Infrastructure – opportunities beyond headline trophy assets

|

Written By: Martin Lennon |

Martin Lennon of Infracapital (the infrastructure equity investment arm of M&G Investments) examines the attractions for investors of the infrastructure asset class, broadly divided between greenfield and brownfield projects

Infrastructure has become an increasingly popular asset class for pension funds as investments carry a number of appealing characteristics to help them meet their long-term obligations. Schemes invested in infrastructure will recognise the diverse array of opportunities across the industries and sectors that form the foundations of an economy.

Across the asset lifecycle, the risk/return and cashflow characteristics associated with infrastructure align well with the needs of pension funds. Ownership of infrastructure assets can generate attractive steady returns over the long term with cashflows from the assets that are typically reliable. Furthermore, these cashflows are frequently linked to inflation – providing some protection in uncertain inflationary conditions.

The defensive nature of the asset class, thanks to the essential nature of assets (everyone needs water or, arguably for many teens, high-speed broadband), provides relatively uncorrelated returns to other asset classes, and offers a “safe haven” in volatile market climates. These characteristics are generally valued by investors seeking diversification, and an attractive return profile should appeal to schemes facing obligations to pay members’ pensions for many years ahead.

Complementary approaches to investing

Infrastructure assets typically fall into two broad categories, “greenfield” and “brownfield”, referring to different stages in an asset’s lifecycle. Making investments in infrastructure at different stages during an asset’s lifecycle can generate a range of different risk and return profiles and offer mutually attractive reasons for inclusion in a portfolio.

Greenfield assets – new projects that may still be in development or entering the construction phase, offer one route into the asset class. Point of entry into greenfield assets can vary, depending on the risk appetite of investors. Delaying participation until the late development or early construction stage, can offer investors an investment sweet spot whereby the project brings expectations of increased returns but risks can be more readily managed and mitigated. Infracapital’s investment in Gigaclear, which is providing new high-speed fibre networks to underserved rural markets, is a good example, generating a premium return for investors who have a stake in the building of the network which ultimately will have a strong market position delivering the latest form of essential infrastructure.

Greenfield investments provide a complementary strategy to brownfield infrastructure, typically offering higher expected returns, but also likely to carry greater risk. Brownfield assets, in contrast, represent opportunities in businesses that are already operational, delivering essential services and generating steady cashflows. A key attraction is that they are usually able to provide steady cashflows from the outset.

The attraction of these assets has seen increasing investor interest and significant prices paid for trophy assets in the sector. Opportunities still exist for the more active fund managers to deliver premium returns from brownfield assets by leveraging their expertise to originate and source through complex processes or to improve the operational performance. Alternatively, the plan may be to expand the scale of the business meaningfully, creating a “platform” to grow through follow-on acquisitions or investment. Larger scale assets are often expected to command a greater premium when they are subsequently sold on exit.

Infracapital has substantial experience delivering such strategies in the brownfield sector, demonstrated by its investment in Calvin Capital. The company was transformed from a small division of a utility company into a stand-alone business installing and maintaining electricity meters nationally, delivering core, contracted cashflows over the long term, and with significant platform growth. On exit, almost 10 years after the initial investment, Calvin Capital returned a multiple of 3.8 times on its investment to Infracapital.

Pension funds that can participate in both brownfield and greenfield infrastructure therefore have the ability to blend the benefits of each approach to suit their individual cashflow requirements, while also having the potential to capture capital gains.

Opportunities in the mid-market and institutional demand for assets

Infracapital sees compelling opportunities in many infrastructure sectors. Value can be found in traditional infrastructure, and new sectors such as fibre, particularly in the mid-market. This is especially evident where managers with extensive resources and experience are able to either originate or develop more complex investments (as mentioned above).

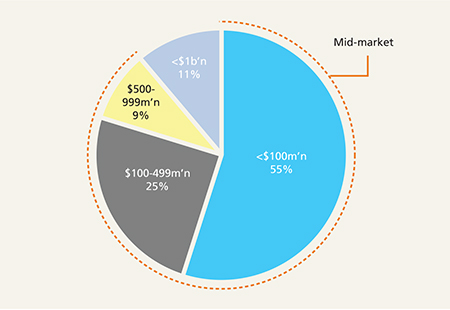

The increasing volume of demand and the scale of commitments earmarked for the asset class has led to a significant amount of “dry powder” – investments confirmed but not yet drawn down and deployed – being raised by funds. Notably, while this suggests greater competition for assets, a meaningful portion of this new investment is in funds of significantly large size which will target deals that are larger in scale. However, plenty of room remains to focus on other, less competed areas of the market. In fact, the mid-market represents a significant majority of the deals transacted recently, those of less than $1 billion in enterprise value terms.

Figure 1: European infrastructure M&A activity by deal value

Source: Prequin, 2016 M&A activity

Asset managers such as Infracapital, that have built strong relationship networks, can sidestep many of the most competed opportunities, likely to be the planned destination of much of the dry powder raised recently. Across Europe and in the UK, Infracapital uses its expertise to explore the mid-market, where it sees less competition for assets, and where extensive and diverse opportunities remain significant for experienced investors to capture value. Opportunities here are often too small or complex to attract large-scale investors, offering Infracapital greater scope for value creation through active asset management.

Future pension fund investment in infrastructure

With assets typically generating long-term, contractual and inflation-linked income in excess of corporate bonds, it’s unsurprising that pension schemes have been increasing their target allocations to the asset class. Nevertheless, investors should still be aware that investments in infrastructure still carry risk and it’s the manager’s role to manage and minimise that risk on their behalf. Regulatory risks can be particularly pertinent, reflecting the potential for negative impacts from political or regulatory changes. In delivering essential services, infrastructure providers come under close scrutiny to ensure that fairness prevails. At the same time however, regulatory pricing features can also offer some protection to service providers by reducing the potential for excessive volatility, ensuring predictable contracted revenues. For experienced investors however, understanding the needs of the regulator and stakeholders is all part of being a responsible investor, and indeed the head of Infracapital’s asset management team has also previously served on regulatory boards. Given the long-term nature of infrastructure assets, they are held in long-term funds. Therefore, investors also need to accept the associated illiquidity risks of these structures, however the secondary market continues to develop.

With the advent of pooling, partnering with a specialist investment manager to invest on behalf of a larger pool could help local authority pension schemes to implement planned increases in allocations to the asset class more easily. They will also be able to collectively target more diverse opportunities.

In pursuing diversification in their holdings, rational investors should be aware that the most attractive market opportunities could arise within and outside the UK as well as in a range of sectors across the asset classes.

Pension schemes, aiming to expand their exposure to infrastructure, should consider the likelihood of more frequent and better value opportunities in the mid-market and new-build projects, rather than deals that grab the headlines. To best capture the benefits of the opportunities available, it makes sense to engage an experienced investment partner with long-standing expertise across all market sectors.

For Investment Professionals only.

The distribution of this document does not constitute an offer or solicitation. Past performance is not a guide to future performance. The value of investments can fall as well as rise. There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and you should ensure you understand the risk profile of the products or services you plan to purchase.

This document is issued by M&G Investment Management Limited. The services and products provided by M&G Investment Management Limited are available only to investors who come within the category of the Professional Client as defined in the Financial Conduct Authority’s Handbook. They are not available to individual investors, who should not rely on this communication. Information given in this document has been obtained from, or based upon, sources believed by us to be reliable and accurate although M&G does not accept liability for the accuracy of the contents. M&G does not offer investment advice or make recommendations regarding investments. Opinions are subject to change without notice. Reference in this document to individual companies is included solely for the purpose of illustration and should not be construed as a recommendation to buy or sell the same.

M&G Investments is a business name of M&G Investment Management Limited and is used by other companies within the Prudential Group. M&G Investment Management Limited is registered in England and Wales under number 936683 with its registered office at Laurence Pountney Hill, London EC4R 0HH. M&G Investment Management Limited is authorised and regulated by the Financial Conduct Authority.

More Related Content...

|

|

|