Striking a better liquidity balance

Comment

|

Written By: James Sparshott |

|

& Lushan Sun |

James Sparshott and Lushan Sun of LGIM discusses show how short-term alternative finance can boost returns on assets held for liquidity purposes

In recent years the LGPS has increased its exposure to private markets to access a wider range of investments, including infrastructure, private debt and property with the aim of providing enhanced, diversified and resilient investment returns.

As the LGPS continues to deploy into private market assets, there is an ongoing consideration with respect to how to source liquidity for meeting capital calls, the timing of which can be difficult to predict and stretch over several years.

Boosting overall portfolio liquidity is helpful during a volatile market but having too much can be a drag on returns. Short-term alternative finance can help improve that balance and diversify the sources of liquidity.

Improving the balance between liquidity and return

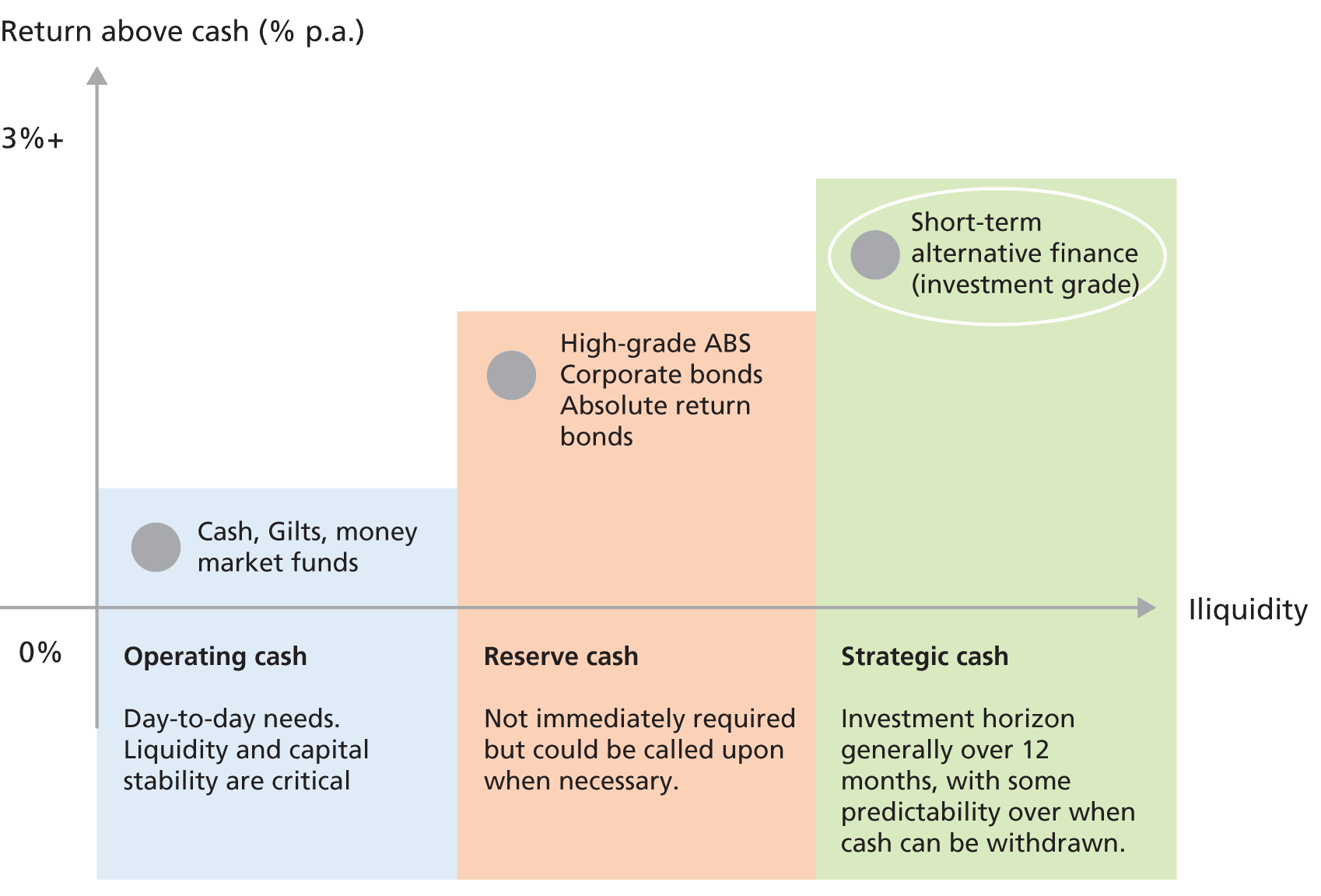

Many clients use a “cash ladder” to manage the balance between liquidity and return. Effectively this is a plan that sets out the types of assets that are held for liquidity purposes with details of how they should be used. Cash, short-duration Gilts and money market funds tend to be used for day-to-day operations. These assets generate very little in excess of the risk-free rate. Other assets that can be redeemed on a daily or weekly basis are regarded as being at the next level in the cash ladder. This includes corporate bonds, asset-backed securities (ABS) and absolute return bond funds, which typically return cash plus c.1.5% – 2% p.a.

When considering what combination of investments to use in a cash ladder, we look to strike a balance between having enough liquidity to meet planned and unplanned requirements while minimising the drag on overall return.

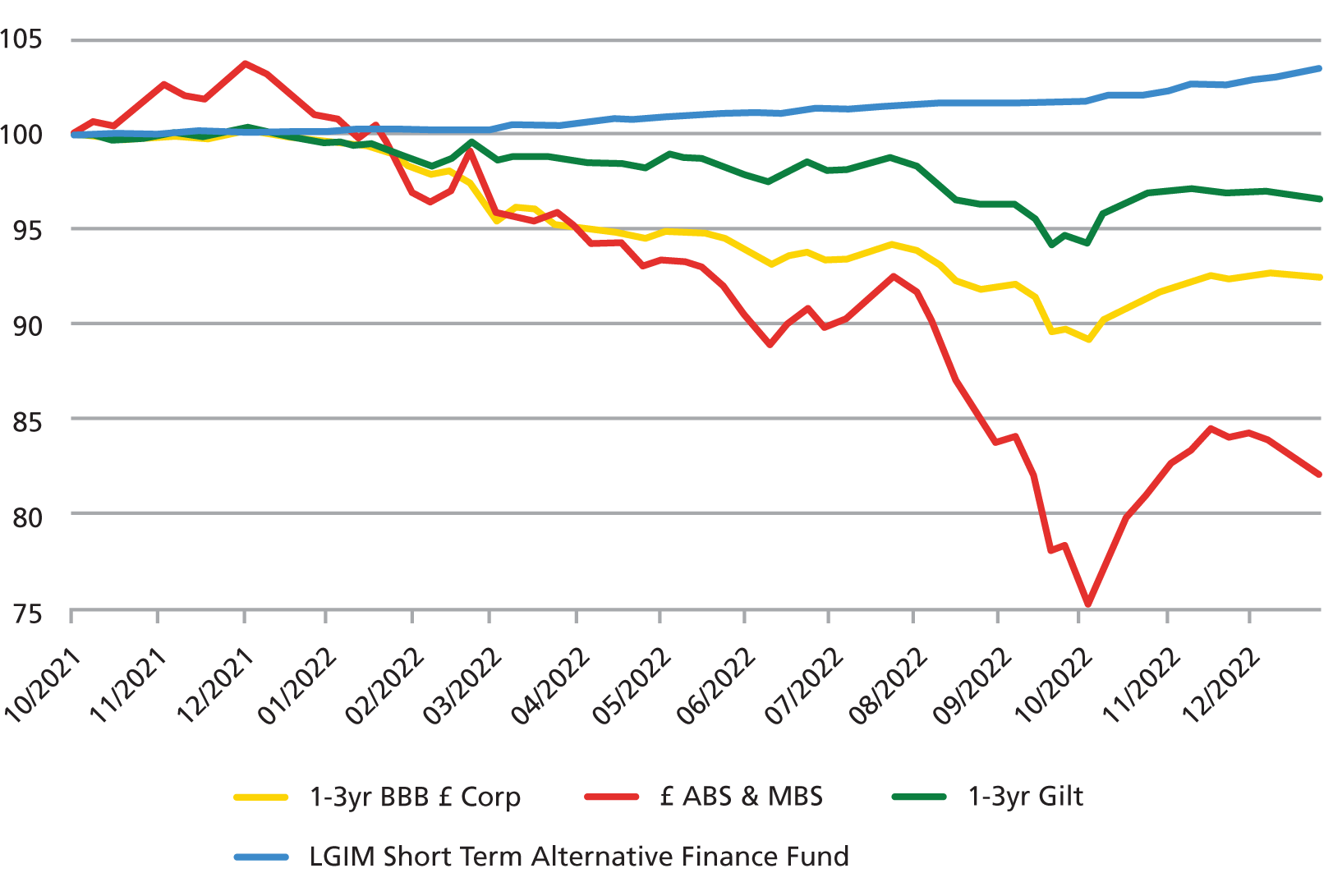

Market movements this year have also demonstrated how “low risk” liquid assets can lose significant value over a short period of time. As a result, the extent to which the value of different investments is likely to remain stable in different market environments is also an important consideration.

Figure 1: Cash management

Source: For illustrative purposes only.

Short-term alternative finance can play an important role in a cash ladder given its liquidity and return profile. It is largely uncorrelated with the broader financial market, providing valuable diversification and capital preservation benefits. The short-term nature of the underlying loans (typically less than one year) means that cash can be returned to the investor over a short period.

This is an area historically dominated by banks but bank retrenchment over recent years as a result of regulatory pressure has enabled other investors to fill the void. The underlying borrowers are generally investment-grade companies¹ and often global in nature which limits credit risk, whilst the complexity and illiquidity allow investors to benefit from a meaningful premium and reduced volatility over similar public assets.

Figure 2: Performance of short-term alternative finance versus public comparisons

Source: LGIM and Bloomberg, as at 31 December 2022. Indices used: 1-3 Year BBB Sterling Corporate, ICE BofA Sterling ABS & MBS, ICE BofA 1-3 Year UK Gilt, FTSE All-World, Short Term Alternative Finance Fund (STAFF). An investment into STAFF will incur fees which will detract from returns. Past performance is not a guide to the future. The value of an investment and any income taken from it is not guaranteed and can go down as well as up; you may not get back the amount you originally invested.

What is short-term alternative finance?

Short-term alternative finance covers a multitude of opportunities. Examples include:

Capital call facilities. Short-term funding to private investment funds to bridge the time between when an investment is made by the fund and when capital contributions are received from investors to finance that investment. The loans, which help private funds smooth their drawdown process, are secured against the legally binding LP commitments and fund assets.

Supply chain finance. Whereby a supplier of goods sells its invoices at a discount in order to receive immediate payment and thus optimise their working capital position. Supply chain financing allows the supplier to secure lower cost financing based on the credit rating of the buyer, which is typically a larger investment grade corporate, whilst the buyer is able to negotiate better terms from the seller, such as extended payment terms.

Asset-backed financing. Funding provided to a company backed by its balance sheet assets, including short-term investments, inventory and accounts receivable. Asset financing is most often used when a borrower needs a short-term cash loan or working capital to purchase assets and/or enter into leases.

More diversification, less volatility

Diversification is particularly important when it comes to aiming to reduce portfolio volatility. As the table below shows, short-term alternative finance provides access to uncorrelated return drivers not available from other strategies which should reduce portfolio volatility. A broad industry network and strong due-diligence and execution capabilities are required in order to effectively harness the complexity and illiquidity premia.

Case study – LGIM multi-asset portfolios

In early 2021, the LGIM multi-asset team started to reduce duration across some of the multi-asset portfolios by selling government bonds. This created investable cash which was initially put into liquidity funds. However, the funds didn’t require immediate liquidity, so the fund managers explored other ways to optimise the cash position. Short-term alternative finance was an attractive solution given its low duration and volatility. Its private market nature allows a return premium to be harvested which is diversifying compared to the rest of the multi-asset holdings, without taking as much credit or market risk as other alternatives such as short-duration credit or absolute return bond funds. The allocation positively contributed to the performance of the multi-asset portfolios as it significantly outperformed the public fixed income market and reduced overall volatility.

ESG considerations

It is challenging to initiate transaction-specific engagement with the borrowers since the loans are so short-term. However, since the borrowers tend to be large cap firms, asset managers such as LGIM are able to leverage the investment exposure and ongoing engagement at the firm level to deliver real world positive change.

The short-dated nature of the loans does make it much easier to divest from borrowers in the event of negative ESG developments or a change in views as the maturity is only several months.

From an impact perspective, the ongoing supply chain disruptions have presented huge challenges for small- and mid-size suppliers, who have struggled to meet the capital requirements needed to shore up their inventory. Providing faster invoice payments at a lower cost can make a positive impact in terms of supporting smaller suppliers and smoothing their cashflows during a difficult environment.

Conclusion

By taking on some credit risk, short-term alternative finance can help improve returns on assets held for liquidity purposes. It provides an attractive premium and the low maturity of the underlying loans means that cash is recycled quickly. This gives investors more flexibility when it comes to managing their liquidity needs. Additionally, the uncorrelated return drivers provide valuable diversification which is essential in today’s volatile market environment.

Key risks: For illustrative purposes only. The above information does not constitute a recommendation to buy or sell any security. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Views expressed are of LGIM as at 08 November 2022. The Information in this article (a ) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272

1. Examples include well-known auto manufacturers and large supermarkets.

More Related Articles...

Published: December 1, 2022

Home »

Alternative Investments