UK commercial real estate – worth considering again?

|

Written By: Philip Gadsden |

Philip Gadsden of Orchard Street considers the pros and cons of investing in the UK commercial property sector and concludes that 2023 will be a turning point, with sustainability-led properties proving the most attractive

Over the last 20-30 years Core and Core+ investors in the UK have invested in “unleveraged, directly-owned commercial real estate” (referred to as “CRE” in this paper) because it is partly a diversifier from other asset classes, partly a hedge against inflation, and partly about income – indeed, over the long term 80% of the total return from CRE is attributed to income.

Traditionally UK CRE was let on long unexpired leases, with upward only rent review clauses, and the 1954 Landlord and Tenant Act tended to work in favour of tenants, which meant occupiers were more likely to renew leases at expiry, than vacate. But roll forward through the 1990s and the GFC, and things have changed: leases have become shorter with widespread use of break clauses (that are often exercised), tenant entities themselves have become harder to underwrite and most recently, occupiers have developed their own sustainability objectives which materially influences the calibre of buildings they wish to occupy, i.e. can the building operate on a net zero carbon basis?

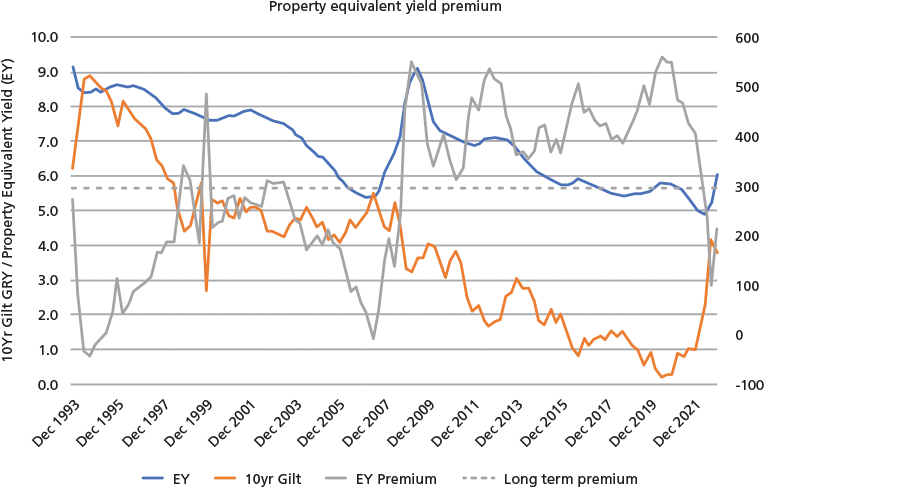

Also, over the last 20-30 years CRE in the UK has been re-priced relative to the 10 year Gilt rate. In the 1980s and early 1990s property yields were lower than the 10 year Gilt rate, the so-called reverse yield gap but since then, as illustrated in Figure 1, this reverse yield gap disappeared and became a positive yield gap, averaging 100-300 bps above 10 year Gilts, as inflation reduced through the 1990s and early 2000s leading up to the GFC.

The period post the GFC led to a materially lower interest rate environment and property yields also fell – but not by as much as Gilts. Indeed for most of the period since the GFC property yields have tended to average 3-500bps above the 10 year Gilt rate albeit perhaps that was more a reflection of exceptionally low interest rates than an actual requirement for a higher risk premium from CRE. With interest rates now likely to settle at levels that pre GFC were considered “normal”, perhaps the risk premium for CRE in the 2023 period and beyond will land closer to its pre GFC level – 100-300 bps – than its post GFC level.

Figure 1: Premium CRE Equivalent Yield to GRY of 10 year Gilt – end 1993 to end 2022

Source: Macrobond, MSCI Quarterly Index Sep 22, OSIM est. Dec 22

Rising inflation, rising interest rates – but sustained income

With inflation now back to 1980/90 levels and interest rates heading back to levels considered more normal in the pre GFC period, where does that leave the case for CRE in the UK?

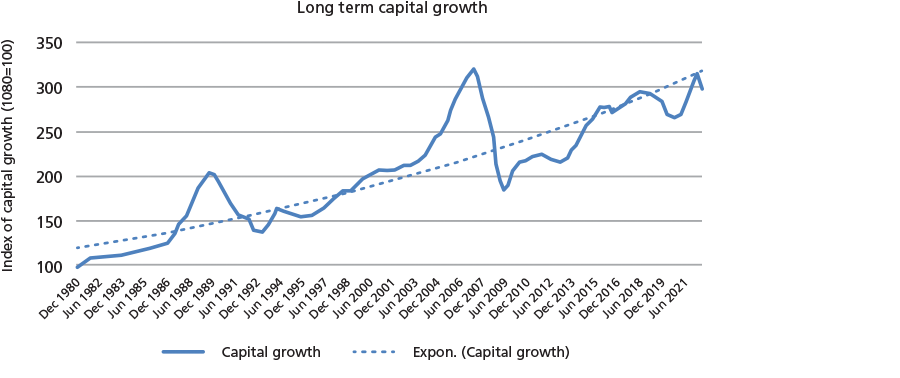

Over the long run, 20% of the total return from CRE is attributed to capital growth arising from a combination of rental growth and/or yield compression. Whilst the majority of long-run return – from income – has proved pretty stable, the 20% can be much more volatile as witnessed in 2022.

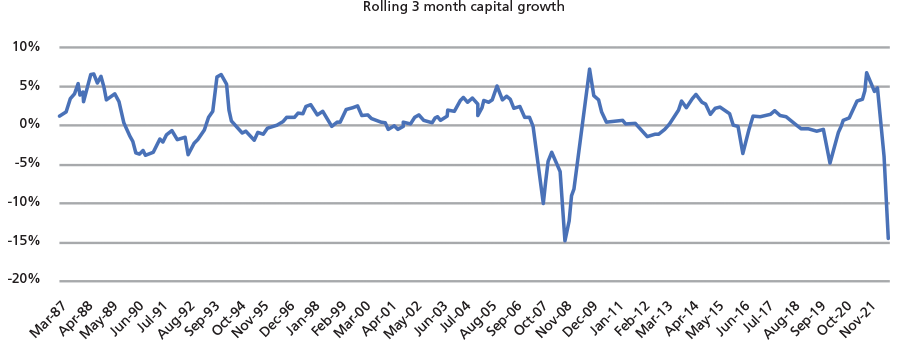

Buoyant investment demand in the first half of 2022 – particularly for industrial properties – was still pushing CRE values upwards until the summer. But since then, UK property values have responded quickly and sharply to this higher interest rate environment, as illustrated in Figure 2, which shows 3 month capital growth over the last 35 years (from MSCI’s Monthly Index). Indeed, PMA now estimate that when capital values stabilise, it may be that the average fall in values across the market will end up being around 25% from mid-2022 levels.

Figure 2: Change in average capital values – rolling 3 months – 1987 to Nov 2022

Source: MSCI Monthly Index Nov 22

Independent studies show a positive relationship between inflation and rental growth which supports the thesis that CRE offers a partial hedge against inflation.

But with income contracted on shorter leases than in the past, haven’t the risks associated with receiving that income increased relative to 20-30 years ago? To some extent that must be true. But as occupiers have demanded more control over their own occupational strategies, so the asset management industry has responded by materially advancing its proposition to occupiers – “customers” – through an increased provision of services. Examples of that are readily apparent in the office sector – with shorter flexible leases accompanied with pricing that is inclusive of utilities and broadband, plug and play style fit out, better facilities (cycle storage and showers) communal space (lounges, roof terraces etc), and meeting rooms rentable by the hour.

Different versions of a landlord service based model can be seen in other sectors too including industrial estates, self-storage, multi-family residential, student accommodation etc.

Ironically the sector where services have long been part of the landlord proposition to tenants and their customers is shopping centres. But retail property has suffered its own headwinds as online retailing now accounts for c. 30% of all retailing and many shopping centres are having to be re-imagined – a simple refurbishment may well not be enough to create a future for an asset that is substantially obsolete.

But retail warehousing still offers a good income-based future, particularly those parks offering services via food and other amenities, and are underpinned by tenant entities that are often quite resilient, particularly those in the food and discount/convenience sectors.

Lending and development both subdued

Previous strong periods of growth in CRE pricing have been inflated by a highly competitive lending market with individual lenders looking to grow market share. In the past that has led to over exuberance with new development, often speculative, in the office and shopping centre markets in the 1980s and particularly in the office sector in the run up to the GFC. Indeed, the overhang of new office space that had been developed in 1985-90 period lasted well into the 1990s and put a brake on rental growth for some years.

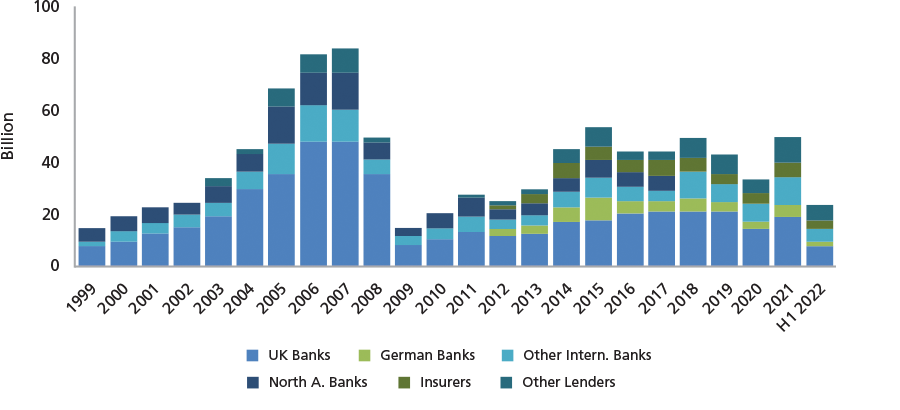

But the recent period of growth has not been inflated by excessive lending – Figure 3, from Bayes, illustrates loan originations by lender type from 1999 and shows that new lending to the CRE sector in the UK is far lower today than it was pre GFC and more recently. And the overall cost of debt is still high – discouraging borrowing – because lending margins have on average increased to levels 10x higher than before the GFC.

Figure 3: Loan originations by lender type; 1999 – H1 2022

Source: Bayes Business School Commercial Real Estate (CRE) Lending Report

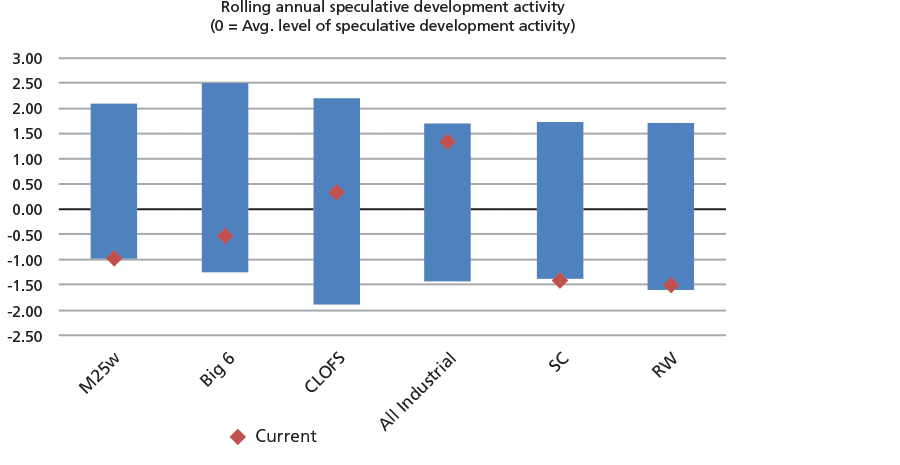

Also, tighter regulation post GFC has limited the risk appetite amongst lenders for speculative development such that most sectors of the UK CRE market have seen speculative development at 20 year low levels, excluding Central London offices and large high bay logistics units (the latter being a major component of the All Industrial segment in Figure 4).

Figure 4: Rolling annual speculative development activity 2002 – 2022

Source: PMA, 2002-2022

As a result, and as shown in Figure 5, the growth period leading up to the 2022 CRE price correction has not been characterised by the kind of capital value bubble that we saw before the last two significant market downturns after the Lawson boom in the 1990s and during the GFC.

Figure 5: Long-term capital growth – 1980 to Q3 2022 – vs long-term trend growth

Source: MSCI, Q3 2022

Rental growth?

Rental growth will be at its strongest in those parts of the market where supply is most constrained and occupier demand is strongest – which points towards the multi-let industrial sector, and to some extent retail warehousing. Higher vacancy in the office market is more nuanced, in that secondary offices, where vacancy is highest, do not offer the modern occupier experience that is increasingly in demand. Grade A offices built with a strong consideration towards the environment, occupier wellbeing and amenity space are in short supply and those are the buildings where office rental growth is likely to be the strongest.

We see this phenomenon continuing and not just in offices – rental growth will be at its strongest for the best specified properties in all sectors that can operate on a net zero basis.

2023 and beyond?

Inflation seems likely to fall quickly in 2023 with a number of factors already pushing the index down including oil, grain and transport costs, and increasingly this year the high price rises in 2022 will drop out of the comparative numbers. Interest rate rises in the US are slowing – although it remains to be seen whether central banks will be nimble with downward interest rate movements as the inflation picture becomes clear.

With interest rates potentially close to their peak, and with recent data suggesting the UK didn’t enter recession in 2022, it is possible this downturn may prove quite shallow. In addition, the rapid adjustment in property pricing in the second half of 2022 may signal that early 2023 pricing levels may represent the high point for property yields in this market correction.

The market seems unlikely to be destabilised by loan defaults in the near term, given wider industry levels of debt and supply shortages. The best properties that are sustainability led will see demand-led rental growth, while the rest of the market may see flat or falling rents.

So 2023 may be the point where the fundamentals of CRE in the UK once again look attractively priced relative to Gilts, that are themselves priced more in line with pre-GFC levels. Total return from CRE will once again be dominated by income, and there will be positive rental growth from sustainability-led properties that not only are in short supply but are also what occupiers increasingly want to occupy.

More Related Content...

|

|

|