|

Written By: Mark Bunney |

|

& Tony Yu |

|

& Matt Day |

Mark Bunney, Tony Yu and Matt Day outline an innovative strategy for investors seeking exposure to commercial real estate

The benefits of investing in property as part of a multi-asset portfolio are widely recognised by institutional investors and their advisers. Specifically, property offers:

- Attractive long-term returns with characteristics of both equities and bonds

- Relatively low volatility compared with other asset classes

- Diversification, through low correlations with other asset classes

- Stable and attractive income returns, with the potential for capital growth

- Inflation-hedging characteristics

As a result, the case for including property within a pension scheme’s investment portfolio is compelling from an asset allocation perspective.

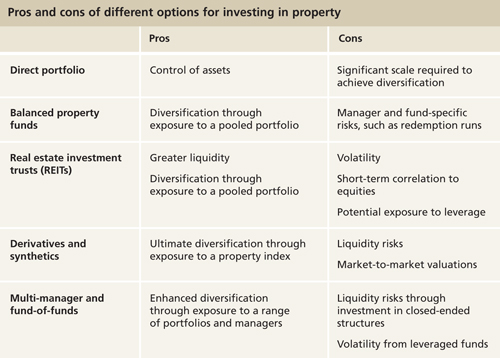

There are various options for pension schemes to invest in property. As the table below illustrates, there is no perfect solution. The choice will be determined by a range of considerations, including the pension scheme’s size, tolerance for risk and liquidity preferences.

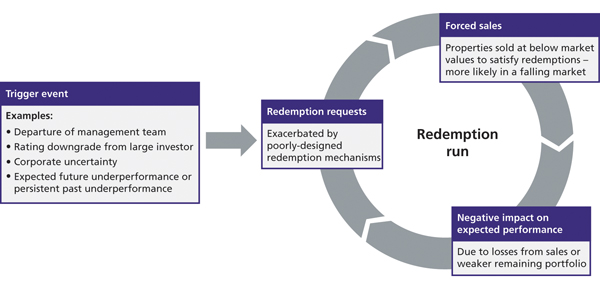

Most balanced funds that have severely underperformed over the past 10 years have suffered from redemption problems at various points. And while risks between funds vary in terms of size, style and quality of management, the single biggest risk that an open-ended balanced property fund is exposed to is that of a redemption run. This can lead to a vicious circle of forced sales, underperformance, more redemptions and further asset sales.

Figure 2: The risks of investing in an open-ended property fund

Source: Kames Capital

Investors choosing to invest in a single balanced fund therefore have to be confident that the fund they select will not face a redemption run in the future, particularly if the fund is held “passively” over the long term. Recent experiences tell us that, unless regular research and reviews are undertaken, passive investors will be vulnerable to the risk of a redemption run.

Multi-manager or fund-of-funds approaches

Multi-manager or fund-of-funds approaches mitigate the risks of being exposed to a single fund. Instead of investing in a single property fund, a diversified multi-fund solution with exposure to different managers and styles can offer a number of benefits:

- Further diversification of property risk

- Diversification of manager risk

- Diversification of liquidity risk

- Access to specialist managers by sector, region or style

- Potentially greater speed and lower transaction costs from secondary market trading

While this route certainly improves diversification, the typical multi-manager model of the past 10 years actually increased portfolio risk by investing in closed-ended, leveraged specialist vehicles – in some cases outside the domestic UK market. This resulted in many portfolios underperforming due to the employment of debt in poorly-performing funds and illiquid, closed-ended vehicles. Such illiquidity restricted the ability of managers to change the portfolio strategy. At the same time many indirect managers also chased growth, rather than the low-risk diversification their clients were actually seeking.

More recently, rather than reduce risk, some indirect property managers have re-invented themselves as managers of joint ventures and club deals, moving their offerings even further towards illiquid, expensive, private equity-style investments. Many managers are attempting to deliver excessive alpha, rather than generate a low risk market return, which is ultimately the reason that most pension funds invest in commercial property.

It seems that a low-risk diversified solution does not currently exist. However, a different type of multi-manager strategy can achieve the asset allocation objective of accessing property market beta without the traditional risks associated with a single balanced fund strategy or an illiquid, leveraged, multi-manager strategy. Our Active Beta strategy is in tune with what we believe many pension funds are seeking from their property allocation. The strategy invests in a diversified, representative portfolio of open-ended balanced UK property funds, while avoiding closed-ended and leveraged private equity-style vehicles and other esoteric property funds. This strategy aims to deliver the low risk, lowly-levered, diversified and reasonably liquid exposure to property returns that many pension schemes are seeking. Our research, using historic data from funds, shows that it is not possible to deliver a truly passive index return using replication techniques, because the structure of the index constantly changes over time. In particular, underperforming funds (especially those suffering redemption runs) shrink as a proportion of any market or index, while outperforming funds grow quickly. This makes it difficult to replicate any market or index return without active on-going management. Furthermore, the transaction costs of continued replication of the market or index would have too much of a negative impact on performance. As a result, a degree of active management is required to deliver a diversified, low risk, property market return.

While this strategy requires active management, the key difference with some multi-manager strategies is that we have strict risk constraints to limit tracking error and avoid exposure to leverage and illiquid fund structures. The strategy limits the investable universe to a large basket of UK balanced funds (thereby avoiding illiquid and geared specialist vehicles or joint ventures) and limits the active positions against the index weights of individual funds. By investing in a diversified range of open-ended balanced funds, liquidity risks are diversified and limit the highly damaging impact of being stuck in a single fund suffering from a redemption run.

The active management in such a strategy has two elements:

1. Small active fund positions

Thorough and regular fund research can provide a view as to which funds outperform or underperform, and enables under or overweight positions to be taken relative to the market. In order to restrict risk and in particular tracking error, we limit active positions against the Index.

2. Secondary market trading

The secondary market in unlisted property funds is highly inefficient and we have long experience of exploiting its potential as a source of outperformance. Judicious use of the secondary market can help investors mitigate the full transaction costs commonly associated with property. The secondary market also allows for the use of relative value strategies that more passive investors do not analyse or consider.

Most small-to-medium sized pension schemes either invest in a single balanced property fund or use multi-manager or fund-of-funds solutions. However, the risks of redemption runs from single balanced funds have increased in recent years. This makes it difficult for investors to be confident in the long-term liquidity and performance prospects of any single fund. At the same time many multi-manager and fund-of-funds models have incorporated too much leverage for pension schemes seeking exposure to UK property market returns. Kames Capital has developed an innovative multi-manager solution that enables pension schemes to track property returns with reasonable levels of liquidity. Our Active Beta strategy invests in a diversified portfolio of open-ended balanced property funds. By taking small active positions in funds and transacting on the secondary market we can actively manage our clients’ portfolios within defined risk limits, which enables us to deliver returns with a risk profile appropriate for pension schemes seeking property market returns.

This document is not intended for retail distribution and is directed only at investment professionals. It should not be distributed to, or relied upon by, private investors. All data in this presentation is sourced to Kames Capital unless otherwise stated. The views expressed in this document represent our understanding of the current and historical positions of the market. They should not be interpreted as a recommendation or advice. Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and is not guaranteed.

We calculate yields in compliance with the industry standard formula we are obliged to use which takes no account of potential future defaults. This may mean that, depending on future economic factors, the actual yield could be less than those shown.

Where funds are invested in property, investors may not be able to switch or cash in their investment when they want because property in the fund may not always be readily realisable. Redemptions or liquidations may therefore be deferred. Whilst property valuation is conducted by an independent expert, any such valuation is a matter of the valuer’s opinion. Property funds invest in a specialist sector, which may be less liquid and produce more volatile performance than an investment in broader investment sectors.

This document is accurate at the time of writing but can be subject to change without notification. Kames Capital is an Aegon Asset Management company and includes Kames Capital plc (Company Number SC113505) and Kames Capital Management Limited (Company Number SC212159). Both are registered in Scotland and have their registered office at Kames House, 3 Lochside Crescent, Edinburgh, EH12 9SA. Kames Capital plc is authorised and regulated by the Financial Conduct Authority (FCA reference no: 144267). Kames Capital plc provides segregated and retail funds and is the Authorised Corporate Director of Kames Capital ICVC, an Open Ended Investment Company. Kames Capital Management Limited is an appointed representative of Scottish Equitable plc (Company Number SC144517), an Aegon company, whose registered office is 1 Lochside Crescent, Edinburgh Park, Edinburgh, EH12 9SE (PRA/FCA reference no: 165548).

More Related Articles...

Published: October 1, 2015

Home »

Alternative Investments