Opportunity in Europe’s under-competed sale and leaseback market

|

Written By: Max Mitchell |

|

Chris Nichols |

Max Mitchell and Chris Nichols of Intermediate Capital Group (ICG) explain the benefits of sale and leaseback transactions, which have the potential to provide institutional investors with a package of long-term cash flows

European corporates’ appetite for funding continues to grow, driven mainly by mergers and acquisitions, fixed investment and the need for working capital. However, European banks, the traditional source of corporate funding, continue to face challenges from both regulators and shareholders, and corporates are increasingly open to considering alternative sources of funding. Sale and leaseback (SLB) transactions are one such source, well established in the US but part of an under-penetrated market in Europe.

What is a sale and leaseback transaction?

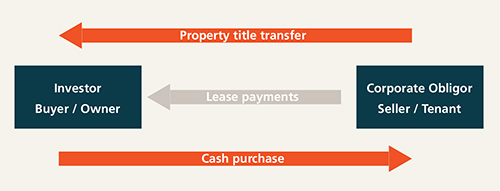

In the simplest terms, if a company undertakes an SLB transaction, it sells some or all of its real estate assets to a third party and remains in the premises as a tenant, most often via a long-term lease. Leases tend to be triple-net in nature, meaning that the lessee is responsible for repair, maintenance, insurance and property taxes.

Figure 1: The mechanics of a sale and leaseback transaction

Source: Intermediate Capital Group

Benefits of an SLB transaction

When comparing potential sources of financing, there are a number of good reasons for management teams and shareholders to consider an SLB transaction. Perhaps the most obvious is the fact that the full value of the assets can be realised, whereas capital raised by taking out a commercial mortgage would only unlock a portion of that value (typically 50%-60% of its value versus 100% with SLB). The other major consideration highlighted by shareholders and management teams is that they see SLB as a “long-term” financing solution as it dispenses with the refinancing horizon and therefore the risk associated with traditional bank financing.

Additionally, recent regulatory changes have offered potential benefits for corporates weighing up financing solutions. The European Union’s BEPS action plan includes an Anti-Tax Avoidance directive which came into force at the start of 2019 and essentially reduces the level of financial interest that can be deducted for the purposes of calculating corporate tax from 100% of EBITDA to 30% of EBITDA. Lease payments, by contrast, are operating expenses and are fully deductible. Furthermore, as a tenant, the business retains full operational control of its assets and can reinvest the SLB proceeds, for example by driving growth or paying down debt.

Market opportunity in Europe

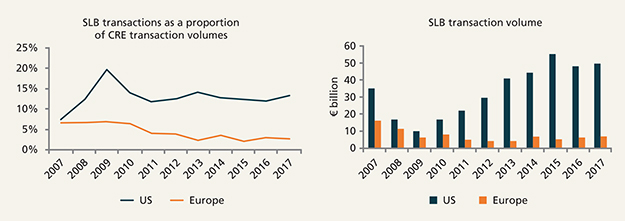

The SLB market in Europe is set to grow significantly. In numerical terms (excluding the UK) we estimate the value of the owner-occupied corporate real estate market to be €5.5 trillion. To normalise Europe to the same owner-occupation level as seen in the more mature US market would take €1.1 trillion of SLB transactions, which is significant white space for the strategy.

A fundamental part of the opportunity relates to owner occupation of corporate premises. In Europe it is high at over 69% whereas in the US, where there is a long-established SLB market, that figure stands at 50%. In our view, there is no clear structural reason for the disparity. Culturally, European companies are used to owning their own assets and because of this, tend to have more of an attachment to them. In the US, by contrast, businesses are much more comfortable with the idea of monetising their business premises in order to optimise the efficiency of their balance sheet.

Figure 2: Sale and leaseback market opportunity in Europe

Source: Intermediate Capital Group

Barriers to entry

Europe is fragmented on a regional basis, requiring great breadth of expertise in order to successfully navigate the individual markets and jurisdictions. Successful SLB investors in Europe need the necessary local presence for origination as well as local expertise in order to maximise their returns. To date, this fundamental requirement has been a significant barrier to entry for SLB investors and is likely to remain so. That said, it is unlikely that the market will remain as underpenetrated as it is now because the opportunity is so significant. Having more professional asset managers actively developing the market should help to endorse the benefits of SLB transactions to businesses that might not have considered them, thereby expanding the universe of potential deals.

What to look for in an SLB deal

There are numerous factors to consider for every SLB investment but there are three crucial factors:

- The criticality of the property to the ongoing operations of the lessee’s business. Access to and occupation of the property should be essential to the lessee company for the continued success of its business. This results in a true partnership and alignment of interest between lessor and lessee

- A strong underlying lessee which operates in an industry with a robust long-term outlook and whose financial status passes a rigorous underwriting test

- Well-invested underlying real estate which is let at market rates and is attractive to other players in the lessee’s industry, providing for an “alternate user” in a downside scenario. In the absence of an alternate user, the real estate should still be attractive to alternate lessees.

Relative returns

The mission-critical nature of the assets means that lessees are highly incentivised to continue paying rent, ahead of other obligations. The alternative is a rental default, which is likely to result in repossession and material value erosion for all stakeholders, whether shareholders or creditors. This preference to pay rent as a priority provides the landlord with “super-senior” creditor status and, consequently, strong downside protection.

The super-senior creditor status conferred on the landlord can attract higher cash yield returns than corporate loans to the same lessee, providing a return premium for the equivalent credit risk. This yield advantage can represent a significant level of compensation for the illiquidity differential between real estate and loan market instruments.

Finding the exit

Selecting the right investments should provide the landlord with the ability to either negotiate very long-term leases from the outset or utilise pre-identified opportunities to extend the existing leases. Either way, the underlying portfolio should still have long-term leases in place at exit. These leases combine to create a diversified blend of long-term inflation-protected income secured against corporates’ mission-critical real estate.

These factors aligned with the high cash-generating nature of the investment should present an attractive opportunity for an institutional investor looking for a package of long-dated cash flows.

More Related Content...

|

|

|