The value is out there

|

Written By: Bernard Abrahamsen |

Bernard Abrahamsen of M&G Investments outlines his views on why credit investors should forget forecasts and focus on valuations

It may be human nature and it may be popular but trying to forecast the future is no basis for an investment strategy. Ever since the credit crunch, and the unprecedented actions by every major central bank or monetary authority, credit markets have twisted and turned unexpectedly – displaying the sort of volatility bouts that can confound and confuse the most confident predictions.

The best piece of evidence that forecasts are not worth the paper on which they are written is that central banks, with more access to information than anyone else, rarely get them right. In the 1990s, the Federal Reserve consistently assumed a normal GDP of 2% when the real figure turned out to be 4%. And the Bank of England’s GDP forecasts of around 3% were dashed as the economy plunged to a -7% figure in early 2009.

Any investors who bet the farm on such outcomes should strap themselves in tight.

A more sensible and, if history is to be believed, reliable way of obtaining acceptable returns from credit over the long term, is to identify where risk is rewarded and where it isn’t. Such an approach relies on a thorough assessment of practically the full breadth of what is on offer. This means evaluating the creditworthiness of each individual issuer and the securities they have issued or assets they want to sell. This can be time-consuming and painstaking.

On top of that, an investor using this approach also needs patience, because value does not present itself with steady, metronomic regularity. Given that the credit market cycle throws up bouts of volatility and unexpected events, an investor also requires plenty of dry powder, otherwise known as cash, to take those infrequent but truly compelling investment opportunities.

Getting those calls right can bring consistent outperformance.

At this stage of the credit cycle, such events are not ten a penny. In about 2008, markets rewarded those who held anything but cash. That changed in 2010 when rewards went to those who simply took risk.

Now, things have changed again and, with much of credit at historically expensive levels, markets are rewarding those who take on complexity, illiquidity and hard work.

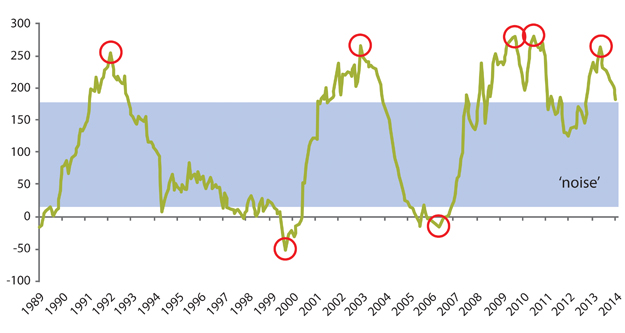

Figure 1: US 2-year versus 10-year spread (bps, monthly, August 1989 – August 2014

Source: M&G, Bloomberg, as at 31 August 2014

Here are two examples.

More and more pension funds are allocating to multi-asset credit funds – products that hunt value across public and private credit markets. While they come in different shapes and sizes, they are usually most effective when conducted on a bottom-up, value basis. This approach to investing in credit says that the silos in which credit markets are often demarcated, from geographical boundaries to the divisions between investment grade and high yield bonds, are effectively meaningless. A bottom-up investor will, for example, recognise that most types of bank debt actually bring exposure to property markets and, instead of selecting, for instance, asset-backed securities over covered bonds, will buy individual securities from each area that have compelling valuations for the risks on offer. Above all, they will say that there is no such thing as a “bad” bond – just bonds that other investors have mistaken, misunderstood or ignored and are priced wrongly.

The second example steps away from mainstream credit investment into the grey areas across and between traditional asset classes.

UK commercial real estate, leased on a long-term basis to good quality tenants, can generate returns that look remarkably similar to that available from the index-linked Gilt market. However there is one crucial difference: whereas the massive imbalance of supply and demand means linkers often pay a negative real yield, returns from long-lease real estate tend to sit at least some 4% above the rate of inflation.

This investment strategy, which blends real estate and credit investment, works by constructing a portfolio of well selected, usually good-quality buildings that are let to thoroughly researched tenants. The leases tend to be about 25 years long and are mostly structured so that they ratchet up every year, keeping rental payments ahead of inflation. This is a predictable and secure contractual cash flow. It makes no leverage demands on the investor and simply relies on the resources to research, the skill to structure and the scale to acquire the assets.

Investment returns are available in credit. Those who do their research and wait for opportunities to arise are likely to do better than those who cannot and will not.

This document reflects the author’s present opinions reflecting current market conditions which are subject to change without notice and involve a number of assumptions which may not prove valid. It has been written for informational purposes only and should not be considered as investment advice or as a recommendation of any particular security, strategy or investment product. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication.

The value of investments can fall as well as rise and past performance is not a guide to future performance. The success of M&G’s investment strategies and their suitability for investors are not guaranteed and you should ensure you understand the risk profile of the products and services you plan to purchase. M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|