Be the card counter, not the patsy

|

Written By: Steve Cain |

|

Aneet Chachra |

Steve Cain and Aneet Chachra of Henderson examine how investors can find value through strategies that exploit liquidity risk premia

Imagine you are at a party and are offered an opportunity to bet on a coin flip. Guess correctly and you win £150,000 but a losing guess will cost you £100,000. Unless you are a secret billionaire, you would surely refuse to play. Suppose the host then cuts the stake to £100 for a £150 win. Now you would likely be more tempted to play, yet perhaps the stakes remain too high for a single coin toss. Finally, you are allowed to flip the coin a thousand times at the lower bet size. Assuming the coin and host are both honest, you would now probably rush in to bet repeatedly. This equally applies to investing – it’s not enough to find a one-off investment with a positive expected return – you also need to diversify to reduce idiosyncratic risk.

Liquidity risk premia

Most commentators characterise liquidity risk premia to be the excess return captured through owning illiquid investments such as private equity, real estate, and venture capital over a long time period. Historical results have been attractive, and these holdings generally provide some inflation hedging and portfolio diversification benefits. However, returns also tend to be uncertain, lumpy, and highly sensitive to market conditions. Interim valuations can be difficult to determine, and exiting during periods of stress is either costly or impossible. Institutional investors should carefully consider the inherent trade-off of accepting lengthy lockups and restrictive terms in order to harvest this long-term liquidity risk premia.

But contrary to this conventional view, there is also a capturable liquidity risk premia at the other end of the liquidity spectrum i.e. in trading liquid instruments over a short time horizon. Liquidity is never infinite – the price of even the most widely traded assets, including sovereign bonds and shares of large companies, will fluctuate considerably when there is excess supply or abnormal demand. However, such imbalances are typically absorbed quickly with prices returning towards equilibrium within days or weeks. This reversion process provides excellent opportunities to repeatedly capture uncorrelated, short-term gains. We illustrate this using two examples drawn from bond and equity markets respectively.

Price patterns around Gilt auctions

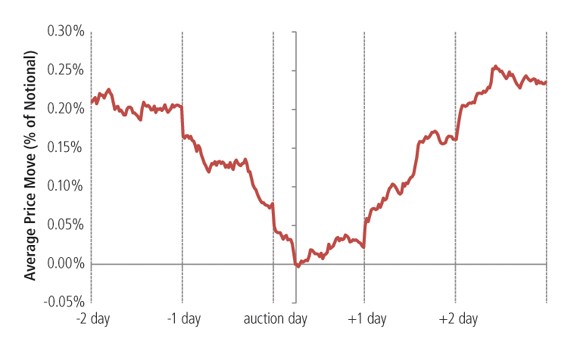

The UK Debt Management Office (DMO) typically issues long-maturity Gilts once or twice a month with an issuance size ranging from £1-3 billion. UK government bonds have existed in various forms for over 300 years, and the Gilt market is considered very deep and liquid. Nevertheless, there is often a price concession around auction events as the market “digests” new supply. On average, bond prices drop about 0.2% the day prior to issuance, but fully make up the decline within the next two days.

Buy-and-hold investors can best capture this discount by regularly purchasing bonds at or near auctions. A more active strategy is to short-sell Gilts in anticipation, cover on the issuance day, and subsequently enter into a long position that is sold once the price has reverted. However, the auction pattern shown in Figure 1 is an average over 90+ events – individual events rarely exhibit this perfect “V” shape. Based on historical experience, we estimate this particular strategy is successful in around 60% of events with a median one-week return of circa 0.4%. But there is also considerable volatility with realised returns ranging from –2% to +4%. Gilts may fluctuate substantially for unrelated reasons such as political news, economic data or movements in other financial markets.

Secondary equity offerings

If you walked into your neighbourhood supermarket and your favourite brand of cereal was on offer, you would be inclined to stock up. Similarly, when a company (or significant shareholder) sells a large block of shares, they usually offer an attractive price (on average, about 3% below last close) in order to induce buyers to immediately acquire new supply. Generally, this turns out to be a good deal for purchasers. Although the share price typically moves lower on subsequent days, it more often than not remains above the discounted price. For buy-and-hold investors, secondary issuance can be an excellent way to establish or raise an investment stake.

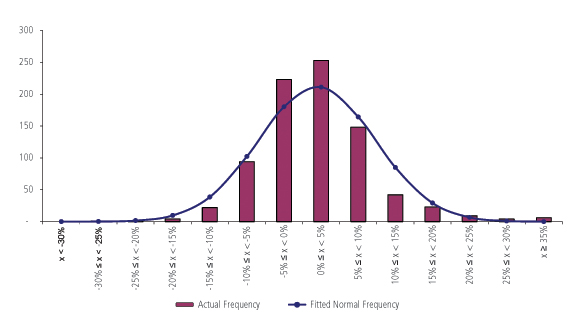

Again, there is considerable variability in outcomes across events. For this strategy, Figure 2 below shows the range of results for the secondaries Henderson participated in last year. We calculate the odds of success for a given equity offering to be 55%-60% with a median event return of approximately 1.3%.

Figure 1: UK long Gilt auctions, Jan 2005 – Aug 2013, 94 events

Source: Henderson Global Investors

Finding an edge and systematically exploiting it

Both the trades above share a common characteristic. Short-term liquidity risk premia returns come from absorbing inventory when there is ample or excess supply and providing inventory when there is normal or elevated demand. Similar strategies exist to capture anticipated price movements caused by index extensions/inclusions/exclusions, dividend anomalies, Exchange Traded Funds, closed-end funds, share repurchases etc.

Similar to counting cards in blackjack, the key to capturing a small, but positive advantage are sizing investments appropriately and participating systematically. Investors and gamblers both face the occasional risk of a “bad beat” where the outcome is negative despite favourable odds. By limiting individual position sizes to account for worst case outcomes, they can prepare for an inevitable string of bad luck. Similarly, consistent participation ensures that the “law of large numbers” averages out random extreme returns. But unlike a casino, an astute investor will not be ejected for exploiting an edge.

Figure 2: Secondary equity offerings – distribution of outcomes

Source: Henderson Global Investors

Why do these opportunities even exist?

The first reason why these opportunities exist is that the success rate for an individual event is typically 55-60% or only modestly better than a coin flip, while the return variance is large relative to the average expected return. In other words, it’s too risky as a one-off investment for most market participants. We aggregate and diversify small returns by participating in hundreds of events annually.

Second, the dominance of electronic markets, and changes in bank regulation, are driving reductions in participation of such opportunities by traditional liquidity providers including block traders, exchange specialists and proprietary desks. Banks are increasingly reluctant to use balance sheet and carry inventory. Meanwhile, most high-frequency trading (HFT) firms do not hold positions overnight.

Third, although the basic principles behind these strategies are relatively simple, a purely mechanistic approach has several shortcomings that specialised knowledge can address. For example, a key consideration when evaluating secondary equity offerings is the type of seller. Our experience is that there is a very different risk profile when transacting with a professional investor compared with when the seller is the company itself. Similarly, implementing bond auction strategies involves optimising entry/exit timing and evaluating the impact of overlapping events.

What makes these strategies attractive relative to other investments?

Short-term liquidity strategies are easily explainable with clear event catalysts and pre-determined holding periods. Bond trades are equally likely to be long versus short, and thus have no net exposure to interest rate movements over time. Similarly, equity trades are usually implemented on a market-neutral basis by entering into an offsetting index hedge. Our research and experience shows that monthly returns are entirely uncorrelated to major asset classes. All the strategies can be implemented using either sovereign bonds or listed shares/ETF’s which provides transparent pricing, liquidity, and no counterparty risk.

Favourably, and unlike most investments, strategy returns are generally positively correlated to the level of volatility. When volatility rises, this increases the potential cost of holding inventory and discourages new players from entering the market. As a result, the average level of liquidity risk premia available to be harvested by those still willing to provide liquidity increases significantly. This is a very attractive characteristic – returns are expected to be higher in stressed market conditions – and provides similar benefits as “tail risk” strategies but without incurring a negative insurance cost during calm periods.

Implementation considerations

In addition to ensuring consistent participation and avoiding overly large average position sizes, geographic diversification can significantly improve total returns while also reducing risk. Distortions such as quantitative easing, collateral shortages, and government share ownership can adversely affect country-specific returns, and thus diversifying across both strategies and markets is prudent.

Additionally, short-term strategies necessarily have high turnover, thus minimising transaction costs is vital to maximise returns. Given the systematic nature of investments, electronic execution is advisable when possible to reduce explicit costs. Further, event entry/exit planning must take average daily transaction volumes into account to avoid undue market impact. Finally, investors need to evaluate whether they or their asset manager is receiving access to all new deals, and not inadvertently being subjected to adverse selection by being offered only less popular transactions.

Overall, we believe that short-term liquidity strategies offer excellent risk-adjusted returns while also serving as powerful portfolio diversifiers. We currently run two liquidity risk funds focused on bonds and equities respectively, while preparing to launch a new fund that will incorporate a wider set of these strategies.

This article is intended solely for the use of professionals, defined as Eligible Counterparties or Professional Clients, and is not for general public distribution.

The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change.

If you invest through a third party provider you are advised to consult them directly as charges, performance and terms and conditions may differ materially.

Nothing in this article is intended to or should be construed as advice. This article is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment.

Issued in the UK by Henderson Global Investors. Henderson Global Investors is the name under which Henderson Global Investors Limited (reg. no. 906355), Henderson Fund Management Limited (reg. no. 2607112), Henderson Investment Funds Limited (reg. no. 2678531), Henderson Investment Management Limited (reg. no. 1795354), Henderson Alternative Investment Advisor Limited (reg. no. 962757), Henderson Equity Partners Limited (reg. no.2606646), Gartmore Investment Limited (reg. no. 1508030), (each incorporated and registered in England and Wales with registered office at 201 Bishopsgate, London EC2M 3AE) are authorised and regulated by the Financial Conduct Authority to provide investment products and services. Ref: 34S

More Related Content...

|

|

|