What a Trump presidency means for sustainable investors

|

Written By: Martin Grosskopf |

|

Hyewon Kong |

|

Jonathan Lo |

Martin Grosskopf, Hyewon Kong and Jonathan Lo of AGF Investments look at how a republican administration will affect investment in renewable energy

With Donald Trump pulling off a surprise victory against Hillary Clinton in what may have been the biggest upset in US presidential election history, investors have been scrambling to respond. Like the Brexit vote earlier in June, polls ahead of the election completely missed the mark, showing Hillary with a small but material lead overall and with a decided advantage in the electoral map. As a result, Trump’s victory was widely unexpected, and the surprise has been met with significant volatility in global equity markets.

For us, a more pertinent question surrounding the election result is what does this do to the investment thesis for sustainable investing? After all, Trump has been well documented as a climate change denier, once famously calling global warming a hoax by the Chinese in order to make US manufacturing non-competitive. Will having such a sceptic in the Oval Office impact policies that alter the investing environment for sustainable companies?

Negative overall near-term sentiment

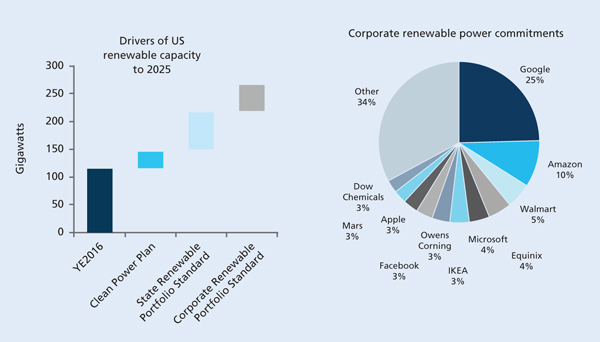

Clearly, the election of Trump is a negative factor for sentiment surrounding renewable energy. On the campaign trail, Trump has said that he wants to scrap all the major regulations that President Obama painstakingly put into place to reduce US carbon emissions, including the Clean Power Plan, and with Republicans now controlling Congress, it is easily achievable. Coal plant closures will slow, resulting in less demand for renewable energy, while protectionist policies on Chinese production could raise the price of solar power. On the demand side, this is somewhat offset by state-level buying requirements for renewable energy as well as corporate demand for renewable power, whereby companies committing to sourcing renewable power to reduce their carbon footprint has become a significant demand driver (see Figure 1). In AGF Global Sustainable Growth Equity Strategy, our exposure to renewable energy companies was 5% heading into the election.

Figure 1: Renewable capacity demand drivers, corporate renewable power commitments

Source: Barclays Research, as of October 2016

In other areas such as energy efficiency and smart lighting, the incentives for actions may be reduced given Trump’s ongoing scepticism over climate change targets. However, our belief is that the transition to these themes are not because of subsidies, but because prices have come down to the point where the cost savings to consumers have become very attractive.

Similarly, for electric vehicles there could also be a reduction in purchase incentives, though we expect the US to remain a leader in this space, given that they have the clear leader in manufacturing and the opportunity for technology leadership from US manufacturers and suppliers. And like energy efficiency and smart lighting, we expect broader trends to continue to remain supportive, as active automotive safety and the electrification of vehicles continues to be adopted by car manufacturers as a common standard, driven by higher safety standards and consumer demands. With regards to fuel economy standards – we acknowledge some headline risk although, in our view, they are now heavily embedded and had already survived the Bush administration without change.

In other cases, it may be that the problem has grown bigger, but then so too has the need for the solutions provided by sustainable companies. For instance, more oil production and manufacturing under Trump would mean more waste volumes and a greater need for waste management companies’ services.

Or, elsewhere there may be a reallocation to other priorities. For instance, on the campaign trail, Trump promised to cut all spending on domestic and international climate change programmes, and reallocate that towards American infrastructure including clean water, clean air, and safety. Thus, we would expect a mild tailwind for stocks in the water treatment and infrastructure integrity spaces.

And finally, in areas such as healthy living and sustainable food, the election of Trump is inconsequential for the trend towards these products. Consumers will continue to demand healthier products and we believe these companies will continue to take share in the years ahead.

Taking the long view and keeping a global perspective

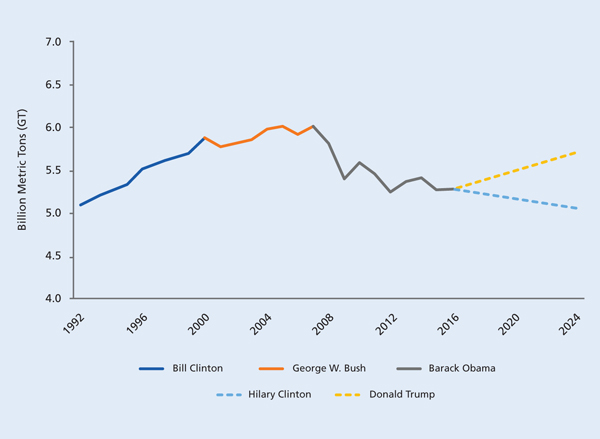

If Trump does adopt all of the policies that he campaigned on, it would unquestionably be a setback for the global goal of reducing emissions. According to Lux Research, two terms of Trump’s policies would result in emissions that are 16% higher than two terms of Clinton, amounting to 3.4 billion tons of greater emissions over the next eight years.

Figure 2: US carbon emission projections

Source: Lux Research, as of November 2016

But it also means that those environmental policy issues will become more pressing – delays in the progress that we need to make will accelerate the need for even more dramatic action later. From a portfolio perspective, that may mean that long-term opportunities may become more attractive in next few years.

Overall, our view is that the companies in our portfolio are exposed to themes that are embedded in the global economy. We believe the long-term growth trends and themes transcend any single country. History has shown that any particular US administration has shown itself to be ineffective at changing these trends to a significant degree.

In an article the day after the election, the New York Times wrote that “Trump knows that America is already a great country, and that, for better or worse, we will survive his presidency.” So too will the transition to a sustainable economy.

Disclaimer

The commentaries contained herein are provided as a general source of information based on information available as of November 9, 2016 and should not be considered as personal investment advice or an offer or solicitation to buy and / or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however accuracy cannot be guaranteed. Market conditions may change and the manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

References to specific securities are presented to illustrate the application of our investment philosophy only and are not to be considered recommendations by AGF Investments Inc. The specific securities identified and described in this presentation do not represent all of the securities purchased, sold or recommended for the portfolio, and it should not be assumed that investments in the securities identified were or will be profitable.

The information contained herein is designed to provide you with general information related to the investment process, alternatives and strategies associated with the mandate. It is not intended to be comprehensive investment advice applicable to the circumstances of a particular investor.

The information contained herein was provided by AGF Investment Operations. It is not intended to be investment advice applicable to any specific circumstance and should not be construed as investment advice. Market conditions may change, impacting the composition of a portfolio. AGF Investments assumes no responsibility for any investment decisions made based on the information provided herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Asset Management (Asia) Limited (AGF AM Asia) and AGF International Advisors Company Limited (AGFIA).

AGFA is a registered advisor in the U.S. AGFI and Acuity are registered as portfolio managers across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

More Related Content...

|

|

|