The impact of inflation on residential mass market housing

|

Written By: Colin Greene |

Colin Greene of Union Bancaire Privée examines the risks facing the mass market housing sector and concludes that its defensive funding strategies make it better placed to adjust to those risks than many other sectors

Mass market residential housing is in structural under-supply. As such, it is a defensive sector. However, it is not immune to supply chain or inflation risks. The sector has seen inflation in construction costs. To date, these costs have been absorbed by rising house prices. Even so, the structural undersupply of housing is such that we expect the sector to continue to be defensive and to offer attractive risk-reward relative to other sectors of the economy.

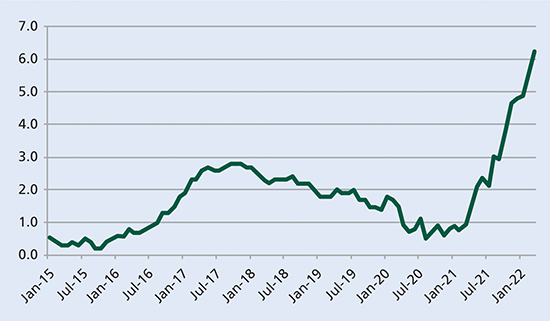

Consumer price inflation

Consumer prices have risen significantly since mid-2020 as a result of supply chain disruptions caused (1) by the Covid-19 pandemic and (2) more recently by Russia’s invasion of Ukraine and the sanctions imposed by western countries in response.

In the UK the consumer price index including owner occupier’s housing costs (CPIH) rose by 6.2% in the twelve months to March 2022, up from 5.5% in February. In March 2022, the UK’s Office for National Statistics (ONS) wrote:

“The largest upward contributions to the annual CPIH inflation rate in March 2022 came from housing and household services (1.49 percentage points, principally from electricity, gas and other fuels, and owner occupiers’ housing costs…” (ONS)¹

Figure 1: UK CPIH Rate

Source: ONS as at Mar 2022

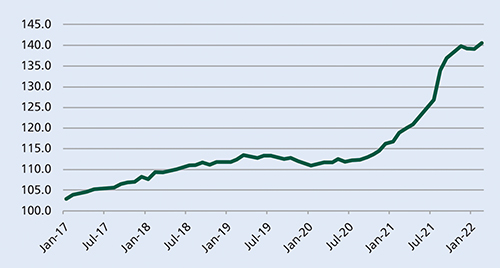

Construction materials inflation

Inflation in construction materials has been rising at a faster rate than general consumer inflation.

Figure 2: UK: Price Index Construction Materials

Source: ONS as at Feb 2022

In the UK, we can see that inflation accelerated in Q3 2021 (ONS).² In November 2021, the Royal Institute of Chartered Surveyors (RICS) wrote³: “Construction materials costs in the UK continue to escalate, reaching a 40 year high based on the annual growth of the BCIS Materials Cost Index.”

Increased global demand in the construction sector, combined with logistical issues and the multiple and complex impacts of the pandemic, have resulted in unprecedented shortages, delays and ultimately, increased prices of materials and labour across the economy.

Within the UK, complications resulting from Brexit have exacerbated this situation, affecting all aspects of trade and labour availability. The repercussions are acutely impacting the UK construction sector.

Construction productivity has largely recovered from the initial shock brought by the pandemic and in some instances significant efficiencies have been achieved as a result of new working practices. However, over the summer, June in particular, a drop in productivity was reported due to sub-contractors self-isolating when contacted by the Test and Trace system.

Other factors affecting construction demand include significant lifestyle changes triggered by the pandemic, with many people continuing to work from home reassessing their housing needs. A booming domestic housing market, substantially increased demand in the repair maintenance and improvement (RM+I) sector, combined with large infrastructure projects such as HS2 have all significantly contributed to recovery in construction demand.”

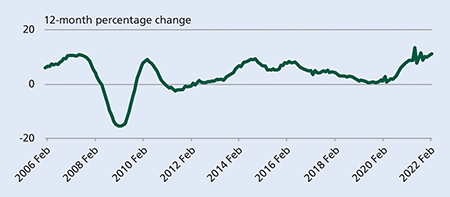

House price inflation

Pre-Covid there was a structural shortage of mass market housing, which was supportive for house prices. Covid-19 has (1) disrupted the supply of new homes, thereby exacerbating the undersupply of housing and (2) accelerated the trend of working from home and the tendency for buyers to look for more space. These factors have meant that in the last two years, house prices have risen faster than general consumer inflation and construction materials inflation.

In its February 2022 release, the UK’s ONS wrote (ONS)⁴:

- UK average house prices increased by 10.9% over the year to February 2022, up from 10.2% in January 2022.

- The average UK house price was £277,000 in February 2022, which is £27,000 higher than this time last year.

- Average house prices increased over the year in England to £296,000 (10.7%), in Wales to £205,000 (14.2%), in Scotland to £181,000 (11.7%) and in Northern Ireland to £159,000 (7.9%).

- London continues to be the region with the lowest annual growth at 8.1%.

Figure 3 shows the annual house price rates of change for all dwellings in the UK between January 2006 and February 2022⁵.

Figure 3: Annual house price rates of change for all dwellings, UK, January 2006, to February 2022

Source: ONS as at Feb 2022

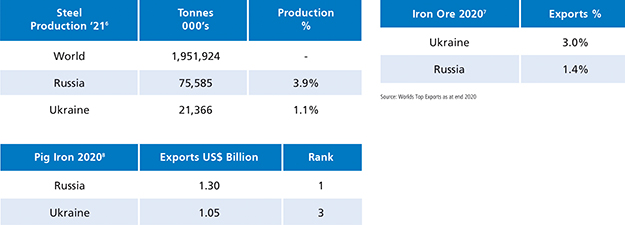

Russia and Ukraine

The war in Ukraine has already caused an energy price shock, which in turn is set to impact every household and sector in the UK and Ireland (and in every Western economy). There are risks of a more widespread war and recession. At present, we consider these to be “tail risks” that would have global consequences. For the purposes of this analysis, we ask how the war may further disrupt supply chains for building materials.

Steel

Russia and Ukraine together account for 5% of global steel production and 4.4% of iron ore exports. In addition, in 2020 Russia exported US$1.3 billion of pig iron, making it the world’s largest exporter of pig iron, while Ukraine was the third largest exporter with US$1.05 billion in exports. The World Steel Organisation wrote the following in its April 2022 Short Range Outlook:

Figure 4: Russia and Ukraine steel and iron production

Sources (left to right): World Steel Association as at end 2021 | Worlds Top Exports as at end 2020 | OEC as at end 2020

- Worldsteel forecasts that steel demand will grow by 0.4% in 2022… after increasing by 2.7% in 2021

- In 2023, steel demand will see a further growth of 2.2%

- The impact [of the war] will also be felt globally via higher energy and commodity prices – especially raw materials for steel production – and continued supply chain disruptions, which were troubling the global steel industry even before the war

- There are further downside risks from the continued surge in virus infections in some parts of the world, especially China and rising interest rates

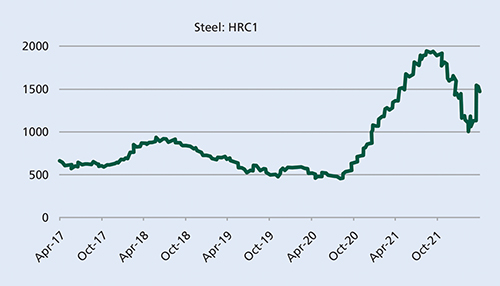

Figure 5 shows the price of the HRC1 steel future (Bloomberg).#8313;

HRC1 is the generic future for hot-rolled steel, traded on the Commodities Exchange Centre (CEC). Steel prices rose steadily from Q3 ‘20 to Q3 ‘21, before steadily declining, but not reaching pre-Covid levels. Steel prices spiked again following the start of the Ukraine conflict.

Figure 5: Price of the HRC1 steel future

Source: Bloomberg as at Apr 2022

The outlook for steel prices is highly uncertain. Anaemic demand, Covid in China and rising interest rates would all suggest lower prices, but supply chain disruption and energy prices suggest higher prices. We have learned in recent years to be mindful of supply chain disruptions. As such, it would be prudent to expect prices to be elevated.

Timber/Lumber

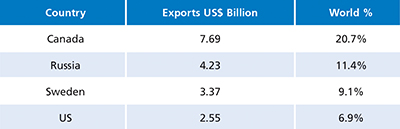

Timber and pulp-and-paper products account for 3.6% of Russian exports (Russia Briefing).¹⁰ Sawn wood is the world’s 98th most traded product with a total trade in 2020 of US$37.1 billion. In 2020, the top exporters of sawn wood were as in Figure 6 (OEC)¹¹.

Figure 6: 2020 top exporters of sawn wood

Source: OEC as at end 2020

The Programme for the Endorsement of Forest Certification (PEFC) is a leading global alliance of forest certification systems. As a result of the UN General Assembly Resolution A/ES-11/L.1 (2 March 2022) “Aggression against Ukraine”, the PEFC has designated all timber (including forest and tree-based products) originating from Russia or Belarus to be “conflict timber” (PEFC)¹². In the UK, the Timber Trade Federation (TTF) has advised all members of the TTF to cease trading with Russia and Belarus.

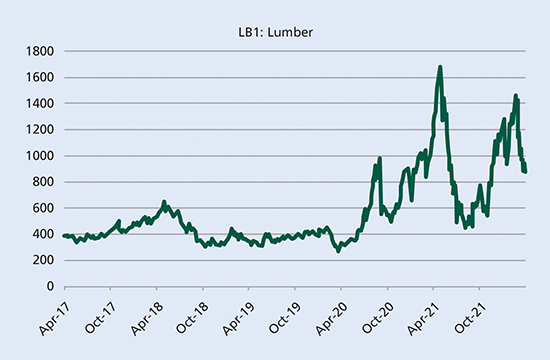

LB1 is the generic lumber future traded on the Chicago Mercantile Exchange (CME).¹³ Lumber futures spiked in the twelve months following the March ‘20 Covid lockdowns, before recovering to near pre-Covid levels by end 2020. US lumber futures spiked again following the start of the Ukraine conflict, before recovering somewhat by mid-April (Bloomberg)¹⁴. Again, in view of disruptions to supply chains, we expect lumber prices to remain elevated.

Figure 7: Price of the HRC1 steel future

Source: Bloomberg as at Apr 2022

China

China has to be considered in every discussion of supply chains and commodity prices. Over the last 10 years, Chinese investment in infrastructure and real estate has been a major driver of commodity prices and the global economy.

We are currently concerned about elevated China country risk:

a) Defaults among Chinese real estate developers speak of a sector that is over-leveraged and over-invested. The sector poses a risk to China’s financial system and could be a source of contagion to the global economy

b) While the West appears to be emerging from Covid-19, China continues to have difficulties that could continue to disrupt global supply chains.

The above risks may have contrasting impacts on global commodity prices. A slow-down in China would depress commodity prices, while further supply chain disruptions would be inflationary.

Relative value and risk/reward

There is a challenging economic backdrop for the world as a whole and for every sector of the economy. Mass market residential housing is in structural under-supply. Financing the development and construction of mass market residential housing is defensive and this sector can offer an attractive risk/reward when compared to most other real estate sectors and other investment opportunities.

The outperformance of house prices relative to inflation attests to the defensive nature of mass market residential housing. The official statistics are supported by anecdotal evidence from developers spoken to in the UK and Ireland who report that house price inflation has outpaced construction cost inflation over the past two years.

What of future house prices? The supply/demand imbalance continues to support house prices. Moreover, even though interest rates are rising, borrowers can obtain mortgage borrowing at well below inflation rates. For the foreseeable future, we expect to see continued house price growth, albeit at a lower rate. We think it less likely that there will be a correction in house prices. Moreover, any such correction would be mitigated by the supply/demand imbalance in mass market housing.

There are other aspects of the sector that support its defensive nature including:

- There is a mitigating mechanism during periods of high materials price volatility

- There are reports of large projects put on hold, as developers and contractors await more stability in materials prices, which has a cooling impact on materials demand

- As gaps appear in contractors’ schedules, they become more willing to “buy-risk”, i.e. take on new construction contracts

- There are reports of a possible two-tier inflation market with higher tender price increases on larger projects due to a smaller pool of potential contractors

- Developers may adjust their cost structures by reducing what they are prepared to pay for land, and by value engineering projects (to reduce construction costs or add higher density of housing units)

Conclusion

Covid-19 exposed the global economy’s vulnerability to supply chains. When tight supply chains are disrupted, there can be near immediate disruption to production and inflationary pressures follow. The Covid-19 induced disruptions are fading, although risks remain, particularly with respect to China.

Russia and Ukraine are significant exporters of commodities such as steel, iron ore and lumber, such that we expect further disruption to supply chains. These supply chain disruptions are set to give rise to inflationary pressures in all sectors of the economy, including mass market residential housing.

Mass market housing is in structural under-supply. We have seen that this supply-demand imbalance has caused house price inflation such that the sector to date has absorbed construction materials inflation. It is to be expected that this supply-demand imbalance will continue for years to come. House price inflation has been one mechanism in which the sector has adjusted to construction material inflation. As we have seen, other mechanisms also exist, including deferral of construction projects, a likely two-tier market split between smaller and larger projects, value engineering etc.

Financing the development and construction of mass market residential housing is defensive and we believe the sector is better placed to adjust to supply chain disruptions and interest rate risks than many other sectors in the economy, thereby offering attractive relative value.

1. Source: ONS, www.ons.gov.uk

2. Source: ONS, www.ons.gov.uk

3. Construction materials cost increases reach 40-year high (rics.org)

4. Source: UK House Price Index – Office for National Statistics (ons.gov.uk)

5. Source: ONS

6. Source: World Steel Association, worldsteel.org

7. Source: Worldstopexports.com

8. Source: Observatory of Economic Complexity

9. Source: Bloomberg LLP

10. Source: Russia’s 2021 Exports By Sector And Country – Russia Briefing News (Russia-briefing.com)

11. Source: OEC

12. FAQ: Timber from Russia and Belarus considered ‘conflict timber’ – PEFC – Programme for the Endorsement of Forest Certification

13. More specifically, a standard load of random length 8 – 20’ softwood 2 x 4s, the type used for rehabbing and construction

14. Source: Bloomberg LLP

More Related Content...

|

|

|