|

Written By: Michael Adefuye |

|

& James Sparshott |

Michael Adefuye and James Sparshott of LGIM explore the build-to-rent sector and look at how as an asset class it has the potential to contribute towards a greener, more sustainable future, while still achieving attractive returns for local authorities

Net zero is a hot topic in real assets. The built environment accounts for 40% of global emissions, with the residential sector contributing 14% of carbon emissions in the UK alone.¹ The UK government’s commitment to achieving net-zero emissions by 2050 will have material implications for real estate owners, operators and occupiers, and as a consequence, for investors.

Build-to-Rent (BtR) is a relatively new sector and as such, many of the assets are already likely to be better placed to meet existing energy efficiency standards than older structures. But with regulation and policy changes increasingly focused on improving energy performance to support climate objectives, we believe these BtR assets will need to exceed these minimum standards in order to guard against the risk of obsolescence or devaluation in the future. In our view, being proactive with net-zero buildings now can help generate positive outcomes in the future both from an environmental, social and governance (ESG) perspective, as well as a financial one.

Applying net zero to residential buildings

Broadly speaking, achieving net-zero emissions refers to reducing greenhouse gas emissions with the aim of balancing those produced with those removed from the earth’s atmosphere. Although it isn’t the only greenhouse gas, carbon dioxide is the most significant.

Currently, there is no officially agreed definition as to what constitutes a net-zero carbon residential building but there is growing consensus from several industry bodies. At LGIM, we adhere to the standards set out by the London Energy Transition Initiative (LETI) and the UK Green Building Council (UKGBC).

These standards cover both the construction and operation of residential buildings and focus on:

- Reducing embodied carbon – the emissions associated with construction

- Reducing energy supplied to the building from “non-green” sources

- Reducing the energy use in buildings with the aim of reducing total Energy Use Intensity (EUI) to be equal to or less than 35 kWh/m2/yr for residential buildings as best practice

- The measurement and verification of annual energy use and renewable energy generation

Practically, this can be achieved using low carbon structural components (such as low carbon concrete) in the initial design and construction, carbon offsetting, or the use of on-site renewable energy. Reducing the carbon energy supplied to the buildings can be achieved by improving overall building insulation through the incorporation of features such as triple glazing or additional insulation in roof and wall spaces, and maximising on-site renewable electricity using solar panels. Low carbon heating systems will also ensure that any heating and hot water used are not generated using fossil fuels.

With 68%² of the existing BtR pipeline in planning or under construction, investors and asset owners have an opportunity to integrate net-zero carbon standards into their designs from the outset and demonstrate best practice. Occupier behavioural changes from residents in the building will also be important in achieving a net-zero carbon building. We believe the more direct relationship between asset owners and residents in the BtR sector is helpful as residential asset owners will have more scope to influence residents’ behaviour.

Managing the risks – leading to better long-term returns

In our view, the wider societal focus on emissions’ reduction results in two new structural risks, both of which can be actively managed: consumer risk and legislative risk.

Consumer risk

Consumer attitudes towards products and services are changing, with an emphasis on sustainable values. Government surveys show that concerns around climate change remain high among members of the public. Approximately 80% of those surveyed in the BEIS public attitudes survey expressed concerns about the environment.³

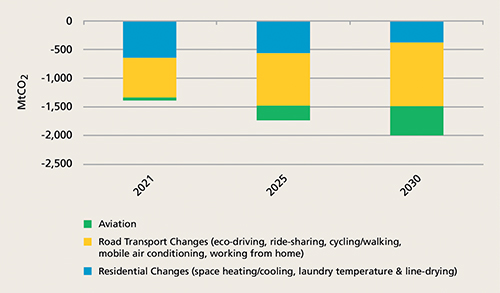

Figure 1: Impact of behaviour changes on CO2 emissions

Source: IEA, 2020, World Energy Outlook, 2020

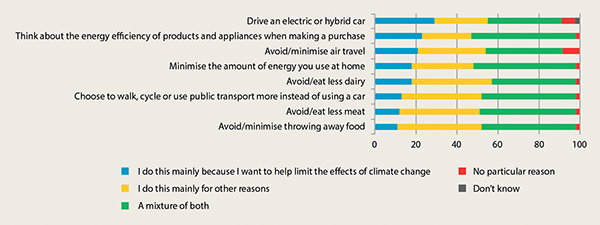

Figure 2: Main reasons for everyday life behaviour changes

Source: BEIS Public Attitudes Tracker Wave 37, as at May 2021

We believe that these attitudes are likely to gather momentum, with consumers paying closer attention to their own personal carbon impact; changing behaviours around how we live in our homes can play a significant role in reducing carbon emissions.

Figures 1 and 2 show that consumers already look to reduce energy use in their homes as a way of playing their part in tackling climate change. Climate change awareness is particularly prominent among the younger generation, who make up a large proportion of residents in the private rented sector. Indeed, almost half (43%) of residents are aged between 16 and 35.⁴

We believe climate change awareness is an opportunity for differentiation in the BtR sector. As consumers learn to distinguish between homes in terms of their carbon impact, net-zero carbon homes are likely to become a more attractive proposition, in our view. Additionally, it provides “good” corporate landlords with an opportunity to showcase their environmental credentials.

Legislative risk

As part of the government’s commitment to net-zero carbon emissions by 2050, residential buildings will have to meet strict energy efficiency standards in the future.

The government’s “Future Homes Standard” is expected to come into effect in England by 2025. This will mean that all new homes must incorporate low carbon heating and world-leading levels of energy efficiency. The aim is for new homes to produce 75%-80% less carbon emissions compared to current levels.

We believe there is also potential for future legislation around carbon emissions. One area where there has been much debate is around carbon pricing, whereby governments may choose to tax products and services that emit greater carbon emissions above suggested levels. This may in turn make it costlier to own, and operate, residential buildings which do not meet the necessary requirements.

How net-zero considerations can drive performance

Attracting consumer demand

With consumers increasingly aware of their own carbon impact, we believe that they may prefer to rent homes with demonstrable lower energy needs. Data from Ernst & Young highlights that 68% of consumers want to use less energy for heating and appliances in their homes over the next five years.⁵

Additionally, the uplift in standards to meet a net-zero carbon target should create more cost-efficient buildings with lower energy bills, and consumers are likely to find this more attractive versus buildings which fall short of these standards.

There is also evidence that consumers are willing to pay a premium for sustainable consumer goods. Survey data from YouGov showed that 57% of consumers were willing to pay more for environmentally friendly products, as opposed to 24% who would not.⁶ This was particularly the case amongst younger consumers, with 69% of consumers aged under 21 and 63% of consumers aged between 21 and 40 willing to pay more for sustainable products. This compared with 53% of over 40s who were willing to pay more.

Obsolescence and its impact on valuation

The importance of focusing on net zero now forms a key part of risk management. With more government regulation and taxation changes likely to transpire, energy-intensive buildings could become notably more expensive to own and occupy. Any residential building failing to meet the “Future Homes Standards” will need to go through retrofit works which, in turn, could impact the valuations of assets both through reduced income – the market reflecting the higher energy cost and reduced demand for those assets in lower rents – and high capex costs to retrofit assets up to minimum standards. Given the long-term investment horizon for BtR, we believe that the significant capex requirements would be detrimental to performance over the medium to long term, relative to the upfront costs involved in delivering net zero from the outset.

Conclusion

We believe that meeting net-zero ambitions will require a fundamental transformation in the construction and operation of residential buildings. For investors with long-term horizons, such as the LGPS, these transformations will be vital in rendering portfolios resilient in a changing world. For us at LGIM, ensuring that existing and future assets meet the standards that can align with a net-zero carbon world remains a priority. We believe being proactive with net-zero buildings now should create not only better performing assets, but also generate positive outcomes for society over the long term.

Important Information

Past performance is no guarantee of future results. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, you may not get back the amount you originally invested. Views expressed are of LGIM as at October 2021.

The Information in this document (a) is for information purposes only and we are not soliciting any action based on it, and (b) is not a recommendation to buy or sell securities or pursue a particular investment strategy; and (c) is not investment, legal, regulatory or tax advice. Legal & General Investment Management Limited. Registered in England and Wales No. 02091894. Registered Office: One Coleman Street, London, EC2R 5AA. Authorised and regulated by the Financial Conduct Authority, No. 119272

1. Department for Business, Energy & Industrial Strategy (BEIS)/ULI

2. Savills/BPF, UK Build to Rent Market Update – Q2 2021, July 2021

3. BEIS Public Attitudes Tracker March 2021, Wave 37

4. MHCLG English Housing Survey 2019-20

5. Ernst & Young, If consumers hold the key to greener future, how can energy companies unlock it? 2021

6. YouGov, Global Willingness for Sustainability, April 2021

More Related Articles...

Published: October 1, 2021

Home »

Alternative Investments