Secure Income Assets

|

Written By: Alex Carpenter |

Local authority pension portfolios stand to benefit from both the matching and growth characteristics of alternative, income-producing assets, says Alex Carpenter, Managing Director, BlackRock’s UK Institutional Client Group

Local Authority pension funds (LAPFs) are increasingly using government bonds, swaps and corporate bonds to match future fund liabilities. However, today these traditional “matching” assets are expensive relative to history, and many funds are reluctant to increase their allocation to such assets.

Secure Income Assets (SIAs), described below, have similar characteristics to both traditional “matching” and “growth” assets, and can be used to match liabilities at a significantly higher real yield. These assets also offer diversification benefits for LAPF portfolios.

What are SIAs?

SIAs are generally defined as assets that produce a predictable income stream of long-dated, fixed or inflation-linked cashflows, secured against underlying assets. Default and recovery rates can be clearly ascribed to each SIA using a credit assessment of the underlying asset and SIAs have a high probability of payment of cashflows at a pre-specified date. Examples of SIAs include long lease property, senior infrastructure debt and senior commercial real estate debt – refer to page 39 for more information on the attributes of each asset class.

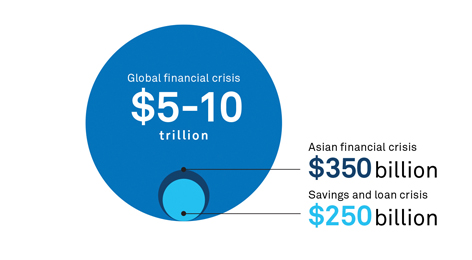

Banks have traditionally originated and provided funding for these assets, but in light of stricter regulatory capital requirements in the wake of the financial crisis, and a challenging banking environment, they continue to pull back (Figure 1). We believe that this is creating an opportunity for institutional investors such as LAPFs to gain exposure to these assets at attractive levels.

In today’s market environment, SIAs typically have the following attributes:

- Higher yields than traditional matching assets due to:

- The illiquidity premium paid to SIA investors (i.e. investors can demand higher yields given the long-term nature of SIA investments)

- Greater credit risk

- Cashflows that are explicitly linked to RPI, CPI and LPI inflation1

- Characteristics similar to both matching and growth assets (Figure 2)

Figure 1: Projected scale of bank deleveraging in the wake of the global financial crisis compared to that of other financial crises

Source: BlackRock estimates as of December 2012.

Inflation matching using SIA’s

Many UK pension funds have liabilities that are explicitly linked to levels of RPI and CPI inflation, as well as various “flavours” of LPI inflation, most commonly LPI(0,3) and LPI(0,5). While the RPI inflation market is well developed, the CPI and LPI inflation markets are noticeably less so.

However, SIAs can generate cashflows that are explicitly linked to RPI, CPI and LPI inflation. Long lease property assets, for instance, can provide cashflows that are contractually obliged to rise with one or other of these inflation measures, and LPI inflation-linked contracts are common. Similarly, from 2014, newly-constructed renewable energy infrastructure assets will provide cashflows that are explicitly linked to CPI inflation. Assets such as these allow pension funds to directly match liability cashflows linked to these more uncommon inflation types.

Liquidity risk

LAPFs may be faced with an unexpected need to pay out benefits, or to post cash or government bonds as collateral or margin. The need to free up cash or sell assets could incur costs or disrupt an investment strategy. This is known as liquidity risk. In light of the long-term nature of SIA investments, it’s essential to balance an appropriate allocation to SIAs with the fund’s ability to meet unforeseen liquidity requirements.

Assessing the appropriateness of SIAs for a portfolio

Not all income-bearing assets are SIAs. Even if the cashflows can be considered secure, certain characteristics would make an asset less appropriate for matching purposes. These include: issuer optionality to change terms, prepayment risk (risk of redemption prior to maturity), linkage of cashflows to price or production, or any uncertainty in cashflow timing.

Income assets with these characteristics can still play a key role as part of a diversified asset portfolio, but are more appropriate for other parts of the portfolio than the matching portfolio.

Exploiting a range of investment benefits

SIAs have similar characteristics to traditional matching assets and can be used to match liabilities at a significantly higher yield than traditional matching assets, due to current bond prices and taking greater liquidity risk. These assets also allow pension funds to diversify their portfolios.

Certain SIAs provide cashflows that are directly inflation linked, with a variety of underlying indices available. An appropriately-sized investment in SIAs should take account of the liquidity requirements of the fund. BlackRock has assisted clients in both sourcing and incorporating SIAs into LDI portfolios.

1. RPI and CPI inflation are inflation measures linked to the Retail Price Index and consumer Price Index, respectively. LPI is Limited Price Indexation, and typically references either RPI or CPI with caps and floors. for instance, LPI (0, 5) describes the inflation implied by RPI, but subject to a minimum of 0% and a maximum of 5%.

More Related Content...

|

|

|