REITs, rates and real estate cycle

|

Written By: Scott Crowe |

Scott Crowe of CenterSquare Investment Management explains the reasons behind the current market concerns over Real Estate Investment Trusts, and why this could in fact provide an attractive entry point for investors

The imminent change in the US Federal Reserve’s interest rate policy has created some market uncertainty for US Real Estate Investment Trusts (REITs). Contrary to consensus fears of a Fed tightening-cycle leading to higher long-term rates, we believe the biggest risk for REITs is a widening in credit spreads driven by economic and financial instability from a flattening yield curve. This tail risk aside, however, our view is that REIT investors should benefit from a slow tightening cycle with continued low longer-term interest rates and moderate growth.

The value of a REIT is derived from the ownership of high quality commercial real estate. REITs are traded every day, while underlying direct real estate is valued quarterly at most, and hence on a daily basis the relationship between REITs and direct real estate can vary. However, over the longer term the relationship is very strong. In fact, REIT returns tend to lead direct real estate returns by approximately 12 months and the correlation between REIT and direct real estate returns steadily improves the longer the time period we examine. Therefore, an effective approach to understanding the impact of interest rates on REIT performance is to analyse the impact of rising interest rates on the commercial real estate cycle.

It is our view that the interest rate which has the most importance for real estate is the longer-term (7-10 year) cost of debt, which is the term structure underlying the majority of real estate financing. This cost of debt is extremely important to a real estate investor because the interest payment is usually a real estate owner’s largest cost variable. However, higher government bond rates also usually accompany an improving economy, which is characterised by shrinking credit spreads, growing rents and higher Loan to Values (LTVs), improving the outlook for a real estate owner. These factors historically have overcome the negative impact of an increase in the underlying risk free rate.

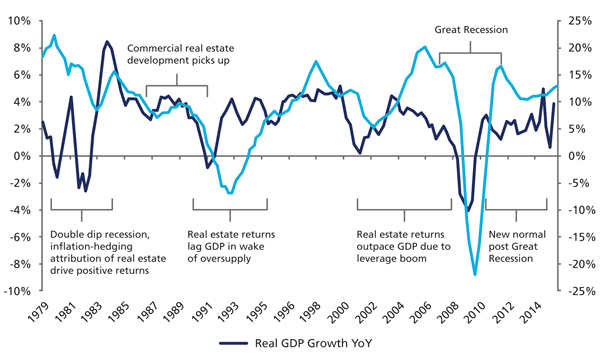

Overall, we find that commercial real estate tends to cycle closely in connection to GDP, although the relationship is not always perfect (Figure 1). We believe that unlike the last real estate cycle (2001–2007), which was short and sharp, the current cycle may resemble something closer to those of previous decades, which were over 10 years in length and had within them a number of mini cycles. Our thesis is that after a long and pronounced downturn beginning in 2008, this cycle is likely to be longer than its predecessor.

Figure 1: Commercial real estate returns and economic growth (1979-2014)

Source: Bloomberg and NCREIF quarterly data from June 1979 through June 2015

What is important this cycle?

There are three underlying trends relevant to REITs and underlying real estate that we think are important to consider this cycle: 1) a changing interest rate environment, 2) low supply, and 3) relatively high spreads between property yields and interest rates.

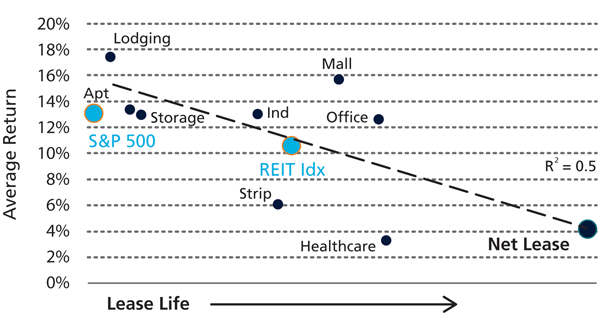

1. Changing interest rates – less about rates, more about growth

We believe that the abnormally high sensitivity of the REIT market to expectations around a changing Fed posture (such as the “Taper Tantrum” of 2013 and the “Fed Lift Off” of 2015) has been less about interest rates themselves and more about economic growth and financial stability. Historically, an increased 10-year bond yield has on average coincided with positive REIT returns (Figure 2). This is because historically, higher interest rates have accompanied an improving economy, rent growth, lower spreads and higher LTVs, which have offset higher bond yields. Hence our conclusion that a rising 10-year bond yield is unlikely to be a primary issue for real estate performance.

Figure 2: Increased government bond yields (1994-2015)

Source: Citi Research, FactSet, Haver Analytics1

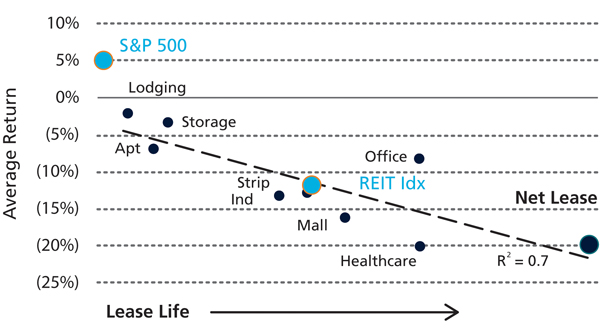

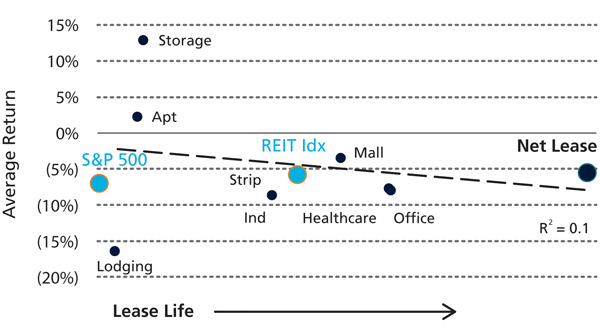

However, today the relationship between asset values and interest rates is likely to be different given the recent extended period of ultra-low interest rates. Markets this cycle are concerned that higher rates may disrupt the economy and derail the real estate markets. Figures 3 and 4 compare REIT performance to spikes in Baa corporate bond yields, which incorporate risk spreads to 10-year Treasuries. Because spreads increase due to concerns around economic growth and financial market stability, what is really driving REIT performance is concern about decreased growth and capital availability, not the level of government bond yields, which remains very low relative to historical levels. These relationships underscore our belief that total debt costs, inclusive of spread, are the key factor.

Figure 3: The ‘13 Taper Tantrum

Source: Citi Research, FactSet, Haver Analytics1

Figure 4: ‘15 Fed Lift Off

Source: Citi Research, FactSet, Haver Analytics1

2. Low supply should prolong the cycle

Current supply is unusually low reflecting prolonged risk aversion following the financial recession, and commercial real estate has not seen a supply cycle since the mid 1980s. Low supply is driving increased rental growth as the economy builds steam and this rental growth is leading to the beginnings of an increase in construction. We believe new development could mark the end of this cycle, though we are some years away from such an event given the time it takes to bring inventory to market and the need for higher rents to precede this.

3. Real estate pricing – low yields, high spreads

Real estate values are positively affected by lower interest rates. A lower cost of debt means investors have the ability to purchase real estate at lower implied yields (higher values) and maintain an attractive internal rate of return (IRR), especially relative to other investment classes, such as fixed income. The healthy gap between real estate yields and debt costs is supportive of current real estate values. This is in contrast to former cycles – such as the 2001-2007 cycle – in which debt costs rose higher than real estate yields, resulting in a “negative carry” and a tumultuous end to the cycle.

However, the current conundrum for investors is that while spreads between real estate yields and debt costs remain high and healthy, the absolute levels of yields are quite low, at levels seen at the “prior peak”. Therefore, the outlook for interest rates does matter. We believe long-term bond yields will remain low for the medium term on the back of low inflation and moderate growth, which should support a further elongation of the real estate cycle.

Although historically REITs have performed well in periods of rising interest rates, REIT markets have shown a higher sensitivity to interest rate increases in recent years. However, we believe that a gradual change in Fed interest rate policy will not likely derail the real estate cycle, which is characterised by low supply supporting fundamentals and a likely continuation of low interest rates supporting valuations. The primary driver of REIT returns over the medium term is the underlying real estate market, which currently looks healthy given a growing economy, low supply and above average property yield spreads to debt costs. We believe that short-term market turmoil in the REIT market driven by fears of higher interest rates may present an attractive entry point for investors into the real estate rate cycle.

1. Sources for selected periods: Increased Government Bond Yields chart includes Oct 93-Dec 94, Feb 96-Sep 96, Oct 98-Feb 00, Nov 01-Apr 02, Jun 03-Jun 04, Jun 05-Jun 06, Jan 09-Jan 10, Oct 10-Apr 11, May 13-Dec 13, Apr 15-Sep 15; Taper Tantrum refers to the period of May 13 through Dec 13; and Fed Liftoff refers to the period of April 15 through September 15.

More Related Content...

|

|

|