The role of bonds in a new era of low yields

|

Written By: Scott Mather |

|

Anmol Sinha |

Scott Mather and Anmol Sinha from PIMCO discuss the resiliency and diversification potential that remains critical in a world with meaningful uncertainty ahead

August 2020 was a month for the record books, just a few months removed from quite possibly the deepest but shortest recession in modern times. With US 10-year Treasury yields setting record lows, and US equities (S&P 500) hitting record highs, some investors are questioning whether traditional core fixed income can still serve as effectively as a ballast in portfolios.

The interest rate sensitivity of core bonds has historically served as a diversifier to equities, providing price appreciation potential and resiliency in the face of stock market declines. Core bonds generally have been used to help dampen overall portfolio volatility while pursuing attractive returns that can outpace inflation.

We will now look at how the traditional appeal of core bonds stacks up today.

Re-examining the value proposition of traditional fixed income

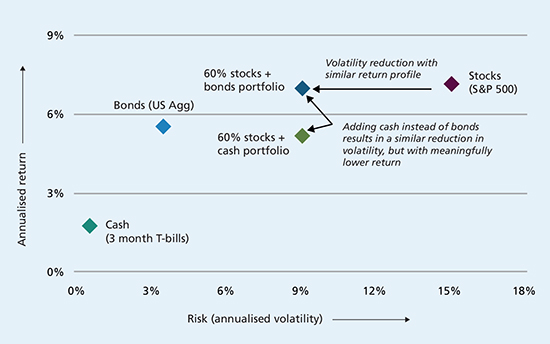

Dampening volatility: In isolation, core bonds display higher volatility than cash. However, in a portfolio that includes equity and other riskier holdings, core bonds have historically offered a reduction in volatility similar to that achieved by holding cash, but with higher returns (see Figure 1). This volatility-dampening benefit is a function of the generally negative correlation that core bonds can display to equities. Even with interest rates somewhat range-bound at lower levels, we believe this correlation benefit should persist – that is, rates could still go lower in a negative growth scenario when equities and risk assets underperform.

Figure 1: Diversification benefits: Adding bonds has meaningfully lowered volatility while providing similar returns (data over past 20 years)

Source: Bloomberg, PIMCO as of 31 August 2020. Past performance is not a guarantee or a reliable indicator of future results. Bonds are represented by the Bloomberg Barclays US Aggregate Index, Cash represented by the FTSE US 3-Month Treasury Bill Index and stocks represented by the S&P 500 Index. Is it not possible to invest directly in an unmanaged index.

Diversifying risk assets in periods of market stress: Core bonds also have had the ability to provide positive return potential when riskier assets face drawdowns. This is because interest rates tend to fall (benefiting rate-sensitive assets) when credit or equity performance is challenged (e.g., by the end of Q1, the Bloomberg Barclays US Aggregate Index (US Aggregate Index) was up 3.15% when the S&P 500 was down 19.60%). With interest rates at today’s low levels, the room to decline is potentially more limited than before – but rates can still fall even in what will likely remain a fairly range-bound rate environment. Moreover, to the extent a more negative growth scenario were to take hold, we would expect rates to decline substantially and thus deliver price appreciation potential (a severe negative shock could push yields to zero, and with 10-year Treasuries yielding about 0.7% lately, a decline to 0% yield would imply price appreciation of over 4%¹).

Supplementing returns: Although the level of yields may have declined, we believe the potential for active management to generate alpha has remained fairly consistent. In fact, with yields on the US Aggregate Index just above 1%, active management may become more critical as alpha could likely be a larger share of returns going forward. With the average active core plus manager capturing a 0.7% yield advantage² over the US Aggregate Index, the return potential is not that dissimilar to years past at inflation plus 1% to 2%. The opportunity for solid returns from active core management – and the potential for price appreciation and resiliency during volatility – can be compelling in a world of low return expectations across asset classes.

Adapting portfolios to the world ahead

Fearing lower returns from core bonds, some investors may be tempted to reduce such holdings in favour of cash or equities. However, if one were to use the example of insurance, it becomes clear that the response to a decline in the potential payout should not be either to own less insurance (i.e., go to cash) or take more risk (buy more equities).³

Instead, investors may find it prudent to examine their asset allocation through the same lens that we apply within core portfolios. With duration offering somewhat diminished diversification to credit and other spread risk, reducing concentrations and broadening the types of spread risk is critical in our view – i.e., emphasising less correlated assets to embed resiliency.

In addition to maintaining duration, we find value in US agency mortgage-backed securities, where overall yields are compelling, especially for an asset class with a government or agency guarantee, direct and substantial Federal Reserve support (via current asset purchases),⁴ and robust liquidity (compared to corporate credit). We are emphasising higher-quality investment grade credit and focusing on sector and credit selection over generic beta exposure given the dispersion between and within sectors (for markets but also the broader economy) and in recognition of an evolving credit cycle that could lead to more downgrades and defaults. Other securitised credit, particularly higher up the capital structure, can also provide compelling risk-reward profiles and the potential for resiliency in what is likely to be a long and uneven economic recovery.

So yes, rates are low, but we believe the defining features of core bonds – diversification and return potential – continue to make them a critical component of a well-balanced portfolio.

A word about risk: Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Investing in foreign denominated and/or domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. High-yield, lower-rated, securities involve greater risk than higher-rated securities; portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not. Derivatives may involve certain costs and risks such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested.

The services and products described in this communication are only available to professional clients as defined in the Financial Conduct Authority’s Handbook. This communication is not a public offer and individual investors should not rely on this document. Opinion and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness.

For investment professionals only. PIMCO Europe Ltd (Company No. 2604517) Ltd (Company No. 2604517) and PIMCO Europe Ltd – Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (12 Endeavour Square, London E20 1JN) in the UK. PIMCO Europe Ltd services are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication. ©2020, PIMCO.

1. As of 31 August 2020 – and based on the Bloomberg Barclays US Aggregate Index duration of 6.09 years.

2. Yield advantage based on the average SEC yield (current 30-day yield) in the Morningstar Intermediate-Term Core Plus category (US) versus the yield on the Bloomberg Barclays US Aggregate Index as of 31 July 2020.

3. Cash and investment products are not insurance. The term is being used for illustrative purposes only. PIMCO does not offer insurance guaranteed products or products that offer investments containing both securities and insurance features.

4. US agency mortgage-backed securities issued by Ginnie Mae (GNMA) are backed by the full faith and credit of the United States government. Securities issued by Freddie Mac (FHLMC) and Fannie Mae (FNMA) provide an agency guarantee of timely repayment of principal and interest.

More Related Content...

|

|

|