Quantifying “green alpha”

|

Written By: Tim Mockett |

Tim Mockett of Impax Asset Management outlines a methodology for measuring the investment return from properties attributable to sustainability and energy efficiency

Green alpha can be defined as the premium that quantifies what proportion of total ungeared differential returns from an individual asset investment can be attributed to sustainability and energy efficiency initiatives. It is a relatively new concept but it is quickly becoming a critical metric for investors in sustainable property.

It seems logical to assume that greener buildings will generate higher returns. Supply of these assets is low and demand is growing. Sustainable buildings increasingly command a rental premium, have shorter vacant periods, slower depreciation, reduced obsolescence, and typically achieve higher capital values. But to date these assumptions have been based on estimates and anecdotal evidence. A robust, quantitative and replicable methodology has proved elusive, therefore becoming the Holy Grail for investors in this rapidly growing asset class. Investors want to know what percentage of a delivered total return has been generated from enhanced sustainability, and how to estimate it in future returns in a predictive modelling tool.

Our experience for the core plus assets that we have assessed, has shown that approximately 10-15% of the total ungeared differential return is attributable to green alpha. This percentage is likely to be greater for value-add strategies where there is a greater level of capex involved in retrofitting older buildings to meet exacting sustainability standards.

Does improving the energy efficiency of a building really add significant value over and above standard market returns?

Property has traditionally been considered a high carbon asset class and the growing scientific evidence of man-made climate change has further highlighted the investment risks. It seems inevitable that the ever-tightening ratchet of global environmental policy, and subsequent implementation of stricter policies, will impact the sector increasingly in the future, and the UK government is leading the way with some of the strictest property environmental regulations in the world.

Most new buildings are constructed to high sustainability specifications but considerable scope exists to create value for investors through adapting existing buildings from “brown to green”.

Research to date

Since 2007, a number of academic studies have been published seeking to investigate the economic value of sustainability. These have typically been conducted for a portfolio, using eco labels such as BREEAM (Building Research Establishment Environmental Assessment Methodology), LEED (Leadership in Energy and Environmental Design), Energy Star and EPC as a proxy for sustainability – and as a predictor of improved environmental and energy performance. However, comprehensively benchmarked environmental performance data are in short supply.

A totally new approach and methodology is required to generate a robust quantification of green alpha at individual asset level using actual benchmarked financial data. To achieve this, two principal data sets are needed:

- The detailed measurement and data for energy and resource use of a building

- The property investment market returns from the asset over the hold period

3 step methodology to determine green alpha

1. Energy performance analysis

Active energy management means that buildings can be equipped with the latest monitoring and measurement technology. This continuous monitoring and subsequent EPC and DEC relevant benchmarking and re-rating, corroborates energy efficiency improvements and associated carbon reductions. Data collection can begin when an asset is acquired and continues until exit. This makes it possible to identify and isolate where capital expenditure on sustainability re-fits has led to tangible operational savings.

Cost savings and sustainability key performance indicators (“KPIs”) over the holding period of the investment can then be benchmarked against the market. Department of Energy and Climate Change (DECC) energy-pricing forecasts can then be used to estimate potential future savings for the building.

Imput data

- Capex in energy efficiency measures

- Calculation of energy savings

- Benchmarking sustainability KPIs over hold period

- Property performance analysis against comparable transactions

- IPD benchmarking and JLL forecast comparison

2. Investment performance analysis

In order to isolate the impact of the sustainability-led capital expenditure on income, capital or total returns it is necessary to account for the impact of macro- and micro-economic cycles and any other market factors that could impact on the sale price of any given asset.

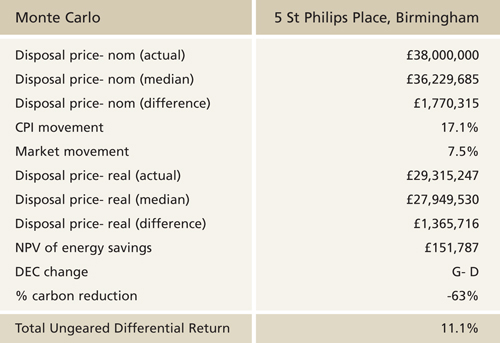

We used JLL’s databases of local rental and capital growth and yield movements over a 20 to 30 year period to account for the impacts of potential variability within the market up until the asset disposal. Using a discounted cash flow (DCF) valuation model, together with rent and yield forecasts at the date of acquisition for the local market, it is possible to use Monte Carlo simulation to identify the most likely or median exit value for the asset at any given date.

This analysis can then be adjusted for the many other possible factors that could impact returns; the greatest of which is usually inflation. To address this, both the nominal delivered returns from the asset are adjusted for Consumer Price Inflation (CPI), as are the results of the Investment Property Databank Index (IPD) over the hold period. This isolates the “real” performance differential of the asset against the market or the “alpha”.

DCF model

- Statistical analysis of 30 years of yield and rental growth data

- Comparing probability distribution curves against JLL forecasts

- Controlling for inflation and IPD market movement using real value

- Isolation of outperformance over and above the market that highlight alpha

3. Attributing green alpha

Green alpha can finally be estimated using future tangible cost savings accruing from the point of exit for a five-year period, using a Net Present Value (NPV) calculation. This NPV figure is then expressed as a proportion of the total alpha described above.

“Green alpha” total return attribution

- NPV of energy savings as % of total alpha

- Isolation of outperformance from Monte Carlo analysis

- External valuation opinion regarding overall green alpha

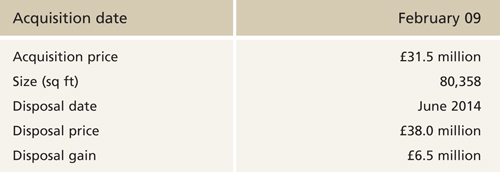

Putting it into practice – St Philip’s Place, Birmingham

An extensive sustainability audit of the building was carried out when the building was acquired in 2009. The new landlord and tenant collaborated under a “green lease” arrangement to share data and manage the building to top quartile as measured by the Display Energy Certificate (DEC) environmental standards.

At acquisition the building had a DEC of G, but within three years was re-rated to a C following an extensive retrofit. The retrofit included full re-metering of the building with the installation of half hourly data loggers and an upgrade of all the heating, lighting and cooling controls. The number of boilers was reduced with more efficient models and the building was entirely re-lit using LED lighting. A total of £700,000 was invested in the property by landlord and tenant. The carbon emissions (and energy costs) were reduced by 63% over the investment hold period. Full payback on this investment (through reduced energy bills) was achieved in less than five years.

Figure 1: Summary of investment performance and attribution of green alpha

Source: Impax Asset Management

Conclusion

Using this methodology, the hypothesis that sustainable buildings are better investments than buildings with poor energy efficiency can be quantified and proved. Investors now have their Holy Grail.

This work highlights how green alpha is predominantly created through active energy management. The remainder of the excess returns are generated by other positive externalities which are also more likely to occur with more sustainable properties. In theory, these buildings will attract and retain stronger covenants and ultimately stave off rental depreciation and rental obsolescence.

Energy cost reductions are real and quantifiable and can be expressed as a percentage of the ungeared net differential total return.

Investors can apply this method of isolating green alpha from market beta performance to any assets. It can also be used as a predictive tool to assess the probable monetary value of investment returns before commencing a retrofit or investing in a sustainable property.

More Related Content...

|

|

|