The case for actively managing currency hedging

Comment

|

Written By: Arnaud Gerard |

Arnaud Garard of Pareto outlines the benefits of currency hedging and examines the advantages and disadvantages of an active approach

As investors increase their allocations to foreign investment, currency translation risk consumes an ever larger proportion of their total risk budget. We believe it is very important for international investors to address currency translation risk separately from currency alpha allocations.

For institutional investors whose liabilities are denominated in their local currency, gains or losses from currency translation risk coming from their international investments can have a greater impact on the total portfolio than gains and losses associated with most allocations to traditional asset classes or absolute return programmes. Once investors recognise the importance of managing currency translation risk, they must decide whether to take a passive or active approach. We believe passive approaches can result in imperfect hedges based on crude mean-variance calculations that rely on uncertain estimates of key variables and do not account for changes in market environments and correlations. These can lead to large interim losses. By contrast, we believe active hedging is a more effective approach towards managing currency translation risk as it allows skilful active managers to adjust a portfolio’s currency hedges as the macroeconomic environment changes, reducing cash flow demands for the investors. The following discussion looks at what we believe are the limits of passive hedging approaches, and why we think active approaches can be more effective.

Currency translation risk versus currency alpha risk

International investors hold two types of currency risk: currency translation risk and currency alpha risk. We believe they should manage these risks separately. Currency translation risk is a by-product of foreign investment. Investors gain from the diversification benefits of holding foreign assets, but they are typically exposing themselves to the currency translation risk that comes with it without expecting to be compensated in the way they would expect to be with other forms of market risk. Yet exchange rate movements generate losses and gains that can have a significant impact at the total portfolio level.

By contrast, currency alpha risk involves a deliberate attempt to add value with currency absolute return or global macro strategies. Active managers of these strategies are paid to increase the amount of currency risk in a portfolio in an attempt to increase returns. These strategies are often part of an investor’s allocation to “alternative investments”. However, they in no way help with managing currency translation risk.

Significance of currency translation risk

We believe the issue of currency translation risk is growing in importance as investors take a harder look at how efficiently their risk budgets are being spent and how well they are meeting their liabilities or achieving other investment objectives. By decomposing risk exposures in a portfolio, it is possible in our view to compare the expected returns of each kind of risk. Looking at portfolios from the point of view of risk exposures rather than asset class exposures quickly highlights the prominence of currency translation risk. For example, a portfolio with a 20% allocation to foreign assets contains a 20% exposure to the movements of foreign currencies. This unrewarded risk can have a major impact at the total portfolio level. If we look, for example, at what happened in a year of relative dollar strength like 2005, we see that a MSCI EAFE portfolio would have suffered a 15.8% currency loss when translated back into dollars. Doing the maths, this would have caused a 3.2% loss at the total portfolio level, potentially wiping out all alpha generated by active managers in the entire portfolio. By contrast, with the same MSCI EAFE portfolio, the relative weakness of the dollar in 2003 would have resulted in a 19.0% currency translation gain, with a positive impact of 3.8% on the total portfolio.

These fluctuations highlight the importance of implementing a welldefined hedging policy at the total portfolio level to manage this currency translation risk. Note that we evaluate that risk in terms of the cumulative loss that can be sustained over a given period rather than the standard deviation of returns. We think this is a more realistic definition of that risk since, for example, it is quite possible for currency movements to generate a 5% loss over the course of a year without having a noticeable impact on the volatility of portfolio returns.

Active versus passive hedging

Once investors have accepted the need for hedging currency translation risk, they need to decide if they will take an active or passive approach. A passive approach or static hedge has the advantage that it is relatively straightforward to implement. However, although it can reduce currency losses, it equally reduces the opportunity to make currency gains, so there is no expected return from this activity. There are also implementation costs and the costs of managing the generated cash flows needed to fund currency derivatives. A larger problem involves the difficulties of identifying an optimum passive hedge ratio for a portfolio, as the calculations are based on variables that are very difficult to estimate with any degree of certainty a priori and can change as macroeconomic conditions change.

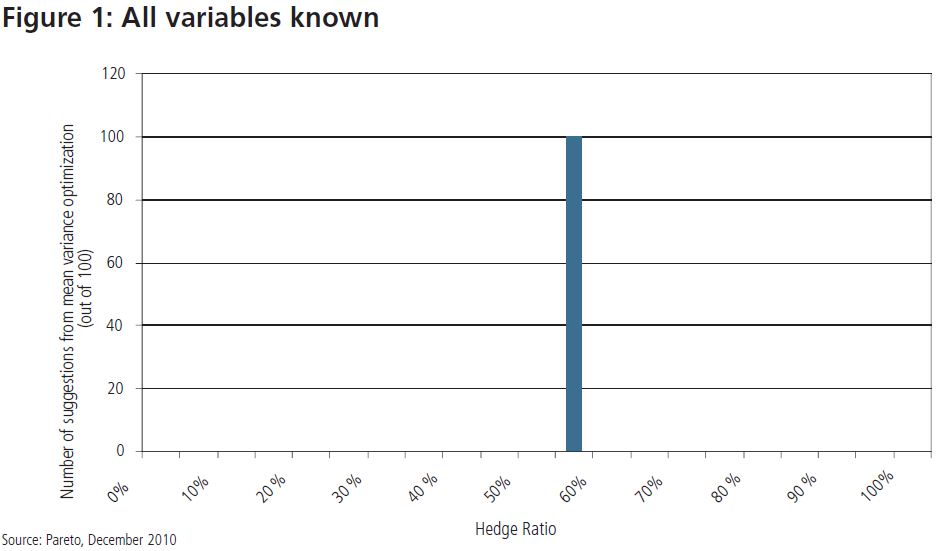

The usual approach to calculating a passive hedge ratio for a portfolio involves estimating the mean return and standard deviation values for both a fully hedged portfolio and an unhedged portfolio, and calculating the correlation between the two. Running those three variables (mean returns, standard deviation, correlation) through a mean variance optimisation process will yield an estimated optimum hedge for the sample portfolio. For example, if we take a portfolio that is allocated 60% to equities and 40% to bonds, and assume a mean return of 10% and a standard deviation, or volatility, of 12% for the unhedged portfolio, and a mean return of 2% and volatility of 9% for the fully hedged portfolio, with a correlation between the two of -0.2, a mean variance optimisation calculation would propose a 58% hedge ratio for an optimal passive hedge, as shown in Figure 1.

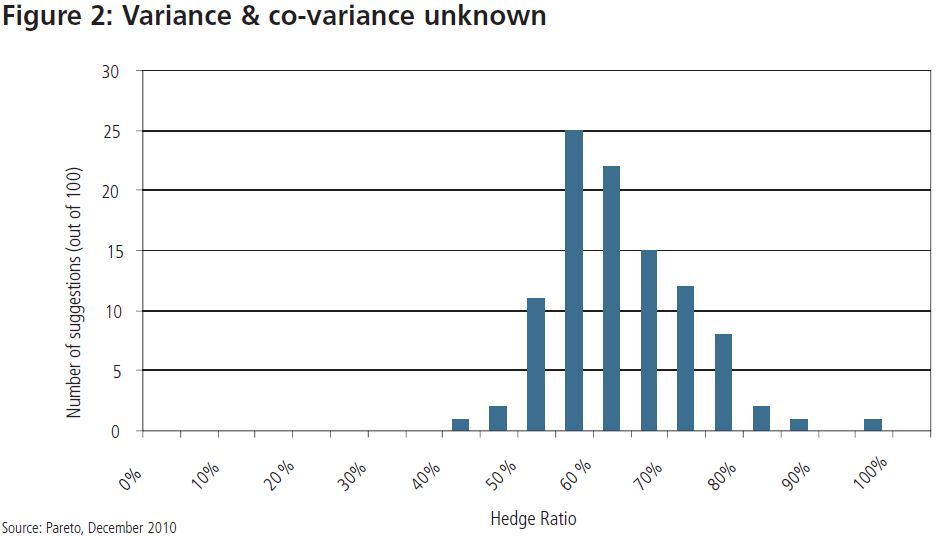

But the above exercise assumes that we are confident of our estimates of the mean return, volatility and correlation or covariance of the fully hedged and unhedged portfolios. In the real world, volatility and correlations can be highly unstable. If we acknowledge that uncertainty in the mean-variance optimisation process, the results will encompass a much broader range of optimal hedge ratios, as shown in Figure 2.

Already, our calculations call for a fairly broad range of “optimal” hedges from 45% to 95%.

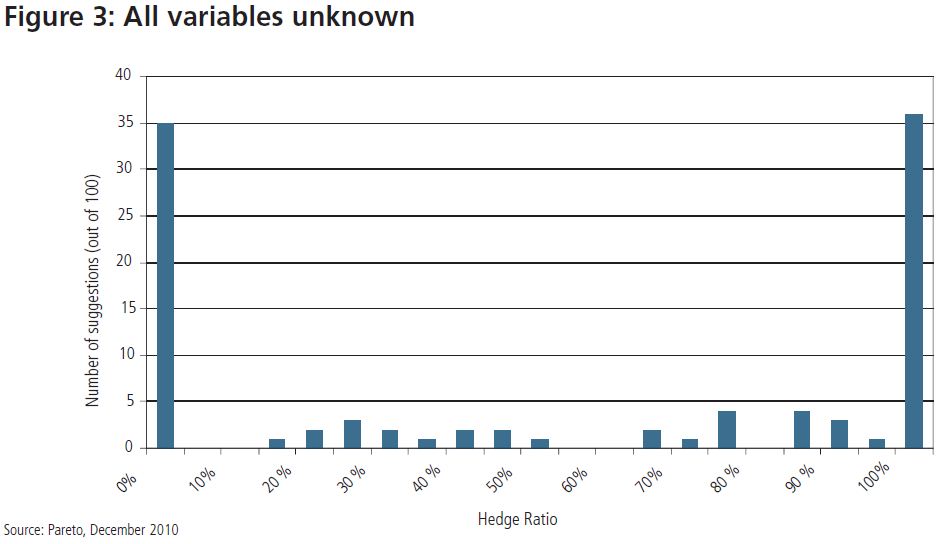

But if the recent financial crisis showed us anything, it is that estimates of mean returns, volatility and correlations can be highly inaccurate in times of market stress. By assuming floating values for our variables (mean returns, volatility, correlation), the optimisation process results based on 100 random iterations call for a static hedge from 0% to 100% (Figure 3).

Recent history has illustrated the reality of this possibility of unstable variables. Figure 4 shows the returns of MSCI World ex EMU compared with the 12-month and 36-month correlations between fully hedged and unhedged portfolios.

You can see that short-term and long-term correlations of market and currency were relatively stable around -0.6 during the period shown. But this correlation dramatically broke down beginning in 2008 in the midst of the global financial crisis. Using those historical variables, we see in Figure 5 that the mean variance optimisation process would have yielded the optimal hedge ratio results in the following chart showing an overwhelming preference for either 0% or 100% hedge position in order to maximise the information ratio of the portfolio.

These results highlight the principal drawback of using the traditional mean variance approach to calculate a static, passive hedge ratio: in times of market stress the recommended policy hedge may position the portfolio at precisely the wrong point, given changes in currency markets. If the sample 60/40 portfolio had been passively fully hedged in 2003, it would have led to a loss of 3.8% for the total portfolio, while an unhedged position in 2005 would have caused a total portfolio loss of 3.2%.

The case for an active approach

We believe a pragmatic solution to the limitations of static hedging policies is to adopt an active approach, which aims to adjust the hedges proactively as the environment changes. The analysis shows that selecting the middle ground will likely lead to interim losses. We believe there is no perfect benchmark that can satisfy all constraints all of the time.

In practice, an active approach acknowledges the strategic/static benchmark, but will lean toward reducing the negative cash flows (by decreasing hedges during a weak base currency environment), while protecting against a strong base currency by increasing the hedges. By varying the hedge in this way, there may be the opportunity to add value over time, as well as to improve the efficiency of managing currency translation risk. For pension plan sponsors concerned with funding status and meeting liabilities, this may mean a more efficient use of risk budgets. As more institutional investors focus on spending their risk budgets wisely, we believe an active approach to currency translation risk should be carefully considered. As investors increase their allocations to foreign investment, currency translation risk consumes an ever larger proportion of their total risk budget. We believe it is very important for international investors to address currency translation risk separately from currency alpha allocations. For institutional investors whose liabilities are denominated in their local currency, gains or losses from currency translation risk coming from their international investments can have a greater impact on the total portfolio than gains and losses associated with most allocations to traditional asset classes or absolute return programmes. Once investors recognise the importance of managing currency translation risk, they must decide whether to take a passive or active approach. We believe passive approaches can result in imperfect hedges based on crude mean-variance calculations that rely on uncertain estimates of key variables and do not account for changes in market environments and correlations. These can lead to large interim losses. By contrast, we believe active hedging is a more effective approach towards managing currency translation risk as it allows skilful active managers to adjust a portfolio’s currency hedges as the macroeconomic environment changes, reducing cash flow demands for the investors. The following discussion looks at what we believe are the limits of passive hedging approaches, and why we think active approaches can be more effective.