The good, the bad and the unrewarded

|

Written By: Andrew Swan |

Andrew Swan of M&G Investments examines some useful strategies for investors facing an environment of high risk coupled with low returns in the fixed income asset class

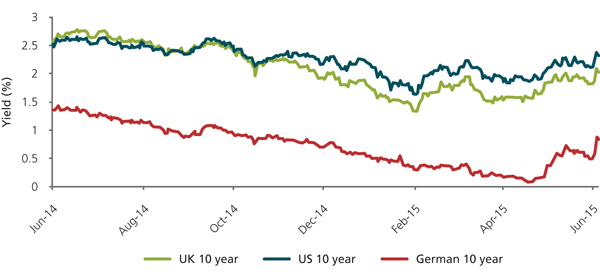

Recent moves in the yields of European government debt have provided a sharp reminder to be cognisant of risk when investing in credit. Initially dubbed the “Bund tantrum”, a sell-off in Germany’s sovereign bonds had pushed the benchmark ten-year bund yield up to a relatively high 0.84% by the time of writing from a record low of 0.07% on 20 April, inflicting large losses on investors who bought in at that level.

The volatility in what are typically viewed as safe securities serves as a warning that markets today can harbour significant risk for often slim returns. Despite the rise in yields, a total €1.05 trillion of European government debt still traded at zero or negative yields at the start of June¹, so offering investors significantly more downside than gain.

Figure 1: Government bond yields are at extreme lows despite the “Bund tantrum”

Source: M&G, Bloomberg (GDBR10, GT10, GUKG10) as of 2 June 2015

Low yields in government debt have had a knock-on effect elsewhere in European credit. Corporate bond yields are made up of two components: duration, or interest rate risk, and a credit spread that reflects the specific risk of the issuer. Over the past two years, the duration element has been by far the largest contributor to returns on corporate bonds in Europe.

This has reached an extreme level as government yields have declined to ultra-low or even to negative yields in some cases, because credit spreads have consequently become the principal contributor to bond yields. The yield to maturity on the BofA Merrill Lynch Euro Corporate Index of euro-denominated investment grade bonds, for example, was 116 basis points as of 1 June 2015, of which the spread over government credit represented 99bps, leaving a slight 15bps attributable to duration.

That means that a typical bond yield is rewarding the bondholder almost for credit risk alone, while its government rate exposure is almost exclusively a source of unrewarded downside risk.

Weaker protection, same reward

This is not the only risk that investors may be poorly compensated for taking. As many seek to deliver a specific target return (despite the low returns available in most credit markets) they are incentivised to take on ever greater risk and accept lower credit quality than they would ordinarily do.

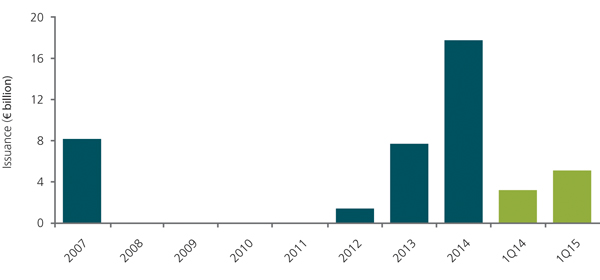

In the bond market, this has led to significant flows of capital into euro high yield, where strong demand has lowered the returns available, particularly on low-rated debt. As demand has outstripped supply, borrowers have been able to offer investors fewer concessions and have pared back the covenant packages designed to limit creditor-unfriendly behaviour, to create “covenant-lite” debt.

The loan market in Europe is not immune from this pressure either. Appetite for covenant-lite loans, which incorporate lighter touch “incurrence” covenants rather than the more onerous maintenance tests, is also re-emerging in Europe after being almost absent after the financial crisis.

“Cov-lite” issuance in 2014 surpassed the previous peak recorded in 2007, according to data from S&P Capital IQ LCD – and the trend continued in the first quarter of 2015.

Figure 2: Covenant-lite loan issuance in Europe is increasing

Source: M&G, S&P Capital IQ LCD, as of 31 March 2015

Finding value through a go-anywhere approach

These trends suggest that typical approaches to investment in credit are not fully compensating investors for the risk of losses arising through volatility or default.

To combat this, investors can develop strategies to allow them greater flexibility and access to a wider range of assets that can help to mitigate the challenging environment and generate attractive risk-adjusted returns. These can take advantage of compelling investment opportunities when value presents itself, while also decreasing the effect of volatility.

Multi-asset credit strategies, which have the flexibility to invest in government and corporate bonds, loans, asset-backed securities and other forms of structured credit, can enable investors to select assets on a stock-by-stock basis based on the value they offer. This less prescriptive approach can naturally build up larger portfolio allocations to asset classes that offer most value and avoid those that offer little – it also brings the benefit of greater diversification of risk. The ability to ignore traditional boundaries between asset classes – such as investment grade and high yield bonds – can enable investors to select securities that may be out of scope for more constrained portfolio managers.

Being unconstrained from a benchmark and able to choose from a range of assets can also support investors’ ability to secure protection on investments they select. An asset-backed security that has a pool of high-quality loans as its collateral may offer an investor a similar yield – or even, on occasion, a better one – than an unsecured corporate bond of comparable credit quality. An investor with the freedom to select the secured bond can benefit from a more attractive risk-adjusted return than those prevented from buying securitisations.

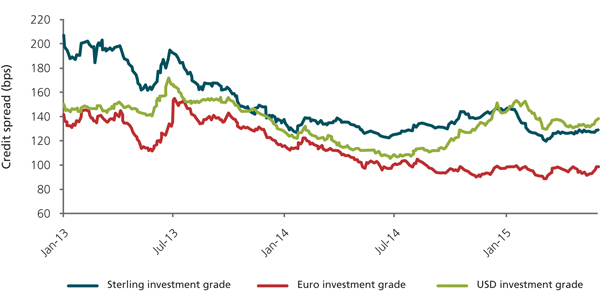

Figure 3: Investment grade credit spreads relatively wide in sterling and dollars

Source: M&G, Bloomberg, Merrill Lynch indices (UC00, ER00, C0A0), as of 2 June 2015.

Take off risk where value is absent

The removal of unwanted risk can add still more flexibility. Interest rate risk, for instance, can be mitigated through hedging strategies to remove its effect on a portfolio. This enables the investor to focus wholly on the risks and rewards offered by credit risk premia across a broad range of assets.

One such is in European investment grade bonds where, interestingly, credit spreads are relatively tight compared with equivalent-quality US dollar and sterling credit. This has been a function of the excess demand for euro credit assets (the “hunt for yield”) and expectations of higher US interest rates this year; this latter point has also caused the spreads of longer-maturity US credit to widen, offering investors attractive entry levels.

However, should credit markets offer few compelling opportunities, the best response should be a cautious one, with a close focus on risk. That may mean retaining a higher than normal allocation to defensive assets or cash in portfolios, since holding dry powder ready to deploy when compelling value is next found becomes a chance to gain rather than an opportunity lost.

A defensive approach may mean the resultant return on portfolios is softer than desired in the short term – but for long-term investors in an environment of high risk and low returns, conservative positioning can be considered far preferable for long-term investors to being exposed to unrewarded downside. The most effective and often least recognised investment strategy is patience.

For Investment Professionals only.

The distribution of this article does not constitute an offer or solicitation. It has been written for informational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. Opinions are subject to change without notice.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority. 0433/MC/0615

1. Source: Bank of America Merrill Lynch Euro Government Index, ref EG00, as of 2 June 2015.

More Related Content...

|

|

|