|

Donald Hall Portfolio Manager, US Cities Diversified Strategy & Global Head of Research, Real Estate Nuveen |

An inflation-resistant bridge to a sustainable future

|

Written By: David Crawford |

David Crawford of Nordea Asset Management UK explains how an actively-managed infrastructure portfolio can make a sustainable impact while also offering some protection against inflation

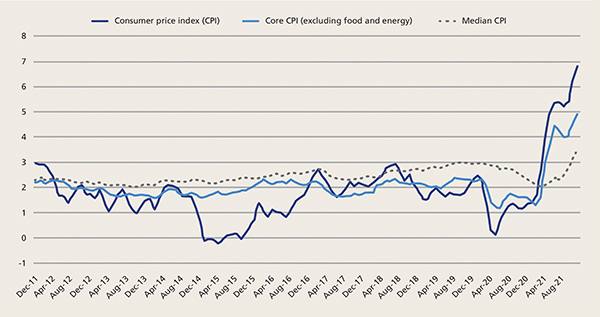

Over the last decade, the path of inflation, as measured by the Consumer Price Index (CPI), has remained relatively stable, hovering around the monetary policy target of 2%. 2015 and 2020 were the exceptions to this given the decline in energy and import prices, and the broad economic dampening felt as a result of the Covid-19 pandemic.

Figure 1: Inflation – 12M Growth Rate (%)

Source: Federal Reserve Bank of Cleveland calculations based on data from the BLS, BEA, Federal Reserve Bank of Cleveland, Federal Reserve Bank of Dallas, and Haver Analytics. Notes: Quarterly data only display for quarters in which all of the monthly data are available. Data for the monthly level of the median CPI, trimmed-mean CPI, and trimmed-mean PCE are not available.

Recently, however, we have seen the CPI spike on the back of the economic re-opening which has been buoyed by easy monetary policy conditions across the world. This spike seems to signal that the current level of inflation is set to remain high for a prolonged period of time, which in turn is corroborated by the recent behaviour of the core CPI, namely the CPI excluding food and energy, two of the sectors which rallied the most over the course of 2021.

These significant increases in inflation might be a source of concern for individuals as well as investors. Investors are increasingly seeking out the best ways in which they can hedge against inflationary pressures without compromising on returns. This is where infrastructure comes into play.

One of the investment benefits of infrastructure companies is that they can serve as a hedge against rising inflation. Over 90% of infrastructure assets in our universe have explicit or implicit mechanisms to pass inflation on to the end-user. Regulated utility companies for instance, are able to charge their customers and earn revenues over a predefined cost basis, which enables them to incorporate the impact of inflation in their cost structure. However, there is often a lag in adjusting for inflation. Such a revenue model benefits when inflation and interest rates rise because the allowed regulated return resets higher to compensate for a higher weighted average cost of capital.

To better understand how this works in practice, let’s use the example of a regulated electricity company, National Grid. National Grid, a global leader in decarbonisation, has a regulated contract with Ofgem, which incorporates explicit inflation linkage. Therefore, when inflation rises, National Grid’s prices increase; these price increases are then passed to the end-consumer through higher bills. This is one aspect according to which the built-in inflation mechanism works in practice for infrastructure companies.

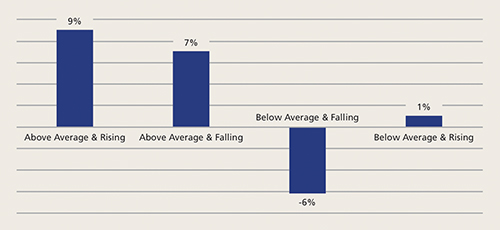

Outperformance in above average inflationary environments

Another feature of infrastructure companies is that, because of these inflation-fighting characteristics, they tend to outperform the global equity market during periods of higher inflation, irrespective of the direction that it takes, i.e., either rising or falling. Historically, within this type of environment, we have seen infrastructure outperform the broader equity market by 7-9%.

Figure 2: Average annualised relative performance. Global infrastructure vs. Global equities during inflation regimes

Source: CBRE Investment Management, US. CPI, UBS Global Infrastructure & Utilities linked to FTSE Global Core Infrastructure 50/50 Index, MSCI World Index as of 09/30/2021. Trailing 20-years based on average monthly total returns during inflation regimes, annualised. Inflation Regimes calculated using the year-on-year charge in the US. CPI, normalising its history using a z-score, and tracking the 3-month moving average of that z-score. The Inflation Regime is determined by both the level and the change in the indicator, requiring two months in the same cycle in order to confirm a new regime. Information is the opinion of CBRE Investment Management, which is subject to change and is not intended to be a forecast of future events, a guarantee of future results, or investment advice. Forecastsand any factors discussed are not a guarantee of future results.

The jury is still out on what path global inflation may take and we could be in for a bumpy ride as it relates to reactionary rate hikes, however, for the various reasons outlined we remain bullish on the outlook for listed infrastructure. We believe that its inflation-protection characteristics alongside the attractive valuations which listed infrastructure companies offer when compared to listed equities, private infrastructure, and global bond markets, makes this one of the most compelling asset classes in today’s market.

The path to a sustainable development

Infrastructure companies form the backbone of every economy, delivering essential services including water, energy, transportation and communication services. Under a broader definition, infrastructure also provides a basis for social development. For instance, infrastructure such as airports, toll roads and railways shape our individual habits and influence the development of urban areas. Infrastructure firms can therefore be thought of as an integral part of our socio-economic fabric.

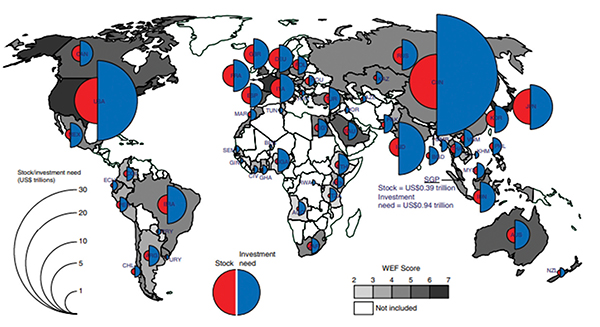

Notwithstanding the positive impacts they have, infrastructure can also generate negative externalities both from an environmental (e.g., GHG [greenhouse gas] emissions) and social (e.g., labour force displacement) perspective. They also require maintenance, particularly in light of our ever-growing population which is heavily dependent on reliable infrastructure. It has been estimated¹ that US$94 trillion of capital investment will be needed by 2040 for both new and replacement infrastructure.

Figure 3: Current infrastructure stock and forecast future needs to 2040

Source: Infrastructure for sustainable development (Thacker et al, 2019). Current stock and forecast future investment needs (2016–2040) were obtained from a previous study². Current infrastructure status using the World Economic Forum (WEF) composite infrastructure score was obtained from a previous study³.

The dependence on infrastructure is particularly pronounced if we consider electricity as the main source of energy for modern societies, and as a vector of the transition towards decarbonisation. For instance, electric utility companies are at the forefront of net zero action. They are installing solar modules, constructing wind turbines and upgrading transmission lines to charge electric vehicles and convert our heating to electricity.

Because of the amount and motives of these investments, infrastructure companies should grow their cash flow substantially and sustainably. Therefore, investors seeking sustainability with a desire to make an impact with their capital, should consider the suite of infrastructure companies that will control the initiatives they care about, and which will converge towards to a sustainable development path.

Alignment to the UN SDGs

As mentioned in the previous section, infrastructure is an integral part of the socio-economic fabric on the basis of the services they provide. It is therefore no surprise that it has wider reaching benefits from an SDG alignment perspective than purely the core SDG which is linked to industry, i.e., innovation and infrastructure (SDG #9). A recent study⁴ has shown that infrastructure either directly or indirectly contributes to all of the 17 UN SDGs, including 72% of the sustainable development targets.

Figure 4: Infrastructure contributes to all 17 UN SDGs

Source: United Nations Sustainable Development Goals, https://www.un.org/sustainabledevelopment/sustainable-development-goals/

For instance, water infrastructure allows people to access clean water and sanitation while protecting them against flooding, which are covered by SDG #6 (clean water and sanitation). Similar considerations apply to energy infrastructure; by building infrastructure such as solar panels and wind turbines, individuals have access to renewable energy at subsidised prices, characteristics which are attributable to SDG #7 (affordable and clean energy) and SDG #13 (Climate Action).

On the other hand, transportation and digitalisation are infrastructure sectors that indirectly affect the SDGs. For instance, transport infrastructure supports mobility, allowing people to become productive members of society and the economy. Technology infrastructure allows people to participate in the digital transformation, thereby minimising the digital divide. All these activities are part, inter alia, of the SDG 11 (Sustainable Cities and Communities).

It is therefore clear that the services infrastructure companies offer are directly and indirectly aligned to all 17 SDGs. These services, however, might be detrimental to the SDGs if infrastructures are not adequately planned. Therefore, as investors looking at generating an impact through their investment, pension funds need to rely on active asset managers who proactively take sustainability considerations into account by selecting companies which own and operate infrastructures in a way that is compatible with the 17 SDGs.

Nordea Asset Management is the functional name of the asset management business conducted by the legal entities Nordea Investment Funds S.A. and Nordea Investment Management AB (“the Legal Entities”) and their branches and subsidiaries. This document is advertising material is intended to provide the reader with information on Nordea’s specific capabilities. This document (or any views or opinions expressed in this document) does not amount to an investment advice nor does it constitute a recommendation to invest in any financial product, investment structure or instrument, to enter into or unwind any transaction or to participate in any particular trading strategy. This document is not an offer to buy or sell, or a solicitation of an offer to buy or sell any security or instruments or to participate to any such trading strategy. Any such offering may be made only by an Offering Memorandum, or any similar contractual arrangement. This document contains information only intended for professional investors and eligible investors and is not intended for general publication. © The Legal Entities adherent to Nordea Asset Management and any of the Legal Entities’ branches and/or subsidiaries.

1. Global Infrastructure Outlook: 2017 (Global Infrastructure Hub, 2017)

2. Source: Nordea Investment Funds S.A. and CBRE Investment Management

3. The Global Competitiveness Report 2017–2018 (World Economic Forum, 2017)

4. Infrastructure for sustainable development (Scott Thacker, Daniel Adshead, Marianne Fay, Stéphane Hallegatte , Mark Harvey, Hendrik Meller, Nicholas O’Regan, Julie Rozenberg, Graham Watkins and Jim W. Hall, 2019)

More Related Content...

|

|

|