Using secured finance as a cornerstone in cashflow-driven strategies

|

Written By: Sherilee Mace |

Sherilee Mace of Insight Investment looks at some of the benefits of secured finance assets, which possess many qualities that are highly desirable in today’s credit climate

Cashflow management is becoming more prevalent in the LGPS sector, and a permanent feature of many investment strategy reviews with a long-term aim to build a portfolio of income generating assets over time. By acknowledging the prospect of payments to retirees exceeding contribution income for the first time, LGPS funds can plan for future divestments and can make use of a pool of maturing asset opportunities to tackle these challenges and bring a greater certainty of having cash available to pay benefits as they fall due.

At Insight, we believe that secured finance assets is an alternative investment opportunity which could help provide greater certainty of outcomes. They potentially possess some of the most attractive qualities within credit today, both on a risk-adjusted basis and given where we are in the market cycle.

Secured finance assets are fixed income investments secured by collateral which are contractual agreements that confer cashflows to the lender, and span the spectrum from liquid public securities through to less liquid private debt.

At Insight, we divide secured finance opportunities into three categories:

- Residential and consumer

Includes residential mortgage-backed securities, auto and credit card asset-backed securities and market-place lending - Commercial real estate

Includes commercial mortgage-backed securities (CMBS), CMBS warehouses and CRE loans - Secured corporates

Includes collateralised loan obligations and warehouses, trade finance and other secured corporate obligations

Divided across the public and private credit space, these three cashflow sources look to create a wide range of investment possibilities.

Contractual cashflows available from secured finance aim to provide control and certainty over the timing of returns. The predictable nature of the return stream from these investments we believe also helps long-term investors to avoid being forced to sell down return-seeking assets to meet short-term cashflow needs.

In our view, it is an area that has become accessible to investors due to the retrenchment of banks in response to changes in regulatory capital requirements. This has created an opportunity for other market participants to deliver a new proposition to clients. Examples include residential mortgage warehousing where companies are financed to write mortgages; real estate lending where companies are financed to acquire assets such as offices; and investments in asset backed securities. The quality of assets we feel is paramount – typically senior secured against collateral, with low loan-to-value ratios and offering high transparency.

In our view, an excess yield can be achieved due to the largely under-researched nature of the assets, as well as a shortage of expertise and resources required to understand them across the industry. Private debt instruments are negotiated on a bespoke basis between a borrower and its lenders. Assets have to be underwritten, valued, structured and quantitatively modelled. With relatively few investors able to pinpoint value, there is little eligible demand for these investments.

Secured finance is a buying opportunity for long-term investors who can accept medium-term illiquidity. Currently, we believe that the asset class can offer yields above those of investment grade corporate bonds with equivalent credit ratings for a total return of 4% in excess of cash.

In our view, the key to successful investment is identifying the sweet spot among these areas in terms of risk-adjusted returns for the credit quality sought – this may occur at any point along the liquidity spectrum from liquid public to less liquid private credit. Selecting from among the range of investment possibilities requires constant observation of market dynamics, which can move quickly in some cases, particularly at the liquid end, where we can rotate to maximise the credit spread premia. Market distortions can often create conditions that favour buying or selling a particular asset at a given time, so this approach favours a broad view of the market to assess where the best value lies.

How secured finance works within a cashflow driven strategy

A carefully constructed portfolio of assets with fixed maturities, attractive yields and credit ratings should help LGPS funds invest in areas with the potential for decent returns, while reducing the risk of negative cashflows.

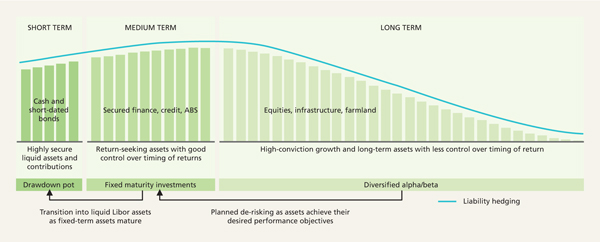

To avoid selling return-seeking assets to meet cashflow requirements, funds could benefit from using investments with fixed maturity dates (see Figure 1). One component of such a plan is to create a “drawdown pot” of highly liquid, short-dated assets that are less prone to mark-to-market risks: for example, money market investments, cash and short-dated bonds.

Figure 1: Strategies with a fixed term to maturity may have a role to play

For illustrative purposes only

Assets such as infrastructure and equities have the potential for long-term attractive returns but can be illiquid or suffer from volatile valuations when they are required to pay pensions. However, if the fund maintains its drawdown pot it could leave such investments untouched and free to target long-term performance. When long-term assets achieve their targets, a portion can be sold to reinvest in medium-term assets with fixed maturities, which will generate cash for the drawdown pot. This process can retain the upside generated by long-term assets while reducing the impact of market volatility.

Funds can benefit from the targeted use of assets with defined maturities which offer the potential for an attractive return within a fixed timeframe. By doing so it is possible to ensure the pension fund can continue to pay pensions without selling assets. Secured finance investments fit well into this framework as they are typically structured with fixed maturities, pay regular interest with a high degree of certainty, and repay capital at maturity.

As the LGPS migrate into the new investment pooling strategy, pooled fund solutions will become ever more important to them. Insight acknowledges this and has created a pooled fund in the secured finance space, combining liquid tradeable securities and less liquid private debt. The additional benefit of such assets is their floating rate nature, which alleviates concerns of how a fixed income asset will behave in a rising interest rate environment.

More Related Content...

|

|

|