Finding value over the long term

|

Written By: Andrei Vaduva |

|

Courtney Bensen |

Andrei Vaduva and Courtney Bensen of Partners Group look at how long-term value assets can provide a well-balanced solution for institutional investors with a long-term investment horizon

The UK-defined benefit pension fund landscape is changing. After a prolonged period of public market positive performance, some pension investors are increasingly looking to de-risk their pension schemes as membership profiles mature and cash flow status becomes more prevalent. Consequently, pension funds and their consultants have been employing a variety of solutions in order to potentially reduce any funding gaps and adequately fund liabilities as and when they fall due.

The primary implementation strategies for a pension fund looking to de-risk, while still addressing funding and cashflow levels, have seen limited new development and have been employed for a number of years. However, with funding levels under scrutiny, the types of assets being used within de-risking strategies are evolving. In fact, schemes are increasingly utilising non-traditional asset classes, such as private markets, which offer income, generate an excess return, or both.

Across the broad spectrum of private markets there is a subset of high quality assets that have matured to a point where they provide a more stable risk-return profile and offer compounding capital appreciation, if held and managed with a long-term perspective (10 years+ time horizon). Partners Group calls these businesses Long Term Value Assets (LTVAs). Specifically, LTVAs are category leaders that exhibit resilience in sectors with long-term visibility and growth potential. LTVAs are differentiated from other assets by their market position and ability to protect their leadership.

We define category leaders as businesses that have been able to capture a substantial share of the market and fall into one of the following categories:

- Platform leaders: a platform company that has successfully built its dominance via add-on acquisitions in a market at an advanced stage of consolidation.

- Market leaders: companies that have built on a particular niche expertise to seize market dominance, and that share their leadership with very few others.

- Franchise leaders: businesses serving a segment with network benefits. These are companies, which contractually, or by the nature of the industry they are in, hold unique franchises and substantially benefit from their ability to scale.

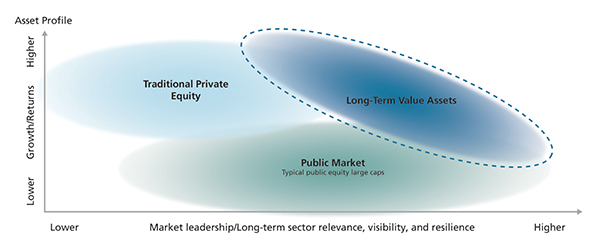

LTVAs represent longer-term investment opportunities that sit between traditional private equity and public market equities. LTVAs can offer compelling long-term growth potential vs public equities as they take advantage of the “hands-on” operational value creation, long-term horizon and improved governance typically found in private companies.

LTVAs also benefit from the market dominance typically seen in mid/large cap public market equities. In public markets, upper mid cap and large cap stocks are often leaders in their respective areas and therefore their earnings (measured as EBITDA) can be more resilient to economic downturns. We see a similar relationship in private markets – typically private companies with leading market positions are more likely to stand firm as smaller or younger businesses flounder. Figure 1 provides an illustration of where LTVAs sit within the wider investment universe.

Figure 1: Asset profile of LTVAs

Source: Partners Group. For illustrative purposes only.

LTVAs also offer uninterrupted ownership, providing advantages for value creation at the asset level and an attractive risk-return profile for investors with a long-term investment horizon. At the company level, an uninterrupted ownership period allows the company to focus on long-term growth and strategic initiatives, freeing management teams from the pressure of quarterly earnings targets typically associated with being publicly listed. For investors, uninterrupted ownership allows them to keep capital fully invested (compounding returns over the long term) and reduce transaction costs (often 2-5% of transaction value).

Analysis of long-term value assets

To highlight the key characteristics of LTVAs, below is a case study of a qualifying investment from Partners Group’s recent investment history – Techem.

Techem

Techem is a sub-metering service provider with a leading market position in its home market, Germany, based on revenue (excluding revenue for smoke detectors, water testing and issuance of energy certificates), which is also the largest market globally. Domestically and internationally, Techem serves c. 414,000 customers in approximately 11 million dwellings across 21 countries, including Germany. Techem’s core business is Energy Services, which includes installing, monitoring and reading individual heating and water consumption devices, as well as energy efficiency consultation.

Techem has low customer churn and long-term service contracts (typical tenure between 5-10 years), which provide sticky long-term demand for its services.

LTVA Drivers:

- Favourable market trends: As climate change becomes an increasingly pressing issue, the European Union has committed to binding targets of 40% reduction in CO2 emissions by 2030. Sub-metering, which can help reduce energy consumption in buildings by up to 20%, is a cost-efficient alternative to larger capital investments, such as building renovations and roof insulation. EU directives require the roll out of smart meters to 80% of consumers by 2020.

- Leading market position: Techem is a leader in the sub-metering industry in Germany (the most advanced European market) with a steady c. 30% market share, as well as a top three position in 15 of the 21 countries where it operates. Proprietary technology, capital intensity and scale for operations ensure Techem’s leading position both in Germany and internationally, with very few new players able to disrupt Techem.

- Resilience: Founded in 1952, the company has a long history of strong organic growth and recession resilience with EBITDA growth of c.5% p.a. throughout the global financial crisis and c.7.0% p.a. over the last 12 years.

- Long term business plan: Techem provides long-term contracts (5-15 years) with a customer churn of less than 5%, complemented by a focus on gaining market share in more European countries, and further expanding its customer base. Long-term value creation comes from revenue enhancing initiatives such as cross-selling additional devices, launching new products, and operational efficiencies driven by automation of certain functions.

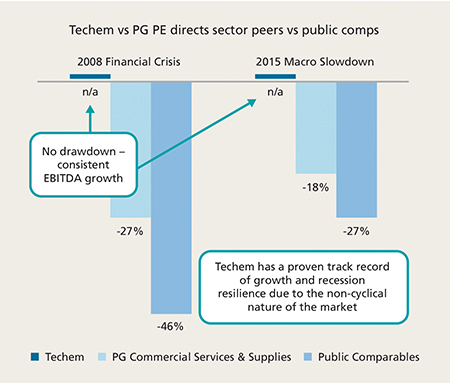

Additionally, LTVAs have evidenced a lower drawdown throughout economic cycles vs traditional buyouts and public comparables. As seen in Figure 2, Techem experienced a negligible drawdown in unfavourable and weak macro environments, maintaining robust EBITDA growth. This stability can largely be attributed to market dominance, long-term contractual cash flows and continuing growth potential.

Figure 2: Techem EBITDA drop vs peer groups during historical downturns

Source: Partners Group 2019. For illustrative purposes only.

Long-term value assets in a pension fund portfolio

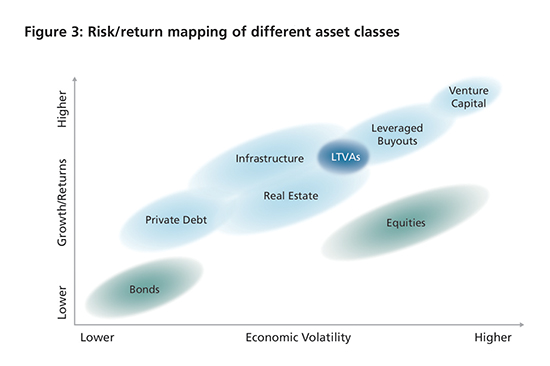

Looking at a pension fund’s assets, LTVAs are anticipated to meaningfully contribute to the return of the overall portfolio with lower volatility than public and private equity. Figure 3 maps LTVAs within the broader investment universe consisting of key private and public markets asset classes. We see LTVAs sitting between private infrastructure equity and private equity in terms of risk/return profile, but closer to the former asset class given their resilience and more stable cash flows.

Figure 3: Risk/return mapping of different asset classes

Source: Partners Group estimates 2019. For illustrative purposes only. The information above is expressed as estimates which may not be achieved.

Depending on the specific investment strategy objectives of a pension fund, LTVAs can arguably be included in both the growth bucket, given their higher return potential, and the matching bucket, given the consistent income anticipated to be generated.

Given their long-term nature, LTVAs generally sit alongside other long-hold assets, such as infrastructure or long lease property, which are used to target longer-dated liability cash flows. Implementation of LTVAs is however flexible, and some investment products in the market are structured as evergreens with regular liquidity windows, thereby also making them suitable for pension schemes with a medium-term horizon.

For investors looking to gain exposure to LTVAs, there are a range of options available, depending on overall portfolio requirements. For larger schemes, LTVAs can be accessed via segregated mandates investing directly in assets and/or via commingled funds. Medium and smaller schemes can access LTVAs through commingled funds, which can either be structured as closed ended vehicles with a 20+ year life or as evergreen vehicles. Commingled funds are currently being offered by some of the more established private equity firms including Partners Group, and some of our well known peers. Depending on proposition, investors should anticipate a target net IRR in excess of 10% p.a., with some products also offering a yield element (note: there is no assurance that targets will be achieved).

Conclusion

We believe LTVAs can offer a well-balanced solution for institutional investors that have a long-term investment horizon and wish to benefit from the improved governance associated with private ownership. In particular, pension schemes can benefit from the growth potential, resilience and diversification benefits offered by LTVAs.

This material has been prepared solely for purposes of illustration and discussion. Under no circumstances should the information contained herein be used or considered as an offer to sell, or solicitation of an offer to buy any security. Any security offering is subject to certain investor eligibility criteria as detailed in the applicable offering documents. The information contained herein is confidential and may not be reproduced or circulated in whole or in part. The information is in summary form for convenience of presentation, it is not complete and it should not be relied upon as such.

All information, including performance information, has been prepared in good faith; however, Partners Group makes no representation or warranty express or implied, as to the accuracy or completeness of the information, and nothing herein shall be relied upon as a promise or representation as to past or future performance. This material may include information that is based, in part or in full, on hypothetical assumptions, models and/or other analysis of Partners Group (which may not necessarily be described herein), no representation or warranty is made as to the reasonableness of any such assumptions, models or analysis. Any charts which represent the composition of a portfolio of private markets investments serve as guidance only and are not intended to be an assurance of the actual allocation of private markets investments. The information set forth herein was gathered from various sources which Partners Group believes, but does not guarantee, to be reliable. Unless stated otherwise, any opinions expressed herein are current as of the date hereof and are subject to change at any time. All sources which have not been otherwise credited have derived from Partners Group.

No representation is being made that any account or fund will or is likely to achieve profits or losses similar to the results being portrayed herein. The gross annual rate of returns represents the compound annual rate of return (“IRR”) before management fees, organizational expenses and the general partner’s allocation of profit, but in some instances (where indicated), net of the underlying general partner’s fees and expenses. The net annual rate of return represents the IRR after management fees, organizational expenses and the general partner’s allocation of profit. Actual realized returns on unrealized investments will depend on, among other factors, future operating results, the value of the assets, market conditions at the time of disposition, any related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions and circumstances on which the valuations used in the performance data contained herein are based. Accordingly, the actual realized returns on these unrealized investments may differ materially from the returns indicated herein. Nothing contained herein should be deemed to be a prediction or projection of future performance of any investment.

Certain information contained in this presentation constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “anticipate”, “target”, “project”, “estimate”, “intend”, “continue” or “believe” or the negatives thereof or other variations thereon or comparable terminology. Due to various risks and uncertainties, actual events or results or the actual performance of any investment may differ materially from those reflected or contemplated in such forward-looking statements.

The products outlined in this communication are controlled investments for the purposes of the financial promotion restriction under section 21 of the Financial Services and Markets Act 2000 (“FSMA”) and are unregulated collective investment schemes for the purposes of section 238 of FSMA. This communication is exempt from the general restriction under sections 21 and 238 of FSMA on the communication of invitations or inducements to engage in investment activity on the grounds that it is made only to or directed only at persons to whom it may lawfully be distributed.

More Related Content...

|

|

|