|

Donald Hall Portfolio Manager, US Cities Diversified Strategy & Global Head of Research, Real Estate Nuveen |

Infrastructure 2.0 – Investing to create tomorrow’s economy

|

Written By: Andreas Köttering |

|

Alice Wilcox |

Andreas Köttering and Alice Wilcox from CBRE look at why significant investment in infrastructure will be needed to support the transition to a net zero carbon economy, creating a compelling opportunity for local authority investors

As the world emerges from a year of disruption and change, thoughts have naturally turned to the kind of world we want to live in the future. With governments around the world strengthening their commitments to a net zero carbon future, increasingly utilising new tech infrastructure, there is a renewed focus on the sustainability of our businesses, communities and society as a whole.

Infrastructure, as an asset class, is set to benefit disproportionately from the trends driving the shift to a more sustainable future. Clearly, the structures, systems and services we rely on will have a key role to play in building and enabling our society’s ambitions for a world in sync. There is also growing demand (and urgency) for upgraded infrastructure to facilitate the digitally connected society of tomorrow. We call this fundamental shift to deploy smart technology and integrate sustainability into the very fabric of our society, Infrastructure 2.0.

Mega-trends driving long-term infrastructure opportunities

Energy transformation

With increased scrutiny on climate change and decarbonisation, the shift toward renewable energy is gaining pace. But what we have seen to date is just the beginning of a dramatic transformation that will reshape the energy sector over the coming years. Already, wind and solar energy were the two fastest growing sources of electricity across the globe over the past decade, and their take up is only expected to accelerate. The costs associated with renewable technologies have reduced significantly, making renewables just another part of the energy mix. As technology evolves and costs continue to fall, renewables will become increasingly attractive compared to conventional generation sources in the coming years.

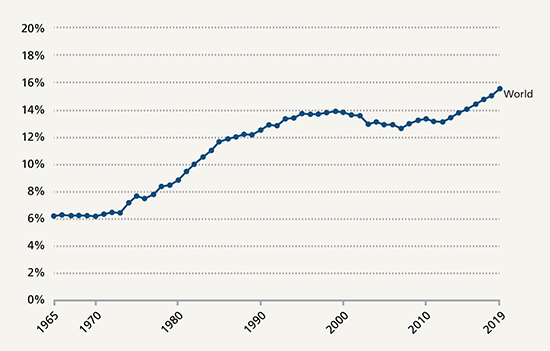

Figure 1: Share of Primary Energy from Low-Carbon Sources

Source: Our World in Data based on BP Statistical Review of World Energy (2020). Note: Primary energy is calculated using the ‘substitution method’ which takes account of the inefficiencies energy production from fossil fuels.

The inexorable rise of renewable energy presents a number of opportunities for investors. There is growing demand for wind and solar power from corporate off-takers, many of whom are entering into long-term power purchase agreements that provide cash flow visibility without the regulatory risk associated with government subsidies. Investors who are able to structure high quality off-take agreements will be able to capitalise on this demand. The increased generation of renewable energy is also giving rise to growing demand for energy storage. Industrial or grid-scale batteries and fuel cells will be key enablers to the mass deployment of renewables, capturing the oversupply of power when the sun shines or the wind blows to ensure a smooth supply of energy. The provision of energy storage will be another important opportunity associated with renewables.

Sustainable transportation

As a significant contributor to greenhouse gas emissions, transportation is another sector on the brink of transformation. Already, several of the major automobile manufacturers have announced pledges to go electric over the next decade. Although this is undoubtedly good news for the environment, the infrastructure to support electric vehicles is not ready to support mass demand, representing a challenge that communities will need to solve in the near term. Governments, the private sector, and infrastructure investors will be playing leading roles in this roll-out.

Similarly, transport operators are increasingly looking to reduce the carbon footprint of their operations. Electric and hydrogen powered rail, bus and ferry services all offer potential solutions to this challenge. Contracting and licensing the provision of more sustainable transport will allow operators to benefit from these new technologies and decarbonise public networks more quickly, without the upfront cost of buying new fleets outright.

Smart technology, smart infrastructure

The use of computing data and the internet has become essential to the global economy, particularly since the onset of the Covid-19 pandemic. Accordingly, global internet traffic has increased dramatically and is expected to continue to rise as a result of trends in usage such as outsourcing, remote working, cloud adoption, online growth, and application usage. As access to data becomes ever more critical, so too does the infrastructure that supports it. There is a growing universe of attractive opportunities in the digital infrastructure space, particularly in assets such as data centres, smart meters, mobile towers and fibre optic networks that benefit from long-term contracts, low elasticity of demand, and resilience to economic downturns.

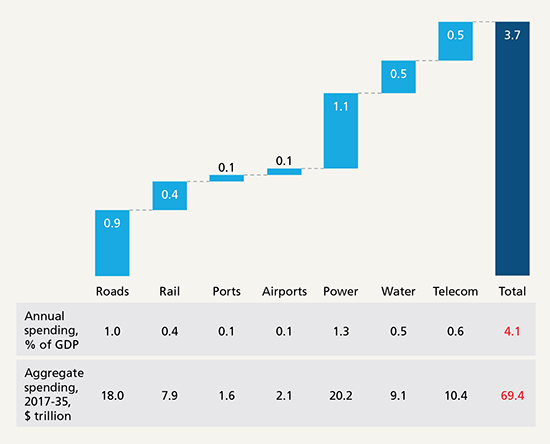

Figure 2: Average Annual Infrastructure Need, 2017-35

Source: Figures may not sum, because of rounding.

Note: GWI; IHS Global Insight; ITF; national statistics; McKinsey Global Institute analysis

Under-investment in public infrastructure

In many countries long-term under-investment has left public infrastructure buckling under the weight of existing demand. For example, utility networks across North America and Europe were built many decades ago. As societies adapt to meet the challenges of the new green economy, there is a clear opportunity for private investment to make up shortfalls in public funding and enable the shift to a more sustainable future. Investors that can identify and gain access to these opportunities will benefit from the strong and growing demand for Infrastructure 2.0.

The long-term case for infrastructure investment

Identifying long-term opportunities

As well as providing opportunities to benefit from the strong and growing demand for sustainable infrastructure, environmental effects also represent risks to infrastructure assets. Climate change, and the associated impact of more frequent extreme weather events, poses clear physical risks to assets. Meanwhile, in the transition to a net zero economy, assets that cannot adapt could become obsolete as regulations and stakeholder expectations change. By taking a long-term view to identify the factors that will detract or drive value for decades to come, astute investors can act early to benefit from key trends while minimising long-term risks.

Secure, predictable income

This demand only adds to an already compelling investment case for infrastructure. The unusually high level of income certainty offered by global infrastructure is particularly attractive to LGPS investors. Many infrastructure assets are regulated and benefit from long-term contracted income. So even if demand for their services should fall, these assets can still receive “availability” payments from governments for the continued provision of essential services and utilities.

Alongside the steady and predictable cash flow, the income from infrastructure assets often has inflation protection built in. Payments are frequently linked to CPI via contracted increases during the term of the lease. This provides a higher degree of income visibility and stability compared with other asset classes.

Long-term, protected access

Infrastructure assets are typically capital intensive and have high barriers to entry. Alongside very long operational lives, these features give them the characteristics of natural monopolies. Difficult to replace, their value is driven by the income they generate throughout their lifetime rather than fluctuating with market sentiment. And as their income is very predictable over the long term, they are not as sensitive to market volatility as other assets.

Understanding the drivers of return

The events of the last year have highlighted the importance of understanding the drivers of cash flow and return for different infrastructure assets. Some infrastructure assets have been remarkably resilient during recent global lockdowns, like data centres, PPA¹ contracted renewables and regulated utilities, whereas others have been impacted due to falling demand, such as volume-linked airports or hydrocarbon midstream assets. When it comes to selecting assets for long-term resilience, it is important to focus on those with low sensitivity to demand shocks, thereby offering diversification from assets that are vulnerable to downturns in GDP. However, over the last year, uncertainty over the shape and timing of the recovery has led to attractive pricing and valuations for demand-driven assets. With a disciplined approach to entry pricing, these assets could offer diversification benefits and boost returns as economies whir back to life.

Aligned with the priorities of LGPS investors

The investment characteristics of infrastructure assets make them particularly attractive to LGPS investors. Steady, predictable income with high visibility over the long term enables liability matching, while continued and growing demand is expected to support returns above the discount rate. Further, inflation protected cash flows should prove valuable for meeting future cost of living needs of beneficiaries.

We continue to see compelling opportunities for global infrastructure, primarily focusing on mid-market infrastructure investments in developed OECD markets. As the recovery gains strength, we expect infrastructure assets that are carefully chosen to diversify GDP exposure, geographic and regulatory risk, will be highly sought after by LGPS investors.

Our key investment themes – renewable energy, sustainable transport, digital infrastructure and smart grids – are expected to experience accelerated growth over the coming years. By investing in Infrastructure 2.0, LGPS investors can benefit from this growth, while also playing an active and important role in building an economy for the future, supporting communities and enabling the transition to net zero.

1. Power purchase agreement

More Related Content...

|

|

|