|

Toby Nangle Global Co-Head of Multi Asset & Head of Asset Allocation, EMEA Columbia Threadneedle Investments |

Investing for real returns

|

Written By: Ian Mason |

Ian Mason of AEW UK looks into the arguments surrounding local authorities’ investment in property and explains how stable, long-term returns may be achieved from this asset class

Liability-driven investing (LDI) has become firmly entrenched in the pensions arena, as schemes become more sophisticated and focus ever more tightly on their ability to pay benefits as they fall due. Yet, while commonplace, LDI can be defined in a great number of ways: it can mean anything from buying an index-linked Gilt to investing in a sophisticated solution that uses swaps and derivative overlays to provide a match for known liabilities. While LDI has evolved in the corporate DB sector (where funding deficits now sit as a liability on the sponsor’s balance sheet), it has also started to influence investment thinking in the local authority universe. Some, such as Surrey County Council’s pension fund (to name but one), have gone as far as to set up an LDI platform, whereas many other schemes have tackled their long-term liabilities using outsourced solutions.

Are schemes targeting the right risks?

However, despite the trend towards LDI, where liabilities tend to be valued by reference to Gilt yields, most pension funds’ underlying liabilities are actually linked to inflation. This explains the growing demand for “real” assets, which are rightly seen as providing cash flows which are a good match for liabilities. They are particularly attractive to local authority schemes, which seek long-term, predictable income streams. Many schemes have invested in, or are considering investing in infrastructure, which has been heavily promoted as a good match for longer-term liabilities. This may well be the case, but investors do not always realise that property – a staple of many pension schemes’ portfolios for decades – can achieve the same result. In fact, long data series exist to show it has already done so.

Property is one of the oldest and most established type of real asset. It has always been an unfashionably simple asset class, but over the last 25 years it has learnt to fight its corner via bodies such as IPF (Investment Property Forum), arguing for its place in institutional portfolios. Exponents have learned to use the language of modern portfolio theory to prove property provides low correlation with, and lower volatility than, Gilts and equities, as well as better risk-adjusted total returns. For the last 35 years, property’s performance has usually been measured against one of the Investment Property Databank’s (IPD) total return benchmarks of competitor funds, bringing transparency and accountability to the sector. In an era of relative performance of growth asset classes, this allowed property to be compared with equities and Gilts – the focus always on total nominal returns.

In fact, according to IPD, property has delivered annualised returns of over 5% pa. above inflation since 1980: nominal income returns alone have been more than 6% pa. over the same period which would seem to make it an ideal match for any pension fund’s liabilities, particularly since there is no reason to believe this relationship should not continue into the future.

Property benchmark now viewed as volatile

But the benefits of property in a capital markets pricing model have now come to be seen by some as disadvantages, and property has been negatively reappraised in the LDI era. Much like equities, its role in an LDI portfolio is often disregarded because it is seen as a growth or risk asset and is therefore viewed as volatile. The current focus on matching assets has accelerated the demise of sector-specific benchmark-driven strategies in most asset classes. Diversified growth funds with no benchmark constraints have proliferated as a catch-all solution to producing equity-like returns with reduced volatility.

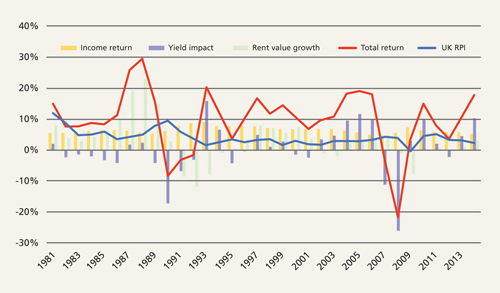

Figure 1: Aligning the real benefits of property with investor cashflow needs

Source: IPD; AEW UK

With IPD peer group benchmarking still prevalent in the property sector, scheme advisers have increasingly looked at property returns (shown as the red line in Figure 1 above) as a new element of risk within a liability-driven strategy. No matter how attractive total returns have been over the last 30 years, cyclical volatility gives today’s investor little certainty about whether liabilities will be matched.

Some schemes turning their back on property

Despite all the good which IPD has brought to the sector, a peer group benchmark offers investors little alignment with managers who are rewarded on the basis of relative total returns (positive or negative) and who have no incentive to manage volatility. In addition, the benchmark provides limited transparency on the risks being taken by different managers to achieve similar returns. The biggest risk for a property manager is underperforming the competition, which simply encourages benchmark hugging rather than forward-looking investment thinking. As a consequence, some corporate schemes have felt compelled to exit property altogether, despite still having deficits that require growth assets to fill funding gaps.

Rethinking the asset class

I believe schemes considering exiting the asset class altogether should think again. Investing in property does not have to mean investing to a benchmark.

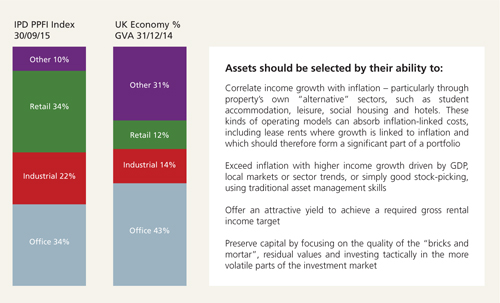

Research by AEW Europe has concluded that traditional property benchmarks have not provided the best asset mix or strategies to optimise real returns from property, particularly when this includes exposure to the more cyclical and volatile sectors of the market.1 Diversifying among IPD sector and geographical weightings alone, has offered little in the way of risk mitigation.2 Instead, assets should be selected by the criteria outlined in Figure 2 below.

Figure 2: A property portfolio should be dynamic and follow demand in the economy, not a static benchmark

Source: IPD; AEW UK

A strategy that seeks to align the benefits of property with the needs of today’s pension savers would set a long-term total real return target, rather than chasing benchmark returns and hugging sector weightings. Such a strategy would allow the management team to focus on building predictable cash flows and a sustainable income growth strategy by investing in all property sectors, rather than solely in the static IPD universe. This has the added advantage of increasing diversification and therefore reducing relative volatility. A dynamic property portfolio should, in any event, look to replicate the growth sectors of the economy, not a historic benchmark.

Long lease investments not risk-free

This strategy, it should be noted, is not the same as long lease funds, which have proved popular with many corporate schemes in recent times. Such funds usually seek only to replicate cash or Gilt-like returns, whereas many pension schemes require higher returns from their defensive growth strategies. I would argue that while understanding tenant covenants is an important part of any real estate investment process, property skills, not long leases, are better able to preserve capital and deliver sustainable cash flows. Indeed, investors who regarded property as an absolute bond equivalent received a wake-up call last year following Tesco’s accounting shock. The aftermath of the shock showed that when covenants get downgraded and demand for stores falls, the value of the property against which the lease is secured will also fall.

Even smaller schemes can access innovative property solutions

Implementing a real return strategy is relatively simple for larger schemes with a segregated portfolio. A number of schemes have already revised their property mandates from IPD to a bespoke form of LDI-style target return. However, the vast majority of smaller schemes obtain their property exposure via one or more of the long established and well-regarded pooled property funds that make up the AREF/IPD PPFI balanced funds benchmark. As the name suggests, they all have the same total return benchmark, and persuading a manager to switch performance objectives is not easy – particularly as many funds now accept non-institutional and overseas capital which invests in UK property for the cyclical total returns from traditional shops, offices and industrial premises, rather than as a match for UK inflation.

Pooled property funds have always been well supported by local authority schemes, and a strategy which adopts a liability-matching target should prove popular to the large number of pension schemes with this objective. Using AEW’s new Real Return Fund, small and medium-sized schemes can gain access to skills and property diversification that can turbo-charge their LDI strategies.

Alternative strategies can support communities

Local authorities understand the dynamics of many of “alternative” property sectors better than others, adding to the attraction of an investment strategy that seeks to embrace all areas of growing demand in the portfolio mix. The latest sector to be christened by the property industry is “social infrastructure”, which encompasses schools, municipal buildings, multiple forms of healthcare, social or affordable housing, assisted living and more. All of these lie at the heart of local authority communities. Local projects might not necessarily have the scale to attract major capital providers, but I believe that opportunities as small as £5 million are ideal for a nationally-diversified pooled fund, where “alternatives” will form a significant part of the strategy. Such a fund could, therefore, also serve an important role in delivering community projects where the manager has the discretion (based on fund objectives) to ensure fiduciary duties are safeguarded.

Conclusion: alignment is the name of the game

Local authority schemes are less likely than corporate schemes to “throw the baby out with the bath water” and exit property altogether. Nevertheless, they are increasingly seeking property funds that align with their performance objectives. They are looking to redefine their relationship with property managers and, in turn, property managers should be seeking to redefine their strategies to match the aims of their pension scheme clients.

As with most asset classes, it is possible to diversify and manage the inherent risks in order to access stable, long-term returns from property. I believe long-term, low-volatility performance depends to a large extent on the judicious use of “alternatives”, which have income streams that have low correlation with traditional property and with the wider markets. Investment firms that have the skills and resources to tap these income streams will be able to contribute significantly to pension schemes’ ability to meet ongoing liabilities.

1. A modern approach to constructing efficient inflation-protected property portfolios – AEW Europe, January 2012

2. Risk constraints in property: help or hindrance? – AEW Europe, April 2015

More Related Content...

|

|

|