ESG investing in emerging markets

|

Written By: James Edwards |

|

Paul Myles |

With interest in Environmental, Social and Governance issues continuing to rise in importance globally, James Edwards of BMO Global Asset Management looks at how Local Government Pension Scheme investors can consider sustainability issues in emerging markets

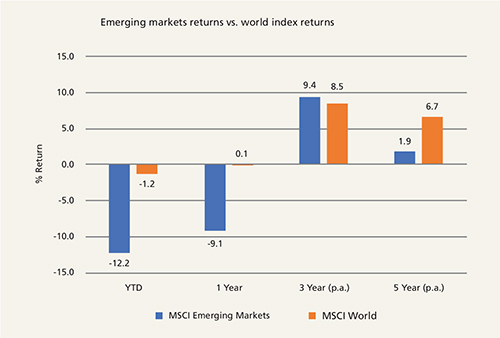

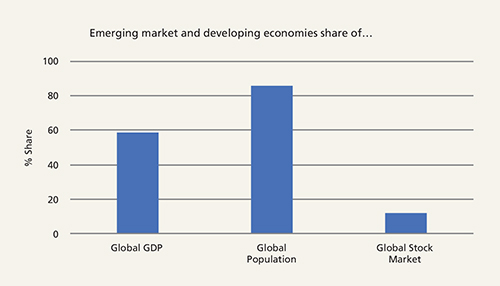

For open, accruing pension schemes such as the LGPS, emerging market equities remain an asset class which may offer long-term growth potential and diversification. Despite emerging market equities’ more recent underperformance compared to developed market equities, the structural reasons to have exposure to emerging markets remain in place. According to IMF data, emerging market and developing economies represent 59% of world GDP and 86% of the world’s population. Yet emerging markets represent only 11.6% of the global stock market by market capitalisation (see Figure 1).

Figure 1: Emerging markets performance vs. developed markets

Source: MSCI, as at 30 November 2018

Source: IMF, World Economic Outlook, October 2018; MSCI

Source: IFM, 2018, World Economic Outlook (October 2018)

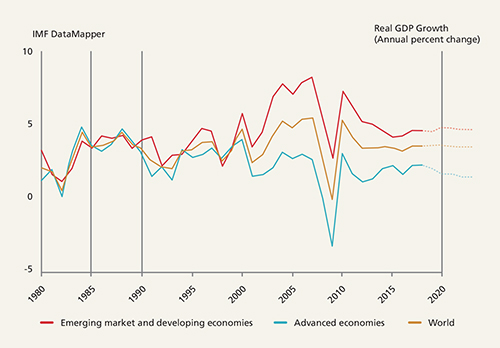

With GDP in emerging markets expected to continue to grow faster than in advanced economies, investors remain structurally underweight in emerging markets.

Why consider sustainability in emerging markets?

The challenges faced by the emerging and developing nations and their populations remain multifaceted and involve problems from population growth, scarcity of key resources (such as land and water), income inequality and access to healthcare.

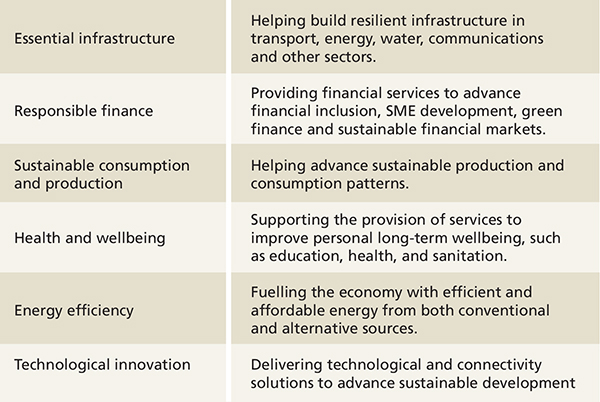

The goal therefore should be to identify companies that have strong environmental and social management practices, allocate financial capital wisely, and, ideally, provide products and services that promote long-term social, economic and personal well-being for the emerging consumer base.

These high-level principles can be distilled into six areas of interest to emerging market investors. See Figure 2 below.

Figure 2: Six areas of interest to emerging market investors

While these areas of focus should offer opportunities in faster growing parts of the market, it should go without saying that any potential investment should be subject to the usual rigorous financial assessment. As history shows, companies contributing to social progress do not necessarily provide the chance to generate good long-term returns. Airlines and cars have clearly been great sectors for our further evolution, yet investment in these sectors has often led to bad investments despite contributing to progress. As such, a focus on the overall quality of each business may add another dimension to the question of sustainability:

- Sustainable business models that generate high returns on invested capital across the cycle, often characterised by strong brands and leading market positions

- Robust balance sheets

- Proven management teams with a disciplined approach to capital and risk management

- A clear alignment of interest between majority and minority shareholders

Regardless of the investment narrative, companies in these markets will only thrive if they are able to maintain their licence to operate. This licence relies not only on their shareholders but equally on their positioning to stakeholders, whether that’s an employee on the ground, the village near their factory, the customer on the outskirts of a large metropolis or the local government. A long-term, sustainable business cannot be sustainable by only making shareholders happy; it must have a purpose beyond maximising profits. It also must take into consideration the stakeholders and environmental factors while offering products that benefit society.

Licence to operate

Assessing licence to operate is not easy. For example, if a company is polluting a river as part of its operations, the licence to operate may not actually be compromised for many years, so it would not necessarily be apparent that the company is at risk by not investing in a water treatment plant.

This offers a great reason for not owning this business. However, that doesn’t mean the company will stop these practices until it is prosecuted or its licence is taken away, and this doesn’t often happen overnight. Sometimes companies can operate with hazardous practices for many years before the public reacts, and this can go on even longer if the owners happen to be politically connected.

As a result, investors will continue to dwell on the financial accounts and keep the share price up until the long-term risk is realised.

This is ultimately why the integration of ESG factors, along with franchise quality and the impact of the end product to the broader society, are crucial to the investment case over the long-term in emerging markets. We find that most management teams and long-term owners of the businesses we interact with agree, and we are therefore able to build strong relationships by discussing these long-term objectives, rather than focusing on short-term changes that often distract the market.

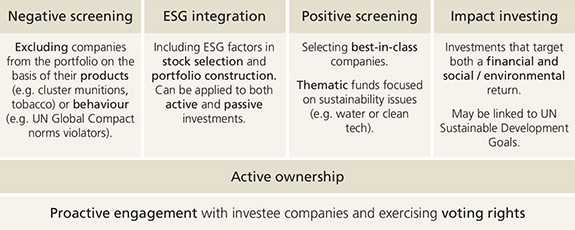

No longer just screening

As interest in ESG has grown over the years, the number of different investment approaches has expanded from funds which simply sought to screen out anything considered to not meet certain criteria (e.g. tobacco or alcohol). Today, a range of approaches are available to investors which may be grouped into four categories – see Figure 3 below.

Figure 3

We can therefore see that the investment management of ESG has developed from just providing ethically screened funds, to offering approaches that seek to make a positive contribution to society either through selecting best-in-class companies all the way through, to full blown impact approaches that target specific outcomes.

Underpinning all of these categories is active ownership: taking a proactive approach to engaging with investee companies, meeting with management and exercising voting rights.

This type of proactive approach is based on constructive dialogue and building a relationship of trust, where, over time, investors can gain a sound understanding of how ESG issues fit into a company’s business strategy, their contribution to sustainable development trends and the potential longevity of their licence to operate and ultimately the potential returns to shareholders.

What does this mean for LGPS investors?

In conclusion, assessing an individual company’s licence to operate, its contribution to sustainable development trends, and ESG risks at the same time as traditional financial measures can offer investors additional ways to identify companies which may be poised to benefit from long-term structural tailwinds in emerging markets.

And whilst data can help with part of this process, taking an active approach to ownership and engagement with companies and boards of directors can help align long-term investors such as the LGPS with these long-term trends as they play out in emerging markets.

Investing in emerging markets is generally considered to involve more risk than developed markets.

The information, opinions estimates or forecasts contained in this document were obtained from sources reasonably believed to be reliable and are subject to change at any time.

© 2018 BMO Global Asset Management. All rights reserved. BMO Global Asset Management is a trading name of BMO Asset Management Limited, which is authorised and regulated by the Financial Conduct Authority. CM18742 (12/18) UK.

More Related Content...

|

|

|