Building goal-driven private market portfolios

|

Written By: Sofia Gertsberg |

Sofia Gertsberg of HarbourVest Partners looks at what LGPS investors should take into consideration when constructing and managing their private market investments

Many of the LGPS are long-term investors in private markets. Relative to other types of investors, the LGPS funds particularly well positioned to take advantage of these potential benefits. For example, LGPS funds tend to have longer investment horizons and fewer liquidity constraints, allowing them to potentially more fully benefit from the institutional experience and the long-term perspective these assets can provide.

In constructing and managing their portfolios, LGPS investors should frequently ask:

- How can I put myself in the best position possible to construct a well-balanced and resilient portfolio?

- What other factors should I consider in order to achieve risk/return efficiency?

- How do I minimise the risk of not meeting my investment objectives over a given investment horizon?

Key considerations

Relative to investing in liquid, publicly-traded securities, private investing can be substantially more complex. Private markets nowadays can offer exposure to a range of different asset classes, with each asset class providing distinct risk and return characteristics, capital deployment and cashflow pace, and investment holding horizons. This complexity requires a multi-dimensional perspective on portfolio construction, blending both conceptual and analytical viewpoints into the process. It is also important to have an in-depth understanding of the trade-offs across various assets at both an individual “building block” level as well as on an integrated, combined total portfolio basis.

Because of these nuances, allocators should keep the following three key dimensions top of mind when making allocation decisions:

1. Return potential and variability of performance outcomes

As a starting point, it is important to understand the cross-cycle, long-term expected return of an asset relative to your desired objective. It is equally important to understand and consider the following:

- The range of potential outcomes in various market environments

- The broader dispersion of returns across the private investment universe

- The likelihood of meeting your return objective

- The upside potential (defined as Expected Surplus – the average of the returns above the return target)

- The risk of under-performance (defined as the Shortfall Risk – the average below return target).

2. Liquidity risks associated with volatility of cashflows

The desired pace of capital deployment and distributions will vary by investor, and distributions are often sensitive to the impact unpredictable cashflows may have on other areas of their portfolio. Working with solutions providers who can model the magnitude or level, pace, and expected volatility of net cashflows across multiple market environments can help to potentially mitigate these risks.

3. Investment horizon of the exposure to the assets

Last but certainly not least, investment horizon and the speed of capital development are crucial considerations. While all private assets have investment horizons that are best measured in years, the horizon can vary substantially depending on the time it takes to realise a certain exit strategy. For example, certain assets build and maintain their exposures more incrementally over longer periods. It is important to focus on the speed of capital deployment, as well as the expected time when capital will be close to being fully returned.

Once asset allocators have analysed these three dimensions relative to their objectives, they may then choose to partner with a solutions provider that has developed a framework and related metrics to help them further understand and consider the critical variables of optimising asset allocation and commitment pacing strategy, as well as the trade-offs in building private market portfolios.

Understanding the private asset universe

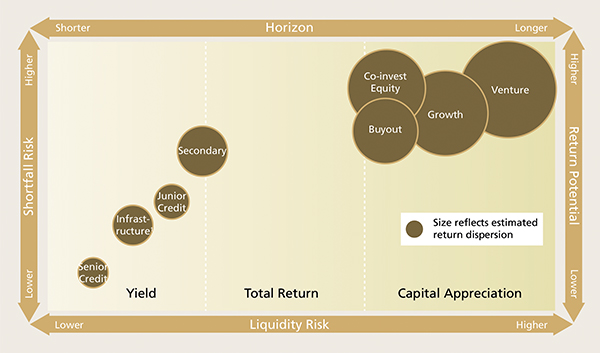

Each private market asset class has a distinct set of properties across the return, risk, liquidity, and investment horizon dimensions. Figure 1 illustrates the different trade-offs inherent to each.

Higher returns are often accompanied by increased risks, including broader return dispersion, shortfall risk, higher liquidity risk, and longer investment horizons. Venture capital, for example, has the highest upside potential and features a greater dispersion of returns¹, longer investment horizons, and lower predictability of cashflows. On the other end of the return/risk spectrum, senior private credit has lower expected returns, along with much lower return dispersion, a shorter investment horizon, and contractual yield that leads to more predictable and consistent cashflows. It is important to note that these relationships don’t always hold true across all four dimensions, an exception being infrastructure where liquidity risk is low while the investment horizon tends to be among the longest of any asset type.

Figure 1: Breakdown of properties across each private market asset class

1. Infrastructure is generally considered to have a long horizon with low liquidity risk

Source: For illustrative purposes only. Statements concerning financial market trends are based on current market conditions, which will fluctuate. Forecasts, estimates, and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that this investment strategy will work under all market conditions or is suitable for all investors. Each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. No representation is being made that any account, product, or strategy will or is likely to achieve profits, losses, or results similar to those shown.

Illustrative objective-driven model portfolios

For LGPS allocators, your objectives, targets and constraints will help play a part in the portfolio construction process. The market offers varied diversified model portfolios that typically seek to maximise returns over a desired investment horizon while reflecting common starting points, preferences, and constraints.

Modelled portfolios help illustrate the impact of various portfolio construction choices on portfolio outcomes across the three dimensions of return, liquidity, and investment horizon. These model portfolios are often optimised using a proprietary simulation model based on both quantitative data and the qualitative expertise and wisdom of senior investors. They can often be tailored to reflect additional preferences around ESG considerations, fee sensitivity, and institutional staffing levels and skills.

Here we highlight three example model portfolios:

Yield Model portfolio

The Yield Model portfolio is typically designed for investors who are in the early stages of building their private markets programme and often prefer an accelerated pace of capital deployment coupled with a shorter investment horizon. These investors may also be sensitive to “J curve” dynamics. The Yield Model portfolio normally turns cashflow-positive and becomes self-funding faster than the other models highlighted. The exposures in this portfolio typically have faster capital development (secondary), include contractual yield component (credit and infrastructure), and have direct exposure to co-investment assets to enhance overall portfolio performance. For infrastructure and credit, it would be expected that these exposures be balanced from a risk standpoint, spanning the range of “core” to “value-added” within infrastructure, and including both senior and junior credit. Geographically, this portfolio tends to focus on developed markets, which is consistent with the overall portfolio objectives, constraints, and the opportunity set.

Capital Appreciation Model portfolio

Relative to the other two example model portfolios, the Capital Appreciation Model portfolio is more focused on maximising long-term returns and outperformance relative to public market equities – albeit with a higher risk tolerance for cashflow uncertainty, greater return dispersion, and more gradual exposure development. The quid-pro-quo for these risks: likely the highest long-term upside potential across each of the example model portfolios. Investors with mature, diverse programmes often gravitate to this type of portfolio strategy, as do those who follow an integrated approach with their public and private market equity exposures. This model portfolio can take the most time to become self-funded; in the meantime, investors usually rely on public equity funding to manage their net cashflow needs. Capital appreciation-focused investors typically seek niche, higher dispersion areas i.e., specialist managers, early-stage venture capital to drive the upside potential, and an opportunity set to realise the greatest reward to their investment selection skill. From a geographic standpoint, this portfolio could lean toward more exposure to Asia and the emerging markets in order to expand the investment universe, and into less penetrated markets to enhance portfolio diversification and maximise any idiosyncratic market opportunities that may arise.

Total Return Model portfolio

The final example is the Total Return Model portfolio which can represent a balance between the Capital Appreciation and Yield portfolios. This portfolio can provide a balanced exposure across the full private market spectrum, including private credit, infrastructure, and secondary investments, along with well-diversified primary and co-investment allocations. This portfolio may also feature more geographic diversification. From a return objective standpoint, this model seeks to blend the attractive attributes of both the Yield and Capital Appreciation portfolios to optimise portfolio performance over an intermediate investment horizon.

Conclusion

Visibility into investor constraints and objectives is critical in allowing long-established private market solutions providers to support and refine client objectives, ultimately constructing efficient and robust balanced portfolios that are informed by both decades of historical data as well as experience.

With the range of data, tools, experience and insights available to allocators today, the possible solutions are also comprehensive. LGPS allocators can maximise on this by working with sophisticated solutions providers who can partner in designing a custom portfolio that matches a specified investment horizon and meets investment objectives while minimising profit downside risk, with a fully diversified and balanced portfolio construction approach.

1. According to HarbourVest Research as at September 2021

More Related Content...

|

|

|