|

Written By: Alistair Dryer |

Alistair Dryer of LaSalle Investment Management’s Global Partner Solutions explores the benefits of going global and how to do it

Two of the stated criteria for the pooling proposals submitted back in 2016 were to achieve benefits of scale, and to lower costs. A key question for the pools is how to best achieve these aspirations for their property allocations. In theory, the scale element will be comfortably realised by the pooling of the constituent schemes, with real estate allocations likely to be in excess of £1 billion for most of the pools, and in some cases closer to £3 billion. That said, in practice, given the variety of current property management arrangements, the pools are not all taking the same approach, with some existing real estate allocations being managed on an “as is” basis rather than being truly pooled. The cost savings can be achieved by simply going down the route of ensuring that the management of the assets is at the lowest fee basis possible. So, whilst the costs of setting up such pools (office costs, regulated entity, back office suppliers and employees etc) now mean that the payback is being pushed out further into the future than previously projected, there could theoretically be some quick wins. We would argue that with scale also comes opportunity, and that the fee considerations are more nuanced for property than some of the other asset classes.

The scale that comes with pooling offers the opportunity to adopt a best-in-class approach that we see with other global sovereign and pension funds in how they allocate their real estate investments. These funds have moved away from “one size fits all”. They blend their real estate exposure with the simple aim of getting best-in-class investment managers that will invest smartly for them. The client and its advisers may set the strategy for the real estate allocation; but what we see is that they want to invest in global cities, in emerging sectors and with good operators. Some of these mega pension schemes have investment scale such that they can buy direct real estate globally; but most will also invest in funds and/or via joint ventures and co-investments, especially for non-domestic allocations.

These smart funds look at their real estate exposure through a variety of different lenses; they may want an element that is a real estate proxy for an index-linked Gilt in their home market and also overseas; they may want some high yield real estate to assist with paying pensions; they may want a growth element, perhaps through developments that will be completing in some future time and will provide some capital growth. They may want their real estate to provide absolute or opportunistic returns and so will invest in such strategies. They may want some tactical investments through the listed property securities (typically via REITs – Real Estate Investment Trusts); or they could be looking for real estate debt as a fixed income alternative. They will want diversification by location and geography, so reducing local investment bias. The idea that their real estate exposure should be looking to simply out-perform their local MSCI real estate benchmark is “old hat” – they want their real estate allocation to do different things for their overall portfolio.

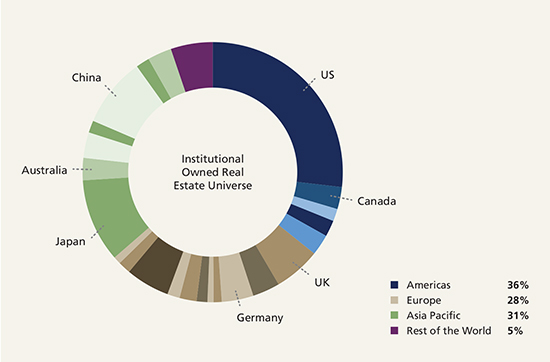

We calculate that the UK real estate market represents around 6% of global institutionally owned real estate (see Figure 1 below); so, if an investor was only investing in the UK commercial property market, then a huge element of the global market is not being considered by them. While many smaller UK institutions can satisfy their property allocations by investing domestically, for the very largest – which will now include the pools – a larger investment universe becomes both feasible and, potentially, attractive. Some of the local authorities have already recognised this and sought the greater diversification and wider opportunity set that investing globally can offer.

Figure 1: Institutionally owned real estate universe

Source: LaSalle Investment Management Global Real Estate Securities, Oxford Economics, Citigroup, Bloomberg, NCREIF, MSCI, Investment Property Forum (UK), National Bureau of Statistics of Chine, US Bureau of Economics Analysis, US Federal Reserve, Company financial statements. Estimate as of November 2018.

As we saw during the Global Financial Crisis, global investment cycles can be correlated for asset classes and commercial property is no different. However, there are also specific issues that impact individual real estate markets, as we are finding in the UK with regard to the uncertainties surrounding the Brexit negotiations – so over most periods real estate markets globally are not well correlated and this can be beneficial for a global investor.

Large global investors have generally found that trying to invest globally with a small team based in their domestic country is a sub-optimal way to invest for their beneficiaries – real estate is a local investment play where you need to have a good global coverage of experts who know the markets and can provide one with good investment expertise. We believe it is important that investors regularly review the global macro outlook and the implications for real estate investment, and keep this in mind when considering global portfolio construction and investment risk-return styles.

In short, the pools’ real estate allocations should be considered on a global perspective. No UK pension scheme is investing only in UK Gilts and UK equities, as to do so would be to target a very narrow investable universe. Commercial property should be considered no different to these markets. There are only a few truly global real estate investment managers that invest across the public and private quadrants of real estate for their clients, be it real estate debt, real estate equities, direct real estate equity investing or via real estate funds.

Arguably, the pools could decide that the lowest cost way for them to access property, both locally and globally, is through an Exchange Traded Fund (ETF) investing in REITs – the fee here will be lower than the lowest a real estate fund manager would be able to charge. The downside of this approach is that REIT investing adds short-term equity volatility, some corporate governance issues and historically higher levels of debt on such listed vehicles. However, over the long term there is some correlation with the direct real estate market performance, but this is not the case over the short term.

Fees are an emotive issue in any form of business, investment managers have historically not covered themselves in glory in showing value for money for clients; with expensive offices and other largesse. There needs to be a fine balance and most investment managers have been cognisant of these issues, with LGPS funds being beneficiaries as investment manager fees have fallen considerably for all asset classes managed on their behalf. Arguably, much has already been done in this arena and many of the LGPS funds have successfully negotiated lower management fees.

However, real estate assets are all different and by their very nature require active asset management. By reducing fees in property mandates to their lowest level, this will drive the schemes to be holders of direct real estate assets that will, not surprisingly, be passively managed. The incumbent fund manager will not be rewarded to undertake complex and challenging real estate investments, such as refurbishments, developments and site assembly as the fee basis on the scheme cannot countenance all but simply a “buy and hold” strategy. Passive “tracker” investing has merits in certain asset classes, but to generate strong returns from real estate one needs to be an active manager. Indeed, the heterogenous nature of real estate means passive management analogous to that achievable in equities via index-tracking is not only not advisable, it is not feasible.

So, if the approach is the “lower the fee, the better”, then this is counter to the philosophy of creating the pools; which were, at least in part, designed to better the urban environment in the UK and create long-term value and improved performance for the beneficiaries.

Looking across the globe, we at LaSalle do not see any other government pension schemes that have an overriding objective of paying as little as possible. The underlying beneficiaries of the pools want to see their pool investments performing strongly; the pools have a fiduciary duty to their clients: the LGPS funds and their beneficiaries and future pensioners. High fees do impact returns, and this is well documented. The counter to this, as Project POOL put it in its 2016 report, is that “the benefits of seeking the lowest possible fee for the provision of services in respect of physical assets where quality is a factor should also be considered. A willingness to pay (slightly) higher fees may give access to more experienced people and could represent the difference between an asset being let and an asset remaining vacant.” We hope that the drive for cost reduction does not see managers judged solely on how low they can get their fees without balancing this with the service, strategies and performance they can deliver at that level of remuneration.

More Related Articles...

Published: December 1, 2018

Home »

Alternative Investments