The role of secure income assets post-Covid-19

Published: October 1, 2020

Written By:

|

Stuart Hitchcock |

|

Calum Macphail |

|

Amie Stow |

Stuart Hitchcock, Calum Macphail and Amie Stow of Legal & General Investment Management discuss the growth of funding source diversification, which offers the private credit market access to a wide range of opportunities, particularly in ESG-focused investments

The impact of the global pandemic is expected to continue to influence the world around us, long after its eradication. Potential changes to industry precipitated by the crisis include the ways in which we shop, travel, socialise and work. Secondary and tertiary effects may also become clearer over time. A trend that we see accelerating is the disintermediation of banks, with companies seeking access to broader sources of funding as a result. In our view, secure income assets¹ can play a crucial role here by helping support the regeneration of the UK economy and providing pensions funds with stable and long-term cash flows.

A brief history of private markets

Traditionally, banks have been one of the primary sources of funding for borrowers. In the early to mid-90s, a relatively small number of European borrowers began to take advantage of private institutional investment markets, using the availability of longer-term capital from the likes of US insurance companies to match their liabilities with income. This “private placement” market, used by US borrowers for half a century, was now expanding internationally.

Over the next decade, these private markets grew significantly. However, a real step change in borrowing behaviour followed the financial crisis, when the willingness and ability of banks to lend, particularly to small and medium sized entities, declined. We observed a sizeable increase in issuance across sectors that had only sporadically accessed institutional money in the past – for example, housing associations and universities – and an increase in financings undertaken with more modestly-sized companies that would not be able to access the public bond markets. We have also seen an increase in pension fund money stepping in to bolster available capital across sectors.

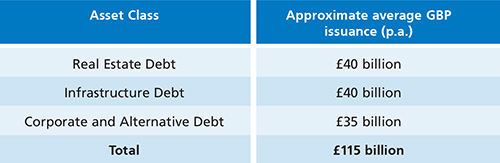

Current estimated direct GBP investment volumes across private markets are detailed in the table below.

Source: LGIM internal data, August 2020

Private capital to play a more meaningful role

In our view, Covid-19 may provide the catalyst for a further step change in private funding.

With parts of the economy having ground to a halt, the ability of companies to manage their liquidity has been stretched. This is different to the bank-led global financial crisis and is causing borrowers to review their sources of funding to ensure access to more diversified sources of liquidity. Going forward, using banks for short-term liquidity facilities and institutional investors for longer-term debt may strike a better balance for borrowers to manage the effects of economic cycles and bouts of market instability.

As a large institutional lender, we believe part of our role is to help navigate periods of uncertainty by providing core, more permanent debt. This implicitly helps companies steer through tougher periods while using more traditional sources of funding, such as banks, for shorter-term liquidity. In our view, it also helps support the growth and development of sustainable businesses.

We believe pension funds also have an opportunity to play an increasing role in financing longer-term debt. These patient pools of capital marry well with companies seeking long-term funding, many of which are engaged in revitalising the UK economy by investing in new infrastructure projects, helping to refinance upcoming debt maturities or providing additional debt funding where needed. Pension capital could ultimately drive a return to growth through investing in these secure income type assets. Access to private markets for smaller pension funds, which may not want to make asset allocation decisions themselves, can be through pooled funds. Larger pension funds may prefer to invest through segregated accounts and co-investment opportunities in certain transactions.

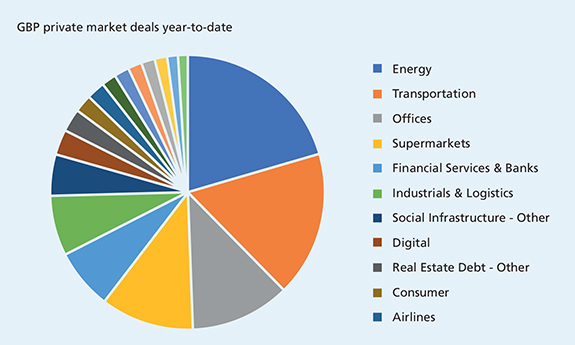

A wide range of borrowers are now looking to the private market for capital. We believe the majority of these require between £100-300 million of debt finance, which is generally regarded as too small for public markets. We also see opportunities in more nascent sectors such as digital infrastructure and those in the crossover space, where access to other capital sources has become more challenged. Figure 1 gives an overview of the diversity in sectors we have witnessed in the private markets so far this year, demonstrating the increasing breadth of secure income assets.

Figure 1: Sector breakdown of all deals seen across sterling secure income assets, year-to-date

Source: LGIM Real Assets, 28 August 2020. Chart represents all private credit deals seen by LGIM’s private credit investment team year-to-date. It does not reflect assets transacted on by LGIM during the period.

Case Study: Social Housing

The UK continues to suffer from a shortage of affordable housing, with 1.3 million households on local authority waiting lists. An example of private capital’s role in the post-Covid growth of the UK economy is evidenced by a recent £100 million long-term loan to Bromford Housing Group (Bromford), the largest provider of affordable homes across Central and South West England. As a strategic partner of Homes England, Bromford has a key part to play in providing social and affordable housing; this partnership should be able to deliver 12,000 new affordable homes by 2028. These homes will serve the communities in which Bromford operates, as well as delivering both real economic growth and social value for the UK.

Conclusion

Over the past three decades we have witnessed a necessary and positive escalation of funding source diversification in the UK, enhancing the opportunity for borrowers and lenders. We believe this will continue to accelerate. For the private credit markets, this evolution can offer investors the opportunity not only to access a much greater range of investment opportunities, but also to help shape the world around us, particularly in the context of ESG-focused investment.

In our view, providing financing for high quality assets across the UK such as social housing developments, renewable projects, logistic centres, offices in core locations and manufacturing businesses, among many others, is likely to align with many pension schemes’ objectives. It has the potential to increase certainty of a scheme’s returns and to generate cash flows to pay pensions, while also supporting the broader market recovery.

Important information

Past performance is not a guide to future performance. The value of an investment and any income taken from it is not guaranteed and can go down as well as up; you may not get back the amount you originally invested.

Views expressed are of Legal & General Investment Management Limited as at September 2020.

This document is designed for the use of professional investors and their advisers. No responsibility can be accepted by Legal & General Investment Management Limited or contributors as a result of information contained in this publication. The information contained in this brochure is not intended to be, nor should be construed as investment advice nor deemed suitable to meet the needs of the investor. Nothing contained herein constitutes investment, legal, tax or other advice nor is it to be solely relied on in making an investment or other decision. The views expressed here are not necessarily those of Legal & General Investment Management Limited and Legal & General Investment Management Limited may or may not have acted upon them. This document may not be used for the purposes of an offer or solicitation to anyone in any jurisdiction in which such offer or solicitation is not authorised or to any person to whom it is unlawful to make such offer or solicitation. No party shall have any right of action against Legal & General in relation to the accuracy or completeness of the Information, or any other written or oral information made available in connection with this publication.

As required under applicable laws Legal & General will record all telephone and electronic communications and conversations with you that result or may result in the undertaking of transactions in financial instruments on your behalf. Such records will be kept for a period of five years (or up to seven years upon request from the Financial Conduct Authority (or such successor from time to time) and will be provided to you upon request.

© 2020 Legal & General Investment Management Limited. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, including photocopying and recording, without the written permission of the publishers. Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272.

1. ‘Secure income assets’ (“SIA”) identify cashflow outcomes from illiquid private asset classes, where the income stream often benefits from a range of contractual protections that enhance asset owners rights to maintain expected cashflows (for example, covenant protections, specific security or ring-fenced collateral). The contractual protections of a particular asset will depend on these terms and the financial strength of the counterparty. SIAs are held with the aim of producing a predictable income stream – this income stream is not guaranteed and there is no underwriting of income.

More Related Content...

|

|

|