The year ahead: a global outlook

|

Written By: Alicia Levine |

|

Shamik Dhar |

Inflation, trade wars and euro debt are among the potential headwinds for the world’s economy in 2019 – but that doesn’t mean the overall global picture is necessarily a negative one, say BNY Mellon Investment Management’s Alicia Levine and Shamik Dhar

If 2017 was the year of synchronised global growth, 2018 was the year the global environment diverged as the US powered ahead while the rest of the world stumbled. Ten years into a record-length recovery and attendant bull market in the US, the divergence between the strong US economy and rest of the world, along with a determined Fed, ultimately roiled global equity markets from Beijing to London to New York. Looking ahead, tighter financial conditions, a downtick in European growth, some idiosyncratic emerging market stumbles, the deleterious worldwide effects of a stronger USD, and trade tensions all threaten to spill over into 2019. The question facing investors as they focus on allocations in 2019 is whether fundamentals are strong enough to steady global markets and whether current asset prices sufficiently discount solid, though weaker, fundamentals and risks to the global outlook.

As we look to the investment environment in 2019, we believe the global picture will remain relatively benign. Global growth is still positive for the developed economies, even if the pace of increase for most countries is slower than in 2017 and 2018, While China and Europe will slow further, the US will remain the consumer of last resort, powering the global economy. Several emerging markets such as Turkey and Argentina have experienced weakening external funding vulnerabilities, but there has been no contagion to other emerging economies and pockets of strength persist.

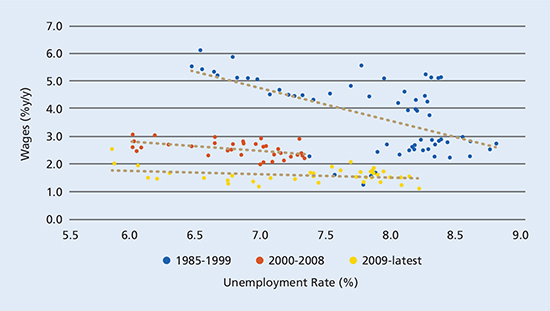

Global inflation expectations are well anchored in the developed economies, lessening the chance of inflation spikes. While the Fed will likely tighten at least twice in 2019, we, like the market, are sceptical of a third rate hike in 2019. In addition, lower average unemployment across the G7 is not leading to corresponding wage gains and rising inflation, as the Phillips curve appears to be flat. As a result, we do not foresee a spike in long rates, leaving markets with a constructive backdrop. We also believe that the ECB may choose to push out its first rate hike since the global financial crisis into late 2019 or even early 2020. The US dollar could creep higher in 2019, but any Fed pause or Brexit clarity in Brussels would put a halt to its march. Under these expectations, we believe the worldwide market sell-off in 2018 presents an opportunity in risk assets in 2019, and bonds will remain negatively correlated with equities, allowing standard multi-asset portfolios to perform. While risk assets may not appreciate as steadily as in the recent past, the firm global backdrop will ultimately support asset prices.

Figure 1: G7 Phillips Curve: wage growth vs. unemployment rate

Source: BNY Mellon Global Investment Strategy using data from Capital Economics and Thomson Reuters

2018 data as of Q3. Chart shows simple average of unemployment rate and wage growth across G7 economies.

Despite this, we believe that greater market volatility is in store for 2019 as the risks to this constructive scenario come from trade tensions, global tightening of financial conditions, and fears about debt sustainability and banking stability in Italy.

The US trade conflict with China is deepening. The Trump administration, while it started with a focus on trade deficits, is homing in on China’s forced technology transfer, surveillance of foreign businesses, and President Xi’s plans for China 2025, a direct threat to US technological domination. These issues are unlikely to be solved quickly and we expect 25% tariffs to be placed on all Chinese imports to the US in 2019. The US, as a relatively closed economy, can withstand this pressure in the aggregate particularly as growth remains strong, but the Chinese economy will feel the pain. As worldwide trade contracts, Europe and emerging markets will be affected as their growth are more dependent on global demand.

Further, 2019 will mark the end of monetary global easing by the developed markets central banks and the beginning of quantitative tightening. The US has already rolled off ~US$400 billion of Treasury and MBS assets through the end of November and is currently at a US$50 billion per month pace. Japan remains committed to extraordinary monetary policy, but Europe will mark the end of its Asset Purchase Program, the monthly net purchasing of public and private sector securities, at the end of 2018. Coupled with this, the US Federal Reserve is determined to raise rates before the next recession. This withdrawal of global liquidity is bound to put continuing pressure on emerging markets with large external funding needs and high debt ratios.

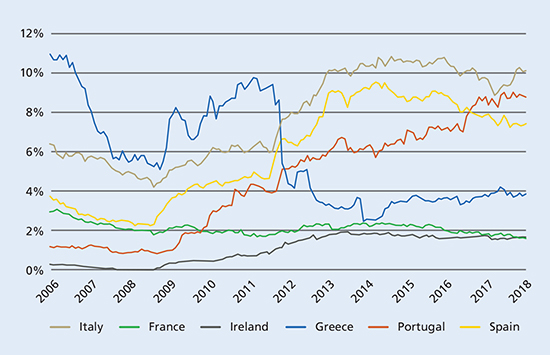

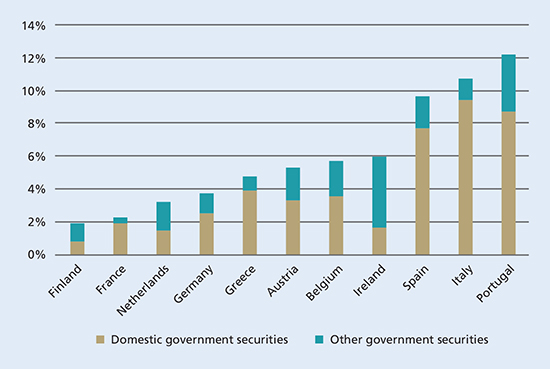

Finally, the euro area remains vulnerable to risks in the financial sector. The slow-moving train wreck between Italy and the ECB continues, and we note that the European banks still own the sovereign debt of their home countries. Italian banks are the most exposed to their own national debt but exposure is high for Spanish and Portuguese banks as well. In addition, European banks own the debt of other sovereigns, increasing the risk for region-wide contagion in the financial sector. And, as the Turkish currency crisis revealed last summer, the European banks lent heavily to emerging market corporates during the days and years of free money. As global liquidity tightens and the carry trade reverses, those assets on the balance sheets could be marked lower, putting pressure on bank capital ratios.

Figure 2: Banking sector exposure to domestic government debt

Source: BNY Mellon Global Investment Strategy using data from TS Lombard.

Data through 30 September 2018. Monetary Financial Institutions (MFI) holdings of domestic sovereigns (% total assets).

Figure 3: Holdings of euro area government securities, % of total assets by European banks

Source: BNY Mellon Global Investment Strategy using data from Llewellyn Consulting. Data as of March 2018.

The sleeping giant in all this is inflation. Even as inflation gently moves higher in most developed economies the slope is both manageable for current central bank tightening plans and fairly benign for global economies. Should the pace of increase in inflation accelerate – i.e. we get a spike – then the constructive scenario we foresee for 2019 would break down and break down quickly. A Fed with an itchy trigger finger could raise rates faster than currently priced in, triggering a sell-off in risk assets – rates, equities, and emerging market debt. The US dollar, on the other hand, would exhibit strong performance, whose strength would be the mechanism to roil global economies. Related, would be a re-set of long-term global real interest rates which are unprecedently low and in Europe and Japan, negative-yielding. Any move towards convergence with US real rates, which are positive, would shock all asset classes. Under these scenarios, the investment regime would change rapidly, as the correlation between equities and fixed income goes positive, presenting asset allocators very different challenges than in the days of financial repression.

The global backdrop remains solid, if unexciting and a bit worn down compared to recent years. We expect the 2018 sell-off to provide investors with a comfortable entry point and an opportunity to rebalance their allocations. They key variable in our rosy view is inflation – and as long as that remains gently sloping upward, then we expect upward, if more volatile, performance of risk assets in 2019.

For Professional Clients only. Any views and opinions are those of the investment manager, unless otherwise noted. This is not investment research or a research recommendation for regulatory purposes.

More Related Content...

|

|

|