The attraction of the unloved

|

Written By: Shaun McWilliam |

Since the financial crisis a flight to safety by domestic and international investors has led to substantial investment in UK prime real estate assets, mostly in London. In contrast, investors have eschewed lower quality secondary properties. This is changing, creating an opportunity for investors

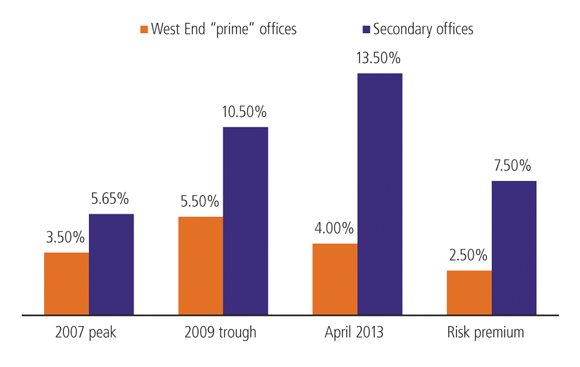

We believe that the UK secondary property market offers a compelling opportunity to buy fundamentally good assets at double digit yields. For example, yields in secondary offices are averaging 13.5%, compared to just 4.0% for prime offices. We believe this historically wide pricing gap will narrow significantly over the next few years. Looking at the yield spread between prime and secondary assets, the market is now rewarding risk and selective stock picking, providing an opportunity for active fund managers with experience in the secondary market.

UK banks under pressure

UK banks are under increasing pressure to reduce their balance sheets and cut their property exposure. As a result they are shedding “unloved” property assets and limiting commercial lending to the sector. As a result properties are becoming available at attractive prices at a time when real estate debt is more scarce and expensive than in the past.

Other sellers include private equity funds, many of which have acquired debt packages from banks, and other distressed borrowers. In all cases the relationships with both the banks and their borrowers are crucial to finding and executing transactions. The reputation and credibility of the property investor are key, since sellers want confidence that the transaction will take place, and in many cases with high levels of discretion.

Figure 1. A significant divergence between prime and secondary yields

Source: CBRE. Liberium Capital, April 2013.

Targeting the secondary market

At Kames Capital our focus is on identifying good quality secondary assets in the UK. Our investment rationale is based on five principal market drivers:

- 1. The market pressure on UK banks is creating opportunities

- 2. Domestic and foreign investors have tended to favour prime and super prime assets

- 3. The market yield spread between prime and secondary assets is at an historic high

- 4. A market which is rewarding risk, but this needs careful assessment

- 5. The yield spread compared to fixed income assets is at record high

We favour properties in the £2-10 million size range, as these are too large for most private buyers but too small for most institutional investors. We look for off-market or mis-priced properties, and those offering attractive value or active management opportunities for enhancing capital and rental value.

By targeting properties within this range, we aim to benefit from highly attractive yields and greater diversification than would be achievable from investment in super-prime properties in London.

Finding value across the UK

We believe that outside the prime London markets, return prospects are more attractive than they have been for many years, primarily due to the attractive income returns that are available. Investors are increasingly willing to move up the risk curve towards the secondary property market, this coinciding with the improvement in the wider economy.

Despite a slight hardening of yields in the secondary market, in some cases leading to excessive property seller aspirations, we believe there remain a number of distressed borrowers under pressure from their banks to unwind portfolios. Furthermore, the banks themselves still have a need to sell down property portfolios from their own balance sheets, a process that is expected to take several years.

We believe our strategy is increasingly replicated by others with the entry of a number of competitors into this space in recent months, although it is vital for investors to seek managers with experience in the sector, stock selection being the key to delivering outperformance. We believe there are still plenty of opportunities in this part of the market away from the prime London and big city sites favoured by many investors. However, making the most of these opportunities requires significant experience and stock-picking ability, to not only identify the right properties but to also manage them to maximise their potential – and determine the best time to sell.

The benefits of active asset management

The active management of secondary property assets can help deliver superior returns for investors, such as through extending leases, letting vacant space and refurbishments. At Kames Capital we manage, which includes cash flow forecasts, rental growth forecasts, tenant analysis, an analysis of income profile such as lease lengths and breaks, and void analysis. The strategic business plans reflect our team’s entrepreneurial approach, and many of our recommendations reflect asset management or value protection initiatives.

Our current positioning

We are already seeing the beginnings of a substantial shift in the investment market for secondary property. The quarter to the end of June saw a significant increase in demand, risk appetite and deal volumes. This increase in demand is leading to a more limited supply of stock, which is why it is vital to have managers experienced in this part of the market, which is very relationship driven.

Due to the changes in sentiment which we are seeing in the market, we advocate a rotation into property to ensure investors are more fully invested and positioned to enjoy the recovery in capital values that we forecast. While the economic and political fundamentals remain challenging – and quantitative analysis suggests it should take time for property values to recover – it would not be a surprise to see a rapid initial snap-up of capital values as pricing reflects the changed sentiment.

Our four core beliefs

- Returns over the next five years will be determined by asset specific factors rather than “sector” factors. In this environment it is vital for stock selection and asset management to create value, while portfolio structure will be less influential.

- The discount of secondary pricing relative to prime pricing has opened up to an extent that is too great. We regard good secondary property as an attractive (but selective) buying opportunity within a rigorous asset-specific stock selection process.

- Buy income, as the search for yield and income will remain with the markets for some years. So for a secure, sustained income yield – which over the long term is two thirds of the total return for a core property investor – property is attractive.

- We have some concerns about the potential overheating of pricing for prime “trophy” assets. At today’s pricing, we do not believe they will deliver attractive long-term returns compared with good secondary assets that carry more specific risk.

More Related Content...

|

|

|