Active is dead, long live active

|

Written By: Hal La Thangue |

Hal La Thangue of Broadridge looks at the benefits of both active and passive investment management, outlining how the two can often be complementary and how active equities still have a positive role to play in LGPS portfolios

Scrutinised by the media on performance grounds and eclipsed by passives on the fees front, one could be forgiven for thinking active equity management is a dying art. Combined with lacklustre projections for global equity markets (even before Covid-19 hit) and far-reaching diversification efforts, the picture looks ever bleaker.

But this is too bearish and belies a more nuanced story. Passive allocations have been rising, but rather than being a substitute for active, both approaches can be complementary. There is a plethora of options available on the active-passive spectrum which, when combined, allow for the creation of a more holistic equity portfolio with differentiated sources of risk and return, greater resilience to market downturns and improved value for money.

While the LGPS pools remain idiosyncratic in their approaches to managing extensive equity exposure, evidence suggests that the system is beginning to harness its newfound scale and governance to enhance equity portfolio construction and gain access to an expanding choice of strategies.

Constructing a segmented equity portfolio

Traditional thinking on equity has frequently led to the creation of two buckets in which strategies could be allocated: a “beta” segment consisting of passive market-cap weighted trackers and a “core active” allocation largely composed of low tracking error “benchmark huggers”. The latter typically charge high fees for returns which could be replicated by other products at a fraction of the cost. They also have low potential for excess returns generated by manager skill, a key component of active manager value.

The concept of holistic equity investing is based on a simple notion: segmenting a portfolio between strategies which have differentiated and diversified sources of return (whether that’s market risk, other systematic drivers of return or individual manager skill) should lead to the realisation of improved risk-adjusted outcomes over the long term, with fees more efficiently allocated to managers.

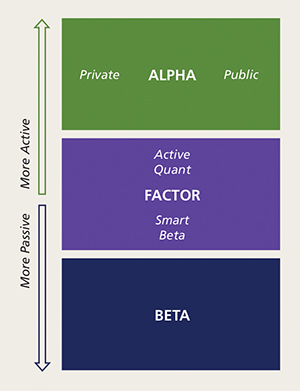

The following paradigm has emerged in the institutional management of long-only equity portfolios and illustrates the holistic use of strategies across the active-passive spectrum. It has three key constituent parts:

- Beta: Captures market returns by investing in strategies which track market-cap weighted indices. Allocations to these strategies are typically focused on more efficient, developed markets (e.g. US, UK) where it is more challenging for active managers to add value.

- Factor: Generates return through exposure to so-called “factors”, which are quantifiable characteristics of stocks that have been academically validated as drivers of performance. Factor investing replicates typical active investment styles in a systematic, more transparent and ultimately lower cost manner. Examples include “Momentum”, the phenomenon of share price increases having a degree of persistence; and “Low volatility”, the observed anomaly that low risk shares tend to outperform higher risk equivalents. These sources of return are primarily captured through two types of strategy that sit on the active-passive spectrum: “Smart Beta” strategies replicate an index which has been designed specifically to invest in “factors”, while “Active quant” approaches are guided by systematic rules that can evolve dynamically under the watch of a portfolio manager.

- Alpha: As both Beta and Factor investing have grown, equity managers have struggled to provide outperformance. Consequently, the portion of the portfolio allocated to truly active strategies has evolved to focus on those which permit a high degree of discretion and rely heavily on manager skill for return, rather than the market or well-established factors. Doing so gives managers more room to generate potential Alpha. Within this segment are strategies focused on inefficient markets (e.g. China, small cap etc.); high conviction strategies allocated to small baskets of global stocks; approaches which are dependent on future megatrends (e.g. impact and thematic) and private equity products that offer an illiquidity premium as another differentiated source of return.

Figure 1: Modern institutional long-only equity portfolios

Source: Broadridge Analysis

Is the LGPS going down a similar path?

With the process of pooling now in full swing – the LGPS now has many new equity strategies in place – each pool and fund is taking an individual approach to the asset class. That said, there are commonalities in behaviour indicative of the steady evolution towards more holistic equity investing.

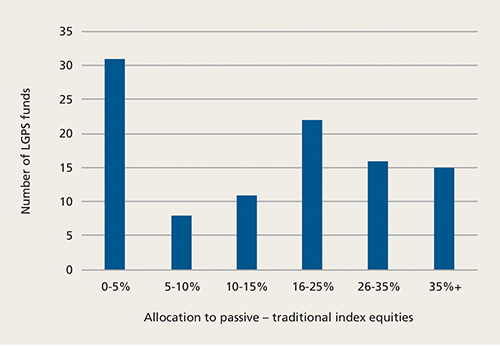

Firstly, the system has embraced market-cap weighted trackers – largely rejecting active “benchmark huggers” and managers that have not been able to outperform the market reliably. It was hard to miss the announcement of the pools’ multi-billion sterling passive mandates placed in late 2017 and early 2018. Allocations to market-cap weighted trackers are now as high 25% in some of the pools, and 60% among some of the underlying funds. But this trend is by no means uniform; around 30% of the funds still have a commitment to active management only. See Figure 2 for an indication of variations.

Figure 2: Percentage allocation of whole portfolio to Passive – traditional index equities – number of LGPS funds in Q1 2018, early in the pooling process

Source: LGPS Annual Reports

Factor strategies, although yet to be fully accepted, are on the rise. Pre-pooling, several funds had adopted fundamentally weighted index products in order to gain exposure to the value factor. Having grown comfortable with this approach, various Smart Beta trackers which capture multiple factors, often alongside ESG tilts, are being placed within equity portfolios. A couple of pools have also introduced “low volatility” equities, as an additional factor exposure.

Cynics may argue that the transition to Beta and Factor products has been primarily driven by cost motivations, as the system faces constant pressure to lower fees. But there remains a hunger for active strategies among the LGPS which is unlikely to dampen anytime soon. The pools appear wedded to their belief in the value added by manager skill.

In line with the thinking outlined earlier, the LGPS are looking to ensure that the increased fees going to active managers are not spent on sources of return that might be captured by the Beta or Factor components of their portfolios. Hence, the pools have focused on facilitating access to strategies where Alpha potential is greatest. Global high conviction strategies, where a portfolio manager will create a concentrated portfolio of 20-30 stocks from a highly diverse universe, have been the most notable beneficiaries of this trend.

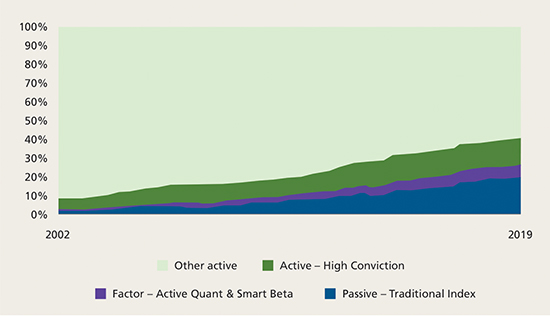

Illustrated in Figure 3, the relevance of these strategies has been growing more pronounced in Europe’s fund management industry, alongside passive and factor approaches.

Figure 3: Global equity AUM held by European investors – breakdown by investment approach – mutual funds only

Source: Broadridge Equity Prism

However, this is a fast-changing scene and numerous pools have set up, or are in the process of setting up, further specialist strategies including small cap, sustainable themed, emerging market, and private equities in order to diversify the sources of return accessible to member funds, and to access “true” Alpha through expansive manager selection efforts.

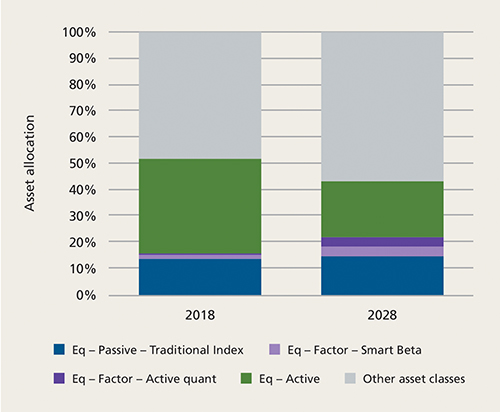

Covid-19 and future forecasts

The global economic fallout from Covid-19 has dealt a hefty blow to the LGPS and many other investors as they attempt to navigate the end of a bull market twinned with a heavy reliance on equities. Over time this reliance will decline as access to private markets, multi-asset credit and other diversifiers are made available. But as Figure 4 reveals, equities will continue to have a pivotal role going forward. Even though they will bear the brunt of the hit from diversification efforts, our forecasts estimate a 21% allocation to active equities in 2028. The process of assets transitioning into purer Alpha strategies, and lower cost products being employed to access systematic drivers of return is being spearheaded by the pools’ more niche product sets. As the above evidence has illustrated, many LGPS funds are still in the early days of more holistic equity thinking. But the trend towards this thinking is only going to accelerate, as enhanced scrutiny is placed on active managers paid to deliver Alpha, while trustee boards look to negate risk concentrations laid bare by the current crisis.

The role of active equities in LGPS portfolios may be evolving, but is by no means dead.

Figure 4: LGPS asset allocation – present and future (%)

Source: Broadridge UK DB Navigator

More Related Content...

|

|

|