The new emerging markets playbook

|

Written By: Stephen Way, CFA |

As emerging market companies deal with a new economic playbook, it’s time to work their assets harder. Stephen Way, Senior Vice-President and Portfolio Manager of AGF Investments explains more

Since 2008, emerging markets (EM) have powered global growth but they’ve faced a slowdown more recently. What’s your outlook for EM?

On a structural basis there is still a positive story for EM due to strong demographics, low credit penetration and low debt-to-GDP levels. However, on a cyclical basis, emerging markets have underperformed since 2010 mainly due to declining return on equity, shrinking margins and higher wage costs. While companies in developed markets have been very disciplined about cutting costs, emerging markets firms haven’t yet followed suit. Going forward, they’ll need to deal with sticky costs and get aggressive about cost cutting in order to remain competitive.

Does that mean investors should temper their expectations about emerging markets?

Emerging markets are maturing. Opportunities will be more selective in the near term, but, over the long term, secular drivers remain intact. Now, similar to investing in developed markets, investors need to better understand a company’s key drivers of shareholder value, which we believe are sales, margins and asset turnover. Although margins in emerging markets are higher relative to margins in developed markets, the gap between these two measures is at a 20 year low. Shrinking margins are an even bigger problem in emerging markets right now because growth is slowing as the global economy continues to languish and these markets become more competitive and crowded.

Clearly, EM companies are dealing with a completely new playbook. To succeed going forward, they need to control costs and do a better job of what we call “sweating their assets”, which means using their balance sheets to improve their return on assets. Developed market companies have been more successful in sweating their assets; however, we see many opportunities for EM companies to achieve the same goal.

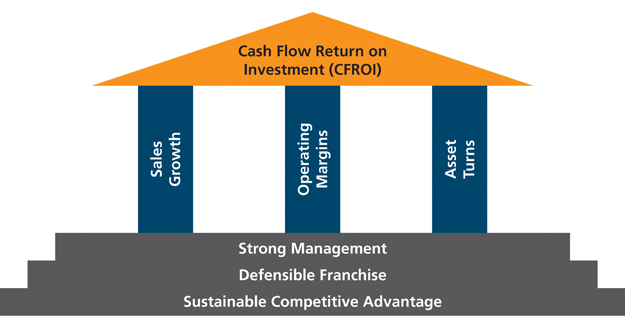

Figure 1. Economic Value Added (EVA): focuses on higher returns while controlling risk

Source: AGF

How do you identify EM companies that are really “sweating their assets”?

At AGF, we use the same Economic Value Added (EVA) investment approach in emerging markets as we do in developed markets. EVA helps us identify firms that are earning a rate of return above their cost of capital. To do this, we look closely at the cost of both equity and debt capital to understand the value added by a company. There are a number of metrics that investors can use to analyse economic profit. One that we believe helps to accurately determine future value creation is Cash Flow Return On Investment (CFROI). CFROI takes into account how much capital is required for the firm to generate each dollar of cash flow. To drive higher levels of CFROI a company can increase sales, improve operating margins or increase the efficiency of their assets.

Another metric we use is a firm’s weighted average cost of capital (WACC), which is based on the cost of debt and equity as well as tax rates. This serves as a firm’s hurdle rate, a minimum rate of return required for a company to break even in economic terms on its investments.

Which sectors in emerging markets look the best from an EVA standpoint?

We see opportunities in the Health Care, Consumer Staples and Consumer Discretionary Sectors. Consumer Discretionary is particularly attractive as it historically demonstrated high levels of CFROI relative to its cost of capital. Right now there is a 200 to 300 basis point divergence between EBITA* margins in emerging and developed market companies. We see no reason why some emerging market companies can’t improve their margins at the same level as developed markets have done.

You employ a country allocation approach within your global equity mandate. Does this approach work for emerging markets? If not, why not?

This country allocation framework is used within our global equity strategy to identify undervalued markets with improving growth prospects and low risk characteristics. Historically, the country allocation framework has not worked when constrained within a particular region (in this case, emerging markets). That is because the framework works best when it is set free to move between different regions (such as emerging markets and developed markets) as it can then take advantage of differing economic trends by allocating funds across those regions. Therefore, we currently do not use a country allocation framework in our AGF Emerging Markets Fund and focus instead on a bottom-up strategy.

When looking for promising stocks, do you tend to look first in some countries rather than others?

Based on our bottom-up approach, our screening process helps us identify potential investments. We start with an investable universe comprised of several thousand companies, then screen for those companies with the most promising characteristics (current or potential generators of EVA) rather than look within certain countries or regions. We thus avoid being biased for or against certain countries/regions. Typically, allocations to countries and/or sectors are a residual of our bottom-up security selection process. Having said that, we remain cognisant of a country’s macro economic environment as well as the importance of diversification: we typically own 60-90 securities across at least eight of the 10 sectors (we currently own all 10) spread over 18-20 countries.

*Earnings before interest, taxes, depreciation and amortization

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA) and AGF Asset Management (Asia) Limited (AGF AM Asia), AGF International Advisors Company Limited (AGFIA), and Acuity Investment Management Inc. (Acuity). AGFI and AGFIA are registered as portfolio managers across Canadian securities commissions. AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets. AGF International Advisors Company Ltd. is authorised by the Central Bank of Ireland and is regulated by the Central Bank of Ireland for conduct of business rules and by the FCA for conduct of business rules in the UK. The commentaries contained herein are provided as a general source of information based on information available as of July 2014 and should not be considered as personal investment advice or an offer or solicitation to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

More Related Content...

|

|

|