The benefits of illiquid credit

|

Written By: Bernard Abrahamsen |

As borrowing becomes increasingly expensive for banks, opportunities in illiquid credit have opened up for investors. Bernard Abrahamsen explains more

It was another year of volatility and uncertainty in 2013 – particularly after the Federal Reserve introduced the word “taper” into the investment lexicon in May. However, it was the best year since the financial crisis for a number of asset classes. High yield and investment grade credit spreads had a great run but are now close to their tightest levels since 2007.

In today’s environment, some of our clients have been questioning whether liquidity in their fixed income investments is always adequately compensated and are therefore looking at some of the investment opportunities that sit outside traditional fixed income, such as illiquid credit.

The banking crisis in 2008 began as a liquidity crisis when wholesale funding dried up for banks such as Northern Rock. Inevitably, banking regulations are being tightened in response, which in turn is causing the market to place a high value on liquidity and liquid asset classes as demand increases. We believe that investors able to reap the liquidity premium potential of their liabilities will be able to find attractive opportunities in illiquid credit as new regulation comes in and bank behaviour adapts accordingly.

Traditionally, the assets that comprise today’s illiquid credit opportunities were held on banks’ balance sheets until the loans reached maturity, and so little or no secondary market developed in these areas.

However, since the financial crisis, changes in the banks’ lending behaviour mean that institutional investors can step in and invest in these assets. Banks’ changing behaviour is driven by two main factors:

1) It costs banks more to borrow

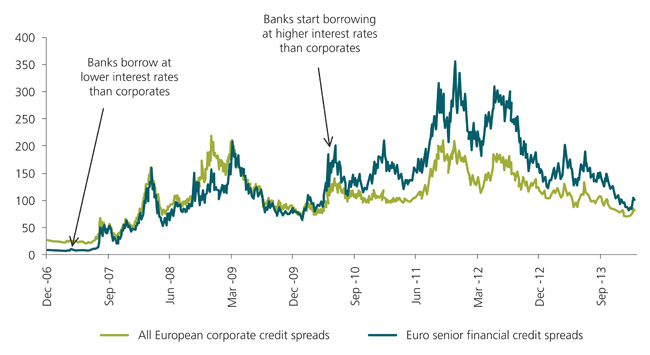

In very simple terms, the traditional business model of banks is to borrow money from wholesale markets and depositors, lend it to companies and home owners at a higher rate and for longer maturities, and profit from the difference between the two interest rates, maturities and credit ratings. However, as Figure 1 shows, this business model has become somewhat unstuck, because bond investors now charge banks more than they charge corporates to borrow.

Figure 1: Financial credit borrowing costs versus the wider market (bps)

Source: Bloomberg/iTraxx, 31 December 2013

Why has it become more expensive for banks to borrow? Bond investors have become increasingly aware that bank balance sheets are not always all that they seem – there are exposures to risky, non-traditional assets and a willingness to pledge traditional assets such as mortgages to gain cheaper funding. All of this means that it is harder to evaluate the chances of a bank defaulting and if a bank were to default it is harder to estimate what amount of your investment you’ll be able to recover.

On the other hand, analysing corporate accounts is comparatively straightforward, so it’s unsurprising that investors are charging banks more to borrow.

2) It costs more for banks to lend

When a bank lends money to an individual or a company, there is always a risk that the bank won’t get back its promised money at maturity. As a safeguard against this, banks are required to hold a certain amount of capital (i.e. cash, equity or other qualifying assets) behind each loan or asset. The riskier the loan or asset is, the more capital the bank has to hold.

Basel III, the updated regulatory regime which governs the amount of capital banks have to hold, is pushing banks to hold greater amounts of higher quality capital than ever before. The cost for banks of issuing this capital means that some types of lending will become much less attractive to banks.

Not only are the capital requirements more stringent but Basel III also introduces new liquidity requirements alongside the capital requirements. One of these, the Net Stable Funding Ratio, will force banks to raise their own long-term debt to match their long-term assets such as loans and project finance. Any reduced availability of long-term debt will make it harder for banks to provide long-term lending.

How to invest in illiquid credit

Illiquid asset classes, such as direct loans, commercial mortgages, distressed debt and asset backed securities can increasingly provide an attractive risks and returns for institutional investors. When investing in them, it’s particularly important that investors fully understand what they are investing in from the off, because it is unlikely that they’d be able to sell it if the credit quality deteriorates. But equally, discipline, patience and flexibility are important. Many of the best investment opportunities today were not available to non-bank investors three years ago and are often still developing asset classes. In order to best access these, an investor’s parameters should be wide enough to allow a manager not to be a forced buyer as forced buying locks in poor value over the life of the asset. In this article, I will highlight one example in particular.

Direct lending to medium-sized businesses

Banks have dominated lending to companies across Europe for a generation but this has been changing in recent years with increasing numbers of large companies accessing the public corporate bond market for financing and new non-bank lenders making medium to long-term loans directly to medium sized businesses.

We have made over £1 billion of these bank-replacement loans on behalf of institutional investors including our parent company, pension funds and HM Treasury. Investors in the sector are attracted by the steady floating rate cash flows delivered by the loans over their five to ten year terms.

Because the companies concerned don’t usually issue bonds in the public debt market, investors also gain diversification away from traditional corporate bond benchmarks.

Bringing illiquid opportunities together

Each illiquid credit sector can offer compelling opportunities for investors but availability and relative value between asset classes can change quickly as new buyers enter a market. By bringing together a fund targeting a range of illiquid opportunities, investors can access the diversified risk and returns of a range of asset classes and can ensure that when certain asset classes become too expensive to offer good relative value, they do not become a forced buyer.

Another benefit of this approach is that, alongside the asset classes mentioned, the portfolio can also invest in one-off illiquid opportunities that are insufficiently available for a standalone fund but have very attractive characteristics. For example, corporate leasing is an area we are investigating as a potential new source of attractive risk-adjusted return giving our clients a further premium for being early participants in a market.

As ever, investing in assets such as these requires a great deal of expertise. Investors need to be well-resourced, with dedicated credit analysts, legal specialists, restructuring analysts, deal originators and experience in structuring and analysing private debt. With all of the skills in place, there are a range of interesting opportunities for institutional investors to tap into. To finish where we began, the world has changed, and for several reasons, we believe that the banking system cannot return to its old ways of doing business. Institutional investors can take advantage of this shift to finance illiquid assets and receive attractive risk-adjusted returns for doing so.

This article reflects the author’s present opinions reflecting current market conditions which are subject to change without notice and involve a number of assumptions which may not prove valid. It has been written for informational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication.

The value of investments can fall as well as rise and past performance is not a guide to future performance. The success of M&G’s investment strategies and their suitability for investors are not guaranteed and you should ensure you understand the risk profile of the products and services you plan to purchase. This and other information is contained in the Fund’s prospectus.

Information given in this article has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents. M&G does not offer investment advice or make recommendations regarding investments. Opinions are subject to change without notice. M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|