|

Donald Hall Portfolio Manager, US Cities Diversified Strategy & Global Head of Research, Real Estate Nuveen |

Government Infrastructure Pipeline reveals investment roadmap

Published: October 2, 2025

Written By:

|

Tom Parker |

From hydrogen networks to housing regeneration, our analysis of the government’s Infrastructure Pipeline shows where local investment opportunities are being prioritised for the coming years

It’s no secret that the government wants the LGPS world to invest more in local infrastructure, as detailed in the Pensions Bill – which “encourages” those in the sector to allocate at least 5% of their assets to local investments in one form or another.

Now, for a brief period there were conflicting reports about what “local” meant in this context, but the government did provide clarification on this point – namely that these investments would benefit people living or working in the area where the scheme or pool is situated.

Coupled with the significantly increased role pools will be playing by March next year, funds will be looking closer to home when it comes to prospective investment opportunities.

One way funds can track where opportunities could sit is through the government’s recently launched Infrastructure Pipeline. Launched in mid-July, the portal provides real-time updates on more than 700 planned private and public sector projects, with spending totalling £530 billion.

It provides information on infrastructure spending across several sectors, including communications, defence, energy, education and water – with some projects not coming online until as far out as 2065/66.

While not every project would be perfect for the LGPS – indeed £285 billion worth of the funding is coming from the public sector – it does give an interesting breakdown of not only where opportunities lie, but also outlines in starker terms where a government that wants to play a greater role in directing funds’ finances has set its priorities.

Energy spending top of the priority list

It’ll come as no surprise to almost anyone reading this that energy infrastructure, both present and planned, is leading the way in terms of sectors being examined – making up more than half of all the projects currently underway.

Most of this investment is going into solar projects across the country. Having said this, most of these projects are being backed by the government’s very own Great British Energy initiative – which, while primarily funded through a windfall tax on oil and gas profits, is on the lookout for further private investment.

As for projects currently seeking future investment in the sector, perhaps the most intriguing is a public/private funded project looking to develop the first regional hydrogen transport and storage network – focused on areas including Merseyside, Teesside, and the Humber.

The well-publicised and much-delayed Hinkley Point C nuclear power plant – which was originally slated to go online this year but is now expected to be completed by 2031/32 – is also seeking further investment, as is Suffolk’s Sizewell C project.

Beyond this, the HyNet North West project could be in need of some financial support over the next few years as it goes through a three-phase process to build a hydrogen pipeline in the region.

The project aims to develop a new pipeline network to supply hydrogen generated at the Stanlow Manufacturing Complex to industrial operations in the region, and as part of the transportation system, and for electricity generation in the region.

Investment still being sought to build housing infrastructure

As for those sectors still searching for further investment, those in the housing and regeneration space account for 34 of the 101 projects currently seeking or potentially seeking future funding.

Most of these projects can be split across three different schemes – Investment Zones, the Local Authority Housing Fund, and the Plan for Neighbourhoods programme – with each being broken down by region.

The Investment Zones focus on opportunities where both central and, more importantly from the LGPS world’s perspective, local government can work with business and local partners to “create the conditions” for “investment and innovation”.

These opportunities include the East Midlands’ push to be placed right at the heart of the UK’s green industrial revolution through the development of nuclear, hydrogen and “future fuel” technologies, and Liverpool’s scaling up of the region’s life sciences sector.

At present, the North East, North West, East Midlands, West Midlands, and Yorkshire and the Humber have published plans for their Investment Zones, with zones in Northern Ireland, Scotland, and Wales currently under development.

The Plan for Neighbourhoods programme – also funded and planned region by region – focuses on areas such as regenerating local high streets and town centres and “securing public safety”.

The Local Authority Housing Fund, meanwhile, provides funding directly to local authorities with the aim of building an additional 7,000 homes by 2026. At present, there have been two rounds of funding for the scheme – with a further round coming, which may need some private support.

Beyond these central government-backed programmes, there are a number of other projects that need private capital support.

Perhaps the most interesting of these is the Morecambe-based Eden Project – which aims to transform the “derelict site on Morecambe’s seafront” to create a “world-class cultural and tourism destination” through horticulture, art and exhibits.

Currently in its design and planning stage, work on the £97 million project is expected to begin in 2026/27, with it seeking further funding by 2027/28.

Which sectors does the pipeline cover?

In total, the government’s infrastructure portal is broken down by several sectors, with a number of sub-sectors fitting within these, as follows:

Communication

Mobile, Broadband

Defence

Defence Estate

Education

Schools, Further Education, Other Social Infrastructure

Energy

Wind Onshore, Wind Offshore, Solar, Interconnector, Tidal/Wave, Oil & Gas, Carbon Capture and Storage, Electricity Transmission, Gas Transmission, Gas Distribution, Nuclear Decommissioning, Energy – Other, Electricity Generation – Other

Housing and Regeneration

Schools, Other Social Infrastructure

Justice

HM Prisons/Custody

Transport

Rail, Road, Airports, Other

Water and Wastewater

Water, Wastewater, Flood/Coastal Defence

Health and Social Care

Police Forces

Science and Research

Immigration

Other Social Infrastructure

Flood/Coastal Defence

Other

A notable sector in this push for infrastructure investment is the communications space – which only has two projects flagged on the portal. However, when you dig a little deeper into these, you’ll realise they’re far bigger projects than first thought.

Both UK-wide, the first is Project Gigabit – which is Building Digital UK’s flagship programme set up with the aim of enabling hard-to-reach communities to access gigabit-capable broadband. It’s part of the government’s target to make gigabit broadband available nationwide by 2032.

It’s also a project which currently receives some support from non-publicly funded sources.

The second project under the communications section of the portal is the Shared Rural Network, which was set up to “address the digital divide” by improving 4G coverage in areas that need it most.

Other infrastructure projects that could be of interest to funds are those in the “Other Social Infrastructure” section of the portal. This includes the much-publicised Bedfordshire-based project to bring a Universal Studios theme park to the UK.

Also featured are England-wide projects to provide funding for arts and culture organisations that are struggling, and libraries in need of building upgrades and improvements in technology.

The infrastructure pipeline is in many ways ideal for investors looking to identify new sources of investment return. The devil is in the detail of course, and the service will only be useful if the project list is exhaustive and kept up to date.

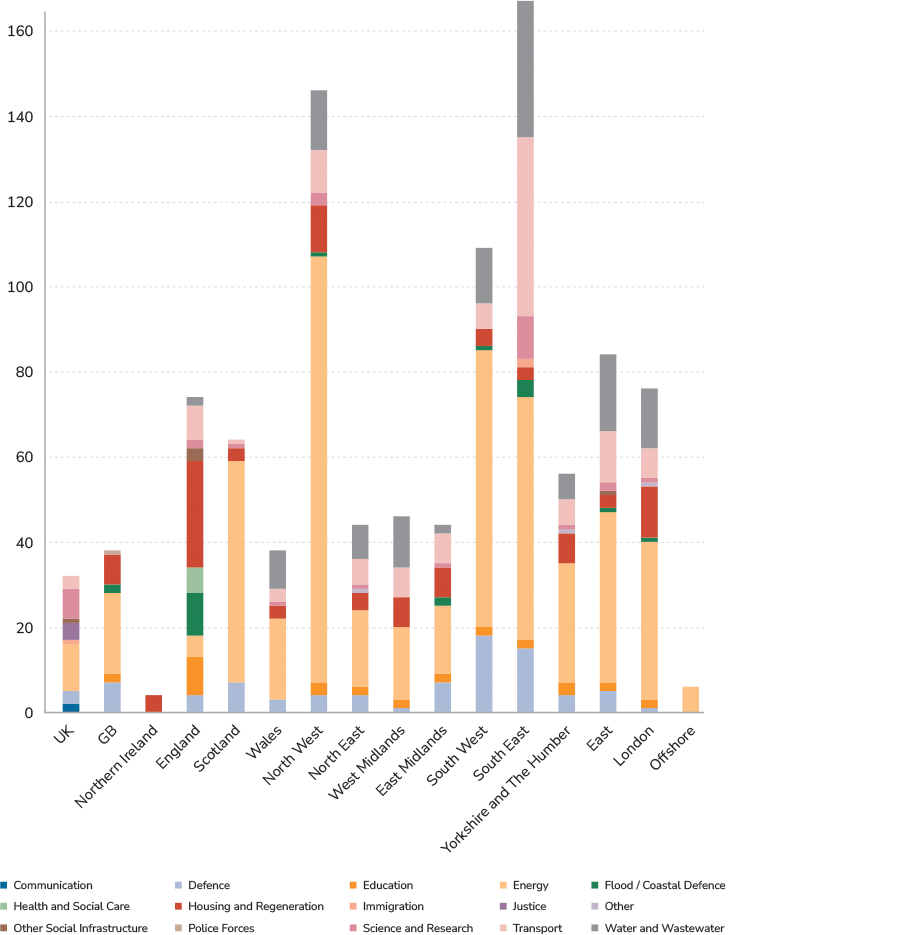

Figure 1: Infrastructure projects broken down by target area

Source: https://pipeline.nista.grid.civilservice.gov.uk/main

Further reading

For more information visit the governments Infrastructure Pipeline website

More Related Content...

|

|

|