Advanced beta comes of age

|

Written By: Ana Harris |

Advanced (or smart) beta is starting to challenge the status quo of active versus passive investment. Ana Harris of State Street Global Advisors explains why the time may be right for advanced beta strategies.

The debate around advanced beta and its potential in asset allocation has intensified in recent years. Since the launch – over 10 years ago – of mainstream indices to capture factor exposures such as value or low volatility, the investment case has become well established. Our recent research survey reveals increasing investor interest into how advanced beta might work for institutional investment portfolios.

A brief recap – how to define advanced beta

These strategies represent an evolution in indexing or passive equity management. Investors are no longer constrained by the active versus passive debate because these strategies, with their new approach, bring elements of the best of both to the fore.

Decades of academic research show that it is possible to have strong long-term performance results by not following an investment weighting scheme centred on market capitalisation. The new strategies and products that try to capture these different investment exposures are called advanced beta.

Advanced beta is sometimes known as smart beta or alternative beta but, in most cases, the definition itself is consistent: an objective, consistent, transparent process for capturing a defined investment exposure. Given these characteristics, it is ideally suited for a passive implementation.

The institutional approach to advanced beta

State Street Global Advisors commissioned Longitude Research to implement a study1 to get further insights into what institutional investors think about advanced beta and how they are planning to include it in their portfolios. Respondents were institutional investors, including public and private pension funds, endowments, foundations, insurance companies and private banks, across both Europe and North America.

One of the key findings was that investors’ views on advanced beta are generally positive and increasingly so. In Europe, 42% of the participants had already invested in advanced beta strategies, and a further 22% were intending to. Only 20% of participants professed scepticism about it and were unlikely to invest in it. Overall the data showed very strong support for these relatively new approaches.

Private pension schemes are currently leading in this space. In Europe, while the majority of private pension schemes in this survey had already committed a proportion of their portfolio to advanced beta, the figure for public pension schemes was significantly less. This looks set to change, however, given that fully 57% of the European public schemes surveyed indicated intentions to invest in advanced beta.

Allocation to advanced beta

Investors are attracted to advanced beta by both empirical evidence and the potential for positive excess returns relative to the market over the long term. The ability to reduce risk at the overall portfolio level using strategies like low volatility and quality are also appealing.

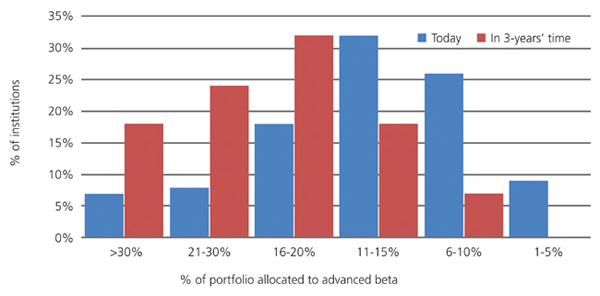

In order for an allocation to make an impact it needs to be significant and most investors realise this. Among the institutions that have already allocated to advanced beta, the majority have between 11–15% of their equity portfolio in these strategies. The survey results suggest these allocations will increase in the coming years.

Most investors consider these strategies to sit somewhere along the passive to active spectrum. So, when considering their allocation, investors will tap into both active and passive allocations to fund advanced beta strategies. Indeed, when asked about future allocations, 63% of institutions indicated advanced beta would be funded from existing active and passive allocations. 28% indicated they would fund entirely from their active allocation, with 8% intending to reduce their passive allocation only. The breakdown was similar when looking at either private or public pension schemes, in Europe or the US.

Figure 1: Allocation to advanced beta – Europe and North America

Source: SSgA, Longitude January 2014

Strategy types

Investors can target a number of factors with advanced beta approaches:

Value: When investors refer to value stocks, they are talking about the names at the lower, cheaper end of the valuation spectrum. Value stocks have been shown to outperform the broader market indices over the long term. These results have been replicated by numerous researchers for many different sample periods and for most stock markets around the world.

Small cap: Similarly to the value effect, the small cap effect has been reproduced for numerous sample periods and for most major securities markets around the world.

In the advanced beta small cap indices, smaller names are not selected by market capitalisation. Instead, all stocks are given the same weight independently of their market capitalisation – in effect they are equally weighted. The assumption here is that there is no information in the share price of the company; the only relevant information is the fact that the stock belongs to the particular benchmark. Several of the leading index providers have created equally-weighted versions of their standard indices such as MSCI and Russell.

The performance differential relative to the original index is quite strong and shows the impact of an overweight in small caps: while the MSCI World delivered 4.61% on an annualised basis since January 1999, the MSCI Equally Weighted would have delivered 8.20%.2

Low volatility: Volatility, or the standard deviation of returns, is used as a measure of risk because it measures distribution of returns. Investors use the historic volatility as a way of gauging future risk. The long-term outperformance of low volatility strategies is quite surprising and is actually at odds with more traditional financial theory. Established theories such as the Capital Asset Pricing Model (CAPM for short) tell you that in order to attain higher returns you need to invest in higher risk securities.

But empirical evidence suggests otherwise. The first investable product in the form of indices only appeared in 2008, post the great financial crisis. Investors’ appetite for these strategies is a product of their dissatisfaction with cap-weighted indices and their volatile behaviour.

High quality: Out of all the factors we discuss here, quality has perhaps the clearest economic intuition. It makes sense that better quality companies are rewarded with better returns over the longer term because they are better at deploying capital and generating wealth.

Although quality investing has in the past primarily been in the domain of active investing, recent developments in the indexing world have created credible alternatives in the form of rules-based, passive quality strategies. Most of these strategies are score-based and the focus is on growth and stability of earnings, plus a sustainable level of debt. Indices in this space are fairly recent e.g. S&P High Quality (2010) and MSCI Quality (2012).

Quality indices tend to show lower volatility and better protection in down markets than standard market-cap weighted indices.

Momentum: Defenders of market efficiency would lead you to believe that stock prices have no memory; meaning that how a stock would move today would be independent from how it moved yesterday. The empirical evidence shows something else: stocks that have done well recently can carry on doing well in the near term. By obtaining more exposure to those stocks that have done well, you benefit from the momentum premium.

Multi-factor: The latest advanced beta variant comes by combining these factors. A strategy that combines e.g. high quality and low volatility can provide enhanced performance and diversification benefits. These products are in a nascent stage but expect to see much more of them because of the advantages they offer.

What’s popular?

Low volatility and valuation strategies have been the most popular thus far, but there is growing interest in quality as a future allocation. Multi-factor strategies are also increasingly on the radar of most investors; 71% of the interviewees in Europe were currently investigating multi-factor strategies with a view to possibly investing in the future.

Looking only at pension funds in Europe, we observe a similar trend with regard to multi-factor, but there is also a concern with income. Around 55% of the public and private pension schemes in the survey are currently investigating the possible use of advanced beta yield strategies.

An advanced future

Investors are increasingly focusing on investment outcomes rather than just investment styles. The empirical evidence supporting advanced beta is strong, growing and consistent, and potential outcomes can be assessed through performance track records that are now well established. Investors need to be mindful, however, that these are strategies designed for the long term. They need to build strong support and awareness within investment committees and the broader stakeholders for a truly successful implementation.

One thing is certain though – these strategies will continue to develop further and challenge the status quo.

1. Beyond Active and Passive: Advanced Beta Comes of Age. SSgA, January 2014.

2. MSCI, January 1999 – September 2013.

More Related Content...

|

|

|