Addressing the cashflow negative challenge

Published: June 1, 2017

Written By:

|

Colin Fleury |

|

Stephen Thariyan |

In a low yield world, appropriate use of assets to combat negative cashflows within defined benefit pension schemes becomes increasingly important. While there are a number of options potentially available, a cashflow, rather than income-focused, approach could help pension schemes manage their short-term liabilities

Many defined benefit (DB) pension schemes will experience serious cashflow issues, as benefit payments become larger than contributions. As they mature from the accumulation to decumulation phase, research suggests that more than half of the FTSE 350 DB schemes are, or soon will be, cashflow negative (source: Hymans Robertson). For trustees, this anticipated scheme drawdown has to be tackled within a low yield environment, alongside the long-term trend of increased pensioner life expectancy. While liability driven investment (LDI) and traditional “Buy and Maintain” investment grade corporate bond mandates may help service long-dated cashflow liabilities, shorter-term (up to 10 years) cashflow requirements could prove more problematic.

Pension schemes are searching for alternative income sources to help combat this problem. Bond coupons, dividends and rental income may not, in aggregate, be sufficient to combat this shortfall. Government and investment-grade corporate bonds are low yielding. Disinvesting from other asset classes has its costs and disadvantages. We believe the solution lies in a tailored programme of short- and medium-term fixed income assets that naturally mature in-step with a pension scheme’s cashflow needs.

The solution: wind down, not sell down

Holding high cash balances to pay pensioner benefits can act as a drag on returns. Instead, by structuring a higher-yielding credit portfolio to redeem at regular intervals in the coming years, it is possible to generate a reliable stream of cashflow at an elevated yield.

Historically, many DB schemes have consisted of a growth portfolio alongside a “protection” or hedging portfolio. However, Figure 1 below shows how we believe schemes may start to think about their asset allocation.

An explicit allocation to a cashflow driven investment (CDI) portfolio will offer additional flexibility for a pension scheme and help avoid some key pitfalls of continuing with traditional approaches. The growth portfolio can be refined and potentially used to target a higher internal rate of return in an effort to improve the funding level, while the “protection” or LDI portfolio can continue to provide hedges against changes in long-term interest rate and inflation expectations.

We have experience of working with schemes’ existing LDI managers through our Buy and Maintain portfolios, and recognise that there will be some embedded interest rate sensitivity in a CDI strategy. Our approach aims to avoid three key pitfalls:

- Disinvesting assets at inopportune moments – sequence of returns is critical, as selling in a falling market can crystalise a loss.

- Punitive transaction costs (commission and spread) – transaction costs can rise markedly during volatile markets due to widening bid-offer spreads. As markets become less liquid, sellers may have to accept large discounts on the price to secure a sale.

- Administrative burden and costs associated with making regular investment and disinvestment decisions.

A fixed-term, amortising portfolio of bonds can help mitigate all of the above factors and provide a boost in yield from the assets used to meet shorter-dated cashflow requirements.

Figure 1: Re-thinking scheme assets

Yield enhancement versus cashflow certainty

By introducing higher-yielding fixed income asset classes, such as asset-backed securities, high yield corporate bonds and secured loans, alongside more traditional investment grade corporate and government bonds, pension schemes can balance the need for yield with cashflow certainty. The relative illiquidity (versus higher-rated equivalents) of some of these asset classes enhances the yield. However, this illiquidity premium should not disadvantage a scheme, because the portfolio is structured to mature in step with cashflow needs. We estimate that the additional annual yield of including alternative credit assets – over a pure investment grade and government bond portfolio – to be approximately 1%.

The fixed-term amortising portfolio

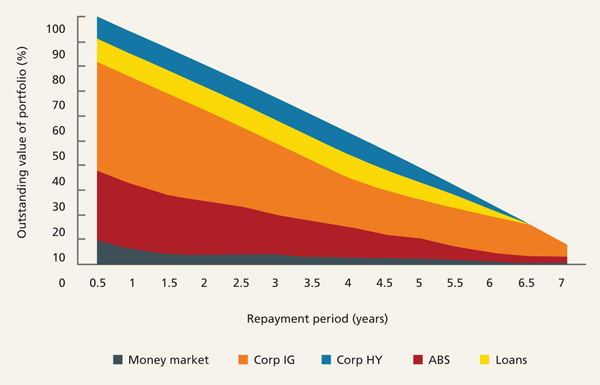

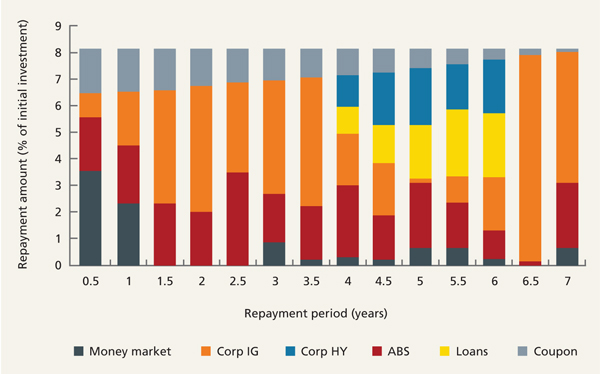

Figure 2 illustrates the “amortising” nature of an example portfolio structured to run for seven years, with the capital value declining as both interest and bond redemptions are paid out semi-annually to investors. Figure 3 uses the same example portfolio to illustrate the repayments from each asset class.

Figure 2: Amortising nature of the assets in the portfolio

Source: Janus Henderson Investors, as at 31 December 2016.

Notes: For illustrative purposes only. Corp IG = investment grade corporate bonds, Corp HY = high yield corporate bonds, ABS = asset-backed securities.

Figure 3: Regular payments broken down by asset class

Source: Janus Henderson Investors, as at 31 December 2016.

Notes: For illustrative purposes only. Corp IG = investment grade corporate bonds, Corp HY = high yield corporate bonds, ABS = asset-backed securities.

Early on in the portfolio’s life, short-term money market instruments perform the biggest role in cashflow distribution as other assets have limited issuance at such short maturities. In earlier years, the potential return from ABS is attractive when compared to investment grade corporate bonds, and the naturally amortising nature of the asset class lends itself well to a portfolio structured to generate cashflow.

Sub-investment grade assets are included according to the maturities typically available in the market and the increased credit risk is managed through rigorous credit selection. By applying scenario-based stress tests, the impact to yield from bonds that repay earlier than their final maturities (a common occurrence in sub-investment grade assets) has been shown to be minimal. Higher-yielding assets that get called early are replaced by shorter-dated and more highly-rated assets that mature when the original bond was due to. This allows schemes to benefit from the higher coupon income while they own the higher-yielding assets, but still working to the same time horizon for redemption proceeds.

The credit quality of the portfolio increases towards the end of its life as it moves into investment-grade bonds. This mitigates the increased level of concentration in the portfolio at this stage.

One size does not fit all

Different pension schemes have different cashflow needs. They will typically have other sources of income and other sources of cashflow maturing at different times in the coming years. Therefore, portfolios can be structured over varying time horizons, with varying distributions. For example, the distribution proceeds could rise each year or could be delayed for a specified number of years from the start of the mandate.

Regardless of the term and profile, the amortising nature of the approach means that schemes do not need to commit as large a proportion of their assets as they would to a strategy focusing on generating higher levels of income.

Risks

Central to an approach such as this is the avoidance of loss due to credit impairment, while minimising turnover. The main risks for this style of mandate are as follows:

- Prepayment and extension risk: the process adopts a conservative approach, with the view that dealing with “early” cashflows is better than “late” ones. The impact of early calls on above-par securities is assessed versus expected returns.

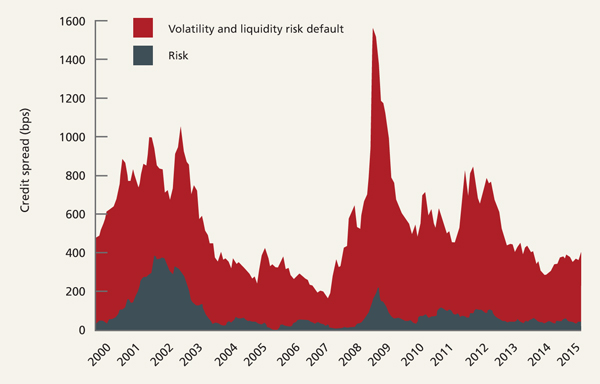

- Default and downgrade risk: while there is an inherently higher default risk associated with moving down the rating spectrum, we believe that a large amount of the extra yield available is due to the relative volatility and illiquidity of these asset classes, rather than default risk, as shown by the Figure 4.

Figure 4: Availability of extra yield due to relative volatility and illiquidity of asset classes

Source: RBS, as at 31 May 2015. Analysis is based on BofA Merrill Lynch Euro High Yield Index, assessing credit spreads, market volatility and trailing default rates.

When holding bonds to maturity, there can be an advantage to accepting illiquidity and volatility in return for potentially capturing the additional yield. A rigorous credit selection and risk monitoring process, combined with a lower band credit rating limit for high yield securities means that default risk can be mitigated.

- Unexpected inflation: the lack of inflation-linked credit assets introduces a potential issue for schemes with inflation-linked pension increases. However, we believe the inclusion of floating rate assets can provide an indirect hedge. As interest rates rise to combat increased inflation, floating rate assets will provide increased coupon income.

We believe by managing these risks and drawing on experience of multi-sector fixed income, secured credit and Buy and Maintain mandates, cashflow-focused strategies can be tailored to best help schemes manage their short-term liabilities.

Past performance is not a guide to future performance

The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

Important Information

This document is intended solely for the use of professionals, defined as Eligible Counterparties or Professional Clients, and is not for general public distribution.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. If you invest through a third party provider you are advised to consult them directly as charges, performance and terms and conditions may differ materially. Nothing in this document is intended to or should be construed as advice. This document is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. Any investment application will be made solely on the basis of the information contained in the Prospectus (including all relevant covering documents), which will contain investment restrictions. This document is intended as a summary only and potential investors must read the prospectus, and where relevant, the key investor information document before investing. Issued in the UK by Janus Henderson Global Investors. Janus Henderson Global Investors is the name under which Janus Henderson Global Investors Limited (reg. no. 906355), Janus Henderson Fund Management Limited (reg. no. 2607112), Janus Henderson Investment Funds Limited (reg. no. 2678531), Janus Henderson Investment Management Limited (reg. no. 1795354), AlphaGen Capital Limited (reg. no. 962757), Janus Henderson Equity Partners Limited (reg. no. 2606646), Gartmore Investment Limited (reg. no. 1508030), (each incorporated and registered in England and Wales with registered office at 201 Bishopsgate, London EC2M 3AE) are authorised and regulated by the Financial Conduct Authority to provide investment products and services. Telephone calls may be recorded and monitored. Ref: 34S

More Related Content...

|

|

|