverage from networks such as Climate Action 100+ or Principles for Responsible Investment (PRI) to amplify the pressure. While it is always favourable to engage with companies to strengthen their environmental profile, decisions to divest could be considered in cases of failure to make progress.

All in all, the path to sustainability is a continuous journey. Making investment decisions based on a frozen snapshot will not do companies justice if they are well on their way to implementing changes. A 20% carbon reduction compared to the benchmark sounds appealing at first, but is it sufficient to tackle sustainability challenges? While it might be easier to automatically rule out high-emitting stocks in exchange for “best-in-class”, a strategic approach of engagement is more suited to make a real-world impact.

Unconventional as it might seem, investing in and engaging with environmental laggards brings real value. On the one hand, alpha can be generated from efforts of de-risking. On the other, the road to net zero does not only involve today’s ESG winners. Rather than being perceived as threats, with the right engagement approach, ESG improvers will emerge as not only enablers, but also catalysts, of the green transition.

There can be no warranty that an investment objective, targeted returns and results of an investment structure is achieved. The value of your investment can go up and down, and you could lose some or all of your invested money.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material and is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. Published and created by the Legal Entities adherent to Nordea Asset Management. This document is furnished on a confidential basis and may not be reproduced or circulated without prior permission and must not be passed to private investors. This document contains information only intended for professional investors and eligible investors and is not intended for general publication. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

1. https://www.msci.com/www/blog-posts/esg-and-the-cost-of-capital/01726513589

More Related Content...

|

|

|