The energy transition and the stranded assets debate – an investment risk or opportunity?

Published: December 1, 2014

Written By:

|

Cathrine de Coninck-Lopez |

Cathrine de Coninck-Lopez of Threadneedle looks at the potential impact of steps taken by the global community to mitigate climate change

Current dynamics in the energy sector point to several challenges for expensive oil and high emission coal that could lead the world to be much closer than ever before to a lower carbon future. This is driving serious questions for the investor community about which companies or sectors are investment opportunities and which present increased risks, and over what time frames.

The starting point of the energy transition and stranded asset debate is whether the world is finally at the point where economics is driving systemic change in the energy sector. In the business-as-usual scenario, energy-related CO2 emissions are likely to increase by 20% and lead to “dangerous levels of climate change”. Current trends however could lead us to be closer than ever on the path towards the 2°C global warming that climate experts have set as the goal for 2050. The idea that some oil and gas assets become uneconomic in this low carbon future is what is referred to as “stranded asset”.

Although most institutional investors still dismiss the idea of divestment from the oil and gas sector, some take a tough stance on climate risk to the economics of traditional fossil fuel energy sources. First movers such as the Rockefeller Brothers Fund said at the UN summit in late September, that it would divest assets in fossil-fuel energy. Several European investors (AP2, StoreBrand) have also put oil sands and coal-based assets on their exclusion list. Other institutional investors are actively considering these risks while also looking for opportunities under the “Energy transition” theme. MSCI have launched low-carbon and fossil fuel-divestment indices to support new investment product solutions in this space.

This article explores three dynamics in global energy that point to a lower carbon future. The regulatory trend is supportive for lower carbon energy both in the EU and China; the shale gas boom in the US and low gas prices are putting the country at a substantial competitive advantage; and oil prices currently at $55/barrel have declined from their previous levels of $100/barrel more dramatically and more rapidly than expected by most. This leads to investment opportunities across the spectrum of solutions that support the energy transition journey.

Five key points

- 1. Dynamics in energy transition are changing faster than most expected

- 2. Oil sands could already be “stranded” today

- 3. Regulation is supportive of lower pollution solutions, renewables and grid transmission

- 4. The shale boom in the US is driving innovation in technologies from exploration to trucks

- 5. Investors are actively seeking out investment opportunities for energy transition

Regulatory support to environmental solutions, lower pollution and better grid connections

China and the EU have led the way so far on environmental regulation. The US Environmental Protection Agency’s proposed 2030 rule, targeting a 30% reduction in greenhouse gases by 2030 from the power sector only, against 2005 baselines, is also a step in the right direction, although highly vulnerable to a change in Federal level leadership.

The EU 2030 climate targets were approved mid-October and highlights include: greenhouse gases to be cut by 40% from 1990 levels by 2030; renewables should be at least 27% of the energy supply by 2030; energy efficiency improved by at least 27% from business-as-usual levels; and, to target an increase in grid interconnections between Spain and Portugal to 15% (current target of 10%). Similarly, Red Electra, the Spanish grid provider, has received EU support of €225 million towards improving grid connections between Spain and France in order to offload some of the excess solar capacity from Spain. Energy efficiency continues to be important for European growth and there are several investment opportunities, particularly in building products and industrial applications. EU CO2 allowance units (EUAs) received the regulatory clarity well and increased the carbon price by 4% to around €6.40.

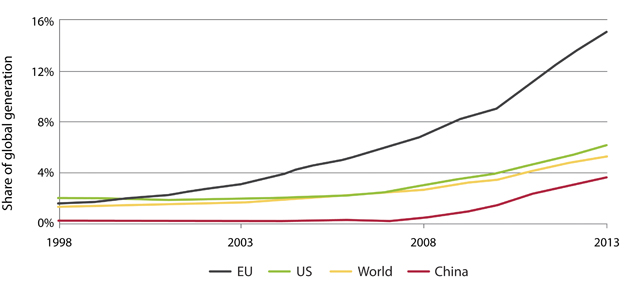

While the CO2 price is too low to be a meaningful incentive, it is noticeable that renewables’ share of global generation stands at 6%, but this grew at its fastest rate in 2013, at 16%. In Europe, renewables make up 16% of energy, and the target of 20% by 2020 is expected to be reached, as well as the 27% by 2030. In this space, onshore wind is the most exciting global story, and there has been strong growth in the US, India and Brazil. The offshore-wind story also has a lot of potential and has largely been driven by the UK, Germany and China. Solar is mostly an Asian story, and the region is expected to account for 50% of global demand. Local players are the most attractive in this space, although corporate governance concerns are widespread in the sector.

The Chinese government has declared a “war on pollution”, and with the updated Environmental Law, and the Air Pollution Action and Prevention plan, the Chinese recognise that air pollution is on average 10 times the recommended level by the World Health Organisation. Companies are having difficulty retaining and attracting international talent, and the health impacts have been estimated at $200 billion pa. to the Chinese economy. It is also amongst the top issues on the list of concerns for the Chinese. New cleaner coal standards will come into effect on 1 January 2015, focusing on reduced ash and sulphur content, most likely “stranding” a proportion of domestic coal production. At the same time, air pollution regulation poses an opportunity for new technologies such as electric vehicles, because fuel standards are tightening and there is a real demand for cleaner vehicles. Companies such as BMW that have the new luxury electric vehicle range, Johnson Matthey that provides catalysts in cars, as well as ABB that are instrumental in enabling charging technology and supply points, are all vocal about the opportunity in China.

Figure 1: Renewables share of power

Source: BP statistical scenarios 2014

The shale gas boom in the US is dramatic and has driven a competitive advantage

The shale gas boom in the US has driven the US gas price to $4/MMBtu. While environmental groups, local community groups and investors have been concerned about the way in which the fracking industry has developed with limited regulation and excessive use of water with potentially harmful chemicals, the USA’s carbon emissions have declined by 450 million tons, or 13% since 2005. Indeed the International Energy Agency and scenarios drawn up by Shell and BP all recognise gas as the transition fuel between coal and renewables.

With these developments, there has been a drive by the service providers to innovate and provide more resource-efficient technology. For example, Schlumberger has a HiWay product which increases production by 20%; reduces proppant by 40% and water by 25%. In addition, the major players state that they are starting to use trucks and rigs driven by compressed natural gas or liquefied natural gas (CNG or LNG) to reduce the overall footprint of their operations. According to the National Renewable Energy Laboratory, CNG trucks now include 11% of trucks offered compared to 6% previously. GE and Chesapeake for example have announced that they collaborate on fuelling stations for CNG, while Volvo has a partnership with Shell to run trucks on LNG. On an energy-equivalent basis, natural gas emits 30% less carbon dioxide and 80% less nitrogen oxide than burning coal so, assuming methane leakage is contained, it is a lower-emission solution for transport.

Rapid decline in oil price is potentially causing oil sands to be “stranded”

In the Q3 2014 results, the Norwegian energy company, Statoil, reported 8.1 billion NOK loss from oil sands largely due to the rapid decline in oil prices in an asset base that has average break-even prices of around $85/barrel.

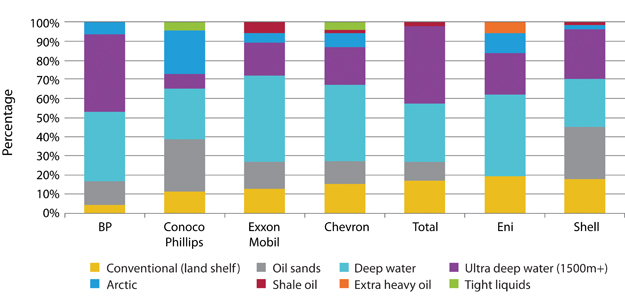

The top risk to the oil sands include: price of oil; risk of land lock and community concerns. Water tailings regulation is also a key concern as the treatment and storage of tailings is receiving a lot of attention following a breach of a tailings dam in British Columbia. The upfront cost of treatment of tailings ponds versus centrifuging are similar (around $1 billion). However, centrifuging and recycling would require new capex in many projects. Given all of these risks, the price of oil would have to increase dramatically to make these assets economically viable because the costs in oil sands are likely to continue to increase by around 4% per year or more due to new regulations and new levels of scrutiny. The companies most exposed are the pure-play oil sands companies and from the majors, Shell (around 25% of reserves) and ConocoPhilips (around 25% of reserves). Both of these companies have had to state impairments to their asset base in the past.

Figure 2 is from a Carbon Tracker report published in May this year indicating the players most at risk. The report has received a lot of attention in the investor and oil and gas community. Rightly so, given that $1 trillion per year is invested in fossil fuels. The debate is interesting because the long-term future of the expensive oil industry is being challenged. Most of the oil majors have announced divestment programmes despite a record low oil price, largely because their balance sheets and cash flows cannot sustain dividends in the current price environment. It would seem that now is the time to invest if asset prices are relatively low, which is the rhetoric of most of the majors. However, perhaps even the oil majors are questioning their own forecasts, as they have yet to announce acquisitions.

Figure 2: Potential capital expenditure on undeveloped projects requiring $95/bb+ Brent oil price (2014-2025)

Source: SocGen Tight Oil vs Oil Sands report

Applying these trends in a portfolio context

As can be seen, the range of companies that are exposed to these trends include all types of companies from electric vehicles, renewables, industrial providers, energy efficiency solution providers, and oil and gas service providers amongst other opportunities. Climate and environmental pollution regulation is happening regardless of a global deal on climate change, and the disruptive technologies exist to drive the transition in the global energy landscape. While the power of existing players and the cost of change are probably the main barriers to immediate and dramatic change, it is interesting that the oil sands are currently substantially challenged and, arguably, “stranded”.

More Related Content...

|

|

|