Impact investing – a more effective way of doing good

Published: December 1, 2014

Written By:

|

Christopher Head |

Christopher Head from BlackRock discusses the conventional ways that ethical investing is undertaken, outlines the shortcomings of these approaches, and proposes an alternative methodology

There is increasing focus on the environmental impact, social responsibility and corporate governance of companies, generally referred to as their ESG policies. Following the recent Queen’s Counsel (QC) clarification, sponsored by the Local Government Pension Scheme (LGPS) Advisory Board, committees have a wider remit to consider ethical issues alongside the financial impact of their investments. As a result, councillors and officers are looking at how to incorporate the ESG concerns of their various stakeholders in portfolios.

ESG is defined as the ways in which companies contribute towards a more sustainable environment, constructively engaging with social concerns at both the global and local level, and ensuring that their corporate governance is competent and fair.

Ethical investors historically have implemented their views using negative screens by excluding “sin” stocks such as tobacco, arms and gambling. This approach however limits the investable universe and can adversely affect the risk and return characteristics of a portfolio.

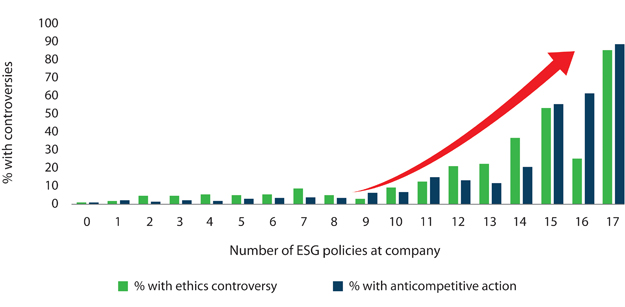

By contrast, some investors look to support desired outcomes and search for companies that invest for social “good”. These goals could include eradicating widespread diseases, developing renewable energy, and promoting progressive employment policies. While in principle we agree with this more positive approach, we believe there is too much reliance on what companies are saying about themselves and the image they are trying to project, and too little analysis of what they actually achieve. Our research has shown that in many cases the companies that have the most ESG policies are actually involved in the most controversies, which in turn attract negative news and social media coverage, and can negatively impact returns.

Are ESG policies effective?

We believe it is more insightful to ask whether having a comprehensive set of policies helps to avoid controversies and bad press, as this is the main way that ESG is likely to affect returns.

The results (Figure 1) surprised us. They show that the more socially responsible policies a firm has, the more likely it is to become embroiled in controversy. This is true of all policies, and holds for anticompetitive as well as ethical controversies. It is also true of popular indices built along ethical lines and remains true after accounting for other factors such as firm size and industry.

We do not believe that it is the policies themselves that actually cause the problems. Rather, the companies most likely to have detailed ESG policies are typically those operating in industries where controversies are most likely to arise, for example resource extraction or pharmaceuticals.

Unfortunately however, it is clear that a systematic approach to ESG investing which focuses on companies with extensive ESG policies fails to remove the risk of controversy it is attempting to avoid.

Figure 1: Companies with more ESG policies attract more controversy

Source: Sample universe: Russell 1000, Policy data source: Thomson Reuters Asset4Controversy likelihood is calculated from average number of controversies for firms in & out of the index in question, controlling for size, industry, country & multinational effects, June 2014

Our analysis

To assess the effectiveness of ESG policies, we first identified 17 standard policies used by many companies, typically focusing on factors such as human rights issues, sharing intellectual property rights, supplier education and employee working conditions. The precise relationship between such policies and stock price returns is inevitably difficult to determine, but it is well established that issues such as child labour and poor working conditions have affected the reputations and share prices of well-known brands that have outsourced production. Other problems have arisen when environmental or animal rights activists have highlighted practices they consider unethical, or when accidents have occurred, such as the 2010 Deepwater Horizon oil spill in the Gulf of Mexico.

An alternative approach

We suggest that investors drop the emphasis on policies and focus less on trying to extract disclosure from companies. We believe a better approach is to leverage the vast ocean of data that exists about companies, which typically provides more information than firms are willing to reveal themselves. This is done by analysing thousands of public information sources, ranging from news feeds to social media, in a thorough and systematic way to filter the information into a manageable universe and take positive stockholding decisions. By blending technology with market-leading investment insight, investment teams can access, consume and interpret vast amounts of public information about the firms being considered for investment.

This approach avoids the biases present in traditional ESG approaches, moves investment decisions past the public images that companies want to portray, and allows investors to measure the “impact” or social good created by their portfolios. The use of multiple measurements and data sources identifies companies whose actions match their words.

Example

When measuring environmental innovation impact, the first step would be to collect all patent applications and grants from global patent offices. Second, using the World Intellectual Property

Organisation’s (WIPO) international patent classification we would match environmentally sound technologies listed in the United Nation’s framework convention on climate change. Companies are then ranked globally based on the percentage of environmentally sound technology research conducted and tracked by how much of the research portfolio results in newly-granted green technology patents.

It is also important to look into whether key stakeholders such as employees, customers and suppliers, believe what a company is saying about itself. This is akin to conducting a 360-degree review for every firm considered for investment, and should include both positive and negative feedback to further inform the impact score.

By incorporating impact scores into an established investment process, active investors can combine corporate fundamentals, and public sentiment into the process. Investors will be able to quantify the impact of their ESG portfolios with specific measurements of employee satisfaction, positive environmental change, improvements in health care and other factors they are specifically concerned about. This approach allows investors to move beyond the public image companies are trying to portray.

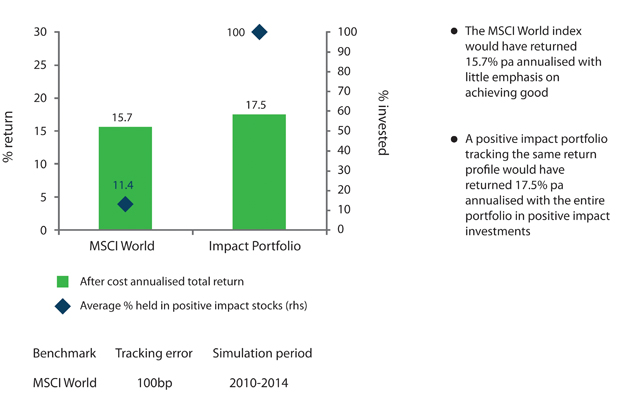

To test these assumptions, we ran a simulation of the outputs benchmarked against the MSCI World Index. In Figure 2 we can see that this combination results in benchmark-beating performance achieved through investments in companies with demonstrable higher positive impact on factors ethical investors care about.

Figure 2: Simulated returns – MSCI World & impact portfolio

Source: BlackRock as of 7th November 2014

How effective is this approach?

According to our simulated returns, our impact portfolio may exceed developed equity returns with a near tenfold greater emphasis on positive ESG impact, thereby confirming that an impact scoring approach can make it easier to quantify the social good impact within a portfolio and increase returns without taking on extra risk. Given this, the answer to the question “Does impact investing deliver?” is yes – provided that you are willing to do the necessary work to look beyond what companies say about themselves and gain a much more detailed understanding of the true environmental and social impact of their actions.

This material is for distribution to Professional Clients (as defined by the FCA Rules) and should not be relied upon by any other persons.

Issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: 020 7743 3000. Registered in England No. 2020394. For your protection telephone calls are usually recorded. BlackRock is a trading name of BlackRock Investment Management (UK) Limited.

Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested. Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

Dec 14-19188

More Related Content...

|

|

|