Activist investing in the current market

CommentMark Shaw, Portfolio Manager, Permal Group

It is very clear from what you read in the media that the activist style of equity investing has returned to the fore and has become more established, better known, and is increasingly gaining recognition as a benefit for all shareholders. Mark Shaw of Permal explains more

Shareholder engagement has progressed from an occasional threat facing corporate management to a consistent feature of the investing landscape that every company needs to be aware of. One reason is the impressive performance across a number of situations in which activists have been involved with, which has attracted interest and increasing levels of support from more traditional shareholders. It is an opportune time for the strategy, with financing available on favourable terms and a corporate landscape that is constructive for engaged shareholders. The long-term performance of the strategy is also impressive and we at Permal believe that the best activist investors can play a valuable role in portfolios.

Activists are shareholders who seek to influence a company’s activities. Often activists will work collaboratively with a company’s management behind the scenes; they do not necessarily seek the limelight, they are satisfied to see a company perform and the stock price appreciate. They operate in contrast to the increasing size of passive funds and other absentee shareholders.

This is a highly specialist strategy but is relatively straightforward to understand, and is more akin to equity long-only investing than other hedge fund strategies. Activists take a highly research-intensive approach to investing in companies with a long-term time horizon. By their very nature, activists seek to identify undervalued companies in which they can unlock value. To achieve this, they focus on a company’s operations, the intricacies of their balance sheet, the quality of the management, corporate structure, strategic ambitions, and so on. These are investors who conduct rigorous in-depth private equity style analysis as they seek to understand and improve a company to generate even greater value. What’s more, they have a substantial part of their own net worth invested, ensuring alignment of interests rather than acting as absentee agents of other people’s capital.

Activism as an investment strategy

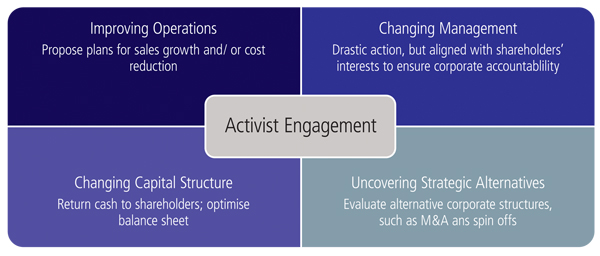

Activism is the most proactive of all investment strategies, as managers engage directly with the management of their target companies. The point of such discussions is to materially improve the company, and typically they will put forward a variety of suggestions, illustrated in Figure 1.

Figure 1: Potential impact of activist management

A number of proposed plans centre on the capital allocation process, both with regard to the operations of the company as well as the balance sheet. Many companies, both big and small, are under-investing in key areas, e.g. Heinz disperses marketing spend across brands rather than focusing on the key brands, or investing in areas that are unproductive, such as Sotheby’s unprofitable dealer segment. The aim of these discussions is to improve sales and/or reduce costs, and, ultimately, improve operations.

Similarly, in the wake of the credit crisis many companies are failing to optimise their balance sheet and are operating with too conservative a financial structure. As financial conditions evolve, so a company’s capital structure should change. Many companies are still hoarding too much cash on their balance sheets which is unproductive and could be returned to shareholders. Furthermore, with interest rates so low and financing available at favourable rates, it makes sense for a company to alter its mix of financing.

Firms with diversified business models are particularly exposed to activists, with many trading at a discount to the sum of their parts. Where this is the case, companies should pursue “strategic alternatives” and evaluate their structure. This is one reason why we have recently seen a number of spin-offs, such as McGraw-Hill which, at the prompting of an activist investor, spun off its education division to leave Standard and Poor’s at the centre of the new company.

An ability to successfully engage with a company to effectuate change requires a specialist skill set. Activists need extensive resources dedicated to analysing and understanding a company and its businesses, as well as relationships with key constituencies including corporate advisors, proxy advisers, and other shareholders to canvass support. On occasion, they must be prepared to engage in a public dialogue and, in extreme cases, pursue a proxy contest. Many claim to be activists, but only a small handful has the required skill-set.

There is a common misconception that activism is mainly short-term based. Often this is not the case and as a general rule activist investors tend to be invested for the long-term with a multi-year time horizon. This is in contrast to the average fund manager that has shortened their investment horizon to quarters if not weeks. Recent academic findings also show that activist interventions result in improved long-term performance for that company, benefiting shareholders; what’s more, when an activist exits their investment, there is no evidence of abnormal long-term negative returns.¹

Why now?

The current economic environment presents an attractive opportunity set for activists, with a relatively muted economic outlook, high corporate cash balances, financing markets open, and an increasingly receptive climate for shareholder-friendly proposals. In such an environment, companies can adjust their capital structures to their advantage, and manage the business more efficiently for shareholders.

Attitudes towards activism differ widely, with the UK and US (where the majority of activist managers are based) well suited to this style of engaged investment management, where it is more in tune with corporate culture and shareholder attitudes. What also makes these markets stand out relative to other regions, is the high level of institutional shareholdings and a high degree of transparency. Indeed, a key recommendation in the UK’s Kay Review was to foster more productive engagement between shareholders and companies.

Continental Europe is tougher, although activists are operating in the region, as EADS and Safran can attest. This is partly because of a different emphasis on shareholders versus other stakeholders, such as employment stability, as well as some of the cross-shareholding structures. The result tends to be less confrontational, with managers operating more quietly in the background, and there are plenty of opportunities in the region for specialists that have the required local knowledge and an understanding of the cultural and governance nuances. Activism in Europe will likely increase as the demand for improved returns from shareholders will drive activism.

Companies of all sizes are today under the microscope. In 2009, just seven campaigns targeted companies with a market value of more than $10 billion, according to research from Citi. In 2012 this figure rose to 20. Last year, activists pressed for change at some of the largest and most established listed companies in the world, including Mondelez, Procter & Gamble, DuPont, Pepsi and Sotheby’s, to name but a few. These are all in the public domain, but activists have been involved in far more engagements behind the scenes. As things stand, a continued increase in activist engagements and at larger companies looks likely to continue.

Portfolio fit

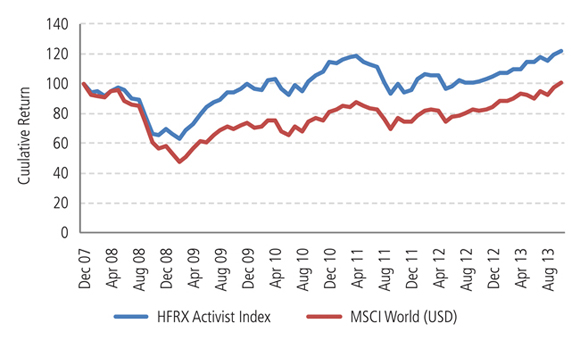

While activists only account for a relatively small part of the investment management industry, they punch far above their weight, in terms of historic returns, as well as in column inches given the press coverage, particularly over the past year. Activism is certainly one of the most intriguing and successful investment strategies with impressive long-term performance returns, generating returns in excess of market indices. Furthermore, activists tend to invest in high quality value stocks that are better able to weather a market wobble, such that we see lower downside participation.

Figure 1: Activist funds versus the MSCI World index

Source: Bloomberg as at 31/10/2013

Investors can allocate to this strategy through their hedge fund or private equity allocation or as a replacement for part of their long-only equity investment. The depth of their research and approach is similar to private equity, but the activist strategy does not require such onerous liquidity terms or suffer from the “j-curve” effect, with investors buying into a portfolio of live investments and not having to wait for their capital to be drawn. Nor do activists have to pay a control premium with the only exit a sale of the company rather than simply selling shares in the public market.

In many ways, the activist strategy is an enhanced version of traditional active long-only funds with the same large universe of public companies, but with the advantage of creating the upside from the engaged dialogue with the company. The other key difference is that the typical activist runs a concentrated portfolio of 8-12 names – no closet benchmarking here! – this enables them to monetise their engagements. However, by the nature of their concentrated portfolios the returns of any single manager can be volatile, so is probably best viewed as part of a broader portfolio.

We at Permal are believers in the strategy, and it is a theme that we have been emphasising for some time across our portfolios, as well as offering a fund comprising a concentrated portfolio of activists.

Conclusion

Activist investing has evolved and is now an accepted part of the investment landscape. These are investors who take a long-term approach and seek to maximise a company’s potential, to the benefit of all shareholders. With a market environment that remains conducive to this style of investing and no company out of reach, we believe that these investors can continue to deliver significant shareholder value going forward.

Disclaimer: Mark Shaw is a Portfolio Manager at the Permal Group, based in London. The views expressed in this article are the employee’s as of the date stated, are subject to change and do not necessarily represent the firm’s opinion.

1. The Long Term Effects of Hedge Fund Activism by Lucian Bebchuk, Alon Brav and Wei Jiang (July 2013)

More Related Articles...

Published: November 1, 2013

Home »