Beyond asset pooling

CommentChris Dulieu, Head of UK Public Sector and Ian Hamilton, Head of LGPS Pooling Initiative, Northern Trust.

The pooling of more than £260 billion1 of pension assets by the local authorities of England and Wales – one of the largest asset exercises of its type ever undertaken – is a collaborative achievement to be proud of for all involved.

In pooling these assets to be managed by the eight LGPS pools, the local authority pension funds of England and Wales are employing techniques used successfully by multinational corporations, insurance companies and asset managers to gain greater efficiency, purchasing power and risk control over investments.

To achieve this, the pools will be responsible for, among other areas, manager selection and implementation of investments for their underlying pension funds. But while much has been written about setup of the pools themselves, it is important to remember the underlying LGPS pension funds will remain responsible for investment strategy, asset allocation decisions and oversight of the newly-created pools.

This raises interesting questions for the sector: how will arrangements be managed between individual funds and the pools? What should each of their priorities be? How should the underlying funds engage with their pools? How can all parties work together to deliver outcomes that match the scale of their ambitions?

The asset pools: varying approaches, common challenges

Reaching this point has required widespread collaboration among the pools, their underlying pension funds and service providers. But as theory increasingly moves to practice, it is only natural to expect further adjustment of operational models, processes and practices across the LGPS.

All pools are different – they are the result of collaboration among their underlying funds. Each has varying ideas, and has adopted different approaches. And while some have only recently begun to transition assets, others have been operational for several years. Therefore we expect that many of the solutions and future adjustments that take place will be similarly unique.

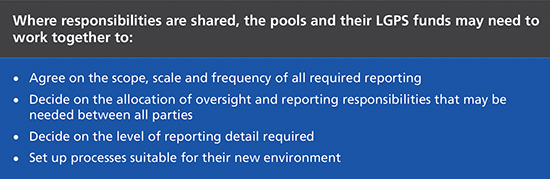

Whatever the approaches taken, certain responsibilities will remain at the level of the underlying LGPS funds, and others will be passed on to their pools. And there will also be overlapping areas of responsibility.

The LGPS funds and the pools: discharging shared responsibilities

In addition to assuming investment management responsibilities formerly carried out by the LGPS schemes, most pools will share several specific responsibilities jointly with their underlying funds. These may include the monitoring of their service providers, measuring investment performance and tendering for further services.

Across these areas, the pools and their LGPS schemes will need to establish new processes and systems to deliver these functions. New agreements may be needed regarding services and responsibilities.

For example, consider proxy voting, where all parties will need to ensure alignment exists between each pool and its underlying investors. This will be necessary in order to ensure clarity and uniformity exists over how votes will be cast and who will vote on the schemes’ behalf.

Governance and oversight for the LGPS funds: same but different?

From the difficulties of generating consistent investment returns, to heightened complexity and pressure on governance and risk management systems, the challenges facing today’s pension funds are well-documented. The LGPS is of course no exception to this, and its underlying schemes will continue to face many of the challenges of other pension funds, even though their assets are now managed by the pools.

In this respect, it is something of a paradox that, while the pooling of its assets is an enormous operational and cultural shift for the LGPS, many of those overseeing local authority pension funds will find that a large part of their day-to-day responsibilities remain the same.

We have mentioned that the underlying LGPS funds will continue making decisions about asset allocation and broader investment strategy. Their responsibilities will also continue for fund administration, accounting process management, and attendance of pension board and investment committee meetings.

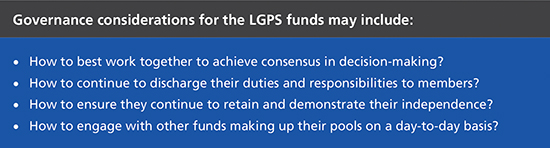

Maintaining good governance and control over the assets being invested by the pools will also continue to be of paramount importance for the LGPS funds. In particular, they will need to ensure that strong oversight mechanisms exist to guide their relationships with the pools, and must also continue to have robust risk management structures in place.

The underlying LGPS pension funds should consider their changing responsibilities in terms of decision-making as well. How will their day-to-day operations be affected? What are the implications for their relationships with existing counterparties? What effect will the pools’ responsibility for investment manager selection have on the underlying pension funds’ relationships with investment consultants, accountants or custodians?

Data and transparency considerations

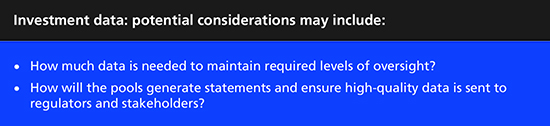

The underlying LGPS funds should also consider whether they are receiving sufficient operational and investment transparency on issues ranging from performance to compliance reporting. Obtaining sufficient reporting data is central to this. In particular, the underlying LGPS funds should consider whether they are comfortable with the amount of available information about their assets.

This is partly because the switch from segregated accounts to a pooled environment will reduce the level of data readily available as the underlying LGPS funds move from having transaction-level information (on shares that they directly own), to being investors in an asset pool.

Currently, across the industry, some investors are content to only have access to, high-level information; whereas others require more detailed data on their underlying holdings. This is where ‘look-through’ asset servicing and data aggregation solutions may be useful to help those overseeing LGPS assets perform their oversight role and discharge their duties.

Alternative investments

For most of the pools, their initial focus has been on pooling their LGPS funds’ most liquid instruments (e.g. equities and fixed-income assets). Beyond this, the pools and their participating funds are now formulating their approaches for pooling and managing illiquid asset classes, particularly alternative assets such as private equity, property and hedge fund investments.

Due to their illiquid and opaque nature, alternatives present particular challenges for investors, and all parties should be aware of these. For example, the systems and processes required for tracking and reporting on alternatives will likely be different to those for more traditional investments.

Investment data may not be readily available for certain asset classes, potentially necessitating specialist data solutions for front, middle or back offices to function smoothly. The pools and their LGPS funds should consider the processes, systems and investment operations required to support these investments, and deliver required levels of accuracy, transparency and timeliness of reporting.

Setting new standards, seizing this opportunity

Northern Trust feels that the pooling of LGPS assets will bring cost savings and efficiencies, and, in time, give pension funds a more powerful voice on key issues that affect its members and its community. But it is nonetheless early days, and we expect the LGPS to evolve, face new challenges, adjust and find new solutions along the way – as it has always done. By speaking with one voice, these ongoing changes provide the opportunity for the LGPS to make a far-reaching difference in society, set new standards for the pension industry and seize what is a once-in-a generation opportunity.

1. Investment & Pensions Europe article: “LGPS: Asset pools (almost) set for action”, April 2018 edition

More Related Articles...

Published: May 1, 2018

Home »