A fresh perspective on a familiar framework

Published: April 1, 2016

Written By:

|

Paul Myles |

Paul Myles of BMO Global Asset Management outlines how adding a third element to the traditional return drivers of market exposure and manager skill can allow an allocation to equities that captures the full range of available sources of return while avoiding unnecessary duplication, nullification or risks

Against a backdrop of market volatility and economic uncertainty, we see that institutional investors are facing challenging conditions. Administering authorities are facing a continuous balancing act between competing priorities to find sufficient assets to pay members’ benefits over the long term as the population ages, whilst managing short-term funding levels. Added to these macro demands, the UK Local Government Pension Schemes (LGPS) face the task of implementing shared asset pools in a bid to benefit from a more collaborative approach to managing investment portfolios and reducing management fees.

As the LGPS begins to consider the structure and make up of their assets within the requested six pools of between £25-35 billion, we provide a fresh perspective on some of the elements to assist in this exercise, with a focus on the global equity pool.

Taking a fresh look at a familiar framework

We suggest that rather than considering the allocations against a regional allocation template, investments are seen as the sources of return and risk across the entirety of your equity portfolio – both active and passive.

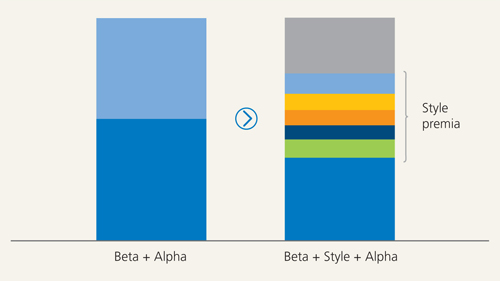

Typically in traditional diversified investment portfolios, returns are thought to be determined by two principal drivers: market exposure (beta) and fund manager skill (alpha). Many investors are now increasingly seeing the benefits of deconstructing the two elements further, to identify a third component – so-called styles or factors.

The terms alpha and beta reference the parameters in the Capital Asset Pricing Model, which postulates that the excess return on a given stock is a simple linear function of the excess return of the market. The emergence of factors, in addition to that of the market, and their incorporation into risk models, is the result of academics and practitioners recognising that a stock’s market beta alone does not sufficiently explain the cross-sectional variation of stock returns.

Consequently, we can see that the returns from an active portfolio can, in practice, be attributed to one of three sources; (i) Beta – the return from the market, typically represented by a market capitalisation weighted index; (ii) Factors – the return from investment exposure to identified factors or styles e.g. value, size, momentum; and (iii) Alpha – the residual returns that are attributed to active fund manager skill, with hopefully low correlation to markets.

Figure 1: Deconstructing active equity returns

Source: BMO Global Asset Management

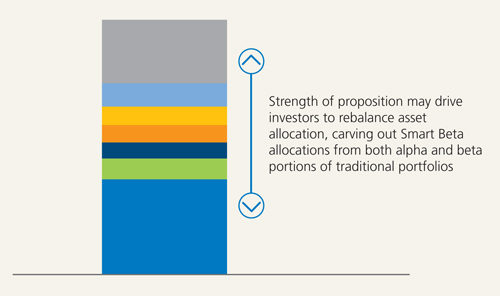

Looking at these sources of return, we can also see them as the building blocks that can be combined to structure a portfolio. We believe that taking a fresh look at your portfolio’s aggregate allocations in each of these areas and subsequently rebalancing holdings may maximise the strengths afforded by each of the three elements and benefit your portfolio in its entirety.

Figure 2: Rebalancing allocations to include smart beta allocations

Source: BMO Global Asset Management

Alpha – unconstrained active management

At the top of the return profile, we can see that there is a contribution from alpha, typically delivered by individual fund managers managing according to their own investment style. However, pure alpha from equity allocations can only be achieved by equity market neutral funds where the ability to implement unconstrained long and short positions delivers a source of returns that are independent of the market.

In practice, the majority of active equity managers are under- or over-weighting individual equities relative to a market. This long-only approach is unable to solely generate “pure” alpha. The resulting excess returns are most probably a combination of returns from factor exposures as well as genuine alpha.

Passive beta – index tracking

At the other end of the scale, a significant component of the return profile in an equity allocation can be attributed to the passive beta allocation. Followers of passive beta believe in the efficient market hypothesis, anticipating that at all times markets will incorporate and reflect all information, rendering individual stock picking redundant.

Passive equity allocations to index funds and Exchange Traded Funds (ETFs) act as potential market substitutes and are perceived to be good bulking agents in an equity portfolio. Investors typically rely on this allocation as a low cost, long-term, buy and hold component of their portfolio providing cost-effective exposure to the equity risk premium.

Smart beta – systematic style investing

Finally, as can be seen by the greater granularity of our three-tiered structure, an important source of excess return in an equity portfolio can be attributed to the exposure to systematic factors.

The emergence of smart beta strategies over the past few years in response to rising investor demand has highlighted the role that these factor exposures play in determining relative stock performance and so the aggregate returns of an actively-managed portfolio. The term “smart beta” is typically used to describe a systematic, rules-based approach to investing, which explicitly allocates to securities that exhibit the properties of academically acknowledged factors.

The most recognised equity styles are either valuation-based, calculated by using “book-to-price” and “price-to-earnings” ratios, or growth-based using measures such as “earnings growth.” Well-known investment styles include Value, Size, Momentum, Quality, Low Volatility and Growth at a Reasonable Price (GARP). Factors or styles are not new, having been identified in academic studies as long ago as the early ‘70s and with a growing depth of supporting empirical evidence.

Smart beta strategies represent an evolution in indexing or passive equity management as investors are no longer constrained by the active versus passive debate as these strategies can combine the best of both approaches. They effectively straddle the band between pure alpha as delivered by truly unconstrained active managers, and the passive beta delivered by index tracking funds.

Active beta through style investing

Having identified and isolated the contribution to returns that the styles are delivering, it is possible to dynamically and systematically combine them into a multi-factor portfolio. The portfolios may be quantitatively structured, possibly using an Equal Risk Contribution methodology, a technique that makes no assumption as to the future returns of individual styles, and results in each style contributing the same amount of risk to the final portfolio.

Additionally, an active approach to risk management allows unwanted exposures, perhaps to countries, sectors or currencies to be specifically controlled.

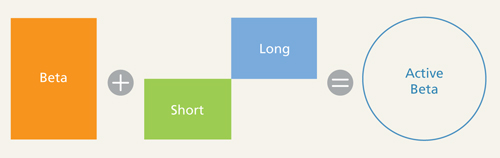

Accentuate the positive, eliminate the negative – benefiting from a long/short overlay

Finally it is possible to take this active beta approach one step further, drilling down further on just the smart beta investing, splitting it between core beta and creating an enhanced leveraged long/short, market neutral component for each of the style factors.

In essence the long/short filters are the result of the same factor analysis used in the long-only smart beta version focusing on the top band of stocks that demonstrate certain characteristics, attributable to a certain style. Having identified the top proportion it is also possible, by definition, to determine the weakest examples, and to create an overlay that goes long in the strongest holdings and short in the weaker holdings.

When applied, the long/short overlay can deliver an enhanced variation of style investing in which the sum of the long weights is equal to the sum of the short weights and so is unfunded.

Figure 3: Enhancing the beta proposition

Source: BMO Global Asset Management

The long/short overlay can be seen as a source of risk and active return. The stand-alone risk of the overlay can be measured and its contribution to the aggregate risk of the active equity portfolio can, likewise, be determined.

Putting it all together – options to consider when combining the building blocks

When it comes to considering ways to combine these portfolio building blocks we see that at each level, any allocation in an active equity portfolio will result in exposure to alpha, beta and style investing factors, not all of which are desirable. We believe that a scheme should be very aware of this element when it is allocating active equity risk, aiming to identify clearly defined factors that should be “refined” of unwanted or overlapping exposures, and managed as a single multi-factor portfolio.

Weighing the costs with the benefits

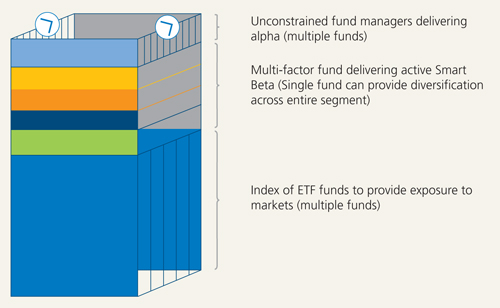

We also believe that schemes should be cognisant of the costs implicit in achieving a healthy combination of diversification on the one hand, yet managing the governance overheads that come with running a large portfolio.

Figure 4: Achieving diversification and adding depth to the portfolio

Source: BMO Global Asset Management

Whilst the basic passive investing component can be delivered for relatively low fees, achieving diversification in the alpha component will come at a higher cost from the management and performance fees charged by the underlying managers, often from various investment houses. In turn, multiple holdings and associated relationships require a level of due diligence in the selection, monitoring and on-going management of relationships and a not insignificant burden on the resources of the schemes’ governance teams.

In contrast, systematic smart beta can deliver a cost-effective solution providing high levels of diversification from traditional asset classes and across factors within one mandate through its multi-factor structure, and can be provided by one investment manager with fewer issues of scalability or capacity given the quantitative, systematic nature of the product.

Taking a fresh perspective

In conclusion, we feel that by taking a fresh perspective on your equity portfolio using this simple framework, it is possible to build an allocation to equities that captures the full range of available sources of return whilst avoiding unnecessary duplication or nullification or risks. Finally, it becomes simpler to identify where returns are generated and where value is being created or destroyed.

As an increasing number of investors realise the benefits of pursuing an investment approach that encompasses smart beta alongside their active and passive allocations, discussions are now focusing on allocation levels. Perhaps leaving us with the question, not “if”, but “how much”?

More Related Content...

|

|

|