Alternative risk premia – constructing a true diversified portfolio

|

Written By: Bill Landes |

Alternative beta (sometimes called liquid risk premia) strategies can provide a solution for investors seeking to improve risk-adjusted returns and deliver meaningful diversification to their portfolios. Bill Landes of Columbia Threadneedle Investments tells us more

While alternative betas were always embedded in stocks, their identification began with Rolf Banz and his 1981 research on the small cap effect.1 That is, smaller firms have higher risk-adjusted returns, on average, than larger firms. In 1993, the Fama/French three factor model2 showed that beta alone was not enough to explain varying, or abnormal, stock returns. In addition to the small cap effect, Eugene Fama and Kenneth French also discovered that value stocks – those with a low book-value-to-price ratio – tended to generate excess returns. Fama and French determined that a stock’s return depended on three factors – beta, size and value.

Subsequently in 1997, this was augmented by Mark Carhart’s four factor model3 which added “momentum” to the other three factors explaining a stock’s return, following on from prior research that had shown stocks with strong short-term price momentum tended to carry on outperforming over the next 12 months.4

Many non-traditional investment managers have employed alternative beta strategies without knowing it. Proprietary trading desks at investment banks, in some form, invested with a bias to momentum and value and employed levered curve flatteners and steepeners, and long versus short currency strategies. These sources of return, once identified as alpha, were in many cases a replicable form of beta. Today, investors are realising that they do not need to pay high active management and performance fees for this replicable beta.

The strategy

Based on this academic research spanning nearly 40 years, alternative beta offers institutional investors a practicable solution to the problem of where to find uncorrelated returns. It can be deployed at scale to diversify returns, with relatively modest fees and good liquidity. This makes it attractive for many of the world’s larger institutional investors, potentially enabling them to push out portfolio-efficient frontiers with the commensurate boost to long-term returns and diversification.

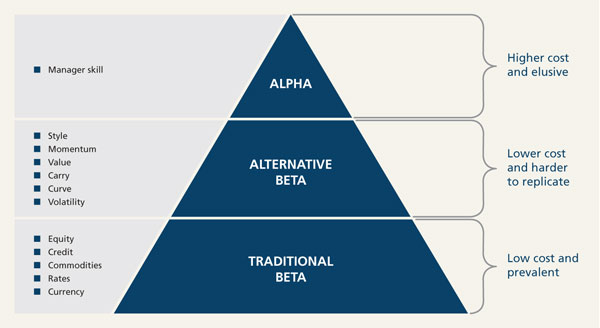

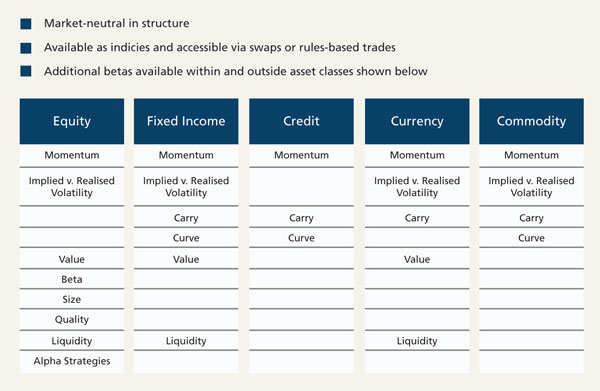

Unlike traditional betas, alternative betas are accessed through non-traditional investment strategies, such as rules-based long/short, relative value, arbitrage, and the like. Alternative betas are available across asset classes – including equities, fixed income, credit, currencies and commodities. They exploit a large number of different anomalies – such as size and value for equities, momentum for all asset classes, and carry (holding two offsetting positions) for fixed income, credit, currencies and commodities. The result is portfolios that can provide meaningful diversification for institutional investors.

Figure 1: The framework of understanding portfolio return has evolved

Source: Columbia Threadneedle Investments

How to access alternative betas

Alternative betas can primarily be accessed in two ways. First, a counterparty can systematically manufacture an index that captures a specific risk premium, which can then be purchased via a swaps contract. To design an index to capture the value-equity risk premium, for instance, a counterparty would take an index such as the MSCI ACWI, rank the securities within the index by a valuation metric such as price-to-book, and then go “long” the top quintile of cheapest stocks and simultaneously go “short” the bottom quintile of the most expensive stocks. The three quintiles of stocks in the middle are not used. This structure extracts the value premium and seeks to remove any market beta exposure. These rules-based indices can be structured as daily liquidity vehicles, which are relatively inexpensive, and offer full transparency to the underlying positions.

Alternatively, an asset manager can develop their own indices to gain access to alternative betas, using their internal quantitative research teams. Either method needs to focus on capital efficiency and low cost. Asset owners/allocators looking to access alternative betas may find the most effective way to access the asset class is to hire an asset manager with specialist expertise. Selecting the most appropriate and effective alternative beta structure is one important element in deriving ultimate benefit from the strategy. Equally – if not more – crucial, is the portfolio construction of multiple exposures. Given their low correlation to one another, alternative betas are most powerfully employed in multi-position, multi-asset class portfolios. The methodology utilised to weight these multi-exposures over time differs among providers, and is often the primary determinant of investment success.

Figure 2: Alternative betas are available accross multiple asset classes and styles

Source: Columbia Threadneedle Investments

Smart beta

A contrasting approach using similar techniques is smart beta. Smart beta is a long-only construct also focused on extracting risk premia, or risk factors. Because smart beta strategies employ long-only techniques, they typically carry more general market directionality in their profile. They also target relative returns and are more highly correlated with the major asset classes. By contrast, alternative beta strategies, when done well, seek to generate market-neutral absolute returns, uncorrelated with the major asset classes.

When considering the addition of alternative betas to an overall portfolio strategy, many investors may target the reduction of portfolio correlation with overall markets as a primary goal. Alternative betas themselves tend to be uncorrelated with one another, leading to low or negative beta to traditional directional asset classes. Based on our internal research looking at the returns of a diversified basket of alternative betas, the correlation of their return to each other, and to the market overall is very low – an average of 0.05.5 (March 31, 2003 – December 31, 2015. Source: Columbia Threadneedle Investments). This low average is the result of multiple negatively-correlated relationships, which makes alternative betas extremely powerful portfolio building blocks, and provides a very compelling story for any investor seeking meaningful diversification – especially when compared to a long-only smart beta approach.

Investor demand

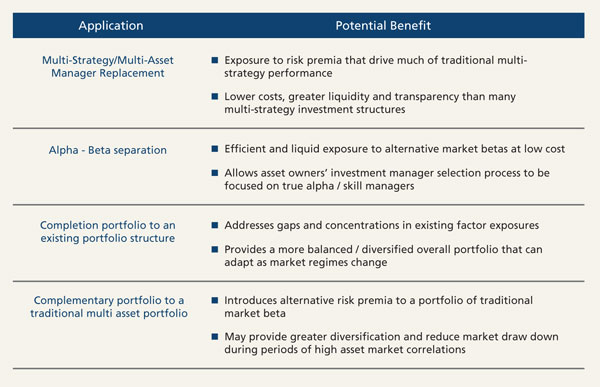

While this is still a relatively new investment approach, despite the long-standing academic evidence, we have seen a few broadly-defined objectives emerge among investors who have demonstrated interest in alternative betas. These include: adding alternative betas to an existing alternatives allocation; replacing current, expensive, alternative investments that are delivering beta and pricing it as if it were alpha; and employing alternative betas to smooth out the volatility of an existing portfolio.

Figure 3: Alternative beta can be used for different client solutions

Source: Columbia Threadneedle Investments

At Columbia Threadneedle Investments, we are able to customise the profile of portfolios to meet most client needs. Despite the best efforts of many institutional investors to diversify, there may still be significant exposure, for example, to momentum or trend following, and little exposure to value and quality within equity, or to other diversifying factors such as short volatility and carry/curve. To correct for this, we can design portfolios to complement existing factor exposures – a “completion portfolio”.

To execute this approach we would analyse and identify the array of factor exposures that exist in the current portfolio and then construct the complementary portfolio relative to the factor exposures present in the existing portfolio. Because of the wide array of alternative betas to choose from, there is significant flexibility in building customised portfolios using alternative betas.

We have seen the interest in alternative betas vary from region to region. The Australian market appears to be further along in their willingness to allocate to alternative betas, while other markets, notably the US and the UK in large part, continue their research. Because alternative beta implementation is still in its early stages and still must prove its ability to generate consistent returns with limited risk, investors are continuing to study the concept in a desire to understand more about the structure, and how liquid risk premia might fit within a multi-manager portfolio. As investor understanding of the approach develops, we believe that alternative betas will likely become mainstream allocations either in standalone form, as part of a diversified multi-strategy portfolio, or as a completion portfolio.

1. Rolf W. Banz. The Relationship Between Return and Market Value of Common Stocks. Journal of Financial Economics. November 1981

2. Eugene F. Fama and Kenneth R. French. University of Chicago. Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics 33 (1993) 3-56

3. Carhart, M. M. (1997). “On Persistence in Mutual Fund Performance”. The Journal of Finance 52: 57–82.

4. Narasimhan Jegadeesh and Sheridan Titman. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance. Vol 48, No 1 (March 1993) pp 65-91

5. Correlation is scaled between +1 for assets that are perfectly positively correlated and -1 for assets that are perfectly negatively correlated.

More Related Content...

|

|

|