The future of food in Asia and alternative proteins

|

Written By: Tai Lin |

|

Shawn Lim |

Tai Lin and Shawn Lim of Proterra Investment Partners examine the opportunities for Asia, based on observations in the US and European markets for alternative proteins, and forecast their significant future growth

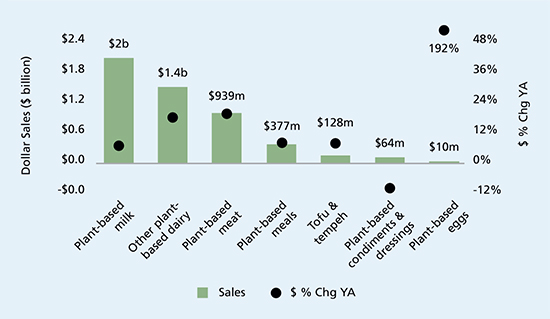

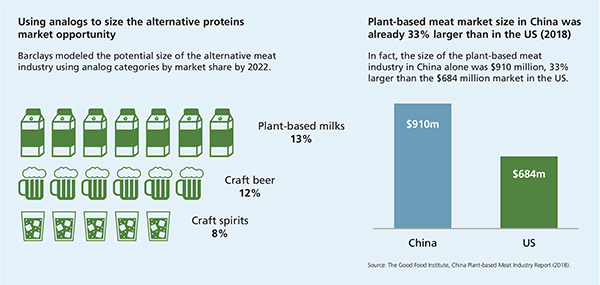

Plant-based alternatives to conventional proteins have grown steadily in popularity in developed economies like North America and Europe over the past decades. The plant-based alternative sector’s growth was led by plant-based milks (e.g., soy, almond, oat, hemp), and has already grown to 14% share of the US retail milk industry. The US plant-based milk market alone was valued at USD 2 billion in 2019 and growing as it becomes increasingly available to the mainstream consumer, with foodservice adoption moving from specialty coffee shops to specialty coffee chains (like Starbucks) to mainstream chains (like Dunkin’, which added oat milk as an option to all US locations in August 2020).

We believe Asia presents a tremendous opportunity for the sector as the most recent wave of modern alternative proteins that have emerged in the West over the past 5 to 10 years has only just begun to take root.

Alternative protein categories

Plant-Based Proteins – these use proteins from plants to produce food that imitates animal-based proteins:

- Meat

- Eggs

- Milk

Fungus-Based Proteins – these use proteins from fungi to produce food that imitates animal-based proteins

Cell-Cultured Proteins – these replicate animal cells outside the animal to produce animal proteins without the need to slaughter the animal.

Figure 1: Total US plant-based food dollar sales and dollar sales growth by category 2019

Source: SPINSscan Natural and Specialty Gourmet (proprietary), SPINSscan Conventional Multi Outlet (powered by IRI), 52 weeks ending 12-29-2019. Extracted from The Good Food Institute, Inc.

Plant-based milks have been around for centuries

Coconut milk is a staple ingredient in traditional foods like curries in Indian or Caribbean cuisines. Almond milk has a long history in the Middle East but also in Europe as far back as in the Middle Ages. Horchata, a plant-based beverage, has traditionally been consumed in Spain and parts of Latin America, while soy milk has been consumed in China at least since 220 AD.

While plant-based milks are not a new innovation, in developed markets like the US and Europe, they had long been relegated to sitting on the dusty shelves of health food stores or the natural food section of supermarkets, a niche product primarily purchased by vegans or people with severe allergies to cow’s milk. In the 2000s, soy milk producers started advertising the health benefits of soy milk on the packaging following a 1999 rule implemented by the US Food and Drug Administration permitting such advertising.¹ Soy milks also began to be merchandised in the refrigerated dairy section, next to cow’s milk, changing consumers’ perception of the product. Other plant-based milks followed suit and the category began to go mainstream.

Henry Ford and soy milk

None other than Henry Ford espoused the benefits of plant-based milks in a 1921 interview: “It is a simple matter to take the same cereals that the cows eat and make them into a milk which is superior to the natural article and much cleaner. The cow is the crudest machine in the world. Our laboratories have already demonstrated that cow’s milk can be done away with and the concentration of the elements of milk can be manufactured into scientific food by machines far cleaner than cows and not subject to tuberculosis.” He went on to build a demonstration soy milk plant in New York in the 1930s.

Plant-based meats too have been around for a time

Tofu and seitan have been consumed in China since before 500 BC. In the late 1800s, John Harvey Kellogg created “nuttose” from peanuts, which he served to patients at the Battle Creek Sanitarium in Michigan as “the perfect substitute for flesh food.”² Morningstar Farms in the US began producing frozen soy-based meats in the 1970s, and Marlow Foods in the UK launched Quorn, a meat alternative produced from mycoproteins extracted from a fungus, in the 1980s.

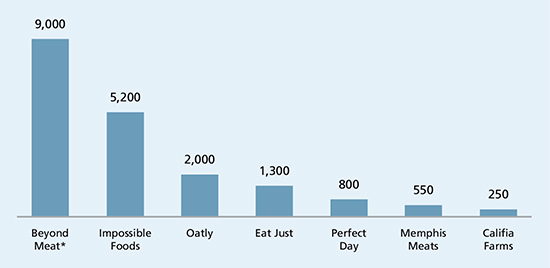

Modern plant-based proteins gained renewed traction with consumers relatively recently. The Beyond Burger, Beyond Meat’s flagship plant-based meat product, only launched in 2016. In 2020, Beyond Meat generated revenue of USD 407 million, with distribution through over 120,000 outlets internationally. So, what’s changed? The latest generation of plant-based alternatives are not the veggie burgers of old. Plant-based meats today sizzle and “bleed” on the grill, and plant-based eggs curdle and scramble in a pan. Most importantly, plant-based protein options available today more convincingly mimic the taste and texture of their respective animal protein counterparts.

Figure 2: Valuations of leading alternative protein companies (USD millions)

* Beyond Meat is a publicly traded company. Source: Pitchbook, public market data. As at 26 February 2021

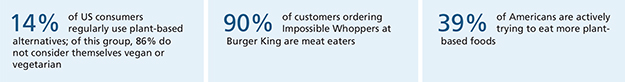

By following a similar playbook to what plant-based milk brands did in the 2000s and merchandising plant-based alternatives next to their animal protein counterparts in supermarkets, modern plant-based protein brands like Beyond Meat, Impossible Foods and Eat Just³ are marketed to “flexitarians” – people who are not vegan or vegetarian, but are looking to reduce their total consumption of animal proteins driven by health and sustainability considerations – which has allowed for more widespread adoption. The new generation of plant-based protein companies have also made a strong push to distribute their products through national quick service restaurant chains to create more opportunities for consumer trial of their products.⁴

Health and sustainability

Plant-based alternatives generally have superior nutritional qualities, such as lower fat content and low to no cholesterol. They also address concerns around the impact that farming animals for protein has on the environment and animal welfare.

Merchandising is crucial

A recent study showed that when supermarket stores placed plant-based meats in a refrigerated section within three feet of animal meat departments, sales of plant-based meat products increased by 23% versus control stores.⁵

Flexitarians, not just vegans

Source: NPD, “Plant-based proteins are harvesting year-over-year growth in foodservice market and broader appeal” (2018), available at: https://www.npd.com/wps/portal/npd/us/news/press

releases/2018/plant-based-proteins-areharvesting-year-over-year-growth-infoodservice-market-and-broader-appeal/

Source: Forbes, “Plant-based protein comes to Burger King: Meet the Impossible Whopper” (2019), available at: https://www.forbes

.com/sites/chloesorvino/2019/04/01/plant-basedprotein-comes-to-burger-king-meet-theimpossible-whopper/

Source: Nielsen, “Plant-based food options are sprouting growth for retailers” (2018), available at: https://www.nielsen.com/us/en/

insights/article/2018/plant-based-foodoptions-are-sprouting-growth-for-retailers/

What does the future hold for alternative proteins? Barclays forecasts that market penetration of alternative proteins would grow from 1% in 2019 to 10% of the global meat industry by 2029.⁶ This would suggest a global market size of USD 140 billion by 2029.

We believe Asia presents an exceptional growth opportunity for the food sector in general, but also specifically in the alternative proteins category. In addition to the health and sustainability attributes of alternative proteins, we are bullish on rapid growth in Asian consumption of alternative proteins for two principal reasons: familiarity, and a demographic tailwind.

Asia has a long history and culture associated with plant-based proteins, with foods like tofu, tempeh, yuba and soy milk forming part of the traditional diet. Going back over a thousand years, vegetarians in China have been consuming “mock meats” made of vegetables, nuts, beans, mushrooms and gluten. In some cases, the underlying raw plant material used to create plant-based products is already a familiar staple food in Asia (e.g., mung bean in Just Eggs).

The millennials and Gen-Zs of Asia will provide an additional tailwind for the consumption of alternative proteins. They are generally better educated, more health and environmentally conscious, curious to try new things, and digital natives who are quick to catch on to global consumption trends. And they are generally willing to spend more on high value food. Millennials will begin to achieve their peak earning capacity in the coming decade. As opposed to millennials in the US, millennials in Asia are out-earning their parents, which will spur a step change in consumption patterns in the region.

With this historical, cultural and demographic backdrop, we believe that Asia in general is primed to become a very important market for the alternative protein sector.

Figure 3: Asia has 5x as many millennials as the US and Europe combined

Source: UN World Population Prospects 2019

Asia will double annual spend on food from $4 trillion to $8 trillion over the next decade

UN forecasts estimate that the global population will swell by another 1 billion people over the next decade, and nearly half of that increase will come from Asia. By 2030, Asia will be home to 65% of the global middle class, and the region is forecast to double its total spending on food from USD 4 trillion to USD 8 trillion over the next decade.

A step towards a more sustainable food system

The global food sector accounts for over a quarter of all greenhouse gas emissions, and Asia is the biggest contributor of emissions within the sector. Plant-based proteins have the potential to generate a positive impact on the environment. As Henry Ford noted in his 1921 interview, traditional animal proteins are a highly inefficient use of natural resources.

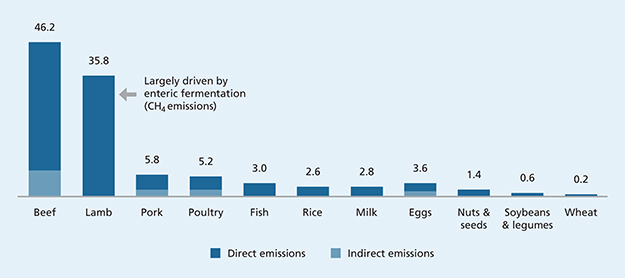

Figure 4: GHG intensity of various foods, kg CO2e/kg of protein

Direct emissions include all on-farm emissions. Indirect emissions include off-farm emissions, such as emissions associated with food manufacturing. Source: McKinsey.

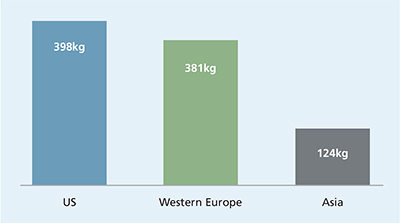

As populations grow wealthier, there is generally a preference to consume fewer cereals and more animal proteins. The world does not have sufficient arable land for Asia to consume the same volume of meat on a per capita basis as the US.

Alternative proteins will form part of the solution to the challenges facing the food eco-system. However, reality dictates that this shift will take time. After all, food is inextricably linked to culture, and culture evolves slowly – over generations. We believe the current alternative proteins movement is the catalyst that is needed to move future generations towards a more sustainable food system and protect the natural resources that Earth has to offer.

Figure 5: Protein Supply per Capita – Asia vs US vs Western Europe

Source: UN FAO

Conclusion/things to watch

Dedicated Asia strategies

With such a large potential market, many new entrants have been attracted to the plant-based protein sector in Asia. We believe formats matter for food products and that Western brands should be wary of simply copying strategies that have worked for their products in their home markets in Asian markets. Asia is also a widely diverse region with different regulatory regimes and consumer preferences in different markets. As the sector grows, pricing will have to come down to reach a broader segment of the population. Furthermore, the proliferation of new entrants will also create pricing pressure in the category. We believe the brands and businesses that will last over the long term will be those that have a strong consumer-centric focus, and develop robust and efficient supply chains that will create a cost-competitive business.

Innovations through R&D

Brands will also be differentiated as they innovate to continuously improve the products on offer as well as new SKUs that are suited to the relevant local markets. The leading plant-based protein brands will work to improve taste and texture (to more closely imitate animal-based equivalents), nutritional profile (e.g., through fortification, lower sodium), and other ancillary attributes (e.g., shelf life, shelf stability).

Cell-cultured meat

Notably, many of the leading plant-based protein brands also have ongoing R&D efforts in cell-cultured meat, where animal cells are replicated in a nutrient rich environment that feeds the cell outside the animal. Cell-cultured meat even more closely imitates “traditional” meat from animals because it is made from the same cells, but can be grown without having to slaughter a live animal, and without the concerns around antibiotic use in livestock farming or other microbiological contaminants like salmonella. Cell-cultured meat is likely to be the next frontier in the alternative protein category, but it will take time for production costs to come down, and for regulatory agencies around the world to review and approve the product for sale to consumers. Currently the only cell-cultured meat product that has been approved for commercial sale in the world is GOOD Meat by Eat Just, which was approved by regulators in Singapore in December 2020.

The information in this document is current as of the date of publication and is provided solely by Proterra Investment Partners LP and its affiliates (“Proterra”).

This document is for informational and discussion purposes only and has been prepared without taking into account any person’s objectives, financial situation or needs. Any person receiving the information in this document should consider the appropriateness of the information, in light of their own objectives, financial situation or needs before acting.

These materials do not constitute an offer to sell, or a solicitation of an offer to buy interests in any product or fund offered by Proterra. Any such offer or solicitation may only be made by the authorized delivery of a confidential private placement memorandum, which would contain material information not contained herein, including a description of certain material terms, confidentiality covenants, risk factors, conflicts of interest, investment considerations and tax, legal, regulatory, and other important disclosures.

1. U.S. Food and Drug Administration, “Food labeling: health claims; soy protein and coronary heart disease” (1999)

2. Brendan Bachmann, “’The Battle Creek Diet System’: A Pamphlet and Birth of the Fake Meat Industry” (2020), available at: https://blogs.loc.gov/inside_adams/2020/02/battle-creek-diet-fake-meat/

3. Proterra has a business relationship with Eat Just via a joint venture based in Singapore

4. See, e.g., the Impossible Whopper at Burger King, the Beyond Famous Star at Carl’s Jr., Just Eggs at Tim Horton’s and Dico’s (China)

5. Plant Based Foods Association, “PBFA and Kroger Plant-Based Meat Study” (2020), available at: https://plantbasedfoods.org/

marketplace/pbfa-and-kroger-plant-based-meat-study/

6. Barclays, “I Can’t Believe It’s Not Meat” (2019)

More Related Content...

|

|

|