The practical challenges of LGPS property pooling

|

Written By: Matt Day |

Matt Day of Kames Capital considers how local government pension schemes can most effectively move property assets from indirect to directly-held property should members follow the recommendations of the project pool report

In January 2016 Project POOL was published. This comprehensive report by Hymans Robertson was prepared on behalf of a joint working group of 24 LGPS administering authorities. It significantly shaped the final submissions for pooling proposals that were submitted in July 2016 and the implementation phase that will follow.

Project POOL rightly focused on the Department for Communities and Local Government’s primary reason for pooling, which was to save costs. With an estimated £13 billion of LGPS assets invested in property, this asset class was identified as offering significant potential cost savings. In particular, the report suggested that economies of scale could be achieved by moving from indirect property funds to directly held property, thereby removing the additional layer of fees within fund and multi-manager structures.

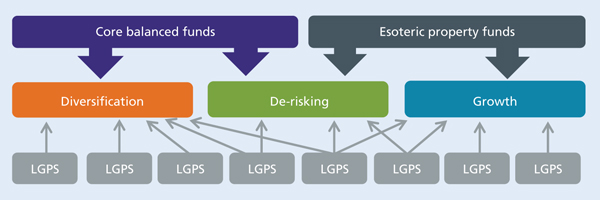

There seems to have been less consideration given to how the various pools move from a disparate collection of property funds to direct property portfolios. The complexity and illiquidity of property will require a detailed strategic vision, along with time and experience to manage the transitions. Given the considerable costs and on-going savings at stake, the advantages to those pools which plan carefully will be considerable.

It looks like there will be eight pools with total assets ranging from around £13 billion to £36 billion. Given a fresh start, each would undoubtedly have sufficient scale to form a direct property portfolio. These would be complemented by indirect holdings or joint ventures to access specialist sectors where individual property values make diversification difficult, such as central London offices, major shopping centres and overseas markets.

But of course the pools are not starting from scratch. Many existing local government schemes already have between £100 million and £200 million allocated to property. So it is no surprise that indirect portfolios have been the route of choice for many schemes, given the transaction cost savings and vastly superior diversification that can be achieved compared to direct investment.

We estimate that indirect funds account for between 55-60% of the LGPS property allocation, although this is not consistent across all eight pools. The Northern Pool and the LPP hold very few indirect holdings, while Access, Brunel and the London CIV have combined property exposure made up almost entirely from a collection of indirect holdings.

We recently analysed the property holdings of these pools. Most will need to develop a sophisticated transition strategy to ensure the final proposition is effective for all, and that the costs of achieving their objectives are not prohibitive.

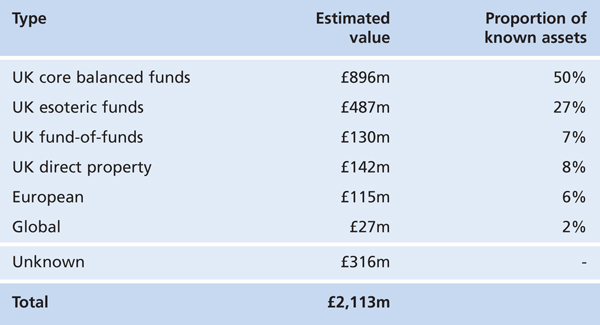

Analysis of London CIV holdings

One example was the London CIV, where our research found that 29 of the 33 individual LGPS participants hold indirect property, with just one having any direct property, and four having no exposure to property. In 2015 the total invested in property amounted to £2.1 billion across 69 various underlying property funds or fund-of-funds.

Figure 1: Property holdings of London CIV

Source: Kames Capital, based on Freedom of Information Request as at 31 December 2014, 31 March 2015 and 30 June 2015.

In Figure 1 we illustrate the breakdown by fund category. This example gives some insight into the transition challenges, with only the core balanced funds offering reasonable liquidity. Even here, this liquidity may be non-existent should all the pools attempt to transition at a similar time. The other indirect holdings are typically closed-ended and are likely to be held on a passive basis until money is returned by the manager. In these instances, strong monitoring and governance is still required to ensure liquidity is achieved on the best possible terms.

Property transactions are expensive. The typical “round-trip” cost for sale and purchase is 7-8%, of which 5% is Stamp Duty Land Tax (SDLT). The rumoured waiver of SDLT may be unrealistic, with actual property unlikely to transition in-specie from unlisted funds, not to mention the inequality in having a different tax regime for LGPS compared to other pension schemes. While the costs of dealing in indirect funds can be mitigated through secondary market transactions where units are sold at a mutually agreed price between buyer and seller, there is unlikely to be sufficient demand to satisfy the huge amount of indirect property currently held by LGPS.

Returning to our case study of the London CIV, we estimate that to achieve the objectives of Project POOL and move from indirect to direct property, the full round-trip will cost around £165 million.

If the London CIV continues to adopt an outsourced management approach then we estimate that the Total Expense Ratio (TER) on a segregated direct portfolio will be around 0.25%. Assuming a 1% blended TER on funds currently held, it will take over 10 years before this cost is offset.

An internally-managed approach may reduce this through even lower ongoing costs, although establishing a direct property investment and management team with relevant experience would require time and expertise.

Finding a solution

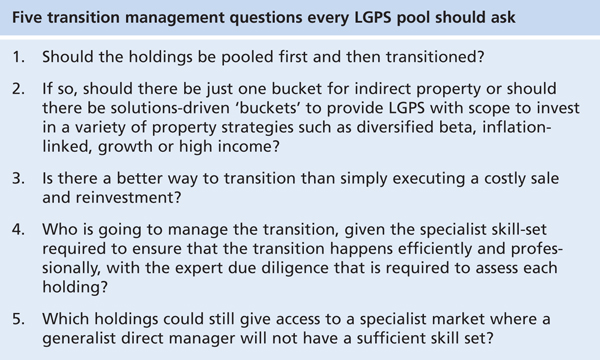

The benefits of investing in property as a part of multi-asset portfolio are widely recognised by pension schemes. Specifically, property offers:

- Attractive long-term returns with characteristics of both equities and bonds

- Relatively low volatility compared with other asset classes

- Diversification, through low correlations to other asset classes

- Stable and attractive income returns, with the potential for capital growth

- Some inflation protection of income

Figure 2: Pension fund objectives supported by property investment

For pension funds, property is a versatile asset class that can support a range of different investment objectives, see Figure 2. There is an opportunity for all existing property holdings (both indirect and direct) to be allocated to three distinct collective investment vehicles, mandated to achieve these high-level strategic aims. Each LGPS would receive a pro-rata share determined by the value of units transferred in-specie into the funds and in time be able to establish exposure that aligns with their strategic objectives.

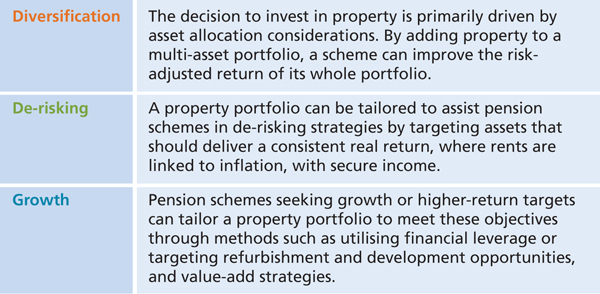

The process, which we illustrate in Figure 3, involves:

- Re-organising existing property into three distinct “buckets”, each providing a different solution (diversification, de-risking or growth)

- LGPS receives pro-rata share determined by value of units transferred in-specie into the funds

- Each LGPS retains control over strategic allocation

This solution would avoid a costly “fire-sale” transition to direct property, and allow the managed long-term movement to direct property within funds.

Figure 3: Structuring property holdings into CIVs

The only indirect property funds that incur SDLT on transfer of ownership are interests in Limited Partnerships. Although the transfer of direct property would ordinarily incur the full 5% SDLT, portfolios of direct properties could potentially be transferred to a pooled vehicle (to be managed directly) if the SDLT seeding relief requirements were satisfied (including an overall total of at least £100 million being transferred).

We believe that structuring the three CIVs would incur minimal initial set-up costs. However, given the varied holding structures of indirect property, the structure of the CIVs would need carefully consideration to ensure their suitability.

This article is not intended for retail distribution and is directed only at investment professionals. It should not be distributed to, or relied upon by, private investors. All data in this presentation is sourced to Kames Capital unless otherwise stated. The views expressed in this document represent our understanding of the current and historical positions of the market. They should not be interpreted as a recommendation or advice.

Kames Capital plc is authorised and regulated by the Financial Conduct Authority (FCA reference no: 144267).

More Related Content...

|

|

|