Social at the centre of ESG

|

Written By: Olivia Albrecht |

|

Del Anderson |

Olivia Albrecht and Del Anderson of PIMCO discuss five major social themes affecting creditworthiness and which are driving new social bond issuance that has emerged during this pandemic-driven economic crisis

The social pillar of environmental, social, and governance (ESG) investing is all about people: employees, customers, and suppliers. The outbreak of Covid-19, followed by global demonstrations calling for action on racial injustice and social inequality, has propelled the S of ESG to the top of corporate and investor agendas.

This is arguably the clearest example of a sustainability crisis in the 21st century, and has highlighted how interconnected, interdependent, and vulnerable the world can be. Moreover, this crisis is disproportionately affecting the most vulnerable communities in the world, exposing and exacerbating the impacts of inequality in many regions.

A renewed focus on the S of ESG investing

Material social issues include health and safety, human capital management and product quality. But inequality and supply chain management are especially top of mind right now. Many companies are increasingly managing their business models with an understanding of the multiple stakeholders in their ecosystem.

It is clear from dialogues with our global clients, issuers, and policymakers that the current crises facing the global economy will only sharpen the focus on how businesses interact with all stakeholders. Reflecting this, we expect greater transparency going forward on social dimensions – which would be a welcome development. As investors, we are committed to encouraging greater transparency from companies.

Watching recent events unfold, it is clear that while the industry has made great strides in research and engagement, this approach should continue to improve.

Deeper dive: trending “S” factors

As part of our engagement with bond issuers, our credit research team has identified five major social themes that have emerged with the outbreak of Covid-19. In many cases, these themes affect creditworthiness and drive new social bond issuance.

- 1. Health and well-being are key priorities: First and foremost, many companies have responded to ensure workers, especially those in essential industries, have equipment and space needed to operate safely. Beyond physical protections, many companies are also improving healthcare options and benefits to better cover peoples’ needs; approaches include telehealth, mental health counselling, and childcare.

- 2. Work is being reallocated: Tens of millions of people in the US alone have filed for unemployment, and a much higher number are estimated to be out of work globally. Hourly wage, service workers, people with children, and minorities appear to be disproportionately affected. It is unrealistic to think that all of these workers will return to the same job, in the same capacity. There will likely be winners and losers in the redistribution of work as the recovery progresses.

- 3. The way many people work may change permanently: According to a recent Gallup poll, more than 60% of employed Americans now say they have worked from home during the pandemic, up from about 30% before widespread “shelter-in-place” orders. The poll reported three in five workers say they would prefer to work from home as much as possible even after public health restrictions are lifted. Employers are starting to think differently about working styles and benefits, with greater flexibility becoming a higher priority.

- 4. Supply chains will need to be derisked: Simplified, transparent supply chains are critical to spotting and managing production stoppages. A key conclusion from PIMCO’s most recent forum on the outlook for the global economy and financial markets, was that firms may try to reduce the risks and complexity of global supply chains, with a key step being improved transparency beyond large, first-tier suppliers.

- 5. Cybersecurity and privacy defences will increase in importance: A sharp increase in employees working remotely and customers shopping online increases risk levels for data and privacy breaches. A recent Verizon report reported Virtual Private Network (VPN) usage is up over 80% and collaboration tool usage is up over 1,200% compared to a typical pre-Covid day. Many companies are focused on making the accelerated transformation to digital safer.

The bottom line is that many companies will require capital to successfully manage these five social themes, and we believe that many will come to the bond market to raise capital through debt financing. We are committed to actively engaging with companies through this crisis.

Investing for impact: social bond issues linked to Covid-19 response and recovery

Bond markets have responded to financing needs of issuers for Covid-19 response and recovery via social bond issuance. Social bonds raise funds for new or existing projects targeting positive social outcomes. Companies, sovereigns, and development finance institutions (DFIs) are among issuers coming to market now with innovative social bonds aimed specifically at supporting economic and health recovery. This is a unique way for investors to invest in debt, which our assessment shows largely trades in line with an issuer’s existing credit curve, with proceeds being linked to measurable impacts.

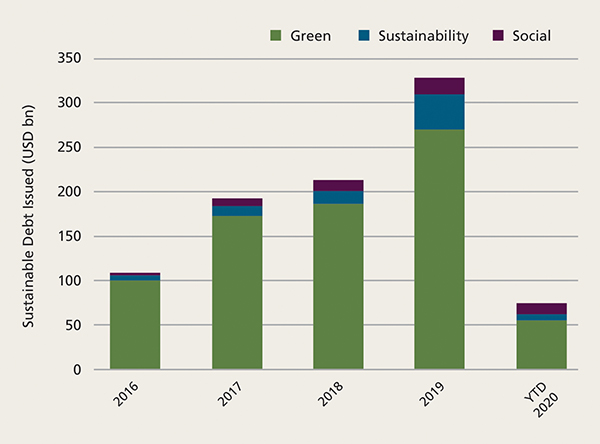

This year has already set a record for social bond issuance, totalling over $20 billion raised for social projects globally. With increased focus on social issues from Covid-19, we expect a major uptick in social (and sustainability, blending green and social) issuance (see Figure 1). Well structured, credible social bonds are a unique market opportunity for investors to finance critically needed health and economic solutions.

Figure 1: Social bond issuance as part of the total sustainable debt universe

Source: Bloomberg, Bloomberg New Energy Finance. As of 31 May 2020.

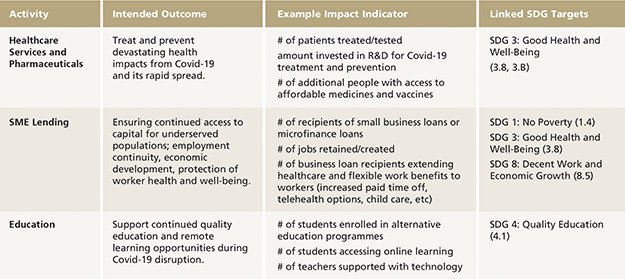

To us, a “well-structured” social bond clearly states the projects it funds are designed to benefit vulnerable, at-risk, or disadvantaged segments of society, and reports transparently on related outcomes. We see immediate need in sectors such as healthcare, pharmaceuticals, manufacturing, and small businesses (including lending to small businesses); this list could be expanded as we learn more about the economic consequences of Covid-19. Importantly, social bonds should be structured to meet immediate needs without compromising on long-term sustainability goals. Our view is that an effective way to achieve social, environmental, and economic goals is to link issuance to the Sustainable Development Goals (SDGs).

Figure 2: PIMCO guidance on effective social bond frameworks

For illustrative purposes only. Source: PIMCO

PIMCO is an active member in the GISD Alliance (Global Investors for Sustainable Development) and ICMA’s (International Capital Market Association) Green Bond Principles and Social Bond Principles Executive Committee. In collaboration with these organisations, we are working to promote bond issuance that acts as a catalyst to improve social, environmental, and economic challenges. Covid-19 is an immediate example of issuers and investors needing to work together to create innovative finance solutions. As we actively engage with companies, we are encouraging the social bond market to grow, but with rigorous standards that drive tangible progress.

Case studies: Engaging on the S of ESG

Recognising that the current crisis is still unfolding and company responses are evolving, our ongoing engagements with corporate issuers have identified examples of companies with advanced social performance providing rapid, innovative social support measures. Immediate support to employees, customers, and suppliers, which doesn’t need to be cash-intensive, is important to maintaining trust and goodwill and can play an important role in mitigating volatility.

Case Study A

A hotel real estate investment trust (REIT), operating in one of the sectors hardest hit by widespread stay-at-home restrictions, quickly partnered with businesses in essential industries to provide temporary work for employees, while maintaining healthcare benefits. This programme helped mitigate devastating income loss for employees, and will help the company maintain its workforce as hotels are gradually reopened. The model has since been adopted more broadly across hard-hit sectors. After we engaged to learn about these positive labour relations efforts, we scored this pioneering company as a social leader versus its peers.

Case Study B

A food and beverage company went beyond needed safety measures to provide increased pay, free mental health counselling, and expanded childcare services. The company already benefited from low employee turnover rates versus peers, a trend we expect to continue and will closely monitor in future engagements.

Case Study C

A technology hardware company stepped up to support small business suppliers through accelerating payments, helping to avoid cash flow issues. The company has not reported major operating disruptions to date. This action confirmed our improving view of the company’s performance on social issues, a view that has been shaped by routine engagements through multiple rounds of bond issuance.

Case Study D

A media company updated a purpose statement for employees and executives to align with the demographics of its broadcast listeners, a diverse group broadly matching US demographics. The company also published social policies covering diversity, data security and privacy, community outreach, and disaster response. Additionally, the company is now publishing an annual impact report to quantify the impact of local campaigns on social issues.

Covid-19 is devastating societies and communities around the world. How companies and investors respond will help support the health of individuals and a coordinated economic recovery. Engaging to understand and value social factors in corporate credit assessments, and investing directly in positive outcomes through social bond issuance, are two key ways that fixed income investors can take action as part of a global response to the current crisis.

For investment professionals only. PIMCO Europe Ltd (Company No. 2604517) Ltd (Company No. 2604517) and PIMCO Europe Ltd – Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK. PIMCO Europe Ltd services are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication.

The above case studies are presented for illustrative purposes only, as a general example of PIMCO’s ESG research and engagement capability and are not intended to represent any specific portfolio’s performance or how a portfolio will be invested or allocated at any particular time. PIMCO’s ESG processes may yield different results than other investment managers and a company’s ESG rankings and factors may change over time. All data is as of 31 December 2019, unless otherwise stated.

More Related Content...

|

|

|