Inflation protection: the listed infrastructure hedge

|

Written By: Sheridan Bowers |

Sheridan Bowers of Vontobel Asset Management identifies the two types of inflation – “cost-push” and “demand-pull” – and considers the likely effects on infrastructure stocks depending whether inflation is transitory or “sticky”

Greeting the world as we emerge from the Covid-19 shutdowns is a word that, at least in many developed countries, has been rarely heard since the 1970s: inflation. As the pandemic appears to be winding down, a mix of factors complicates our reading of the macro-economic environment, with many commentators asking whether the actual inflation we are seeing now will be with us for some time or be more transitory in nature.

Traditionally, inflation is of two types:

- The first is “cost-push” inflation, caused by increases in the costs of goods or services for which no suitable alternatives are available. Higher prices then result, as costs of production increase due to a decreased aggregate supply.

- The second type is “demand-pull” inflation, which arises when aggregate demand in an economy outpaces supply. This type occurs as real gross domestic product swells and unemployment falls, commonly known as “too much money chasing too few goods.”

While they are distinctive inflation types, cost-push and demand-pull inflation can both be understood as separate aspects of one overall inflationary process. Demand-pull inflation explains how price inflation starts, and cost-push inflation demonstrates why inflation, once started, is difficult to contain.

Milton Friedman, who was of the monetarist school of economics, was critical of the cost-push idea and, in 1963, asserted that inflation is always and everywhere a monetary phenomenon. He maintained that there is a close association between inflation and money supply, and that inflation could be avoided with proper regulation of the monetary base’s growth rate.

Ironically, today we find ourselves with elements of all three theories embedded in our discussion of inflation. As a result of the global pandemic in 2020, bottlenecks in global supply chains are resulting in shortages of many elements necessary to our economy (cost-push). We also have many economies, like the US, where the savings rate is currently very high, consumers are ready to get out and spend, and there are massive demands on both labour and resources as we attempt to ramp up to pre-2020 levels (demand-pull). And lastly, as a result of massive government intervention over the last year, our money supply and central bank balance sheets have seen increases with no equal over the last 50 years (monetary factors).

Figure 1: United States CPI-U: All items less food & energy (YoY%, SA, 1982-84=100) As of September 30, 2021

Source: Strategis Research, Bureau of Labor Statistics

So, what to make of current wage inflation? Will supply chains catch up as life returns to normal? Will more production of critical commodities catch up with demand? Will central banks like the US Federal Reserve be able to moderate money supply, balance sheets, and rates in a manner that produces a smooth taper? The answers to these questions will determine whether inflation becomes “sticky” or – as central bankers predict – more transitory. While outside the scope of this article, perhaps the largest factor not yet mentioned is the effect that “temporary” inflation has on consumer psychology and whether the effect becomes embedded. These are not simple times, and in selecting a basket of global equities, one has to consider how the aforementioned factors will affect growth, income, and future purchasing power. With their unique characteristics and potential to protect investors’ portfolios from inflation, what part can listed infrastructure play in this new era?

Global listed infrastructure as an inflation hedge

The question of whether inflation is transitory or not is unlikely to be resolved for at least a couple more quarters. What is clear, however, is that many infrastructure stocks are structured to perform well if inflation does materialise.

At the most basic level, infrastructure companies own physical assets that generate real returns. These assets often tend to be monopolistic or oligopolistic, regulated, and backed by long-term contracts with escalators.

Infrastructure companies operate durable businesses with limited competition and tend to be more resistant to macro shocks than more traditional companies. They are high-fixed-cost and investment-heavy businesses, and, as such, their margins are much less vulnerable to rising costs. Inflation pressures are most heavily felt on new construction, yet companies will not build unless the demand for new construction outpaces the cost of inflation. Also, as construction costs move up with inflation, the value of existing assets goes higher, and this high replacement value acts as a valuation support to stock prices.

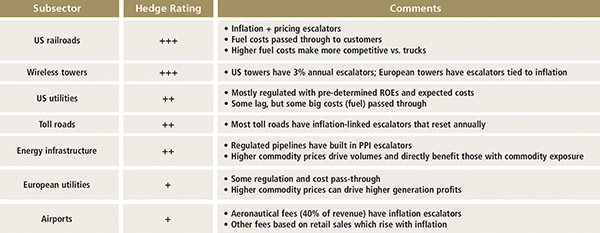

For example, Duff & Phelps (a Vontobel affiliate) targets four sectors in its infrastructure strategies: communications (wireless towers), utilities (electric, gas, and water), transportation (railroads, toll roads, and airports), and energy infrastructure (pipelines, natural gas processing, and LNG export facilities). Each subsector within these four categories is well-hedged against inflation. Almost none should experience a detrimental impact on growth and earnings if inflation increases significantly, as they all benefit from long-term contracts featuring escalators that either rise annually or are tied to inflation. As shown in Figure 2, each infrastructure subsector has built-in inflation protection.

Figure 2: Global listed infrastructure – inflation protection characteristics by subsector

Source: Duff & Phelps Investment Management Co

North American railroads and wireless-tower companies are best positioned. North American railroad service prices increase at or above inflation each year. Additionally, railroads pass through fuel charges to customers and become more competitive against trucks as fuel prices increase.

Wireless towers also have generous built-in escalators. In the US, these feature automatic annual increases of 2%-3% and, in Europe, contracts escalate with any rise in inflation. Even the most vulnerable subsector, airports, still features inflation escalators on aeronautical fees, which make up roughly 40% of airport revenues.

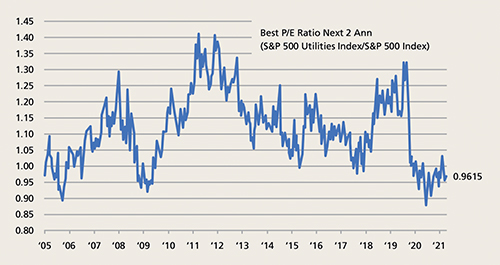

While infrastructure earnings are generally well-protected, it is important to remember that certain infrastructure stocks, especially utilities, typically do not trade well early in the inflation cycle. Higher-yielding, defensive stocks tend to underperform as investors flock to more cyclical companies that will, at least initially, see larger step-ups in earnings. For utilities, we have seen this underperformance play out in 2021 as investors worry about central bank tapering and higher interest rates. However, we remain constructive on utilities as we expect them to continue to generate stable and predictable earnings growth over the coming quarters coupled with relative valuations that remain near a 20-year low.

We are also less concerned about the impact of inflation on utilities because much of the data around how utilities have performed in periods of real inflation comes from the 1970s and 1980s. Today’s utilities are very different . Management teams are more sophisticated, the regulatory construct is more clearly defined, balance sheets are stronger, and earnings growth is higher and more consistent. Additionally, utilities should be big beneficiaries of the transition to cleaner energy.

Figure 3: Historical Price/Earnings Ratio – S&P 500 Utilities Index/S&P 500 Index

Source: Bloomberg Finance, LP

If inflation proves to be transitory, subsectors like airports, toll roads, and midstream energy should thrive as the global economy re-opens and they rebound from the extremely challenging demand environment of 2020. Meanwhile, the secular-growth stories around cell towers and US railroads should continue to drive those stocks.

However, more notable outperformance will likely come if inflation continues to look more permanent or “sticky”. Investors are likely to tolerate higher inflation for a while, as it pushes earnings higher, but as earnings start to slow, multiples will contract, and we would expect the more protected infrastructure names to become a genuine port in the storm.

More Related Content...

|

|

|