The volatility risk premium: an alternative, diversifying return source

|

Written By: David Morley |

|

Tom Lee |

David Morley and Tom Lee discuss the potential of an approach that looks to enhance returns without altering a portfolio’s risk profile

Following successive years of stock market gains post the Global Financial Crisis (GFC) and the rising duration risk across fixed income assets, many institutional investors have pared back their forward-looking return expectations and have become more focused on managing the downside risk of their return-seeking assets. In essence, investors have been looking to achieve equity-like returns with less risk.

The measures institutions have typically taken to this end include: allocations to hedge funds, the introduction of tail risk hedging strategies and investments in factor-based low volatility equity strategies. Each of these approaches can be helpful, but they also have their drawbacks:

- Hedge funds are generally thought of as a diversifying asset class that offers equity-like excess returns. Broadly speaking, however, hedge funds have failed to impress investors in recent years. Generally, net returns have been lacklustre, while transparency and liquidity have remained challenging. There is also a much sharper focus on investment management costs in the Local Government Pension Scheme (LGPS), and hedge fund costs can be prohibitive in this environment. Governance issues also need to be considered when investing in hedge funds.

- Hedging, or tail risk, strategies provide more certainty of protection in challenging market environments. However, investors can grow fatigued with this approach as most strategies require some implicit or explicit ongoing premium payment that reduces expected return.

- Low volatility equity strategies have gained in popularity since the GFC. Factor-based low volatility investing has been supported in academic literature for years. The simple idea is that a portfolio consisting of low volatility equity shares will provide higher risk-adjusted returns than a portfolio of high volatility equity shares. A number of indices have been constructed around this low volatility anomaly, including those created by S&P and MSCI. However, investors in this area need to be cautious. In our view, the popularity of factor-based low volatility strategies has driven valuations above historical norms thus reducing return expectations on a forward-looking basis.

One less-travelled solution investors are exploring is the use of option-based strategies that seek to harness the volatility risk premium (VRP), a well-documented and diversifying alternative return source.

The VRP refers to the observation that the implied volatility embedded in derivatives, such as equity options or variance swaps, is usually higher over time than subsequent realised volatility. As noted by Wei Ge, PhD., CFA, a senior researcher at Eaton Vance subsidiary Parametric Portfolio Associates LLC (“Parametric”), this difference is generally most significant in broad market equity indices, such as the S&P 500 Index.¹ Investors in the VRP are analogous to providers of insurance: they collect a premium from option buyers seeking volatility protection.

The VRP – a persistent, meaningful and diversifying risk premium

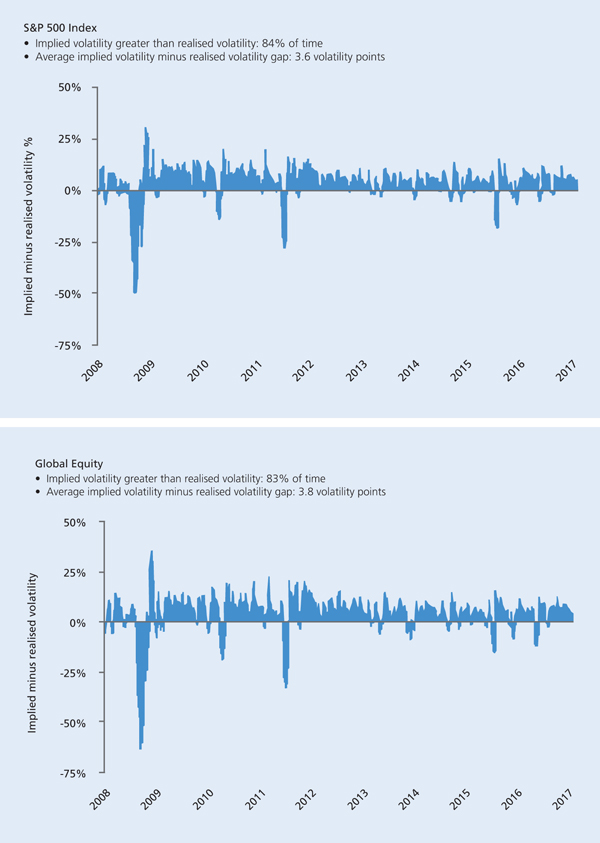

The VRP has historically been a very persistent and meaningful risk premium that exhibits a low correlation to most major asset classes. These features make the VRP an attractive and suitable candidate for long-term investment. Figure 1 highlights the persistence of the VRP – showing that the implied volatility of equity index options consistently exceeds subsequent realised volatility over time.

Figure 1: Equity index options contain a risk premium that compensates sellers for underwriting financial risk

Source: Parametric, Bloomberg as at 26 April 2017. S&P 500 Index options relative valuation measured by taking daily observations of Implied Volatility (as measured by VIX Index) and subtracting the subsequent Realized Volatility of the S&P 500 over the following 30 days. Global Equity implied volatility proxied based on a weighted basket of implied volatility indices for US Equity (VIX), International-Developed (VXEFA), and International-Emerging (VXEEM). VIX and VXEFA data available beginning 2/1/2008. VXEEM data available beginning 16/3/2011. Equity options relative valuation measured by taking daily observations of Implied Volatility and subtracting the subsequent Realised Volatility of the same weighted Global Equity Portfolio over the following 30 days.

Harvesting the volatility premium in equity markets

Investors seeking to harvest VRP returns in a broader portfolio typically do so either via a dedicated capital allocation or overlay product. Both are underpinned by derivative-based methods aimed at monetising the VRP; the most common being: option strategies (selling calls, puts, straddles or strangles), swap strategies (selling volatility or variance swaps) or futures strategies (trading VIX futures). A detailed discussion of their respective strengths and weaknesses lies outside the scope of this article.

That said, research by our colleague Wei Ge found that for most investors, the option-based VRP harvesting strategy was the recommended default. Considerations in this regard included the fact that options have a long trading history, are exchange-traded and highly liquid, and can easily be customised for different purposes.1 VIX futures are highly liquid, efficient to implement and have modest trading costs, but have high short-term volatility and provide returns more correlated with the equity markets. Variance swaps, meanwhile, have a relatively weak performance record in times of market turmoil and are traded over-the-counter (OTC); so may compare unfavourably to the other two methods in terms of trading costs, liquidity and market depth.

Option-selling model portfolios

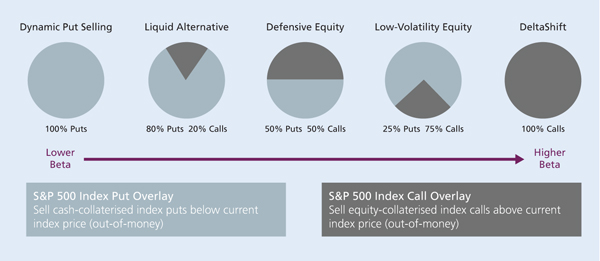

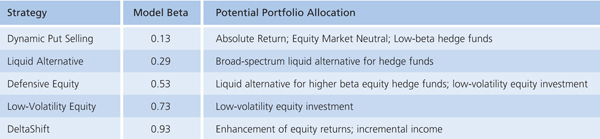

Figure 2 illustrates how different combinations of collateralised equity index put and call option positions (100% cash-secured put selling to 100% covered call selling) can produce unique risk/return profiles across a range of equity market betas. Figure 3 suggests how these various option-selling strategies can be used in portfolios.

Figure 2: Five collateralised option-selling model portfolios

Source: Parametric. Portfolios are constructed using a base model of equities, Treasury bills (or equivalent) or a combination of both to create a range of risk/return profiles across a range of equity betas. Selling options helps capture the Volatility Risk Premium (VRP) across the entire portfolio, without adding any leverage. (Options are fully-collateralised – “out of the money” at initiation, approximately one-month term and staggered over multiple expiration dates.)

Figure 3: Potential uses of option-selling strategies in asset owners’ portfolios

Assessing the use of VRP strategies

Volatility selling is dynamic and tends to be more profitable during or immediately after a financial crisis. That said, the VRP is typically positive and very analogous to an insurance premium so can be used throughout the market cycle. Harnessing the VRP can be done without using leverage by employing liquid, exchange-traded instruments, ultimately resulting in attractive risk-adjusted performance.

Admittedly, many investors are wary of put-selling strategies. With limited upside benefit and potentially large losses, put-selling strategies are not intuitive. Investors are more familiar with purchasing out-of-the-money index options, whereas index option selling – essential to many VRP strategies – contrasts with the tail-risk hedging techniques.

However, this apprehension reflects a significant misunderstanding. VRP portfolios, if implemented with short-dated out-of-the-money options, should by design outperform the market index during a crisis. Further, because not many investors want to be on the short side of put or call option trades, short options – especially puts – tend to command significant premiums.

In our view, VRP capture strategies are more suitable for institutional or high net worth investors with long-term investment horizons such as LGPS funds and pools, who are willing and able to bear the unique risks involved.

Summary

The VRP is an attractive and untapped source of returns with low correlations to traditional risk premiums that can provide return enhancement without materially altering a portfolio’s risk profile. The benefits of a systematic VRP-capture strategy can include simplicity, transparency, liquidity, lower average costs and increased exposure management flexibility.

The persistence of the VRP means strategies do not have to rely on market timing or active market bets in order to deliver predictable results. Investors who take on this unique risk premium can reasonably expect to benefit from it in good times and bad.

Sources: Parametric, Bloomberg as at 26 April 2017 unless otherwise specified

This material is communicated by Eaton Vance Management (International) Limited (“EVMI”), which is authorised and regulated in the United Kingdom by the Financial Conduct Authority and located at 125 Old Broad Street, London, EC2N 1AR, United Kingdom, Tel. +44 (0)203.207.1900. This material is for professional clients only.

Past performance is no guarantee of future results. The value of investments and the income from them may go down as well as up and investors may not get back the amount invested. Forecasts may not be attained.

The views expressed in this material are those of the authors and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and EVMI disclaims any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance product.

This material may contain statements that are not historical facts, referred to as forward-looking statements. An investment’s future results may differ significantly from those stated in forward-looking statements, depending on factors such as changes in financial markets or general economic conditions, the volume of sales and purchases of fund shares, etc.

The information in this material should not be considered investment advice, a recommendation to buy or sell any particular security or tax advice. The information in this material does not constitute an offer to sell or solicitation of an offer to anyone in any jurisdiction to buy Eaton Vance investments, funds, products and services. These are only available to residents of countries where offers of such products and services are permitted by law. This material is for the benefit of persons whom EVMI reasonably believes it is permitted to communicate this information and should not be forwarded to any other person without the consent of EVMI. This material expresses no views as to the suitability of the investments described herein to the individual circumstances of any recipient or otherwise.

1. A Survey of Three Derivative-Based Methods to Harvest the Volatility Risk Premium, The Journal of Investing, Fall 2016, Volume 25, Number 3

More Related Content...

|

|

|