Rebalancing in smart beta strategies

|

Written By: Timothy Atwill |

Portfolio rebalancing is essential in smart beta strategies. Timothy Atwill of Eaton Vance explains the concepts behind the different rebalancing methods.

Many smart beta strategies available in the marketplace today are generally understood to be index-style portfolios, but which are varied or weighted differently from the standard, published indexes. Managers who elect to move away from index weights or allocations do so for a variety of motivations; some fundamentally derived, and some based on market projections or anticipated trends. Parametric’s approach to smart beta strategies also involves altering the portfolio weights compared to the indexes. These strategies rely on, and seek to add value with, a portfolio structure that is more diversified than their comparative benchmark index. That level of diversification is enforced through a system of portfolio target weights. As market actions impact the underlying portfolio positions they will move away from these targets, in effect undercutting the diversification put in place by the target weights. To ensure this impact is limited, a system of rebalancing triggers is employed with each strategy. At the heart of all of these rebalancing systems is a desire to re-establish the diversification as represented by our system of modified equal targets. A counterbalance to this desire is the implicit and explicit trading cost that rebalancing trades can impose on the portfolio. Below is a quick review of two manners of rebalancing (time-based and trigger-based), their pros and cons, and the idea that the characteristics of the asset classes involved should be considered when determining the rebalancing scheme to use in each strategy.

Two types of triggers

Time-Based rebalancing: In a classic time-based rebalancing process, the entire portfolio is traded back to its target weights at a fixed time period, e.g. monthly, quarterly or annually. The advantages of this system is that the portfolio is traded back to each of its diversification targets on a regular basis, meaning that concentration is never allowed to grow beyond a certain period. However, this method also has a high transaction cost, as even positions that differ from their targets by a small amount are traded, incurring a trading cost for very little diversification benefit. For those asset classes where transaction costs are high, these costs can even overwhelm any expected benefit from holding a more diversified portfolio. In addition, for a time-based rebalancing scheme, deviations from the target weights can grow unbounded between rebalance trades. This runs counter to the underlying diversification that is key to Parametric’s approach.

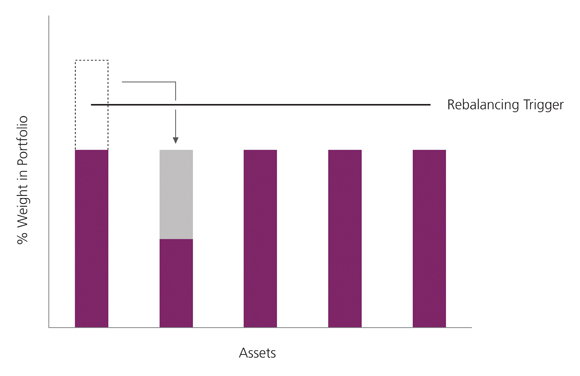

Trigger-based rebalancing: In a trigger-based rebalancing process, a rebalancing trade is only initiated once a position exceeds a predetermined overweight versus its target. For these trades, the entire portfolio is not traded. Instead only the position exceeding its trigger is sold, and the largest underweight position is purchased, as illustrated in Figure 1.

Trigger-based rebalancing avoids the high transaction costs of a time-based rebalancing process, and avoids the situation of concentrations building during inter-rebalancing periods. However, this system of rebalancing can potentially result in many positions deviating from target, but with none of them deviating enough to trigger a rebalance. This type of deviation from target weights could potentially result in concentrations building up in a handful of positions and allow the portfolio to differ materially from its intended set of target weights, potentially for very long periods of time.

Figure 1: Trigger-based rebalancing

Source: Parametric

Rebalancing in practice

Experience shows that a blend of the two methods preserves the advantages of both systems, while mitigating their drawbacks. The blend of the two styles is informed by the transaction costs and volatility of the asset classes. For those asset classes where transaction costs are extreme, we will defer to a trigger-based system. For all other asset classes, we rely primarily on a time-based rebalancing scheme, where the time period selected is tied to empirical experience in the asset class. In between these periodic rebalances trades, these strategies also obey a trigger-based rebalancing scheme, so that no concentrations can build up in the periods between full rebalancing trades. The combination of these two gives a rebalancing process that tends to be low turnover, but doesn’t allow any material concentrations to build up between the full rebalancing trades. The asset class, as demonstrated with our methods below, informs the combination of these two rebalancing techniques, and how each technique is implemented.

Currency: At Parametric, for example, our currency strategy involves holding a portfolio of 1-month currency forwards. Every month the entire portfolio expires, and a new portfolio of currency forwards must be purchased. Because the derivative exposure must be “rolled” monthly to maintain exposure, this can be seen as a “free” opportunity to rebalance back to target weights. That is, the new portfolio of currency forwards is purchased at target weights, which is equivalent to performing a monthly rebalance. In between these monthly trades, the strategy will rebalance an individual position if it deviated by more than 20% from its target position.

Commodity: The commodity strategy at Parametric involves holding a portfolio of commodity futures. Similar to currency forwards, these derivative exposures periodically expire and must be renewed. This essentially provides a free opportunity to re-establish the portfolio weights at their target levels. Given that no additional cost is incurred to rebalance in this manner, this is our preferred method of rebalancing. In between these monthly trades, the strategy will rebalance an individual position if it deviates by more than 20% from its target position.

Developed Equity: Research into developed markets supports the notion that the benefits from diversification are improved very little by rebalancing more often than annually. This is convenient, as we have observed that developed markets strategies periodically need to have their targets reconfigured, to reflect changes in the underlying market structure. As such, we have designed our strategies around a twelve-month reconstitution, where new targets are calculated, and the portfolio is then rebalanced to these new targets. Between these reconstitutions, rebalancing triggers are used to initiate trades when concentrations build to a specified level. These triggers are constructed to balance the trading costs and the expected benefit of reducing concentration.

Emerging Equity: For emerging markets equity, we find that no rigid time-based rebalances can be justified, given the tremendous amount of implicit and explicit trading costs in this asset class. So this asset class does not use a time-based rebalance. However, similar to developed equity, the emerging market strategy establishes a series of triggers that are determined by a country’s volatility and trading costs. These are determined so as to balance the costs incurred to rebalance in the emerging markets with the benefits expected from maintaining diversification.

Conclusion

Along with the decision to weight the portfolio differently from a published index, these smart beta approaches necessarily require an effective rebalancing scheme which reflects the underlying aspects of the asset class, and, where tenable, to blend a time-based and trigger-based system of rebalancing. In this way, we balance the lower transaction costs of the time-based system, while ensuring that the diversification of the underlying portfolio never strays too far from target via a trigger-based system. For those asset classes with high transaction costs, only the trigger-based system is used, as our research has shown that the diversification benefit can easily be overwhelmed when one trades in such an environment. In this way, we seek to benefit from the advantages of our modified equal weight diversification scheme while reflecting the real-world issues encountered when trying to keep such a weighting scheme in place.

This material is presented and issued by Eaton Vance Management (International) Limited (“EVMI”), which is authorised and regulated by the Financial Conduct Authority in the United Kingdom and is located at 125 Old Broad Street, London, EC2N 1AR, United Kingdom. This presentation is for Professional Investors ONLY.

Any views and opinions contained in this document are those of Parametric Portfolio Associates (“PPA”) the strategic affiliate of EVMI. Views and opinions are subject to change and this document should not be regarded as an offer or solicitation to buy or sell securities and no investment advice or recommendation is made herein. Eaton Vance and its affiliates are not responsible for any subsequent investment advice given based on the information supplied herein.

EVMI is a wholly owned subsidiary of Eaton Vance Management. Eaton Vance Management (“EVM”) is an investment adviser registered with the United States Securities and Exchange Commission (“SEC“) and is a wholly owned subsidiary of Eaton Vance Corp. (“EVC”). The non-voting common stock of EVC, parent company of EVM, is publicly traded on the NYSE under the symbol “EV”. For purposes of this presentation, “Eaton Vance” or the “Firm” is defined as all three entities operating under the Eaton Vance brand.

EVMI markets the services of the following strategic affiliates; Parametric Portfolio Associates (“PPA”) is an investment advisor registered with the SEC and is a majority owned subsidiary of EVM, and Hexavest which is an investment advisor, based in Montreal Canada, and registered with the SEC in the United States and which has a strategic partnership with Eaton Vance, who own 49% of the stock of Hexavest.

Parametric Portfolio Associates LLC (“Parametric”), headquartered in Seattle, Washington, is registered as an investment adviser under the United States Securities and Exchange Commission Investment Advisers Act of 1940.

This information is solely to report on investment strategies and opportunities identified by Parametric. Opinions and estimates offered constitute our judgment and are subject to change without notice. This material is for illustrative purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors.

More Related Content...

|

|

|