Structural future-proofing: easy wins for the long term?

|

Written By: John Roe |

John Roe from Legal & General suggests a number of modest changes to asset allocation which can help to build more resilient portfolios

As asset allocation is the main driver of outcomes for LGPS funds’ allocations, modest allocation changes potentially offer easy long-term wins for schemes. These wins include reducing geopolitical risk by adjusting regional allocations, increasing diversification by asset class to reduce overall risk and applying part of the active risk budget to asset allocation which is a key driver of investment outcomes. LGIM’s Asset Allocation team faces similar decisions to those of LGPS funds; the asset classes, regions and currencies we invest in, as well as the opportunities and costs that come from how actively we manage those exposures.

Figure 1: Assessing and mitigating portfolio risk

Source: Legal & General

How exposed are schemes’ funds and what can be done?

By considering how exposed portfolios currently are to these themes, LGPS funds can identify simple, structural solutions that reduce risk to specific outcomes that we do not expect to be rewarded (Figure 1). For example, climate change and environmental damage could be viewed as a significant risk that the most exposed companies all face at the same time and so it is worthwhile understanding total exposure and potentially reducing it.

How funds deal with issues they identify depends on their investment beliefs such as their conviction in active or index-tracking investment. Importantly, solutions can be found in a wide range of asset classes and regions that are consistent with different investment beliefs.

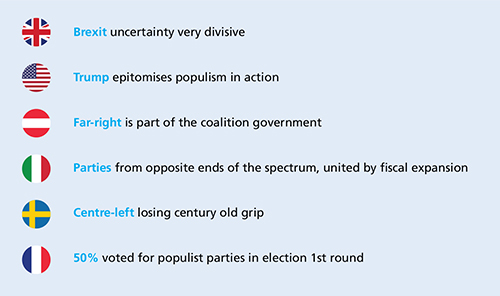

Figure 2: Risks posed by the New Political Paradigm

Source: Legal & General

Geopolitics: the risks posed by the rise of populism

The rise of populism as part of a ‘New Political Paradigm’ has been an important theme in recent years. The world has seen a shift towards anti-establishment politics and policies, driven by factors including rising inequality. President Trump’s election and Brexit immediately spring to mind but there are plenty more examples across developed countries (Figure 2).

While it is easy to be wise in hindsight, the outcomes were hard to predict in many cases. As a result, it is important to focus on preparing for the risk of different outcomes, rather than predicting any particular one. This would mean avoiding too much exposure to any single region or country and therefore avoid being overly exposed to the dynamics in any particular place.

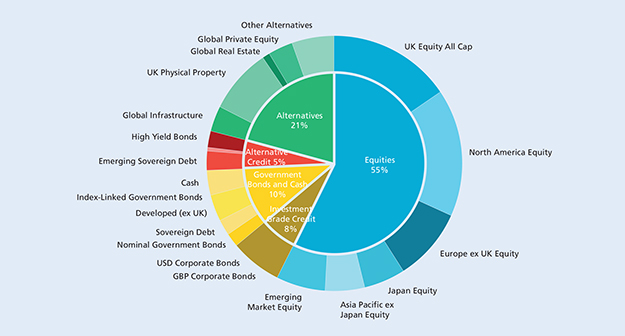

Estimated average LGPS fund overly exposed to US and UK assets

Based on our estimate of the average LGPS fund (Figure 3), they could be overexposed economically and politically both in the US and UK. This includes exposure within assets like private equity, infrastructure, corporate bonds and real estate.

Figure 3: Estimated average LGPS fund asset allocation

Source: PIRC annual review 2018 and LGIM

Easy win #1: increasing diversification by adjusting regional allocations

Given the combination of beliefs on regional performance and the risks posed by the New Political Paradigm, we would tend to reduce US exposure more and diversify it elsewhere. Over-concentration in UK growth assets should be a particular concern for LGPS funds. If the UK performs poorly relative to the world economy, then UK equities, corporate bonds and property would be likely to underperform at the same time as local government income falls. Not only that, but if sterling falls as a result, inflation-linked pension payments could also rise.

The solution for growth assets is similar to the US case; all else equal, LGPS funds should consider diversifying regional exposure further. However, mitigating the UK inflation risk is more difficult, because UK inflation-linked Gilts appear to be poor value relative to similar markets abroad. It may therefore be more attractive to access inflation sensitivity elsewhere; US and Eurozone inflation may be alternatives. This can be paired with significant overseas currency exposure, which helps provide protection against a localised UK crisis or sustained unexpectedly high UK inflation.

Easy win #2: increasing diversification by asset class

It’s noticeable that relative to our own portfolios, the average LGPS fund’s allocation to alternative credit is low. Given the unpredictability of how different asset classes perform through the economic cycle, and also that within any country the reaction of different assets to political shocks will differ, we also tend to allocate more to diversifiers like high yield bonds and emerging market debt. Infrastructure too gets a particular mention in the recent draft guidance on pooling1, because of the attractiveness of stable, long-term cashflows and physical assets backing the investments.

Easy win #3: applying part of the active risk budget to asset allocation could help lead to better outcomes

The recent draft LGPS guidance on pooling reinforces the government’s cost-conscious approach to investment. It comments that pool members should include more passive investments if active funds underperform, which feels like a one-way shift given no similar commentary on when to consider more active strategies.

The current level of active fund use implies that many LGPS funds believe it adds value to the range of potential investment outcomes. The pool members and pool companies then need to consider how to reflect those investment beliefs most effectively given the drive towards lower overall fees.

Applying part of the active risk budget to asset allocation could be one way to combine pool members’ beliefs with the drive for lower overall fees, as unconstrained asset allocators vary exposures across asset classes and regions in a similar way to how some individual active managers increase and decrease total risk within their asset class mandate.

Structural future-proofing

We believe that by adjusting regional allocations, increasing diversification by asset class and applying part of the active risk budget to asset allocation, investors can build more structurally resilient portfolios that tackle issues like politics, costs, sustainability risks and cashflow requirements to pay pensions. In general, the wide range of index-tracking and active solutions allows LGPS to stick to their beliefs on the benefits and costs of active management and illiquid asset classes while tackling these concerns. Prioritising these decisions has the benefit of mitigating the high level risks to which LGPS funds are most exposed.

Past performance is no guarantee of future results. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. The Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272.

M1863

1. Draft statutory guidance on asset pooling in the Local Government Pension Scheme, 2019

More Related Content...

|

|

|