Thinking a decade ahead: a thematic approach to global equities

|

Written By: Henry Boucher |

To invest successfully over the long term, investors should uncover companies which are able to capitalise on global trends. Henry Boucher of Sarasin explains more

The most compelling investment opportunities often arise through change. For global investors, this can mean change on a particularly large scale and the creation of truly investable trends.

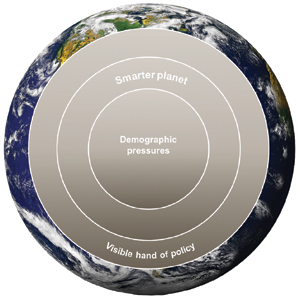

Of course, many of these global trends are already well underway. The demographic pressures of a crowded planet, for example, are significantly advanced. Consequently, the more obvious investment stories from this trend – like emerging market economic convergence and developed world ageing – are already well recognised by the market.

However, over the coming decade, the less transparent knock-on effects from these demographic pressures will unfold. Finding smarter ways to live as our lifestyles alter, and the evolving stance of policymakers legislating for a changing world will lead to investable opportunities across all sectors.

These are the ripple effects of demographic pressure. The smarter planet stems from the ingenuity to improve productivity; from materials science to computing power to robotics, we will see change driving increased efficiency, accuracy and innovation throughout all industries.

Figure 1: The big drivers of change

Source: Sarasin & Partners

Thinking ahead: innovate today, disrupt tomorrow

Investing in the ripple effects of change means anticipating how the winning companies of the future will look. One of the qualities we seek out is the ability to disrupt and innovate. Our Disruption & Innovation theme pinpoints those companies able to offer new products or services which are meaningfully (and sustainably) superior to the existing competition. These are the businesses most able to drive change for themselves, disrupting existing markets and accepted norms.

However, capitalising on innovation requires more than just brilliant ideas; the companies with the most innovative ideas also need the best management structures, the most persuasive investment plans, and a convincing means of bringing their ideas to the market. Those able to achieve this stand not only to be the success stories of their peer groups, but also provide some of the most attractive opportunities for investors.

Finding these companies means more than just focusing on those businesses meeting new demands today. A long-term worldview leads to companies with the potential to succeed in a challenging future: investing in the market disruptors of tomorrow through the compelling market innovators of today.

Evolving for a changing world

A glance at history bears this out. Just ten years ago, few could have predicted the precise levels of technology reached today. From smart phones and tablet computers to a wealth of advanced online services, huge technological progress has affected all industries.

Over the next decade, we will see advances in machine-to-machine communication, nano-level science, robotics and automation… in just a few short years, real life technology may seem little short of science fiction. The healthcare sector, for example, will be highly impacted by these changes.

The implementation of mHealth (mobile and wireless health care delivery systems) is already beginning to support patients and their treatment through mobile phones and other devices, as well as improving the ability to track illnesses and reduce costly time in hospital. In particular, mHealth has huge potential to extend healthcare access in developing countries.

Meanwhile, voice recognition will become an increasingly common tool for doctors making patient notes. Computer-assisted decision making will expand too, with judgements on diagnoses or on the effectiveness of a given treatment enhanced by software searching “big data” to provide instant statistics and centralised knowledge.

Change and advancement are the bedrock of success for companies in this sector. At a nano particle level, scientists are increasingly able to re-programme physical and biological materials to change shape and properties. Combined with a new understanding of the way living systems work at a molecular scale, new advanced medicines and tissue replacements are being developed. These developments are enabling not only better treatments, but also much more accurate medicine prescription, with fewer side effects and a reduction in the need for surgery.

As the price of computing has fallen and productivity improved, there have been similarly dramatic changes in DNA research, with falling costs and easier access to data. This, combined with the increasing use of immune systems to attack specifically cancerous cells, should lead to a revolutionary breakthrough in cancer treatment over the next decade. Companies looking to alter cancer from a short-term critical illness to a chronic, manageable condition in the foreseeable future represent a potentially very investible kind of innovation.

Investing globally: a world of opportunity

Healthcare technology, though, is in fact just one aspect of just one area of change, amid a wealth of investable global trends. Imagine the scale of change that will occur in healthcare over the next decade, and then apply similar advances across most other industries.

Those companies able to drive development, innovate, and create and capture markets, while riding the crest of global change, are likely to be tomorrow’s most impressive market disruptors. It is for this reason that a “sans frontiers” approach to equity investment, not limited by industry, or by national or regional boundaries makes the most sense.

To invest successfully over the long term, investors need to uncover the undervalued companies most able to capitalise on global trends, and return value to shareholders. At Sarasin & Partners, we use our five favoured corporate characteristics – of which Disruption & Innovation represents just one – to identify those businesses most likely to succeed in a changing world.

We believe that pinpointing companies with very specific corporate strengths, positive exposure to key global trends, and the potential to perform over the long run makes for a particularly robust equity investment strategy. A truly global thematic approach ensures diverse and dynamic investment, with high conviction at its core.

More Related Content...

|

|

|