|

Written By: Francesco Di Valmarana |

|

& Toni Vainio |

Pantheon’s Francesco di Valmarana and Toni Vainio discuss the evolution of the Private Debt asset class and the emergence of a secondary market

In our article in the June edition of LAPF Investments we discussed the surging growth of the private equity secondary market, driven by the expansion and sheer volume of capital raised across the asset class combined with more proactive liquidity solutions sought by both Limited Partners (LPs) and General Partners (GPs) in private equity funds. Driven by precisely the same trends, a distinct secondary market is also emerging in the private debt asset class and we believe this provides an opportunity for investors to broaden the scope of their private debt allocation. In the same way that investors have allocated to secondaries in private equity, we believe there are several potential attractions to a secondary allocation for private debt, such as: the potential for lower risk through greater diversification and visibility of underlying loans at entry; accelerated deployment and yield; minimal j curve; and a possible return premium via access to loans at discounts to their net asset value.

In this article we discuss the expansion and evolution of private debt as a whole, and the emerging secondary market for private debt fund stakes. We also seek to address key questions such as: why investors are selling their private debt fund positions and thus facilitating a secondary market; the investment opportunity for buyers of these positions and, for those allocating to private debt, how a portfolio of secondaries compares to that of a direct lending fund.

Private debt evolution

Ten years ago, the private debt fund universe was almost exclusively made up of mezzanine, distressed debt and special situations strategies. After the global financial crisis, the retrenchment of banks – owing to consolidation and increased capital restrictions – led to a significant growth in private senior loan/direct lending funds to fill the void. Growth of the asset class has also been fuelled by investor demand for a premium over the returns offered by the more traditional liquid credit markets.

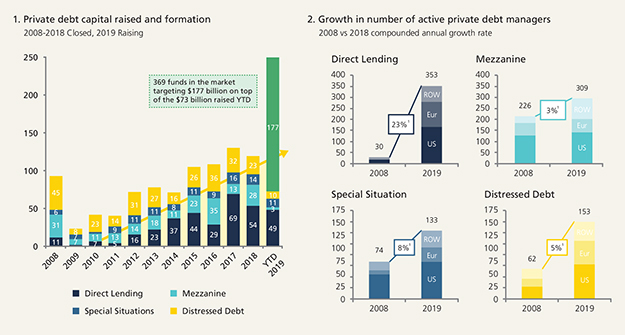

To put this in context, total global assets under management for all private debt funds in 2018 was $771 billion, up from $200 billion in 20071. For direct lending strategies alone, AUM has grown to $261 billion from $14 billion over the same period2. We don’t anticipate any slowdown to the market expansion. Preqin reports 369 private debt funds in the market seeking to raise an aggregate $177 billion ($90 billion of which is for direct lending funds)3. Furthermore, investor demand for the asset class remains very much on an upward trajectory; 95% of investors are expecting to maintain or increase their allocation to private debt according to Preqin’s annual private debt survey. Figures 1 and 2 present the growth and evolution of the private debt asset class by capital raised and number of managers, and particularly highlights the expansion in the direct lending space, which we believe is set to be the mainstay of the asset class in years to come. For a summary of fund strategies across each private debt sub-asset class please see Figure 3.

Figure 1 & 2: Private debt capital and manager universe continue to grow

1. Compound annual growth from 2008 to Sept. 2019

Source: Preqin, September, 2019. *2019 information represents private debt funds currently raising capital. Pantheon opinion.

Note: There is no guarantee that these trends will continue.

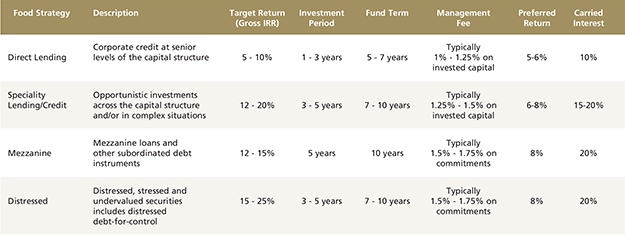

Figure 3: Typical private debt fund terms by strategy

Source: Campbell Lutyens. Private Debt, Market Overview and Update Presentation, December 2017. Figures reflects industry data and are not associated with Pantheon’s services and strategies

Fuelling a secondary market opportunity

When a private market asset class reaches a certain scale and maturity, a secondary market becomes inevitable. Private debt secondary transactions in fact already represented approximately 10% of the total market volume for secondary transactions across all private market asset classes in 2018 ($7.3 billion versus $74 billion in total, the bulk of which is, of course, private equity)4. As direct lending funds command a greater share of the overall private debt market, this is also being reflected in secondary deal flow. Of the secondary deal flow Pantheon has seen in 2019 to date, approximately 70% has been in senior/direct lending funds.

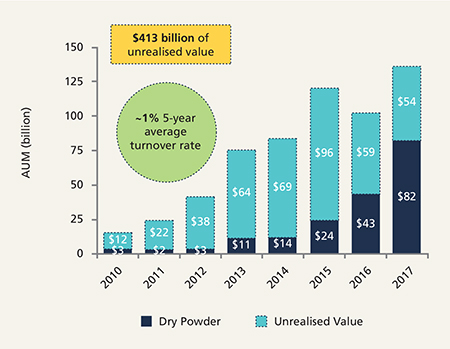

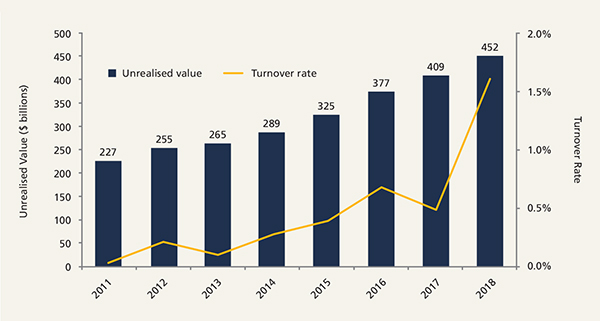

Just like in private equity, the growth of the secondary market is being driven by the twin effects of increasing scale of the overall asset class and rising turnover rates (measured as the percentage of the total unrealised value in private debt funds that changes hands on the secondary market). Figure 4 shows the dry powder and unrealised value in private debt funds of vintages 2010 to 2017 (which is all potential stock for the secondary market) and Figure 5 shows the increase both in total private debt unrealised value and in the turnover rate since 2011.

Figure 4: Private debt AUM – Vintages 2010 – 2017

Source: Preqin, September, 2019. Pantheon opinion. 5-year average annual turnover rate is calculated by dividing the annual turnover rate (private debt secondary transaction volume divided by the unrealised value of private debt funds. Note: There is no guarantee that these trends will continue.

Figure 5: Debt secondaries turnover – 2011-2018

Source: Greenhill Credit Secondaries Market Update January 2019. Pantheon analysis based on transaction volume divided by private debt unrealised value. Preqin, September, 2019.

But why sell?

Private debt funds are different from private equity funds in a number of ways, not least their shorter durations and more predictable cash flow streams. With these factors in mind it would be fair to question the need or desire to sell fund stakes mid-term. Yet, the turnover rate is increasing and we are seeing a number of situations that are motivating sellers and hence generating deal flow. For example, deals may originate from large and diversified portfolio sales (typically where an investor is rebalancing allocations or seeking liquidity) where the majority of positions are private equity funds, but where it’s possible to carve out and sell separately a sub-set of private debt funds. Another example might be an investor deciding to divest from a particular region for macro reasons, and where private debt may not be distinguished from private equity. Like private equity, more proactive and immediate portfolio management by investors is helping to fuel a nascent secondary market. It’s also worth noting that in the event of a downturn for financial markets more broadly, we would anticipate a spike in investors looking to sell to rebalance their portfolios.

We have also seen the early adoption of GP-led transactions for private debt funds (where GPs offer liquidity to existing LPs and transfer assets to secondary buyers, enabling more time to effectively manage out their positions). Again, as in private equity, we expect GP-led deals for private debt funds to grow in prevalence and contribute to the expansion of the secondary market as a whole.

What’s in it for secondary buyers?

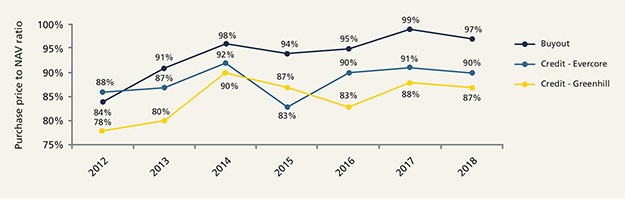

Pricing for debt funds on the secondary market tends to be noticeably lower than for private equity buyout funds, with discounts to NAV in the range of 10% according to intermediaries Greenhill and Evercore. This compares to only very marginal discounts paid for private equity buyout funds (as shown in Figure 6). We believe this points to a lack of dedicated buyers of private debt fund positions and is symptomatic of a nascent and inefficient market. Private equity focused secondary buyers might opportunistically acquire private debt positions, but we’d expect them to seek a meaningful discount at entry to meet their required rate of return. We believe this is likely to be supressing pricing for private debt funds. Consequently, we see an attractive dynamic for a secondary buyer with a private debt mandate, where the required rate of return is lower to compensate for a similarly lower risk profile. They may still be able to negotiate discounts at entry and therefore enhance the return potential, while also outbidding the private equity buyers. The effective discount can potentially be widened through another quirk of the secondary market. Typically, there is a lag of six to nine months in the time between the bid accounts date and the date the deal closes, and in a private debt secondary the yield generated over that period accrues to the buyer rather than the seller.

Figure 6: Secondary market pricing by strategy1,2 2012-2018

1. Greenhill Credit Secondaries Market Update October 2018. 2 Evercore Secondary Credit Market Overview February 2019.

Note: There is no guarantee that these trends will continue.

Why allocate to secondaries?

As we discussed in our June article, many private equity investors have consistently allocated significant capital to secondaries to complement their overall portfolio and benefit from a range of attractive features such as increased diversification, accelerated capital deployment and J curve mitigation. With the advent of a secondary market for private debt, we believe investors can benefit their private debt allocation in very much the same way.

When compared to a commitment to a direct lending fund, a secondaries strategy can offer quicker deployment and shorter durations through more immediate access to funded portfolios, increased diversification meaning that the default of a single loan should have a de minimis effect, and potentially a return premium via access to assets at a discount to NAV. Visibility of the underlying assets pre-acquisition enables the buyer to conduct detailed analysis on the underlying loans which can also potentially reduce risk. Taking all this into account, we believe secondaries offer a differentiated route to market and the opportunity for attractive risk-adjusted returns. Furthermore, with lots of investors looking to ramp up their private debt allocations, secondaries can provide a very efficient means for doing so. With these factors in mind and taking account of the maturity and scale of the private debt asset class today, we see no reason why a secondary allocation should not play an important role for investors going forward.

Conclusion

We believe a secondary market is an inevitable consequence of the expansion and maturation of the private debt asset class. We are seeing attractive opportunities for dedicated private debt secondary buyers to exploit an emerging and relatively inefficient opportunity set. While for pension funds and others, this opening market can potentially provide an additional dimension to their private debt allocations.

1. Preqin. As at September 2019

2. Preqin. As at September 2019

3. Preqin. As at September 2019

4. Greenhill Credit Secondaries Market Update January 2019

More Related Articles...

Published: October 1, 2019

Home »

Alternative Investments