Alternative investments: driving returns with active management

|

Written By: Alan Ross |

Alan Ross of ICG discusses the benefits of active management in a time of market turbulence and the importance of selecting the right partner

The active versus passive debate has raged for decades but in our view, severe market dislocations merit an active response. Necessary ingredients for success include having a broad market perspective, a global footprint and expertise in problem-solving, allied with the patience of capital to ride out the storm.

In private markets, for example, the better a portfolio manager understands the fundamentals of a business the more involvement and influence an investor can exercise and the more likely they are to maximise returns. Whether private market corporate strategies, private equity, real assets or capital market strategies, we believe active decision-making is key.

The benefit of active management is rarely more noticeable than at the time of a market dislocation, such as that prompted by the global spread of Covid-19. Investment opportunities become available that are unlikely to present themselves during normal market conditions and it requires an active management strategy to take advantage of them. Some of the opportunities arising will involve distressed assets, and these can appear across the spectrum of alternative investments. Event-driven secondary investment opportunities, urgent liquidity requirements, refinancing obligations, private capital restructuring and hard assets – all of these come to the fore in periods of economic turmoil.

Past outperformance of distressed as an asset class

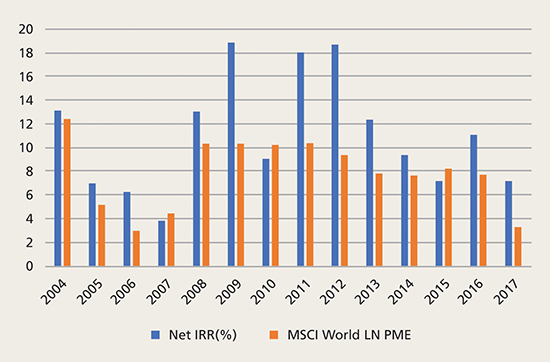

While investing in distressed assets is ordinarily a contrarian strategy, it has proven extremely successful for those who allocated to it in and around past dislocations or market downturns. After the oil price shock of 1990-1991, the dot-com bubble of 2000 and the global financial crisis of 2008, investments in special situations opportunities significantly outperformed global stock markets. While it can be hard to compare private funds with public markets in a like-for-like manner, Figure 1 compares the net IRR of private funds versus a public markets equivalent of the MSCI World between 2004 and 2017. Clearly visible is the outperformance of distressed in the years of the financial crisis (2008-2009) and the Eurozone crisis (2011-2012).

Figure 1: IRR of distressed funds (net) vs MSCI World LN PME (gross)

Source: ICG

In the past five or so years the performance of global distressed funds has been mixed, in part due to the unprecedented response by governments and central banks that has continued long beyond the aftermath of both the global financial crisis and the Eurozone crisis. In setting ultra-low interest rates and undertaking sustained asset-buying programmes, they endeavoured to support vulnerable economies from further shocks. However, we believe maintaining these conditions over the longer term has contributed to the misallocation of capital, as traditional triggers of corporate stress have been absent. It is the imbalances that have arisen from this that are now contributing to some of the opportunities in the market.

Opportunities yielded by market dislocation

One area on which an active manager is likely to focus is in meeting liquidity needs for companies suffering from weak short-term trading but with intact business cases for the medium-term. Additionally, some areas of private debt where previously heightened competition for assets led to aggressively-structured deals are now being offered on much more favourable terms for the investor. Commercial banks have retreated from capital markets, leaving behind opportunities in the void, and private equity sponsors are looking for off-market solutions to complete their M&A activity. In liquid credit markets, it is believed volatility is likely to remain elevated in the near term and will present multiple potential entry points. There is also scope to acquire illiquid private debt from banks or other market participants at significant discounts to fundamental value.

Active management: attributes to consider

As is generally the case across the spectrum of active investment management, in the alternative investment sphere a manager’s market experience is crucial. It speaks to long-term industry relationships, one benefit among many being a likely advantage sourcing deals. And it indicates first-hand understanding of a broad range of market environments, none more important at the present time than previous significant dislocations. Rigorous adherence to due diligence processes is also vital as it means that assets held are likely to show greater resilience in times of volatility. Insistence upon strong documentation also serves to reduce a manager’s exposure to risk. Ultimately it is the collective good judgement of a portfolio manager and their wider team, in many cases underpinned by the culture of the firm behind them, that defines the quality of an alternative asset portfolio and the likelihood that it will perform in both good times and bad. In these uncertain and unprecedented conditions, it is vital to select a partner with the experience, discipline and know-how to seek out the genuine opportunities available on the best possible terms and unlock value at a time of market dislocation.

More Related Content...

|

|

|